As Yuga Labs restructures, how are investors and collectors responding to the changing situation in the NFT market?

Yuga Labs, the company behind the hugely popular Bored Ape Yacht Club (BAYC) NFT collection, is undergoing a restructuring.

This move comes amid a challenging period for the company, marked by a sharp decline in the value of its key NFTs and the need to refocus its strategic focus.

CEO Greg Solano recently shared a candid message on X, acknowledging the company’s problems and outlining a path forward.

gmm, really tough day today. I am determined to transform yuga and return us to our roots, and that means making tough decisions. by far the hardest part is saying goodbye to some talented team members. This was my message to the team this morning. pic.twitter.com/gBkoNf2iK3

— Garga.eth (Greg Solano) 🍌 (@CryptoGarga) April 26, 2024

Solano cited the importance of regaining focus and agility, positioning Yuga Labs as a leaner, more efficient and deeply crypto-savvy organization.

One of the key initiatives in Yuga Labs’ restructuring plan is the divestiture of certain gaming projects. HV-MTL and Legends of the Mara, two notable companies, have been acquired by gaming studio Faraway.

Additionally, Yuga Labs is placing renewed emphasis on its Otherside metaverse project. Launched during the peak of the NFT boom in 2022, Otherside aims to create a digital universe where users can interact, create and trade NFTs.

Despite market challenges, Yuga Labs has outlined plans to advance this ambitious initiative.

The crypto community’s reaction to Yuga Labs’ restructuring has been mixed. While some have expressed support for the company’s efforts to adapt and evolve, others have raised questions about the future direction of its NFT offering.

Current Performance of BAYC NFTs

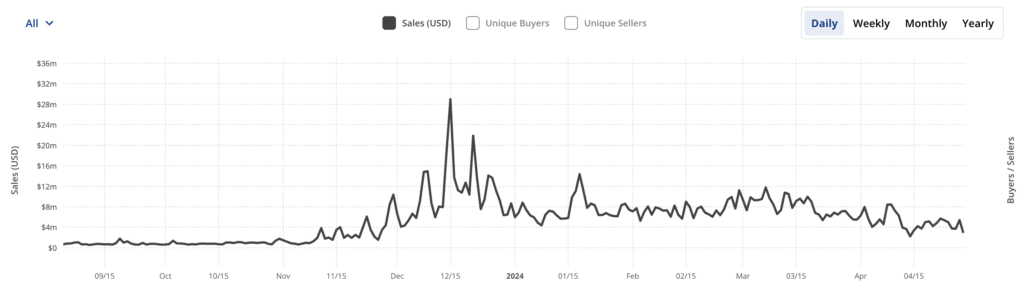

Following the announcement of Yuga Labs’ restructuring efforts, there has been a notable increase in the performance of its flagship BAYC NFT collection.

As of April 30, BAYC NFTs have seen an 80% increase in trading volume over the past 24 hours, with approximately 1,300 ETH traded in the past 24 hours, equivalent to approximately $4.2 million.

The estimated market cap of BAYC NFTs is approximately 147,139 ETH, which amounts to approximately $466 million. This represents approximately 11% of the total NFT market capitalization of $4.23 billion.

In addition to trading volume and market capitalization, the number of sales of BAYC NFTs also increased by more than 52% to 96.

Performance of the NFT market

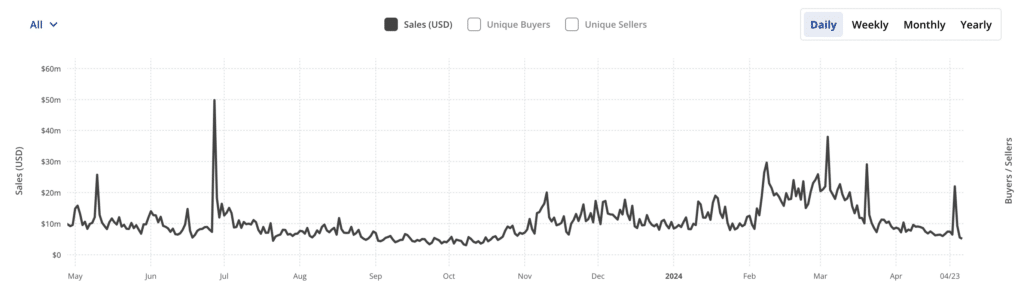

The NFT market has experienced an uptick in activity and growth, with several blockchains and projects seeing notable increases in sales and prices.

Ethereum: Ethereum (ETH) has the highest sales volume in the past 24 hours on April 30, at only about $9 million. However, Ethereum saw its monthly volume drop by more than 57% since March to around $250 million.

Source: CryptoSlam

Bitcoin: Bitcoin (BTC) recorded nearly $7.5 million in NFT sales in 24 hours, the second highest in the industry. Bitcoin generated $542 million in total NFT sales in March, its best month since last December, and up 70% from the previous month.

Solana: Solana (SOL) was in third place on April 30 with $4.7 million in sales in the past 24 hours, a 52% increase in daily sales. Solana had its most successful month for NFTs this year in March, with sales of more than $250 million, up about 16% from February. The average selling price of Solana-based NFTs surpassed $100 in March for the first time since April 2023.

Overall, NFT prices are rising across all blockchains, with the average selling price on some chains reaching the highest level in almost two years.

If this trend continues, we could see renewed interest and investment in the NFT space.

What can you expect next?

TechNavio’s analysis predicts an expansion of the NFT market, with a compound annual growth rate (CAGR) of 30.28% between 2024 and 2028, reaching a market size of at least $68 billion.

By 2024, TechNavio predicts annual NFT market cap growth of at least 23.27%.

Geographically, North America and Europe are leading the way in NFT adoption. However, data from Metav.rs shows that Singaporeans, Chinese and Venezuelans were the most active NFT traders in 2023.

Interestingly, women in Thailand have shown more interest in NFTs, with 30% collecting them, compared to 23% of men.

In contrast, 70% of Americans are still unaware of what NFTs are, underscoring the untapped potential in the US market.

In France, 3.5% of the population has purchased NFTs, and almost half of French youth aged 18 to 24 are open to buying NFTs.

However, as governments around the world take a closer look at the crypto space, more rules and regulations are expected, which could also impact the NFT markets. Furthermore, the general volatility in this area can make or break the game.

Read more: Most Expensive NFTs: Best-Selling Digital Gems