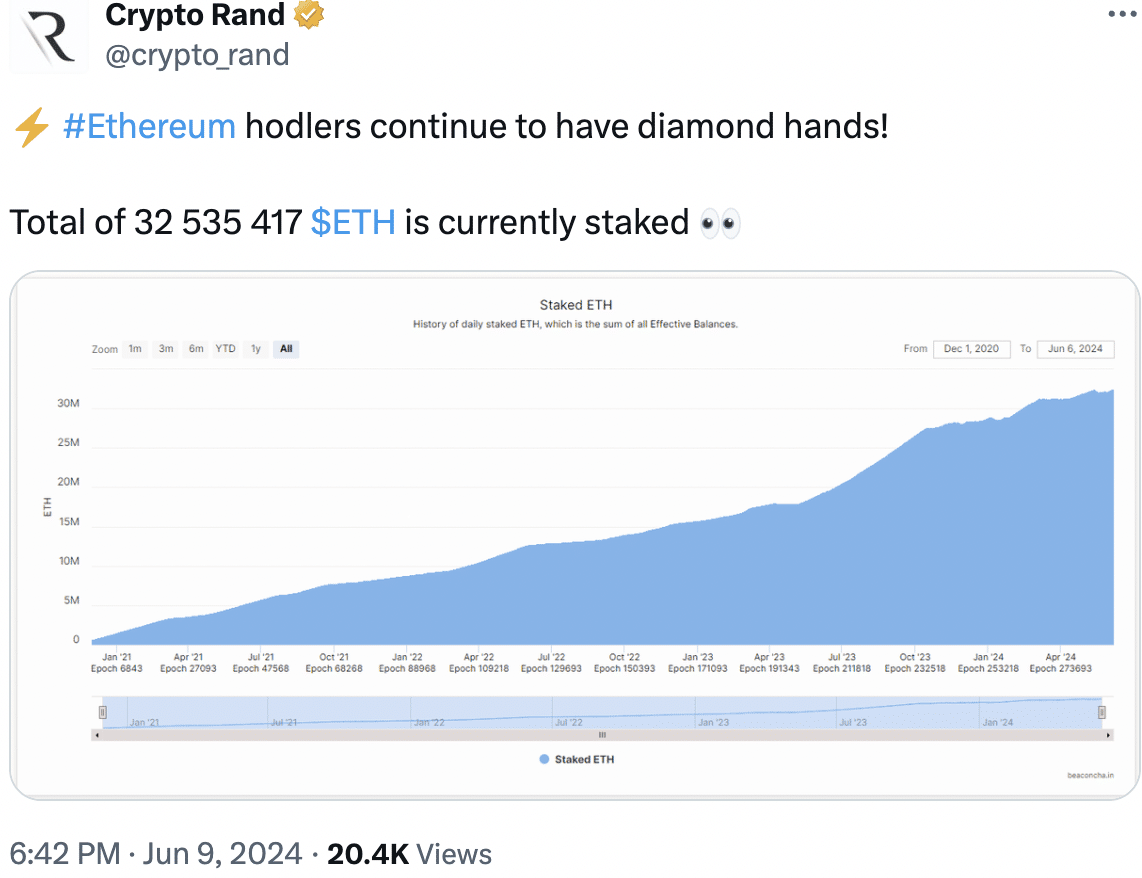

- The amount of ETH staked has increased significantly in recent weeks.

- The price of ETH continued to move sideways.

Ethereum [ETH] has been stagnant around the $3600 level for quite some time. But despite the sideways movement, optimism around the cryptocurrency has remained high.

This was indicated by the increasing interest in ETH stakes in recent weeks.

Ethereum Staking Increases

According to recent data, 32.5 million ETH had been staked on the network.

Source:

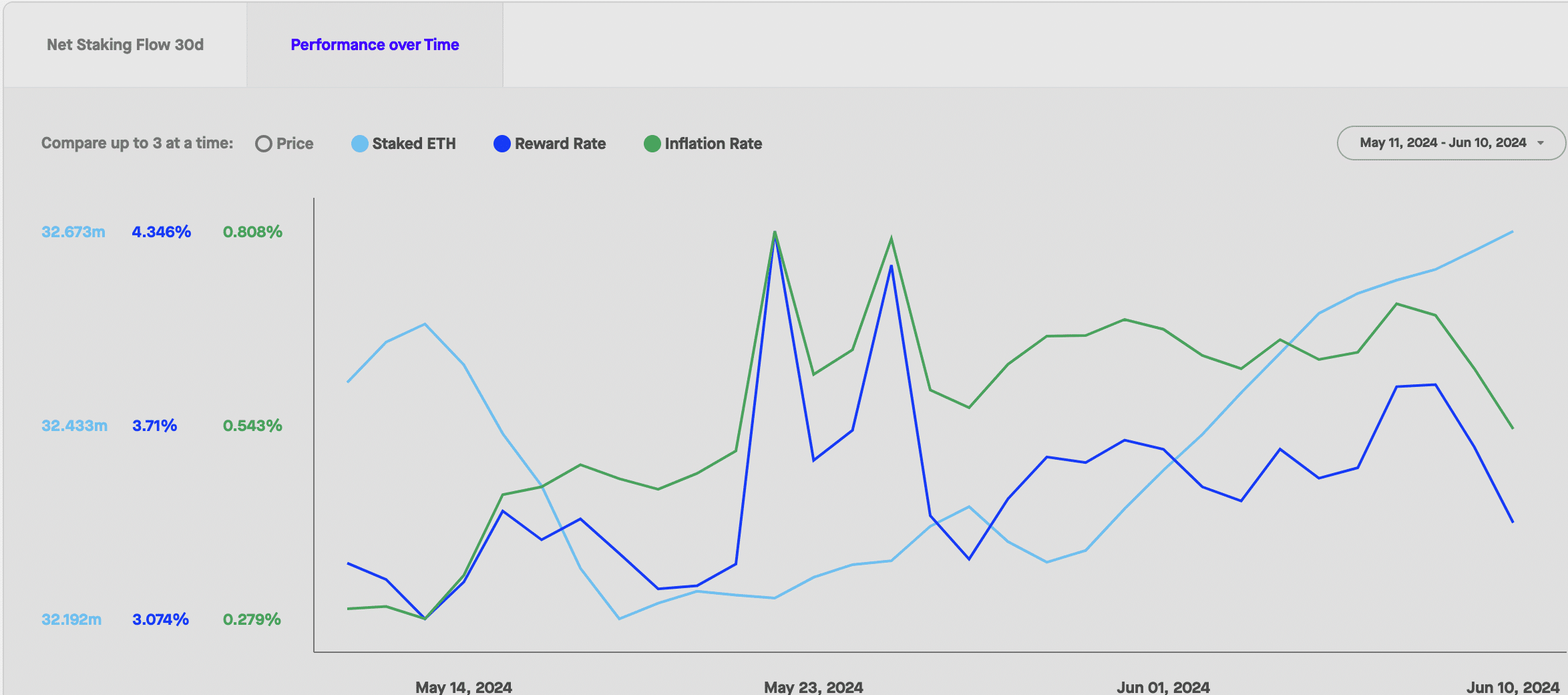

Although the number of stakers increased, which can typically boost rewards, both the reward rate and inflation rate for staking ETH saw a decline.

The rewards rate refers to the annual return a user gets for staking ETH. It is essentially the interest a user earns for helping secure the network.

The inflation rate, on the other hand, reflects how quickly the total supply of ETH is increasing. New ETH is created as staking rewards, and this contributes to inflation.

A decreasing reward rate means that a user will earn slightly less new ETH per token staked in the short term. However, declining inflation indicates that the total supply of ETH is growing at a slower pace.

In the long run, this could even be a positive sign for ETH’s value. If demand for ETH remains strong while supply grows more slowly, this could push the price of ETH higher.

Source: Staking Rewards

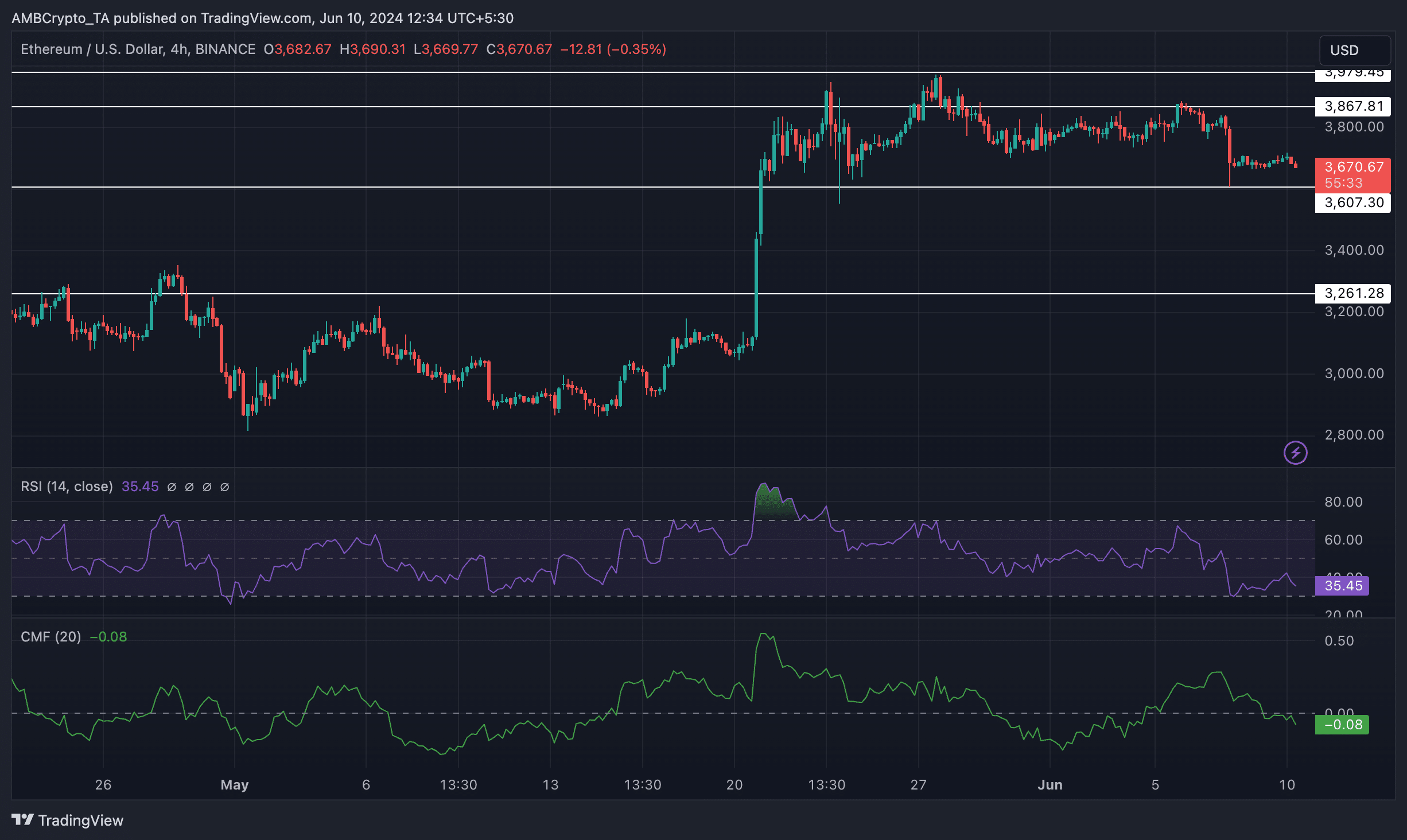

At the time of writing, ETH was trading at $3,669.67. After rising past the $3,600 level following the ETF’s announcement, the price has moved between the $3,979 and $3,607 levels.

This recent correction in the price of ETH can be attributed to profit taking by short-term holders after the sudden price increase.

The RSI (Relative Strength Index) for ETH had fallen significantly in recent days, implying that the bullish momentum for ETH had waned.

Is your portfolio green? Check out the ETH profit calculator

Moreover, the CMF (Chaikin Money Flow) for ETH had also decreased, implying that the flow of money into ETH had decreased. If bearish sentiment prevails, ETH could retest the $3,607 levels before heading higher.

Source: trading view

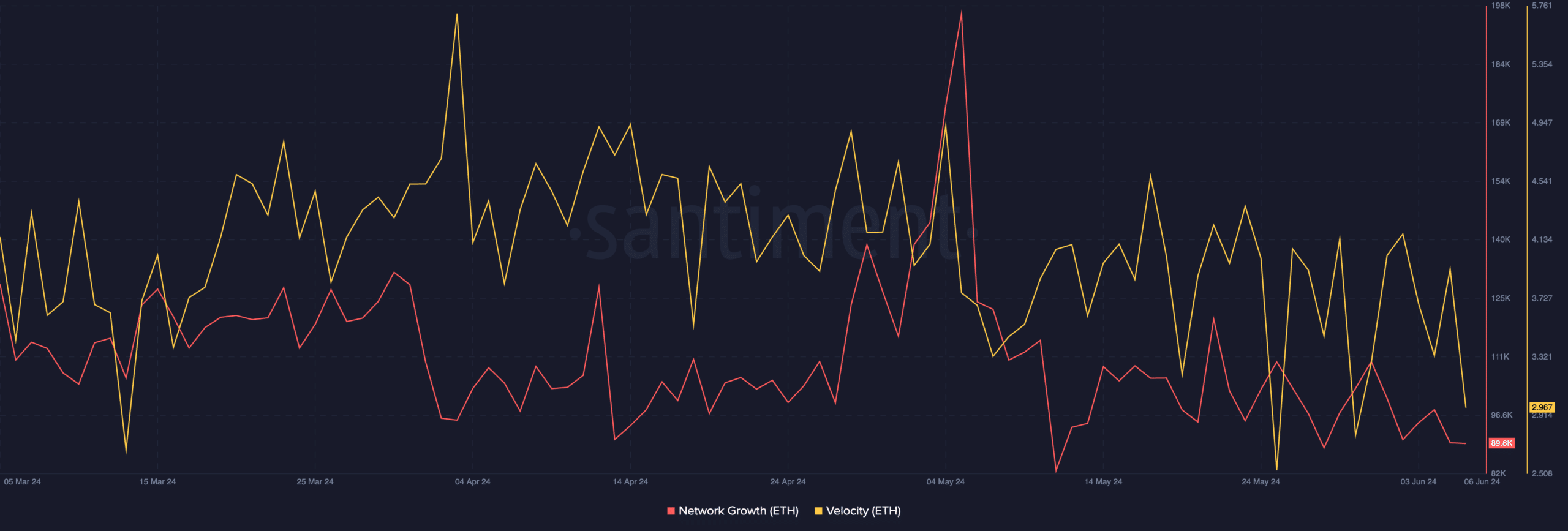

Ethereum’s network growth has also slowed significantly in recent days. This implied that there were new addresses showing interest in ETH, which could cause problems for the altcoin in the long run.

Source: Santiment