- Bitcoin is currently in an underwearing zone where sharp sale was followed by strong rebounds.

- Can Bitcoin repeat his historical trends under current macro -economic conditions?

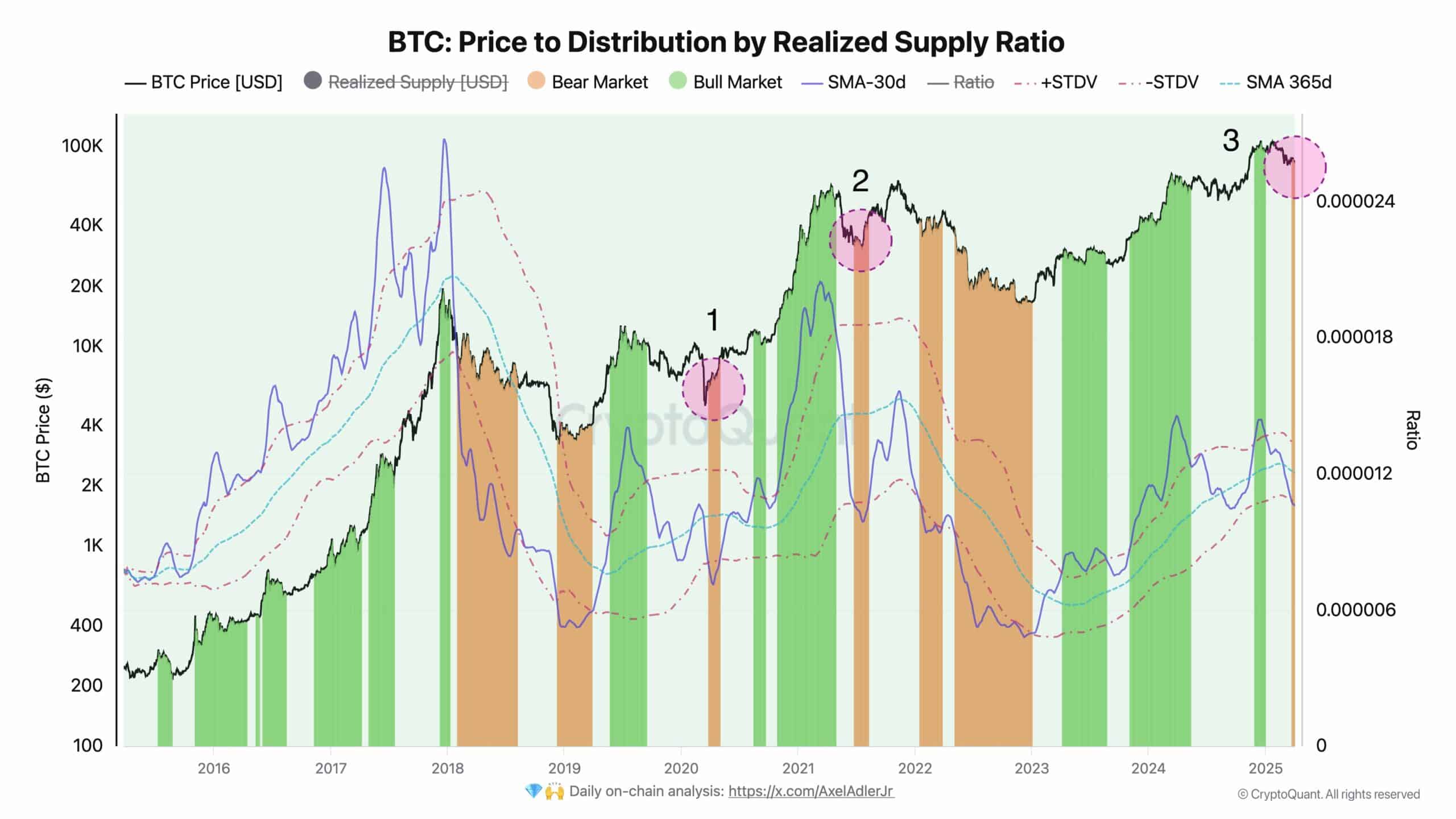

Bitcoin [BTC] is approaching an undervaluation phase as indicated by its 30-day metal metal.

Historically, such conditions preceded important market movements, either by capitulation -driven corrections or a auxiliary prally from a local soil.

Simply put, the realized delivery refers to the total amount of bitcoin that has not been moved in a certain period, so that we have insight into how much of the delivery is actively traded.

When the range realized is high, this suggests an increased activity, while a low -realized stock can indicate that Bitcoin is being held by long -term investors or sleeping addresses.

As shown in the graph, the 30-day advancing average of realized offer (purple) fell during the last two corrections under the lower dotted line, which indicates over-sold circumstances.

Source: Cryptuquant

This pattern took place during the COVID-19 crash and post-china mining ban, both followed by rebounds. A similar arrangement has now been noticed.

After a volatile Q1 with a decrease of almost 11%, BTC’s 30-day stock is realized on the bottom, indicating that Bitcoin is undervalued.

Historically, this has marked a point of capitulation, where sales pressure fades and buyers intervene at lower prices, which often cause a rebound or aid.

Low liquidity: a sign of market maturation?

Typically, when fewer coins are actively traded, this often indicates that more holders-such as settings and long-term investors and “hodl” assume mindset, reducing the frequency of transactions.

In the long term, such circumstances can release the way for Bitcoin to see more as a store of value or a hedge, similar to gold.

However, to have a bull run, however, buyers must intervene.

Although the “hodl” sentiment reduces the slippiness inflow, the sales-side pressure of weak hands must be absorbed to establish a market base, which makes the road clear for a potential auxiliary prally.

In essence, mitigating the liquidity on the sales side of derivative marketsWhere Call -orders dominate sentiment, is crucial. But buy bulls in the undervaluation signal?

A bullish breakout for bitcoin still in the dark?

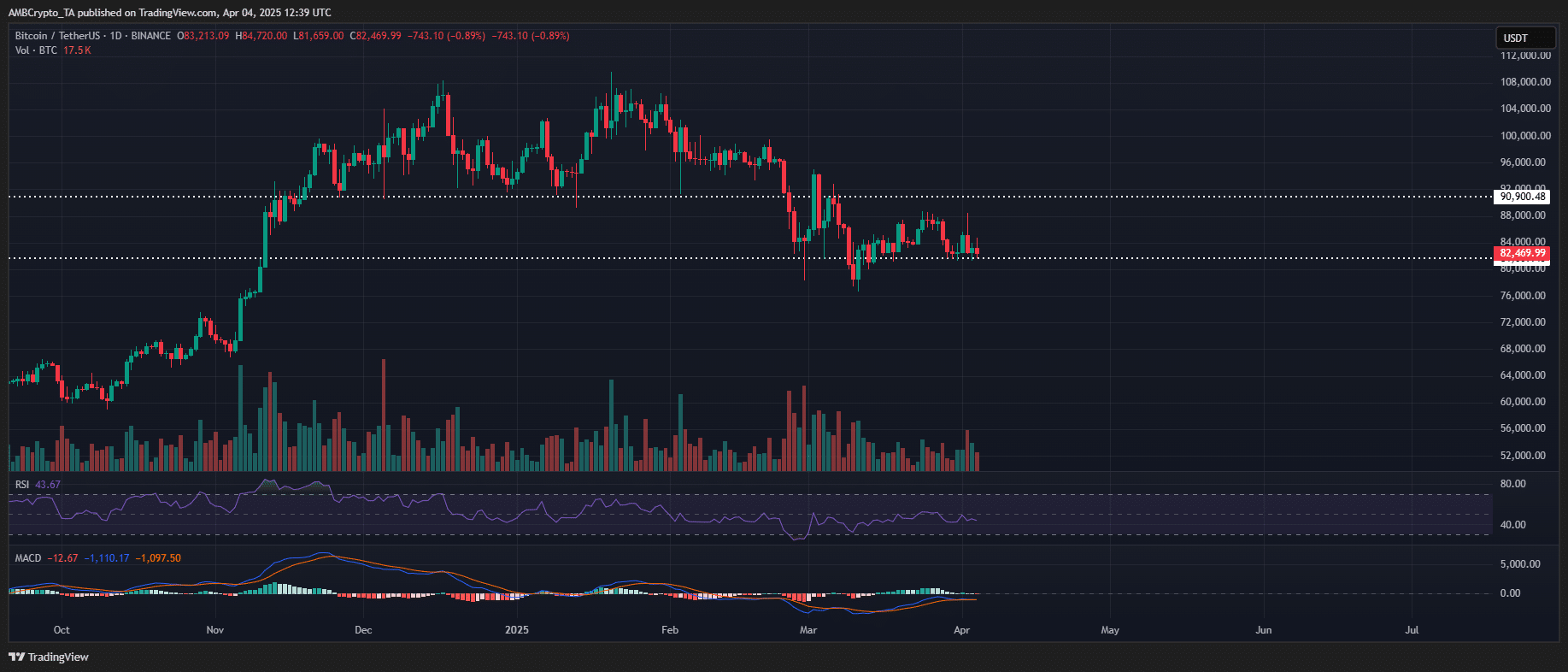

Despite the fact that Bitcoin supports support above the $ 80k level in the middle of macro-economic headwind, a definitive shift to a fully-fledged bull market still has to be released.

Long -term holders (LTHS) liquidated 1,058 BTC with an average of $ 82k because tariff news came on the market, which leads to a retracement back to $ 81k.

While the Q2 unfolds, the persistent effects of Trump’s policy on retail feeling will probably continue to dampen bullish momentum.

Although undervaluation signals can cause institutional accumulation, in combination with Hodling behavior that maintains support over $ 80k, the inflow of the retail trade remains lukewarm.

Source: TradingView (BTC/USDT)

This lack of Retail participation is a key factor that in the short term brakes a considerable price movement to $ 90k.

Without a remarkable shift in the market structure or sentiment from retail investors, the chance of an outbreak seems to be filled in this quarter.