- BTC has been stuck within the range of $ 80k $ 85k for a while.

- Analysts remained cautious despite the hope for a potential FED’s Dovish -Tilt.

On Tuesday Bitcoin [BTC] Iched another attack of the sale of crypto market after falling to $ 81k of $ 84k and closed the daily session with a loss of 1.54%.

It was the first day of the FOMC meeting (Federal Open Market Committee) and analysts also linked the sale to geopolitical tensions.

According to the Crypto Options Trading desk QCP Capital, renewed tensions in the Middle East have fueled the sale. Part of his daily market report read”

“In the absence of new tariff newspapers, geopolitrically returned to the front.

What is the next post-FOMC?

The BTC departure saw Top Altcoins Post varied recovery. Solana [SOL] Fell 5% but closed the session by only 2%. XRP also placed a loss of 2.2%on Tuesday, comparable to ADA.

Ethereum only [ETH] Stabilized with a profit of 0.27% during the trade session.

On the contrary, EOS [EOS] and hyperliquid [HYPE] were top performers with 17% and 7% profit in the same period respectively.

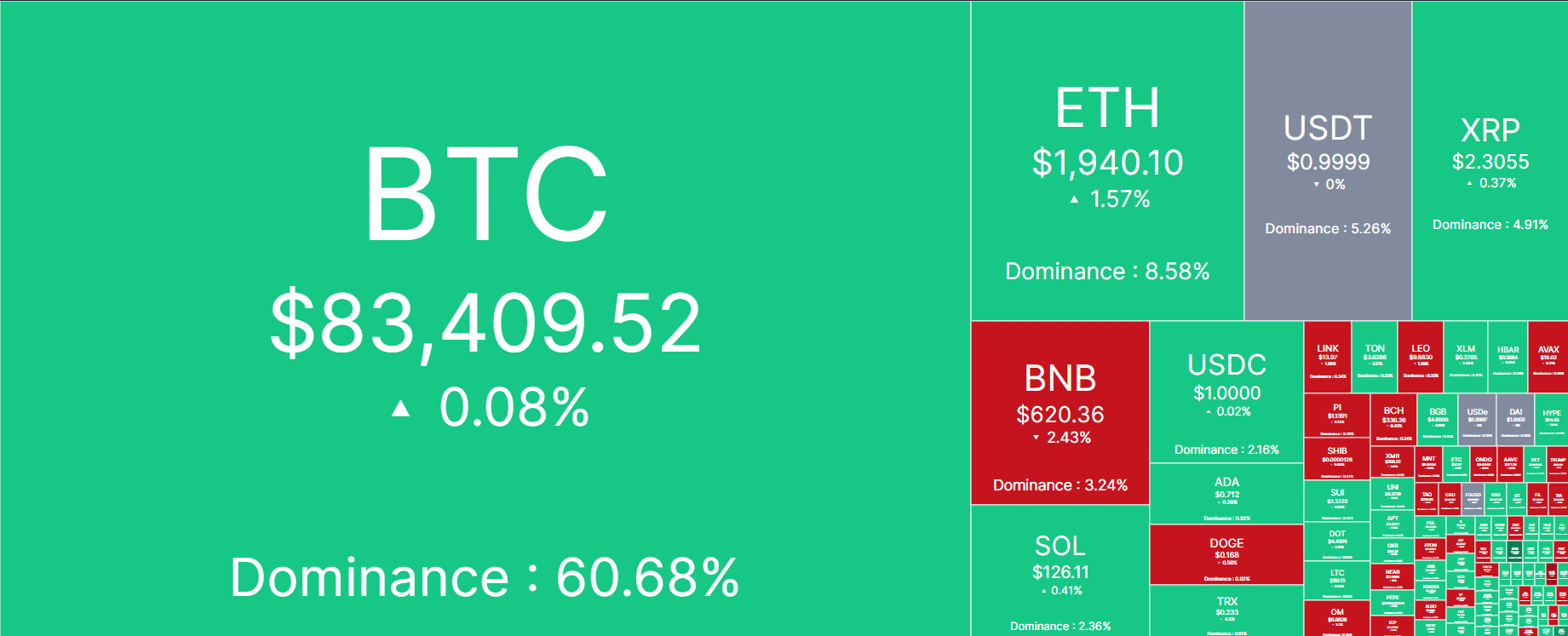

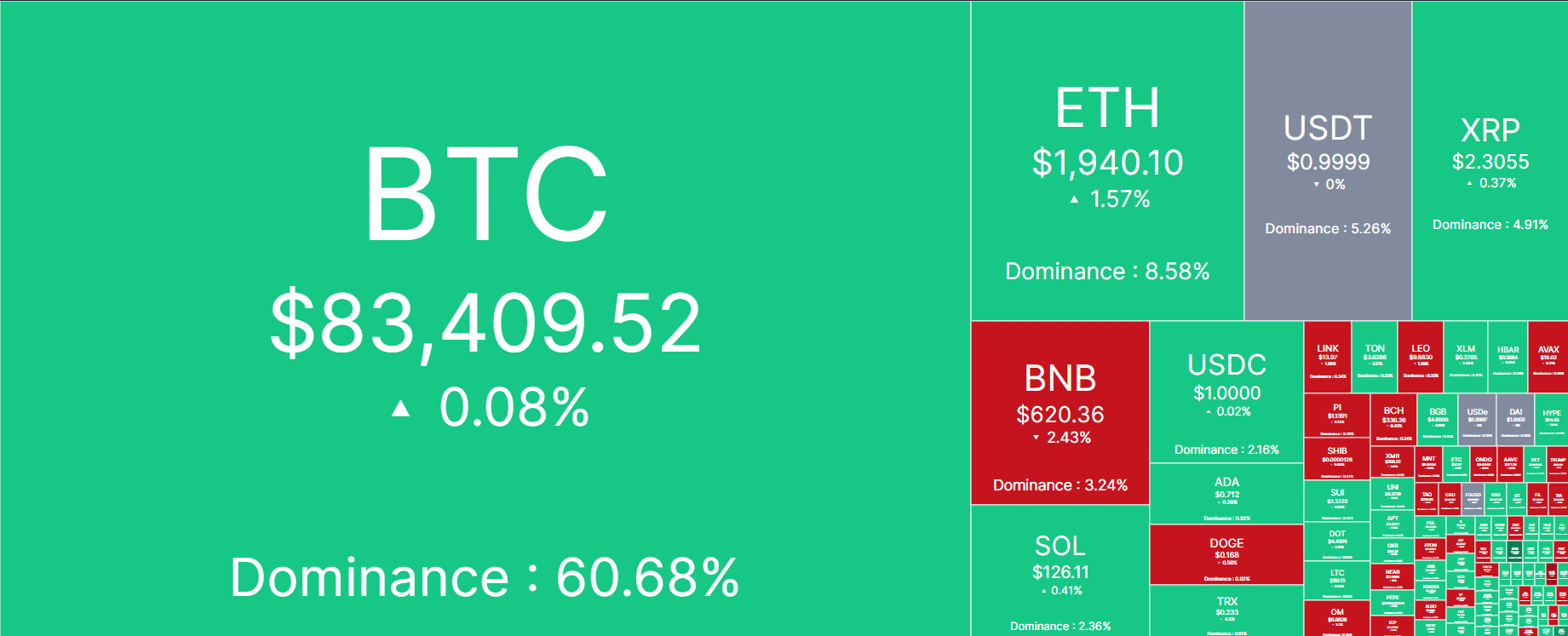

At the time of the press, BTC recovered $ 83k, while ETH was higher than $ 1.9k a few hours before the FOMC announcement. But Binance Coin [BNB] and dogecoin [DOGE] Had still contracted from this letter.

Source: Coinmarketcap

Whether the decision of the FED rate will feed Crypto repair or extend the decline is still to be seen.

That said, Jake Ostrovskis, an OTC (freely available) trader in winter mute, noted That BTC and Crypto would remain covered, given his positive correlation with risk-to-American shares than gold.

“With Correlations Firm with the first (Nasdaq), the market will have difficulty being higher without being led by a broader risk.

For his part, the Swissblock Blockchain Analytics Firm repeatedly That the market was in a ‘risky’ and that downward risk could not be overrun.

The risk-off sentiment was confirmed by the crypto anxiety and greed index, which was at ‘fear‘Levels of 32. Although this can be a’buy’ Opportunities for long-term investors, the FED policy prospects can offer instructions for such a relocation.

In the meantime, QCP Capital warned that the new rates round of President Trump may be planned before 2 April of April important information to view after the FED meeting. It stated”

“BTC for $ 80k: a real floor or a Mirage Momentum & Carry Trades are relaxed.