- Assessing the relationship between USDT dominance and crypto prices.

- USDT flows show a nearly equivalent outcome between buyers and sellers.

USDT’s dominance can reveal a lot about the mood of the market. This is largely because USDT is the largest stablecoin, meaning its on-chain activity and flows can reflect the state of liquidity in the market.

USDT’s dominance should technically have an inverse relationship with Bitcoin [BTC] and altcoins. In other words, dominance should be higher when cryptocurrencies experience outflows.

For example, while September was mostly bullish for cryptocurrencies, USDT.D saw a significant retracement.

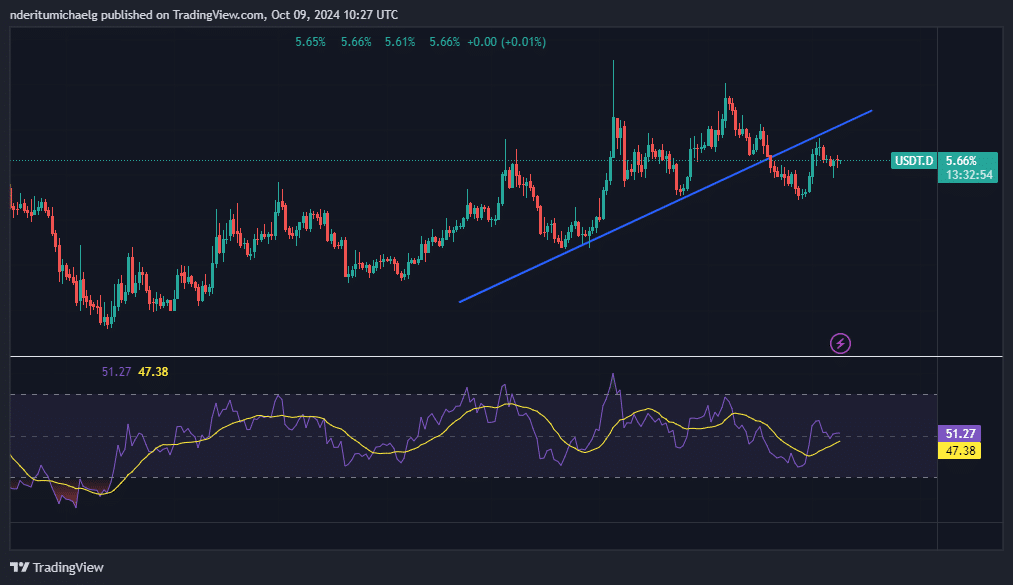

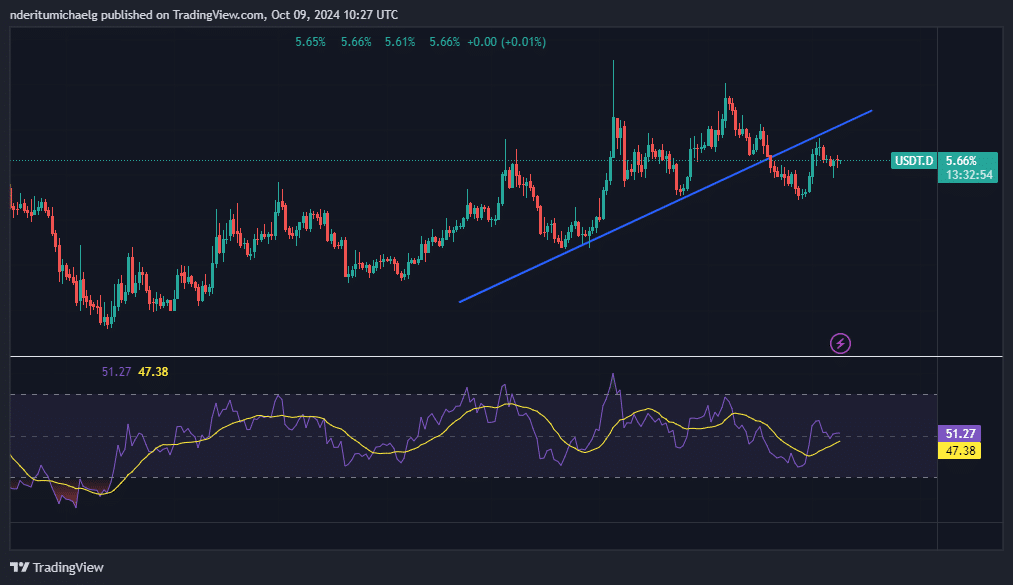

Patterns in USDT dominance can also provide a rough idea of how the market will behave. USDT.D broke below the three-month ascending support line on September 19.

It has also reached lower highs, indicating waning momentum.

Source: TradingView

Although the month started with a sign of renewed momentum, USDT’s dominance has cooled somewhat in recent days. It hovered slightly above the 50% RSI level, indicating a zone of indecision in the market.

If the price falls below the RSI level of 50%, this is considered confirmation of a further decline. In other words, liquidity will flow in favor of Bitcoin and altcoins.

On the other hand, a recovery from current levels could also be in store, in which case cryptocurrencies will continue to bleed. This will ultimately depend on market sentiment.

What USDT’s dominance and flows reveal

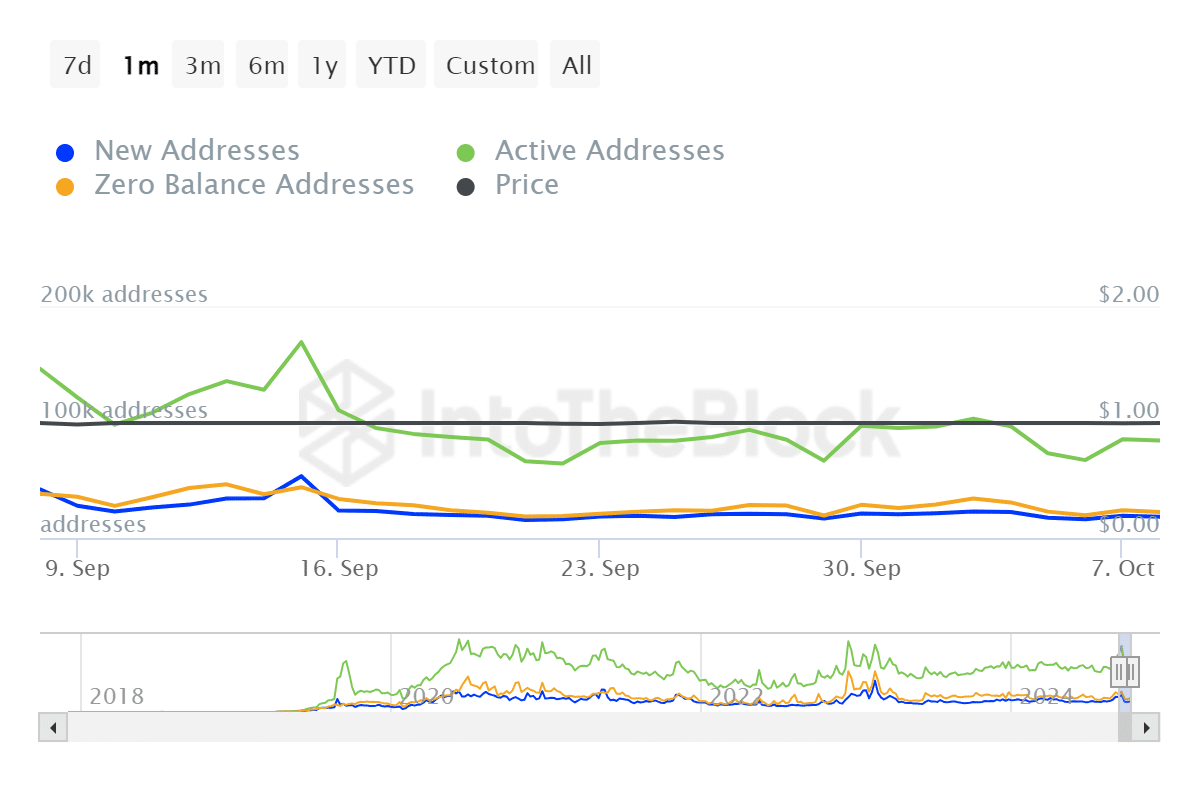

USDT address activity dropped significantly between October 3 and 6.

However, it has since recovered, with the number of active addresses growing from 16,360 addresses to more than 18,400 addresses in the past three days.

Source: IntoTheBlock

The number of addresses with a zero balance increased from 19,860 on October 6 to 22,530 addresses on October 9.

This suggested that a fair number of addresses had moved liquidity from USDT to altcoins, also in line with the decline in USDT dominance over the same period.

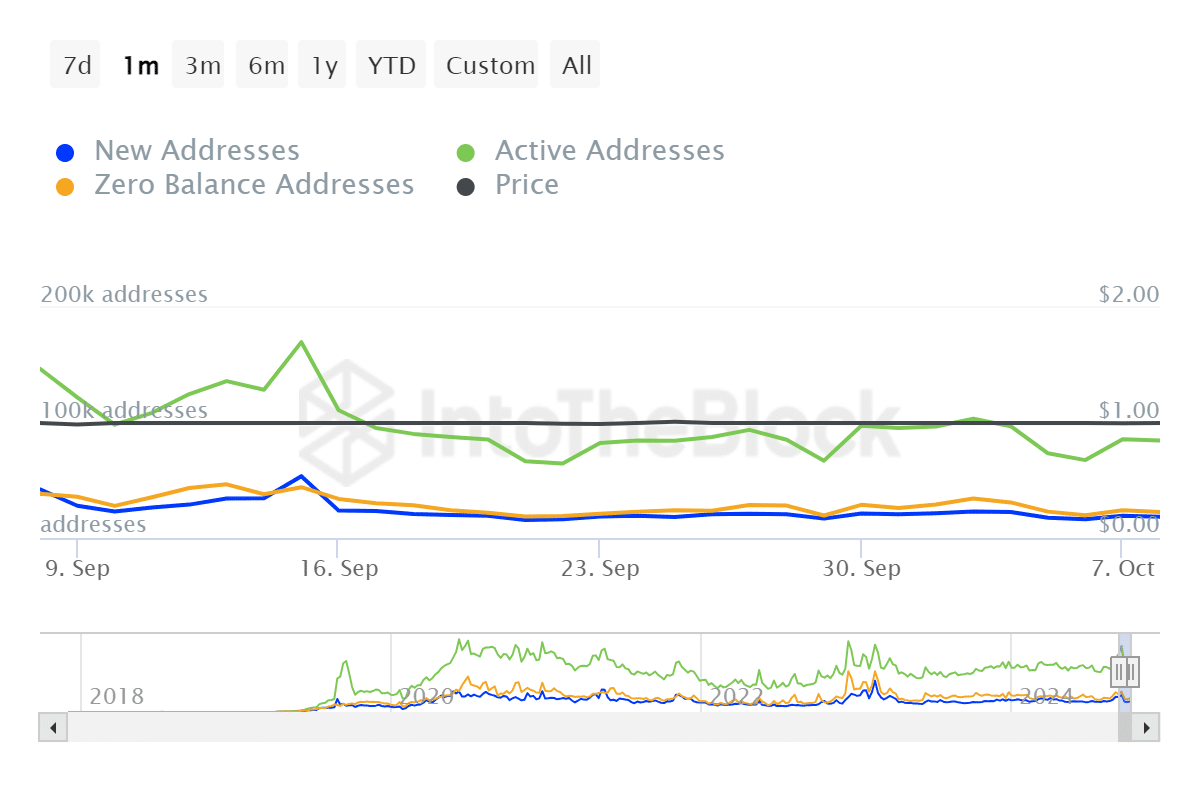

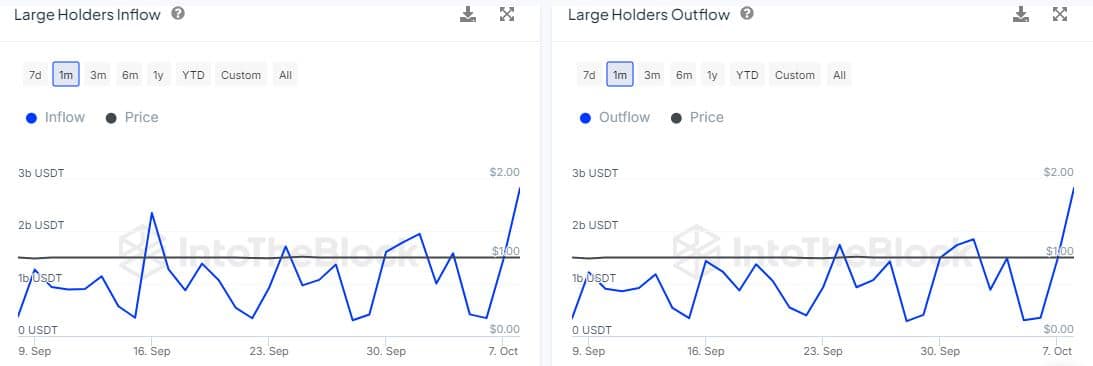

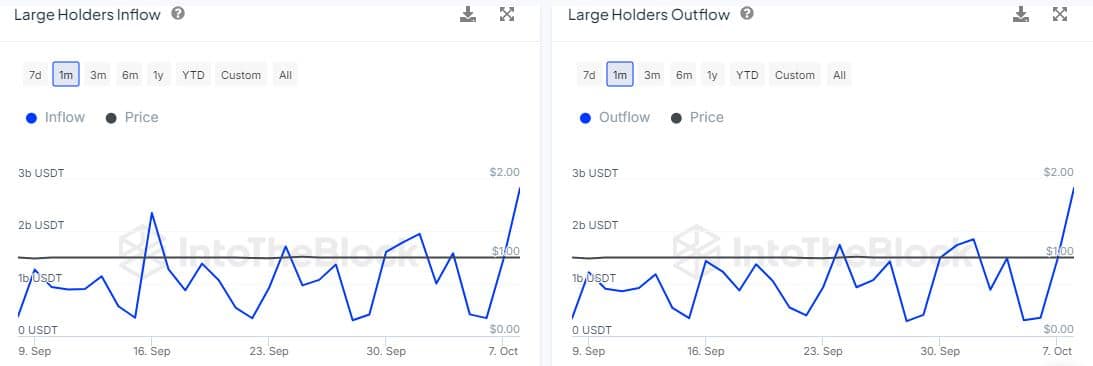

Despite the above observation, large holder flows showed some deadlock in terms of directional impact.

Large holders or whales usually have the greatest impact on liquidity flows and therefore influence the direction of the market.

Source: IntoTheBlock

The flows of USDT major holders have been almost flat over the past 24 hours. Large holder inflows peaked at USDT 2.82 billion, while large holder outflows peaked at USDT 2.83 billion.

Based on the above findings, we can conclude that there was some uncertainty about where the market will lean. In other words, it was in line with the prevailing neutral sentiment in the market.