- BTC fell near the psychological support of $60,000 after FOMC Minutes.

- Will US CPI data spark a recovery or escalate the decline?

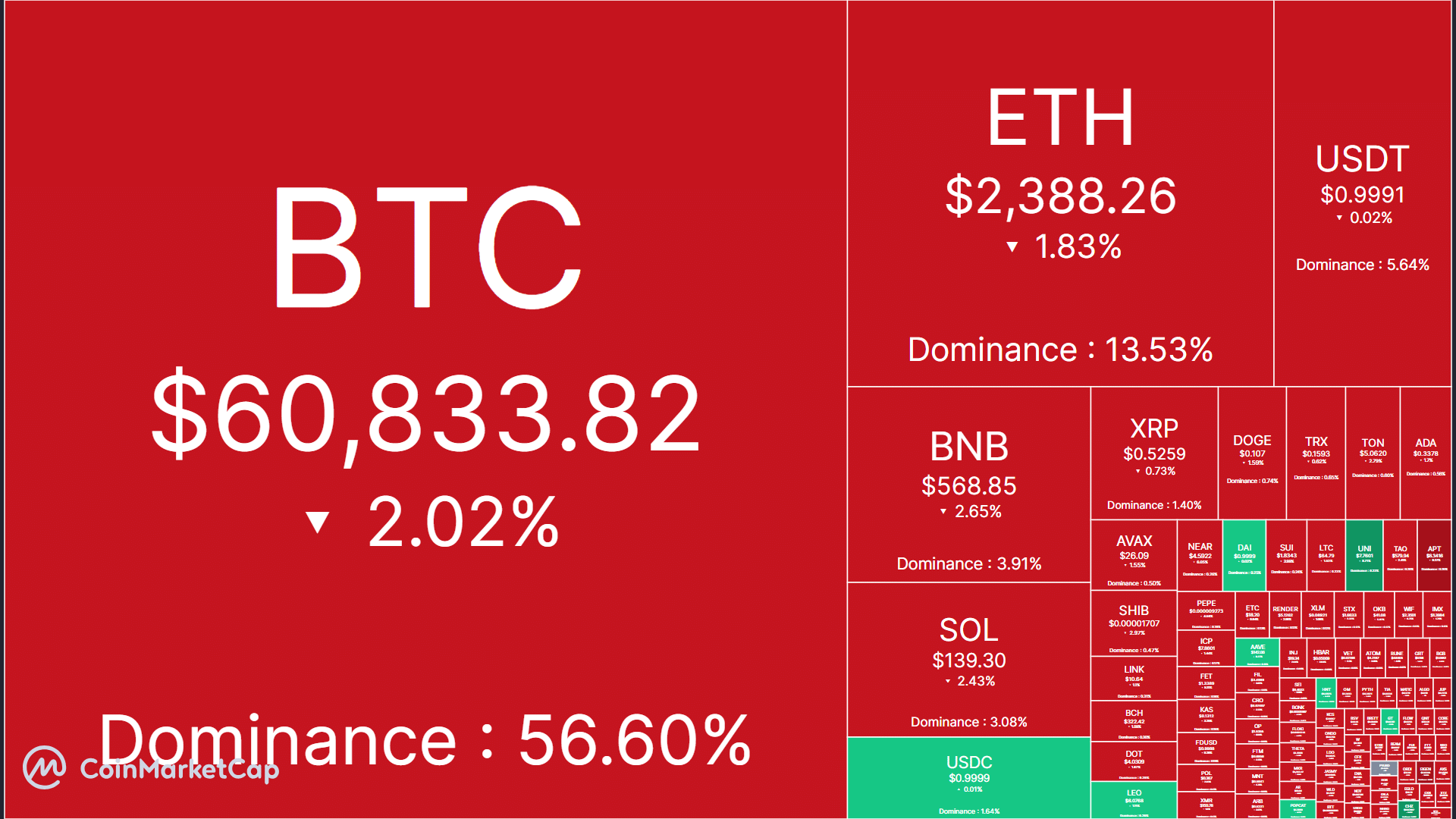

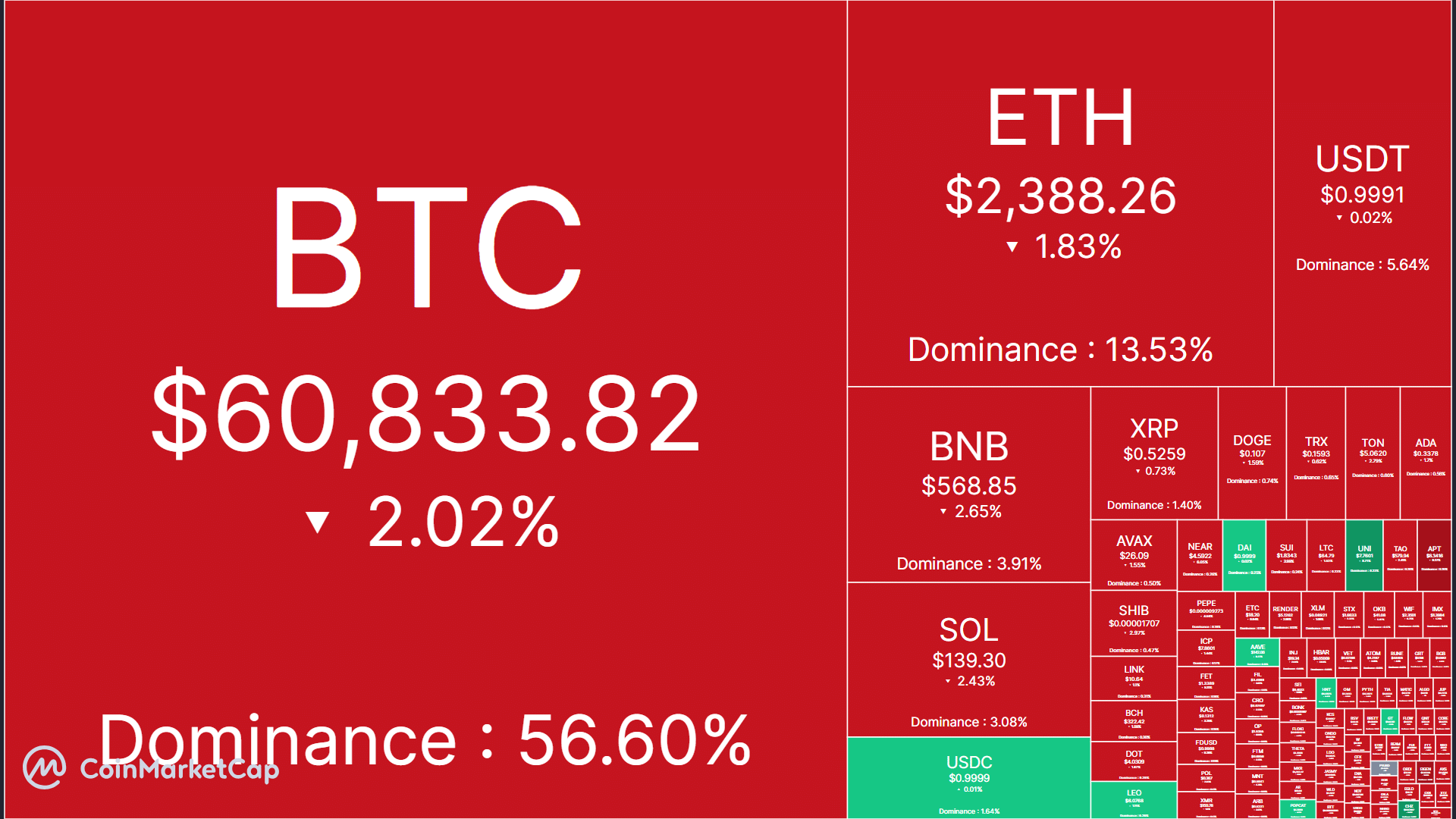

On October 9, Bitcoin [BTC] led the crypto market’s decline, losing 2.45% and falling to critical support.

The world’s largest digital asset lost $1.5K, falling from $62.5K to a low of $60.3k, after the release of the FOMC minutes from the September meeting.

FOMC Minutes Sink BTC and Crypto

Source: CoinMarketCap

Among the majors, Binance [BNB] saw the highest retracement at 2.65% at the time of writing.

XRP saw a negligible decline, while Solana [SOL] and ether [ETH] fell by 2.4% and 1.8% respectively. But Uniswap [UNI] emerged as a top daily winner.

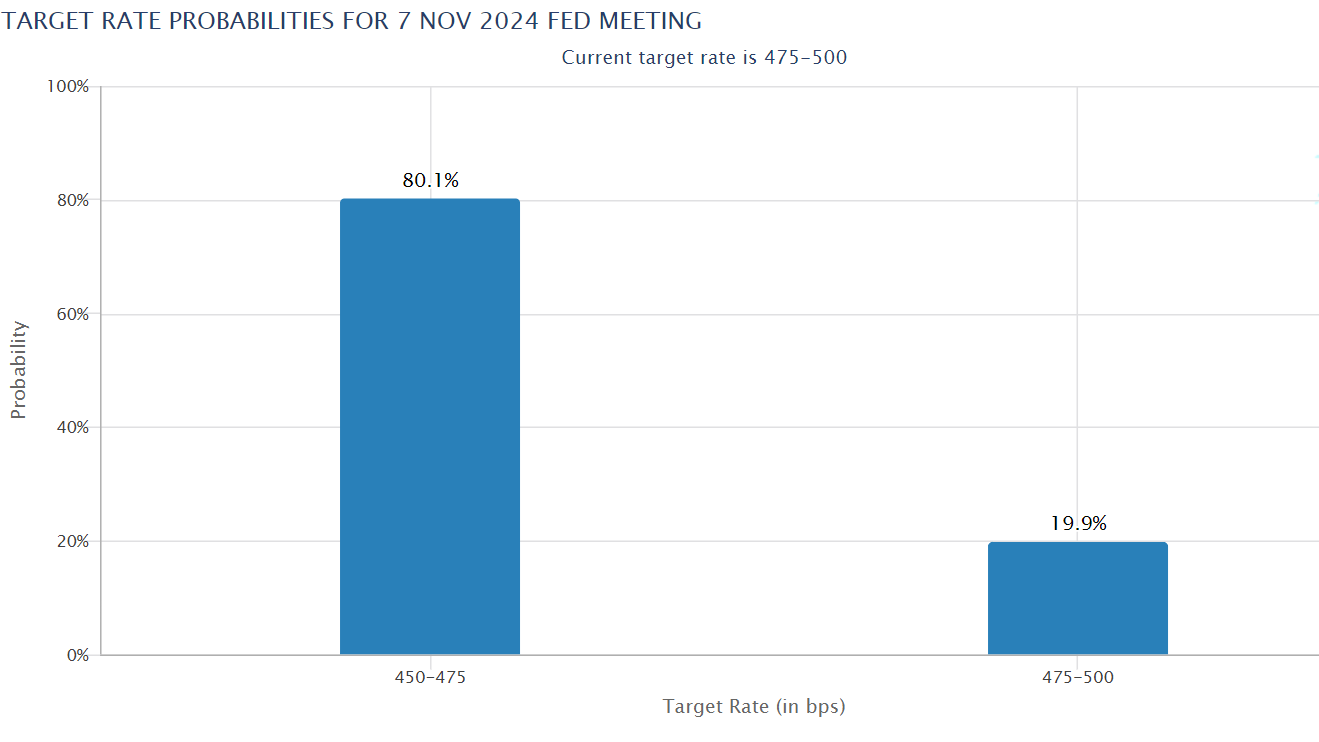

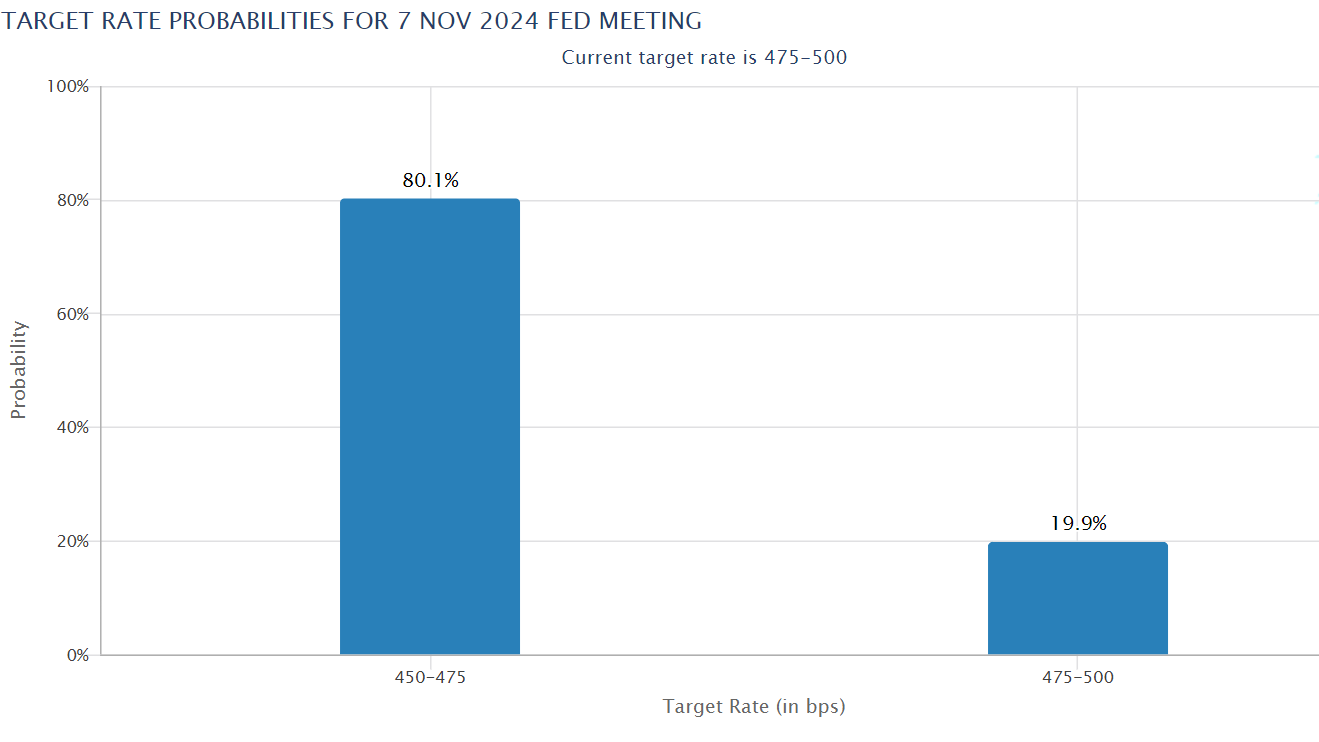

The market decline was due to the FOMC minutes, which lowered expectations of another 50 basis points (basis points) rate cut by the Fed in November.

Notably, the minutes showed that most members supported the Fed’s aggressive 50 basis point rate cuts in September, citing weak US labor market conditions. This was based on the data at that time.

Since then, however, the U.S. labor market has experienced remarkable growth. According to facts released on October 4, 250,000 roles were added in September, exceeding analyst expectations.

This meant that concerns about the labor market, a critical factor in the projection of an aggressive rate cut, were off the table.

Analysts therefore predicted that the Fed would choose to cut rates by 25 basis points or leave current rates unchanged.

At the time of writing, these were the traders prices 80% of a 25 basis point cut and a 20% chance of leaving the current interest rate unchanged.

Source: CME FedWatch

However, this could change depending on September inflation data (CPI). BTC has shown greater sensitivity to expectations of Fed rate cuts and US equities, a typical reaction common to risk-on assets.

Interestingly, US stocks did not sink like the crypto markets after the FOMC minutes. US stocks closed in green as BTC faced increasing selling pressure.

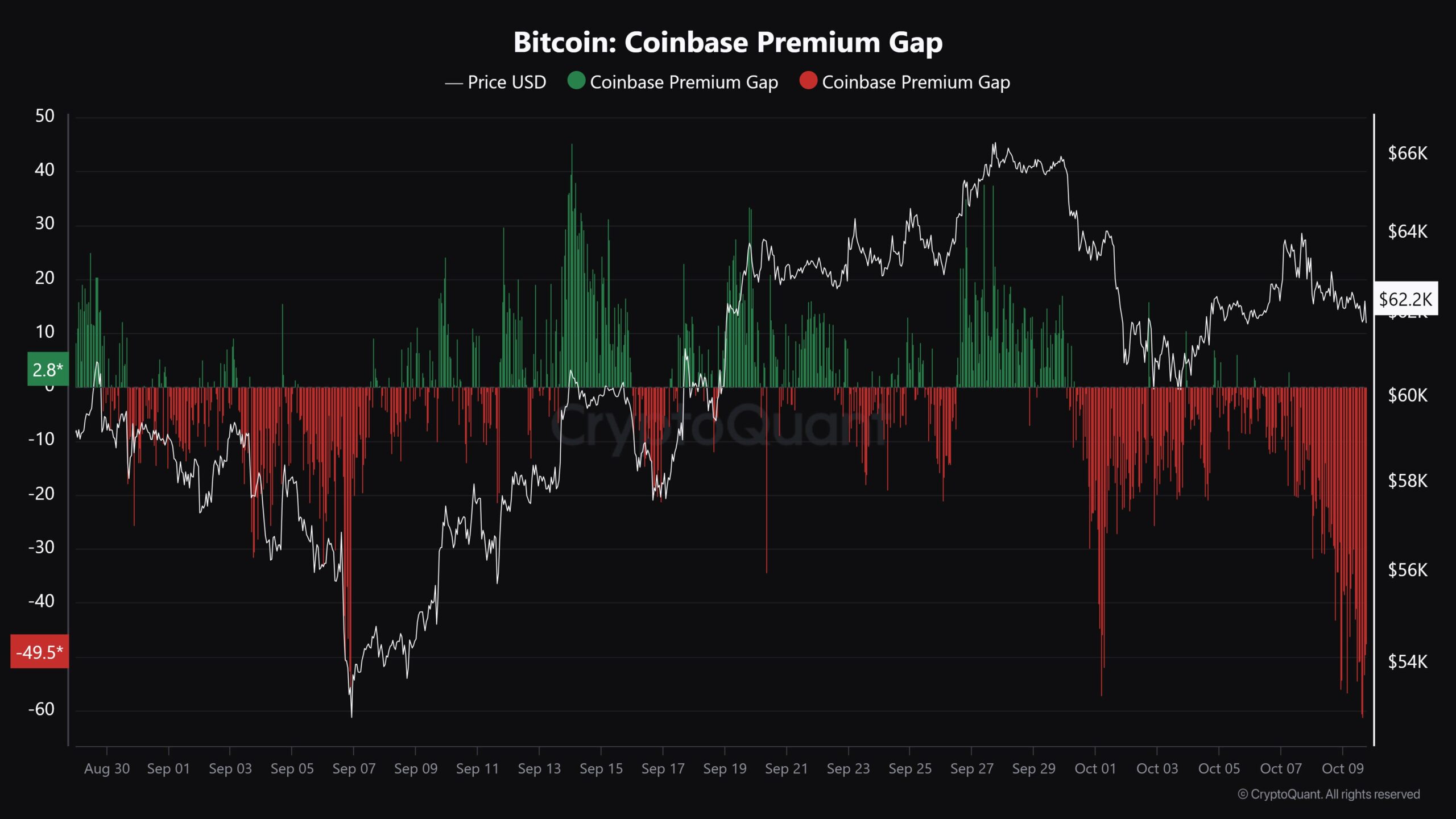

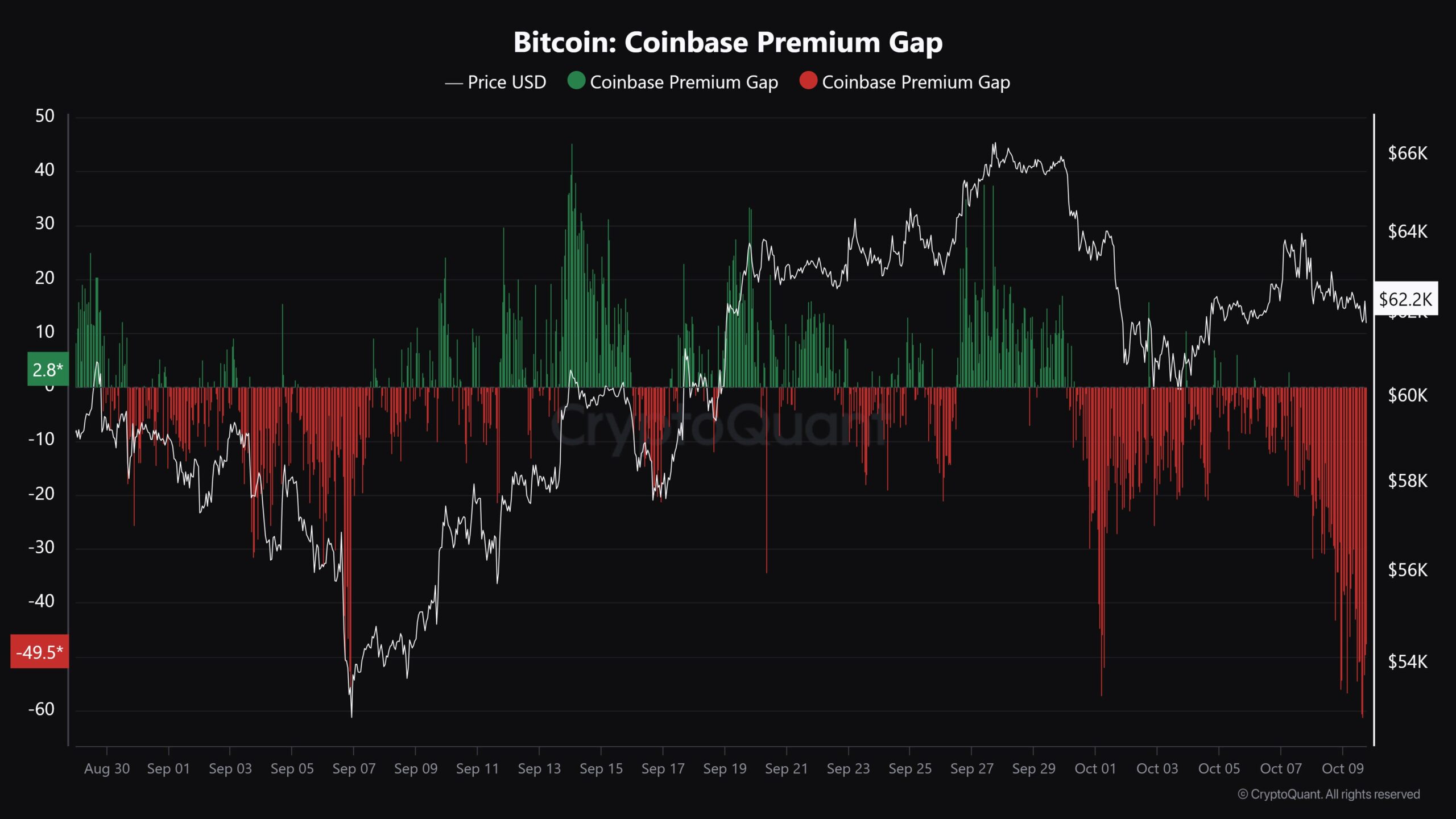

According to CryptoQuant YES Maartuncould reverse BTC’s plunge if US investors ease the selling pressure.

“Forecast: Bitcoin Poised for a Sharp Rise Once the Coinbase Seller is Ready.”

Source: CryptoQuant

On price charts, BTC was at a key support near $60,000. While support halted the decline in early October, it remains to be seen whether it will hold following the US CPI data.

Should support at $60,000 hold, a recovery towards the 200-day MA (Moving Average) of $63.5K would be feasible.

However, a crack below the post-CPI support could drag BTC towards the next support at $58,000.

Source: BTCUSDT, TradingView