- Market sentiment deteriorated and liquidity shortages dragged prices down.

- Bitcoin and Ethereum faced rejections in their respective resistance zones.

On August 26, the total crypto market cap dropped from $2.216 trillion to $2.041 trillion the next day. This was a decrease of $215.87 billion or 9.7% across the market.

Certain tokens were affected more than others.

In the past 24 hours, market prices have already started to recover. Bitcoin [BTC] and Ethereum [ETH] rose by 3.84% and 6.82% respectively. But what could explain why crypto has stopped working since the 26th?

Behavior of market participants

Source: USDT.D on TradingView

The Tether dominance chart measures Tether’s market cap as a percentage of the total crypto market cap. The chart above shows that USDT.D is up 10.91% from Monday and has entered a 5.9% resistance zone.

It has declined since then. Tether dominance and crypto price movements are inversely proportional.

When USDT.D rises, it means more investors and market participants are trading their crypto for Tether, implying a lack of confidence and an increase in selling pressure.

This has decreased in recent hours and a price increase was observed for the major altcoins and for Bitcoin.

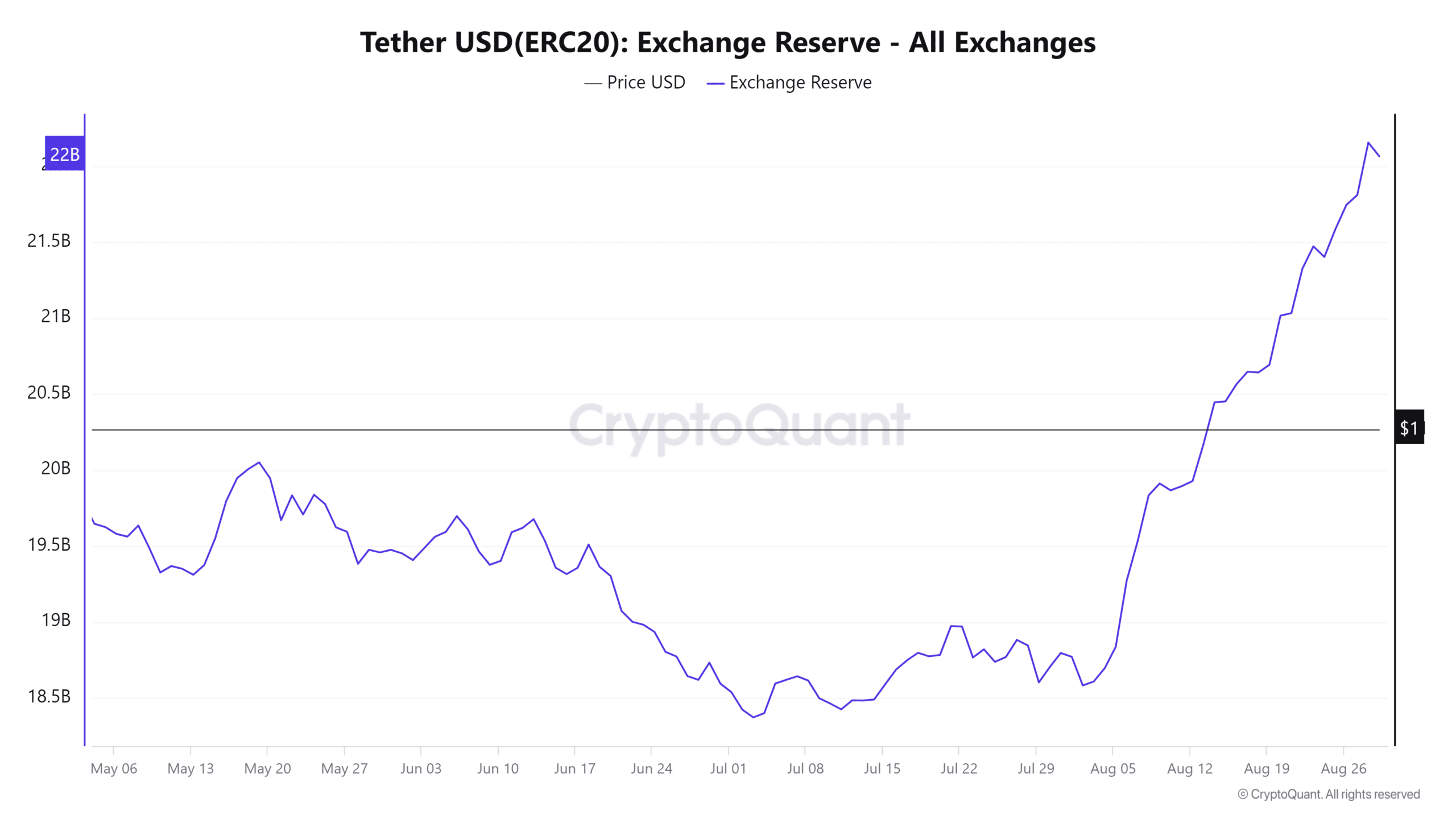

The Tether exchange reserve has been trending higher since early August. It was an indication of the increasing purchasing power in the market.

However, it is difficult to say when prices in the crypto market would start to rise, but the benchmark showed that there is room for expansion.

Liquidity explains why crypto is in trouble

Investors flocking to stablecoins is a good gauge of market sentiment. Another way to gauge where prices are likely to go is by looking at the liquidation charts.

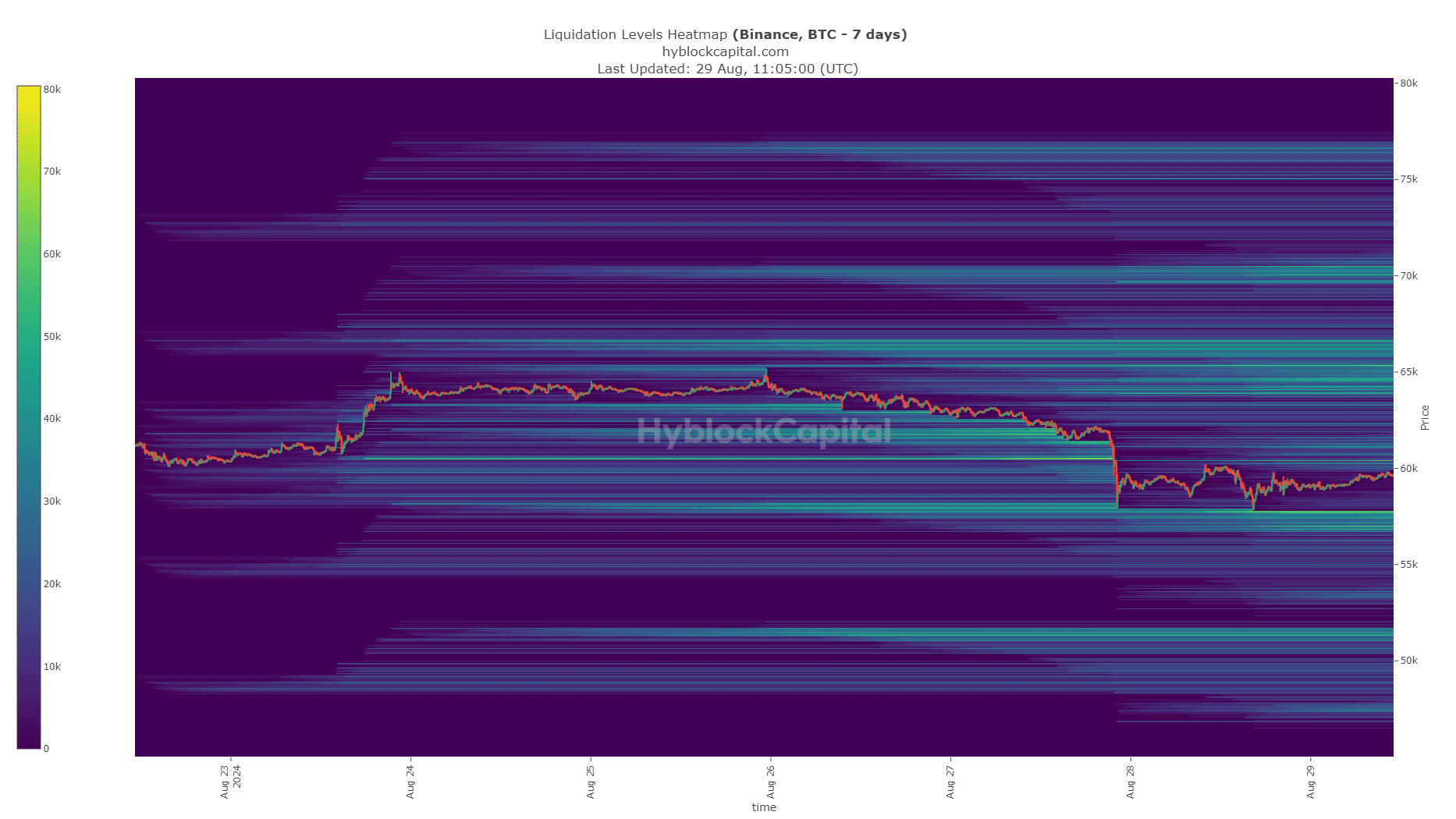

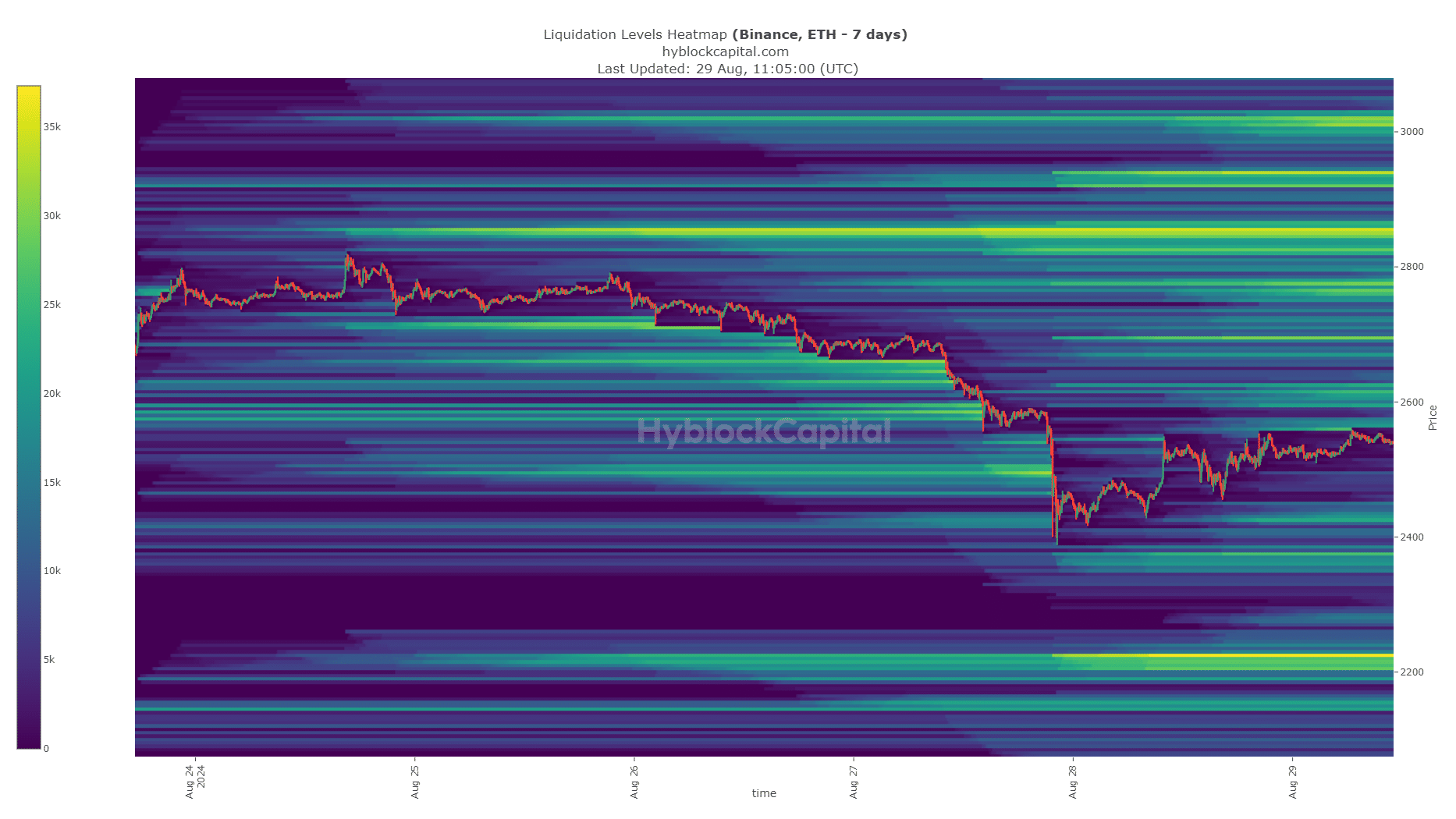

Since Bitcoin and Ethereum are the largest assets and the price performance of most major altcoins has a high positive correlation with them, AMBCrypto decided to investigate their liquidation heatmaps.

On August 27, Bitcoin crashed through multiple short-term liquidity clusters and quickly reached the $58,000 liquidity pool. The situation has stabilized since then, but liquidity is a key driver of price movements.

Read Bitcoin’s [BTC] Price forecast 2024-25

Ethereum also saw a dense cluster of liquidation levels reaching $2490, but ETH continued to decline, hitting the $2415 pocket. At the time of writing, it looked like it was heading towards the $2.6k liquidity margin.

Liquidity and market sentiment were the main factors behind crypto’s decline. The move triggered millions of dollars in liquidations, and the crypto market could consolidate in the coming days.