- Bitcoin ownership appears to have stabilized, with notable buying activity observed at prominent addresses

- Whales are positioning themselves for a potential rally as liquidity inflows into the crypto market increase

Despite a market-wide decline, Bitcoin remains [BTC] has managed to stay above the $90,000 level for weeks. This stability has limited recent losses, with the same losses being just 3.97% for the week and 5.49% for the month.

With market sentiment showing signs of shifting and traders ramping up their buying activity, BTC could be poised to rise again.

Accumulation is gaining momentum

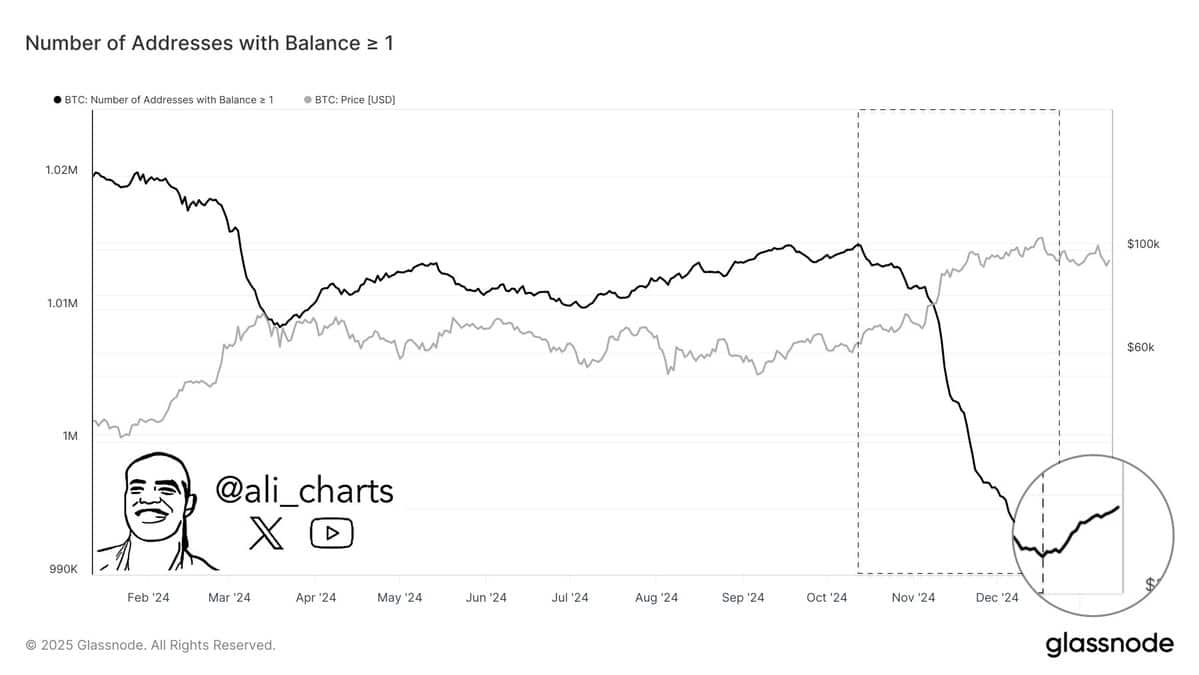

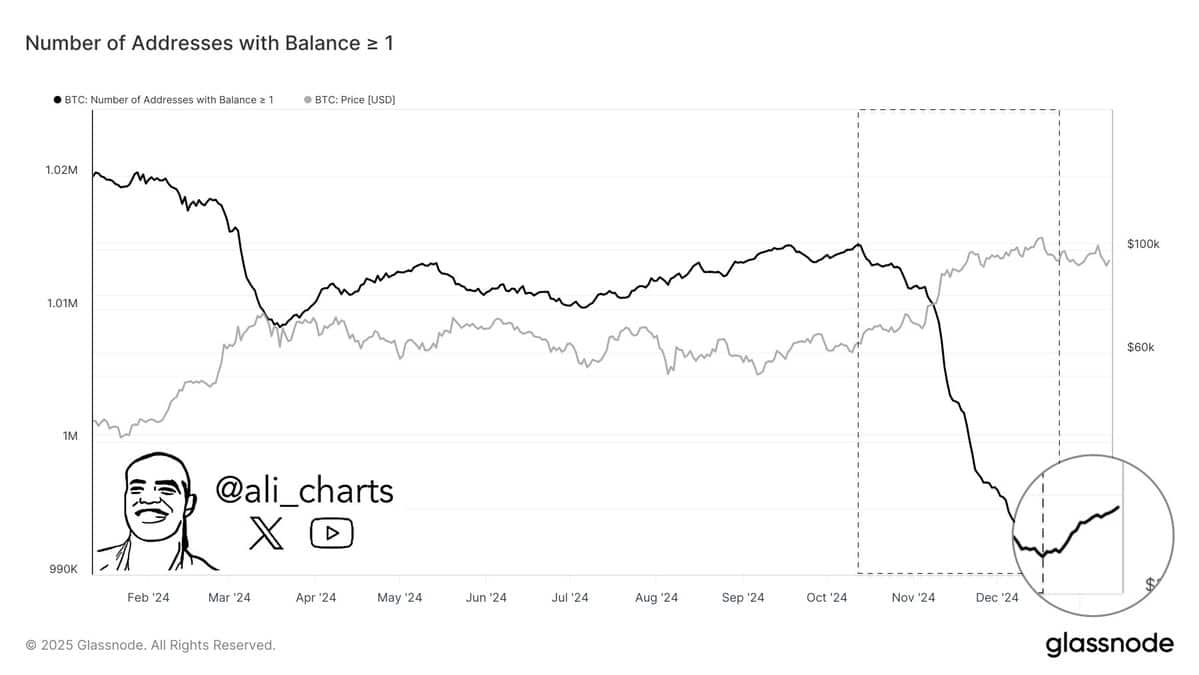

After tracking the number of addresses with a balance of at least 1 BTC, Glassnode found that Bitcoin acquisitions have skyrocketed this year.

According to the data, there has been a significant increase in the number of addresses holding more than 1 BTC. This marks a notable shift, especially after a lengthy distribution phase that began in October during which many BTC holders sold.

Source: Glassnode

Such accumulation often indicates a renewed sense of confidence in the market. When investors switch from selling to holding, it means they expect lasting value and are likely to hold the asset – potentially triggering a rally.

AMBCrypto also observed other market activity, indicating growing bullish sentiment among traders. This could indicate a possible increase in the value of BTC in the short term.

Liquidity increase and adjustments of BTC investors

According to Whale alertUSD Coin (USDC), the second largest stablecoin issuer in the crypto market, added 250 million USDC to its coffers in the last 24 hours.

Such coin activity typically signals growing demand for stablecoins as traders prepare to acquire more crypto assets. Historically, BTC has often benefited from these types of increases in coin activity. If the trend continues, the price of BTC could gradually rise in the coming trading sessions, fueled by increased interest in takeovers.

In addition to the increased liquidity, there has been a notable shift among top BTC investors who collectively hold 2,535 BTC (worth over $239 million).

These investors moved their holdings from a cryptocurrency exchange, Kraken, to a private wallet, signaling growing confidence in BTC. Mainly because they chose to store their assets outside of exchanges for added security.

The transfer, from Kraken to an unknown wallet, took place in three transactions: 620 BTC, 888 BTC and 1,027 BTC.

Derivatives traders are unconvinced by BTC’s rally

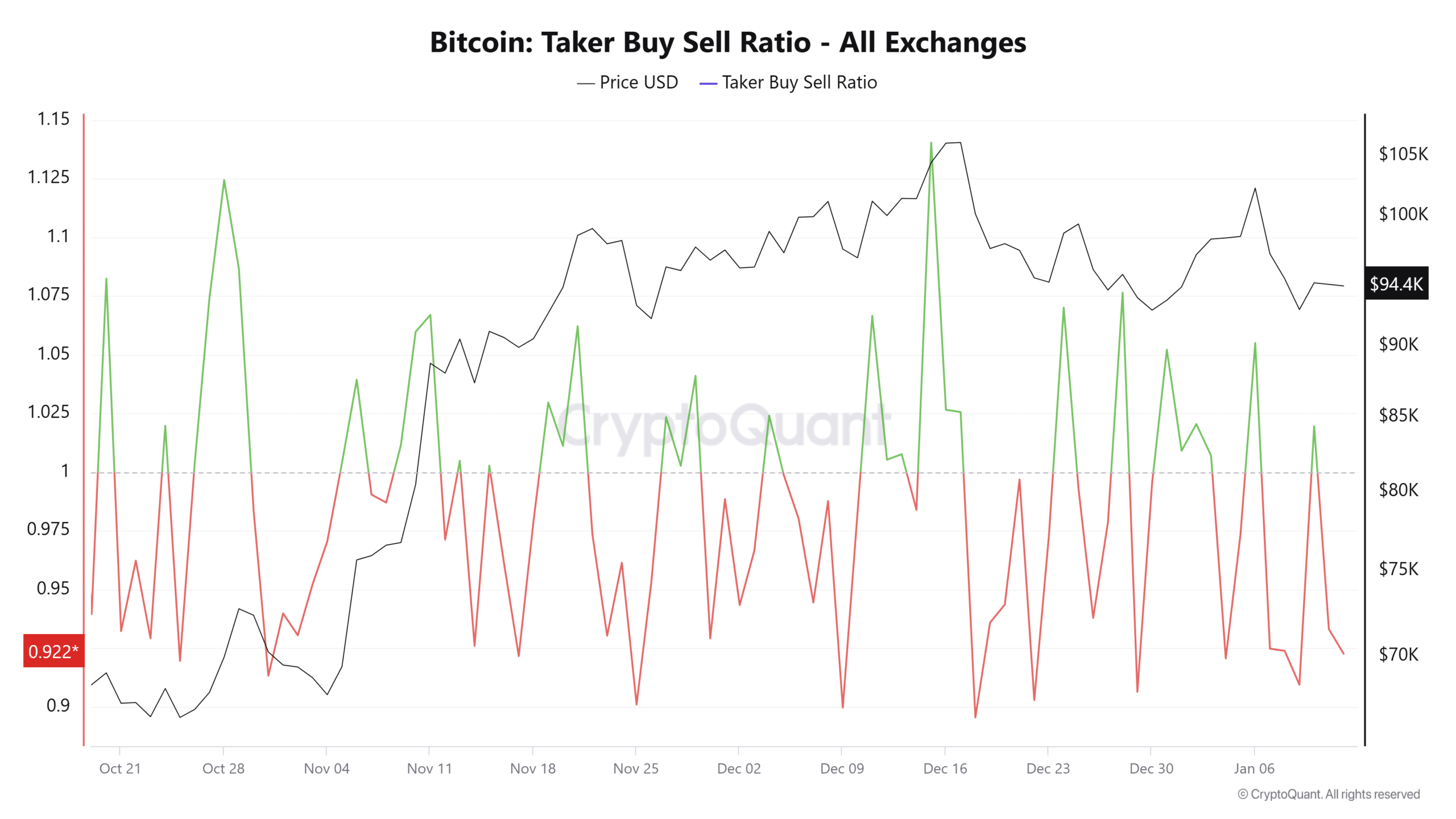

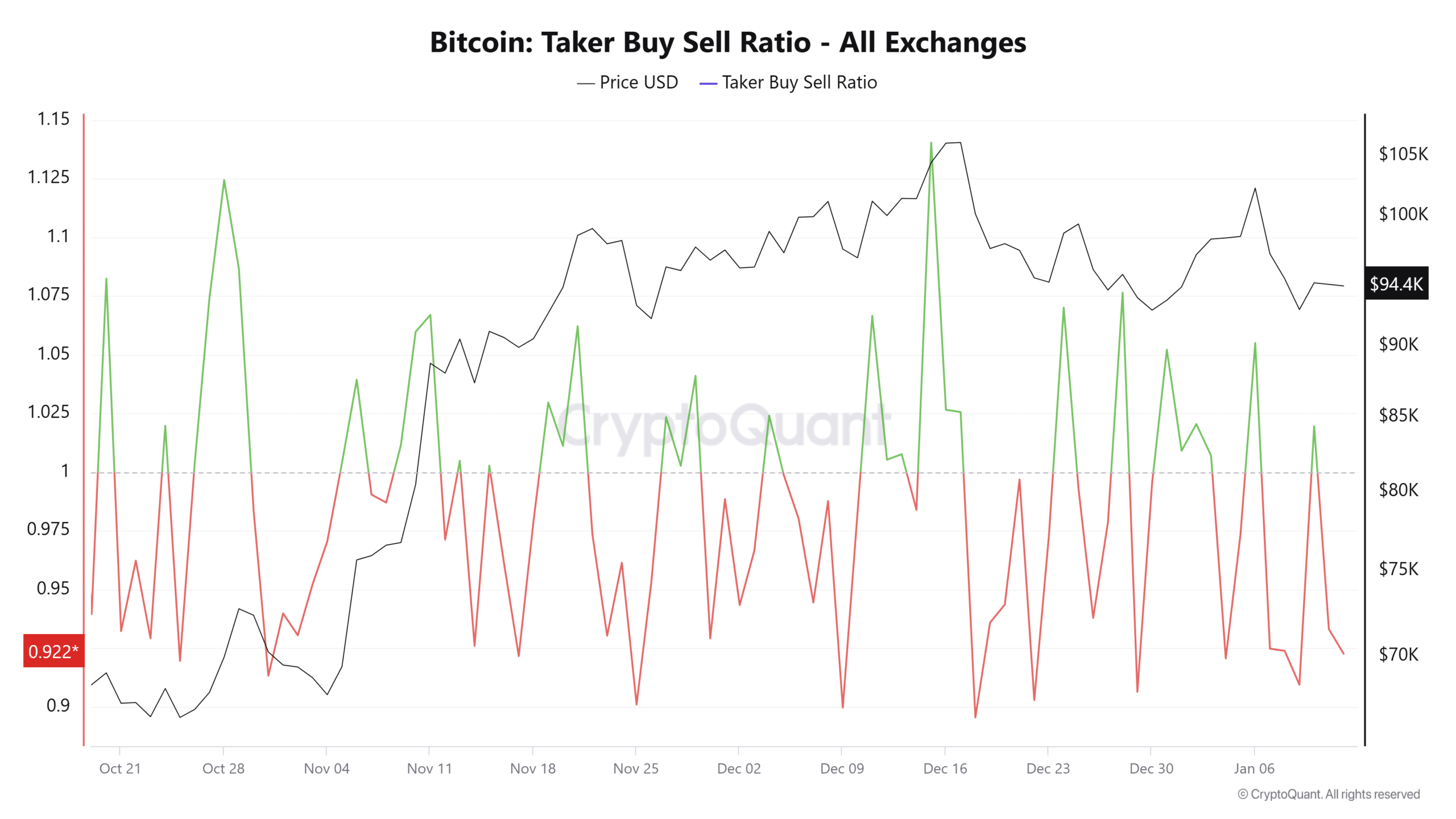

According to the Taker Buy Sell Ratio on CryptoQuant, which measures the ratio of buying to selling in the derivatives market, sellers currently dominate the market.

At the time of writing, this ratio had fallen below 1, with a value of 0.922. This indicated that sales activity outweighed purchases. If this metric continues to decline, Bitcoin’s continued price appreciation could be delayed.

Source: Cryptoquant

However, since the gap with the neutral zone is less than 0.1, an inflow of additional capital into the market and a larger outflow of BTC from the exchanges could positively influence sentiment among derivatives traders. This could continue the asset’s rally on the charts.