- Bitcoin bulls emerged in response to rate hikes as the market gets a confidence boost.

- Evaluating the risk of prolonged liquidations as volatility makes a comeback.

Bitcoin [BTC] responded positively to the Federal Reserve’s latest interest rate cut announcement. The long-awaited decision showed that interest rates will fall by 50 basis points.

Investors responded to the rate cuts by participating in a Bitcoin buying wave that pushed the price above $62,000 for the first time this month.

This was in line with previous speculation as lower interest rates are expected to have a positive impact on liquidity flows in risky assets. But the real question is: where does the market go from here?

A bumpy ride ahead for Bitcoin?

There are high expectations around Bitcoin, especially now that interest rates are falling. While this could support more upside potential in the coming months, it also paves the way for more volatility.

Translation, more unexpected pullbacks and highly volatile price movements.

A classic example of why Bitcoin will experience more volatility is that high expectations lead to more optimism and a greater need for leverage. It is likely that more long positions will now be executed.

Meanwhile, whales and institutional players see this as open season for liquidations.

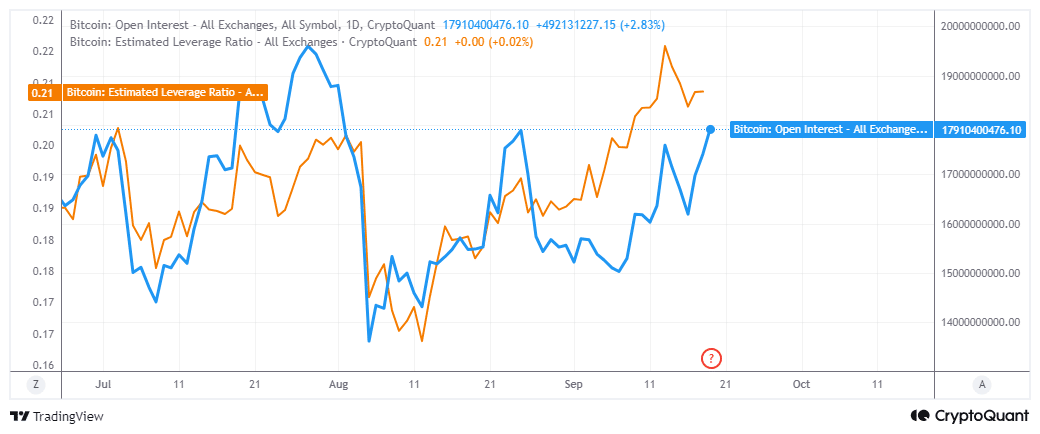

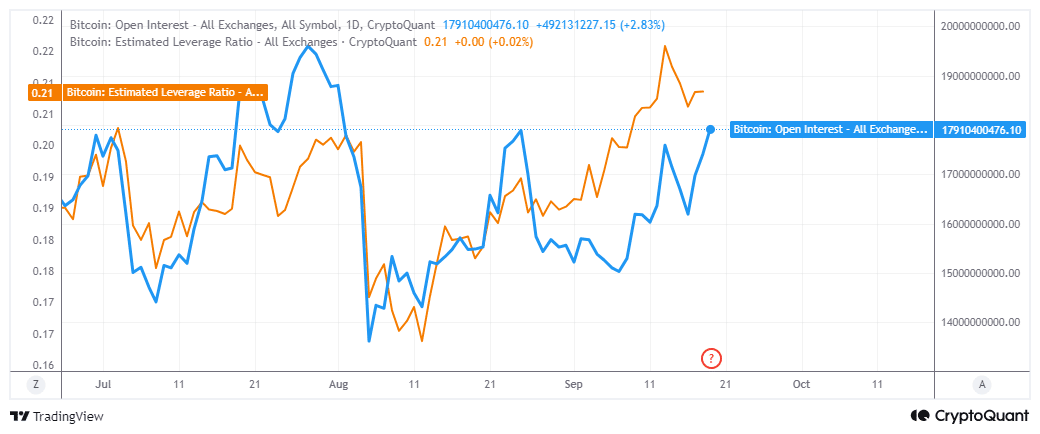

Market data coincides with the above expectations. For example, open interest just rose to its highest level in the past seven weeks.

The estimated leverage ratio, which reflects the level of leverage at a given point in time, has been rising since its August low.

Since September 13, the price has retreated slightly, but is poised to end higher thanks to the recent improvement in market sentiment.

Source: CryptoQuant

Speaking of sentiment, the announcement of interest rate cuts appears to have had a positive impact on Bitcoin ETFs. There was approx $52.83 Million in Bitcoin ETF Inflows on September 18.

Positive ETF flows and expected liquidity injections should set the stage for a healthy Bitcoin run-up. However, it could also pave the way for heavy liquidations and withdrawals along the way.

Assessing recent demand

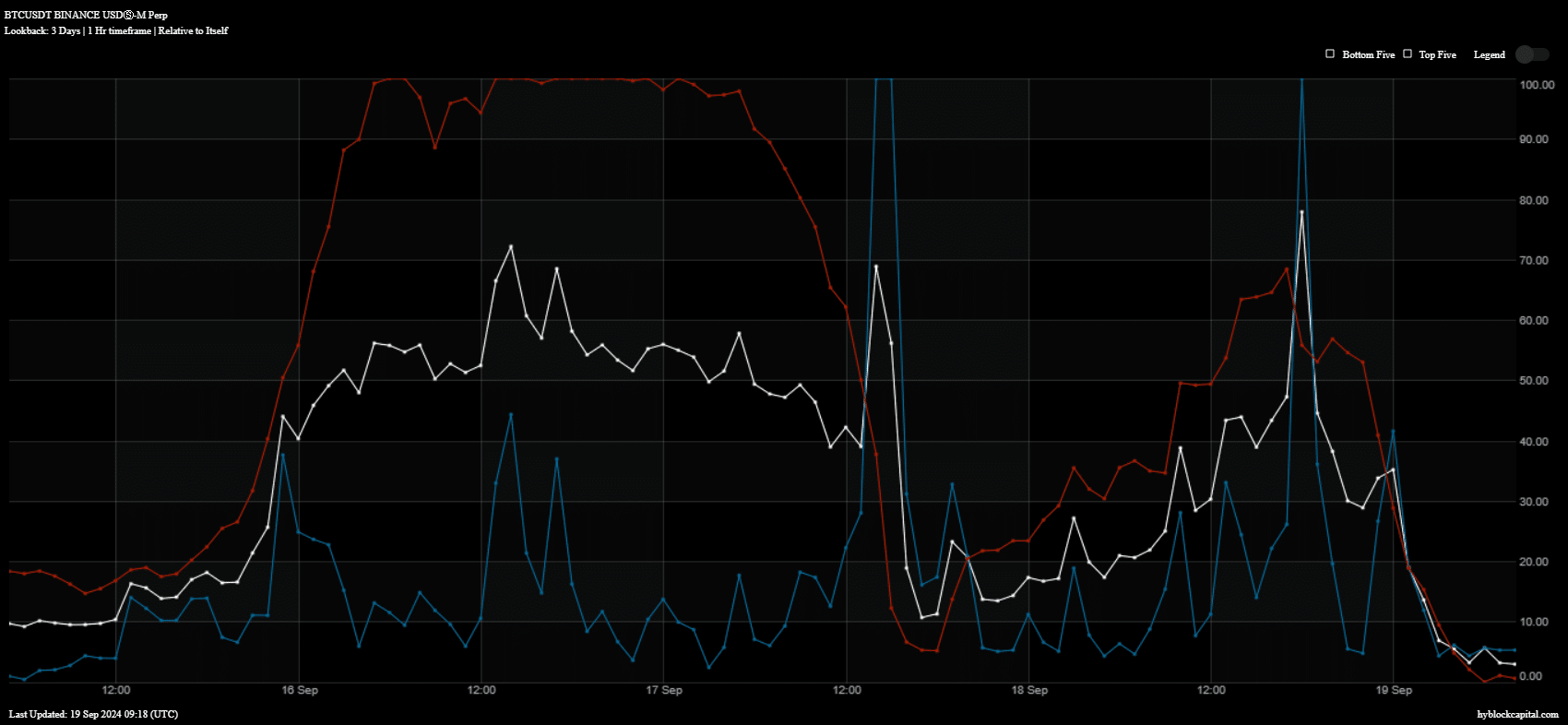

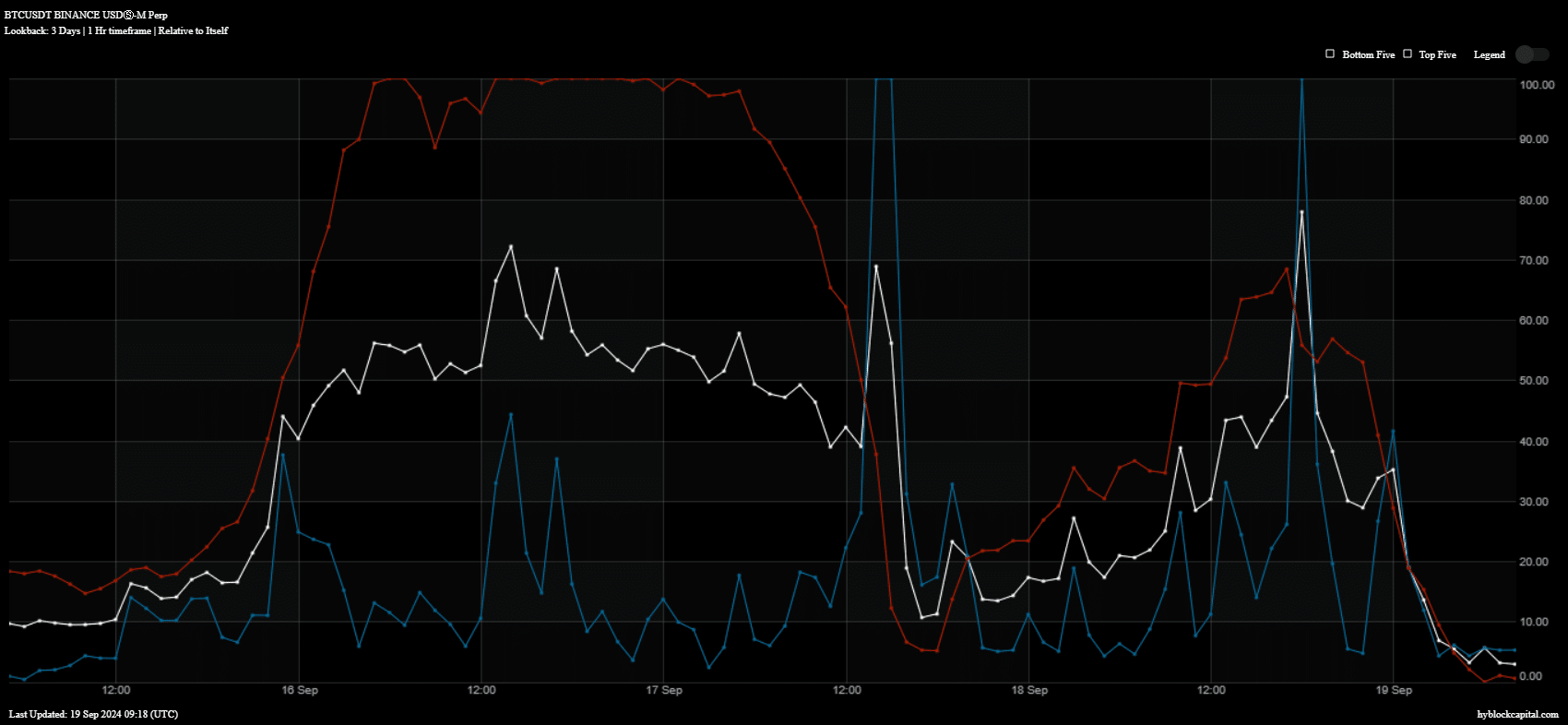

Bitcoin is still at risk of liquidations that could happen soon. On-chain data shows that the recent wave of liquidity injections into Bitcoin has already dissipated, as evidenced by buying volume (blue).

We have also seen a spike in long positions (red), which are at risk of liquidation if the market pulls back unexpectedly.

Source: Hyblock Capital

Read Bitcoin’s [BTC] Price forecast 2024–2025

The presence of highly leveraged long positions can pave the way for whales and institutions to manipulate prices.

Despite the possibilities of a retracement, higher liquidity flows are expected to push Bitcoin higher in the coming months.