- On October 16, Lido announced its plan to leave Solana.

- SOL is up more than 5% in the past 24 hours.

Leading decentralized liquid staking protocol Lido Finance [LDO] has announced that it will cease operations on the Solana [SOL] blockchain. The decision was taken in response to a community votes and will be implemented in phases over the coming months.

After an extensive DAO discussion followed by a community vote, the sunset of Lido on Solana was approved by LDO holders and will commence shortly.

More information here: https://t.co/MyImL1qpap

— Lido (@LidoFinance) October 16, 2023

Realistic or not, here is the market cap of SOL in ETH terms

Lido’s short stay on Solana

Lido launched on Solana in September 2021 and allowed the chain’s users to stake their SOL coins in exchange for Staked Solana [stSOL] Coins.

Two years after the introduction of the chain, Yuri Mediakov, who heads P2P Validator, the development team that has overseen Lido on Solana since March 2022, has submitted a financing proposal proposal to the Lido DAO.

As noted by Mediakov, P2P Validator took over the operation of Lido on Solana from Chorus One and has been running it ever since.

According to Mediakov, P2P Validator has made significant progress, including growing the protocol’s TVL from 954,000 SOL in December 2021 to 4.1 million SOL in October 2022.

This marked a remarkable 330% growth and market share growth in the second quarter of 2022, and continued growth until the unexpected collapse of FTX in the same year.

Mediakov further added that the number of decentralized finance (DeFi) protocol integrations has increased from four to 22 after P2P Validator took control, and that stSOL has secured listings in 12 major wallets.

The development team has also established partnerships with entities such as Hubble, Kamino, Francium, Solend and Aldrin since March 2022.

During the 2022-2023 fiscal year, the development team invested approximately $700,000 in Lido on Solana. However, the proposal emphasized that

“Yet-to-date revenue was approximately $220,000 (developer fee + milestone reward), resulting in a loss of $484,000.”

To support Lido’s activities in the chain, Mediakov requested $1.5 million from the Lido DAO Treasury.

He added that in the event that the DAO denied the request, Lido on Solana would be discontinued, following the previous cases of Lido on Polkadot. [DOT] and Kusama [KSM]which also turned out to be financially unviable.

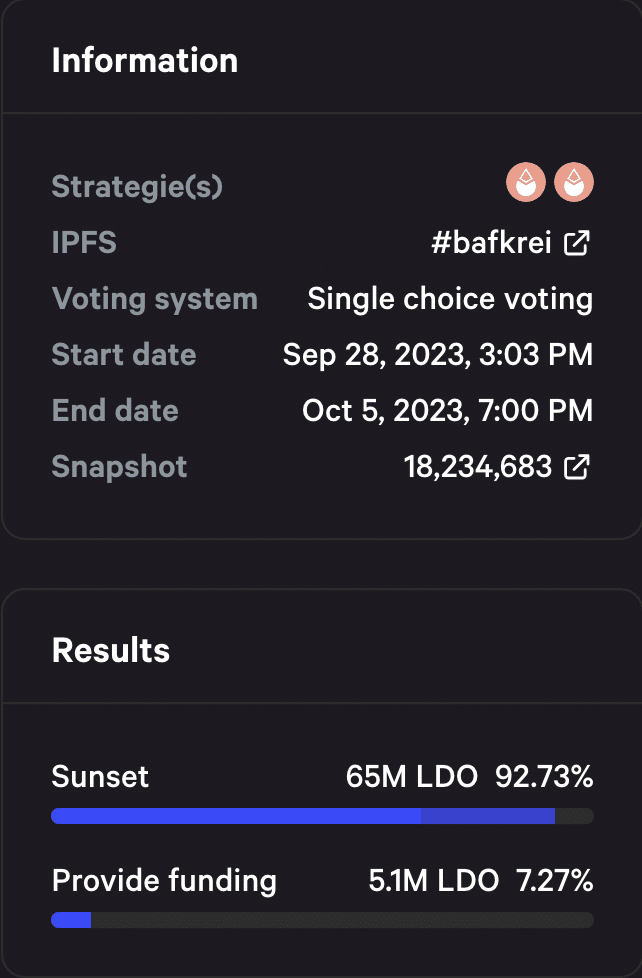

Voting on the proposal began on September 28 and ended on October 5. According to information from the open-source voting platform Snapshot, 93% of all votes cast were in favor of discontinuing Lido on Solana.

Source: snapshot

Next steps

During the ongoing sunset process, holders of the stSOL tokens will continue to receive rewards. However, by February 4, 2024, all token holders must have their SOL coins vacated via the protocol’s command-line interface. The deployment on Lido on Solana stopped on October 16.

Also, node operators will receive voluntary off-boarding guidance from P2P Validator, and Lido NOM contributors using Lido community channels. The onboarding process is expected to start on November 17.

On February 4, Lido frontend support on Solana will be discontinued and undeployment will only be possible via the command line interface.

Read Solana’s [SOL] Price forecast 2023-2024

SOL makes a profit

Interestingly, despite Lido’s decision, SOL’s value has increased by 5% in the last 24 hours. According to data from CoinMarketCapthe altcoin was exchanging hands at $24.09 at the time of writing.

The price movements, observed on a 12-hour chart, showed increased accumulation. At the time of writing, buying activity was outpacing the sell-off, with key momentum indicators noted above their respective midlines.

Source: SOL/USDT on TradingView