- Metric revealed that Bitcoin was overvalued.

- A price correction could bring BTC back to $61,000.

After reaching almost $65,000, Bitcoin [BTC] turned bearish again when the daily chart of the king of cryptos turned red. As that happened, short-term holders continued to sell their holdings. Does this mean a trend reversal or a continued price decline? Let’s find out.

Is Bitcoin Selling Pressure Increasing?

The price of the king coin rose by more than 8% last week. The rebound allowed the bulls to push the coin towards $65,000 on August 24.

However, things took a turn for the worse in the past 24 hours as the price of BTC dropped marginally. According to CoinMarketCapAt the time of writing, Bitcoin was trading at $63,816.53 with a market cap of over $1.28 trillion.

In the meantime, intoTheBlock has posted tweet reveals an interesting pattern. According to the tweet, important information can be obtained by monitoring the balances of short-term traders.

Historically, peaks in the metric have regularly coincided with market tops and bottoms, providing useful clues for timing the market.

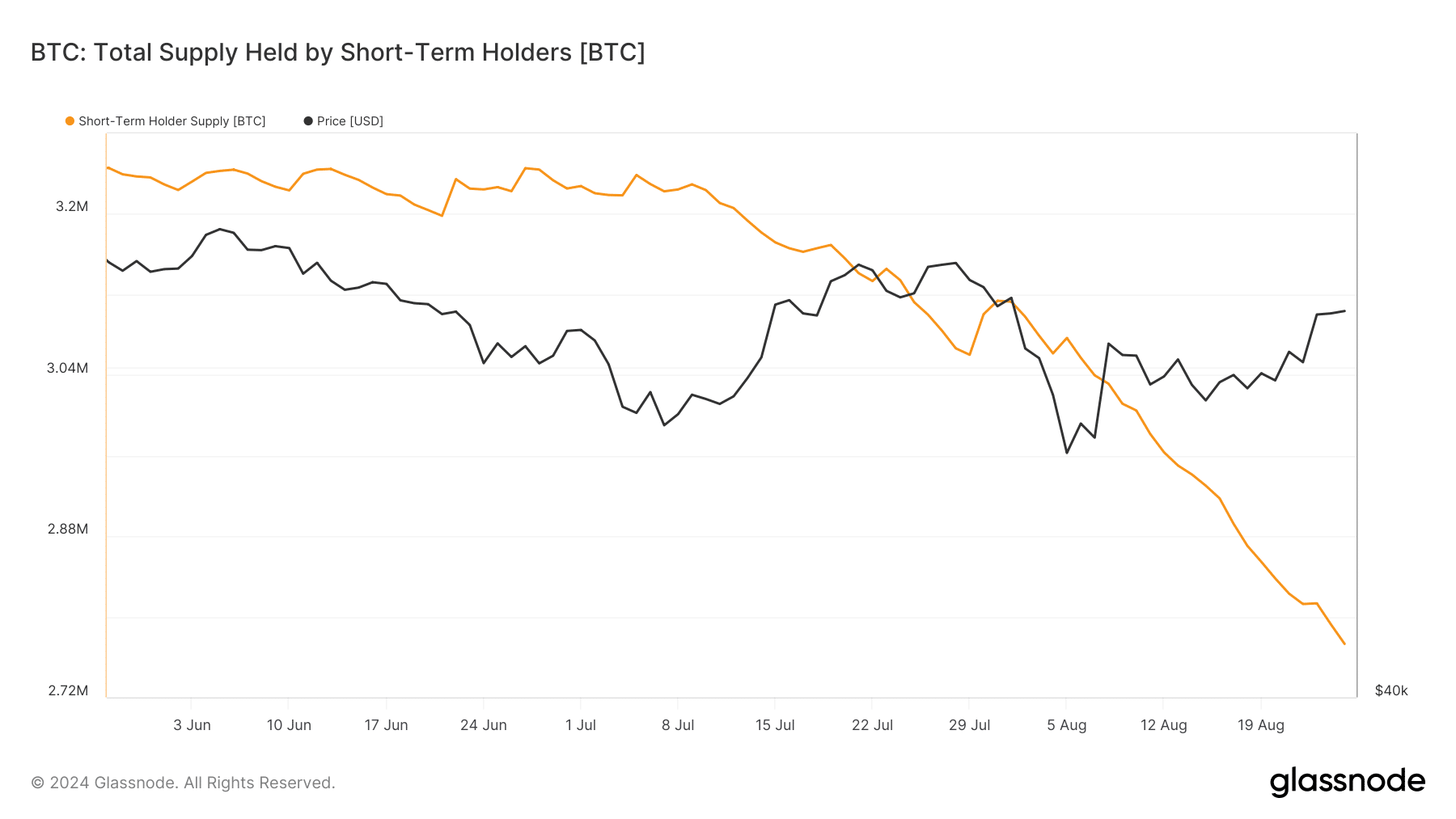

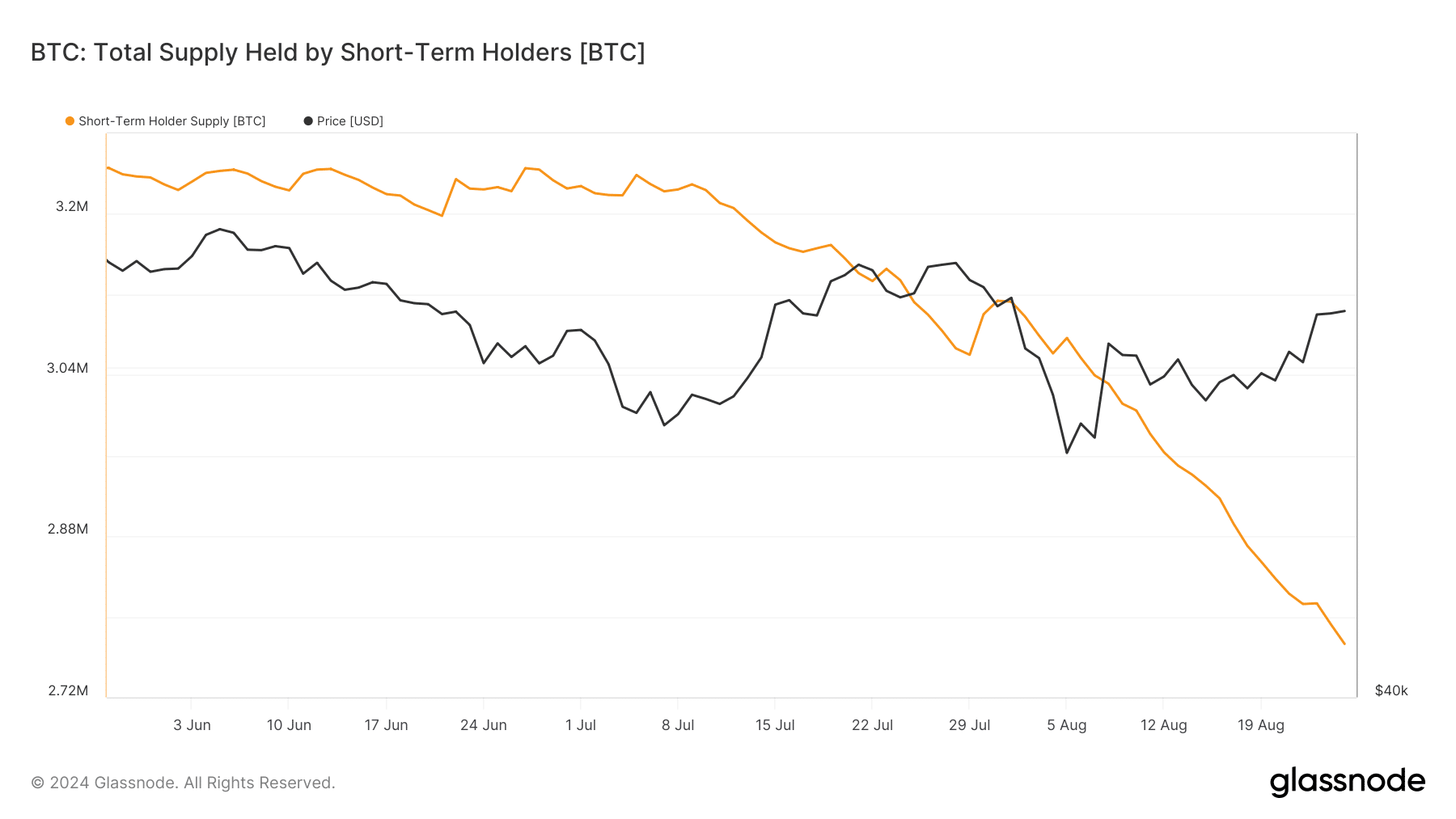

AMBCrypto then checked Glassnode’s data to find out how STHs behaved. According to our analysis, STHs were selling. This was evident in the massive drop in the total supply of short-term holders over the past three months.

Source: Glassnode

The path that BTC has ahead of it

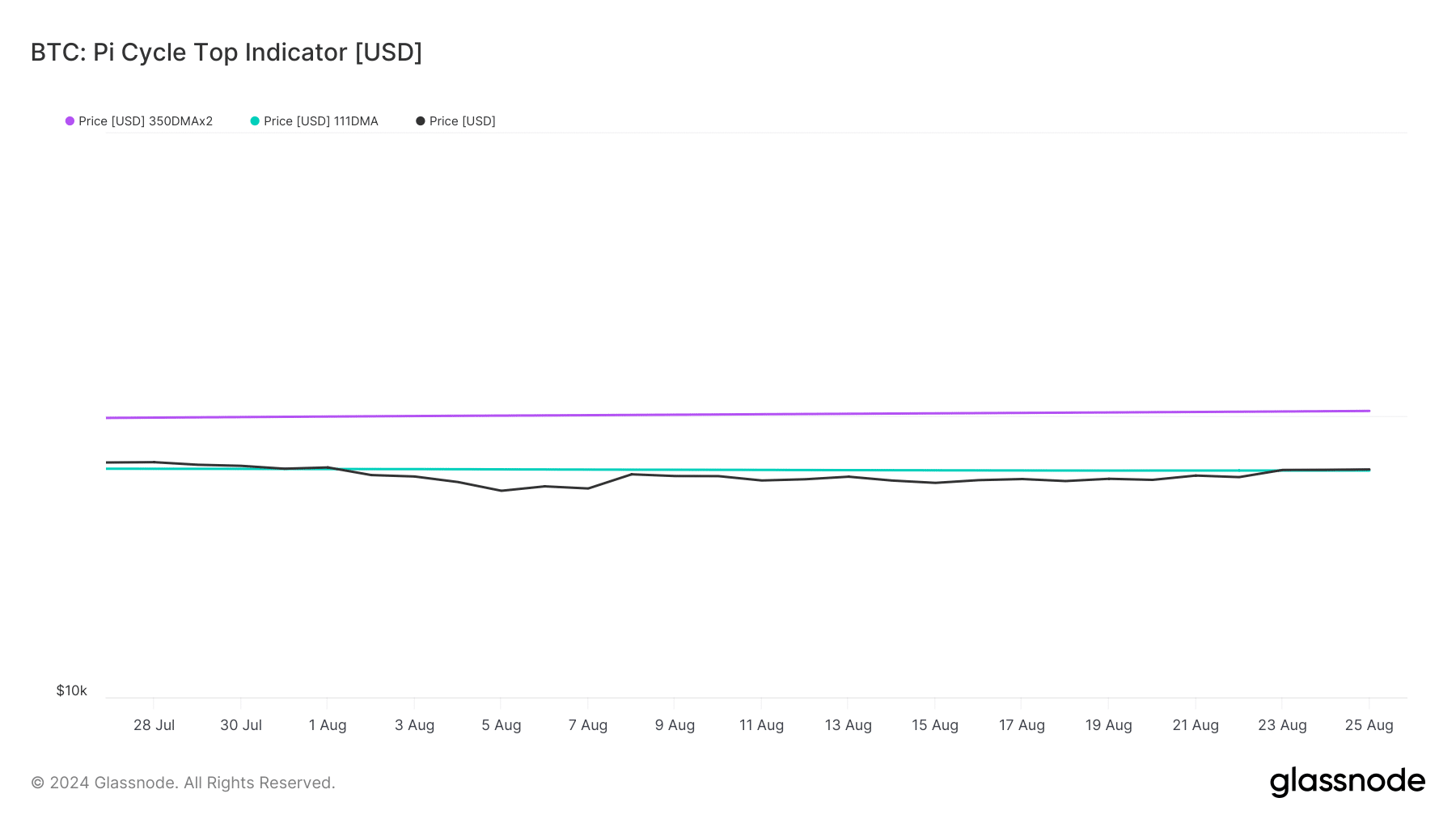

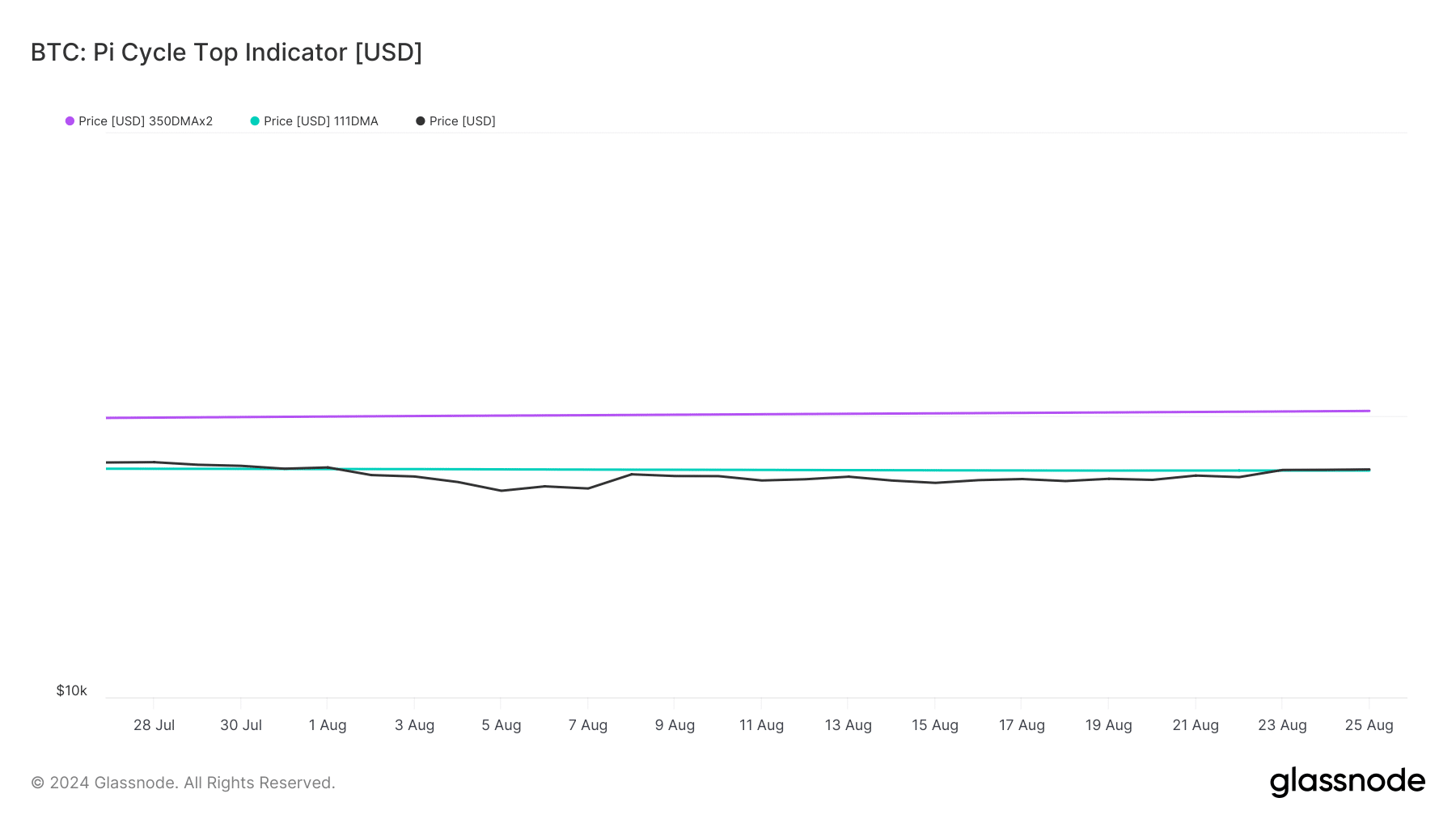

To find out if BTC was at the bottom of the market, AMBCrypto looked at BTC’s Pi Cycle Top indicator. According to our analysis, BTC was right at the market bottom of $63.7k.

If the indicator is to be believed, BTC could soon start its bull rally and reach its possible market top of $102,000 in the coming weeks or months.

Source: Glassnode

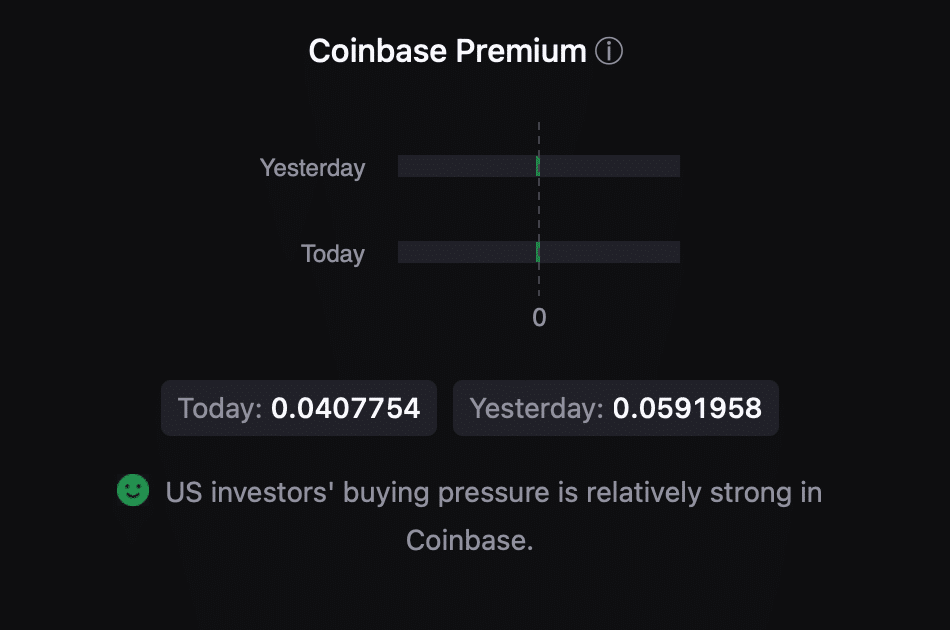

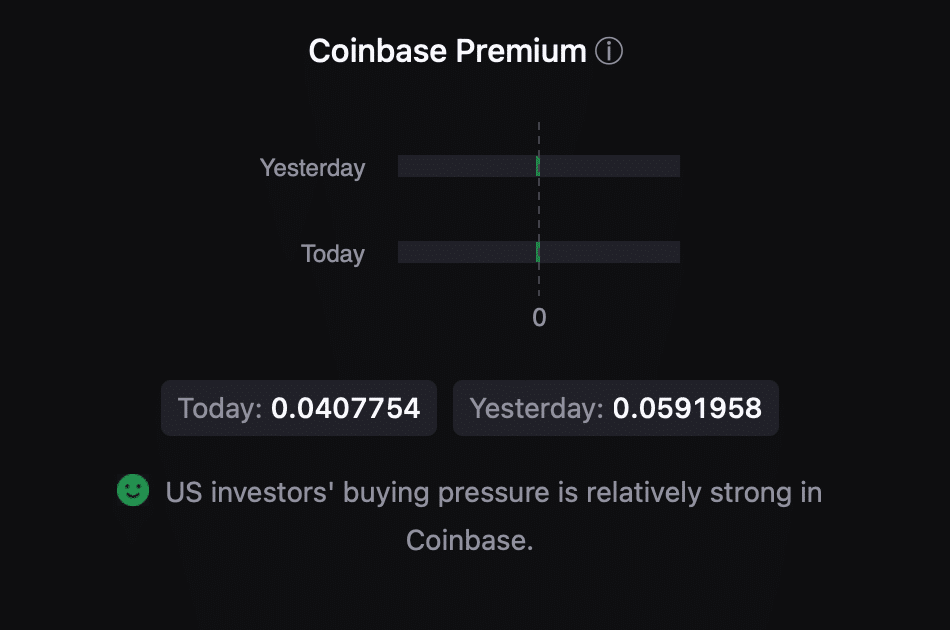

We then checked other metrics to find out how likely Bitcoin is to start a new bull rally. Our analysis of CryptoQuant’s facts revealed that BTC’s Coinbase bounty was green.

This meant that buying sentiment among US investors was strong.

Source: CryptoQuant

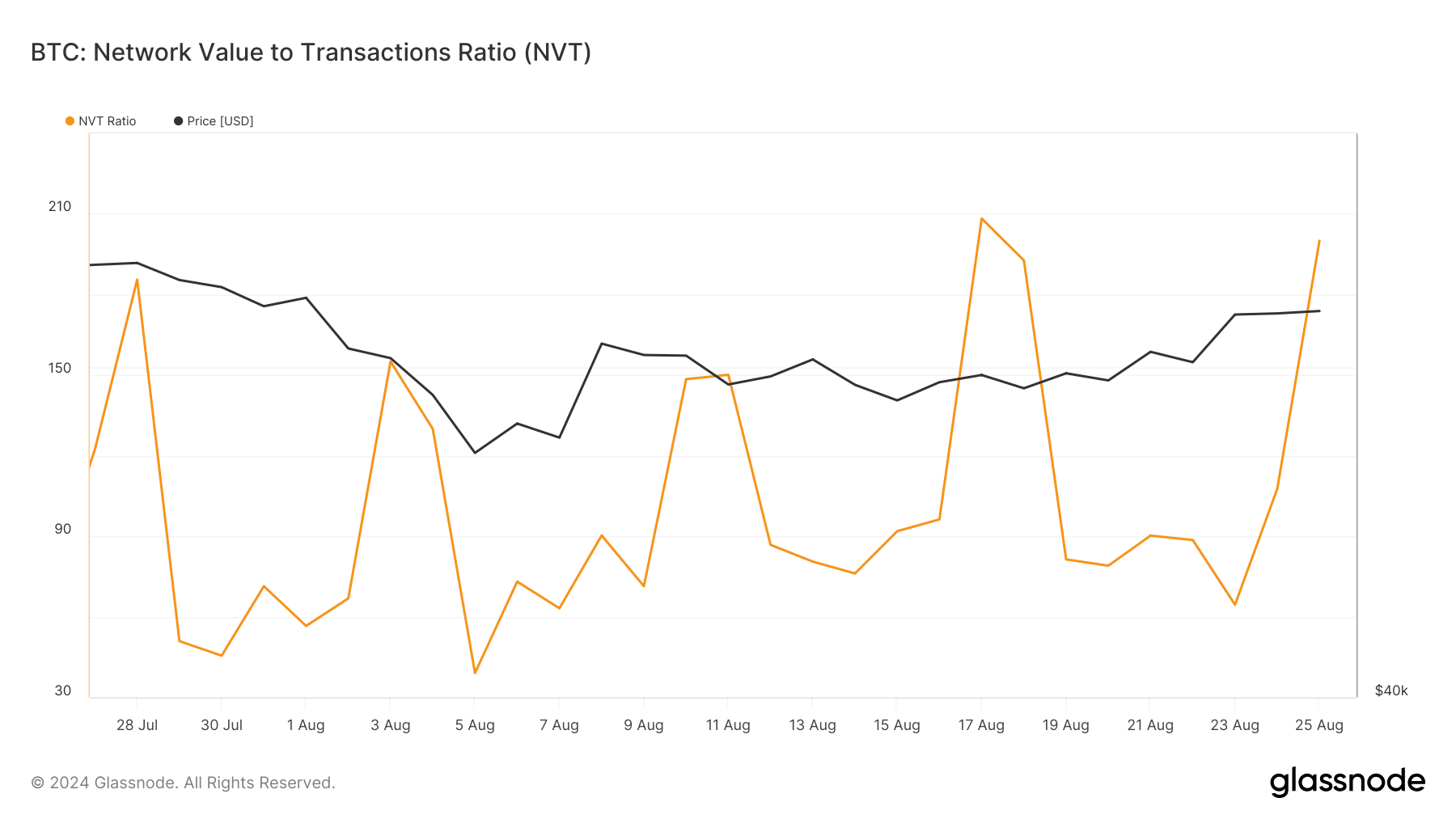

Net deposits of BTC on the exchanges were also low compared to the average of the past seven days, indicating an increase in buying pressure. However, the king of cryptos’ NVT ratio recorded a sharp increase.

Generally, a rise in the benchmark means an asset is overvalued, indicating a price correction.

Source: Glassnode

Read Bitcoins [BTC] Price prediction 2024-25

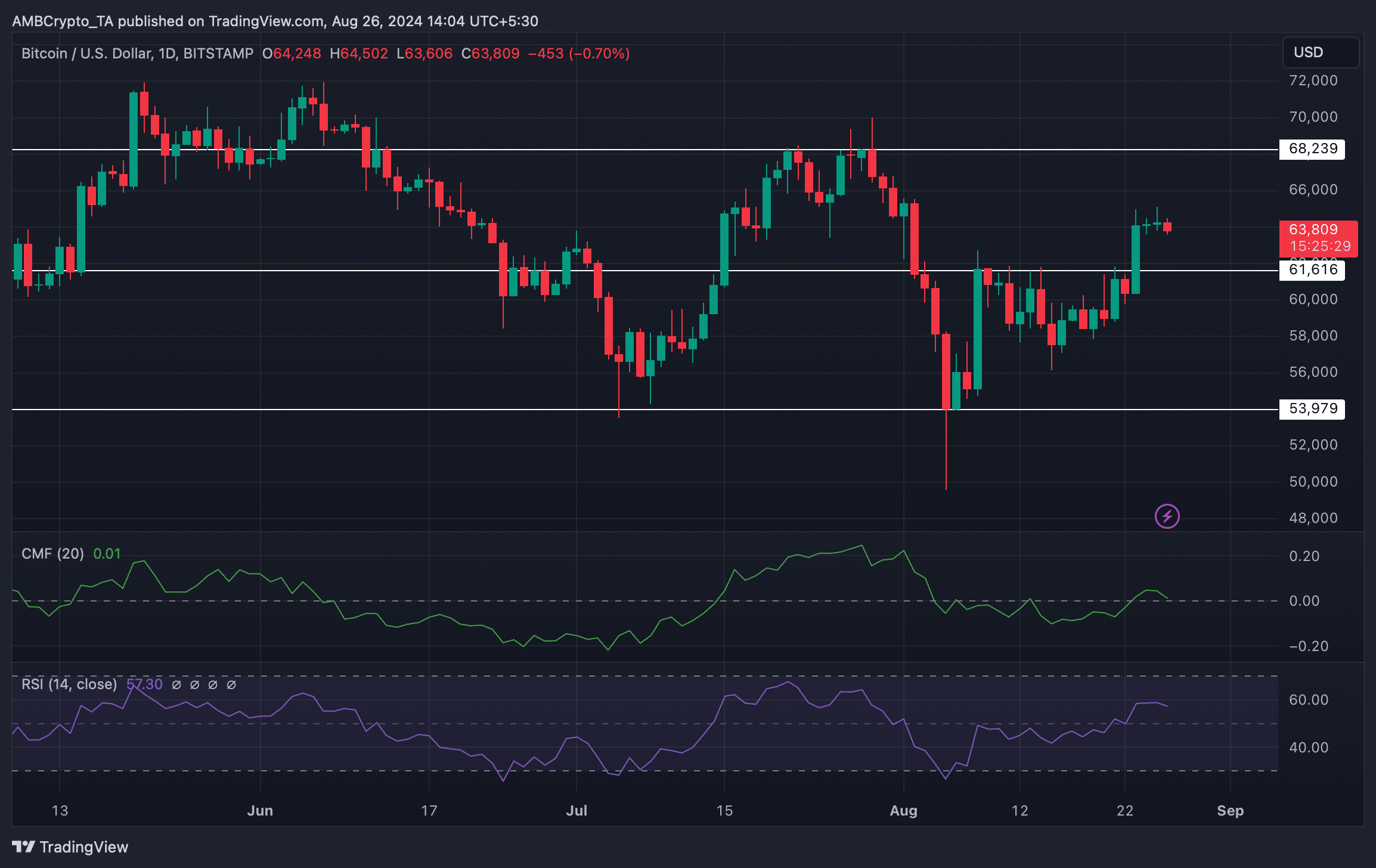

Just like the above stats, the market indicators also looked quite bearish for BTC. For example, the Chaikin Money Flow (CMF) recorded a decline. The Relative Strength Index (RSI) also followed a similar path.

These indicated that investors might witness a short-term decline in the price of BTC before it regains bullish momentum.

Source: TradingView