- In 2024, the SEC imposed 4.9 billion dollars on crypto-related fines.

- The SEC expanded its focus to NFTs, where makers were charged unregistered securities offers, which was a signal of stricter regulations for digital collecting objects.

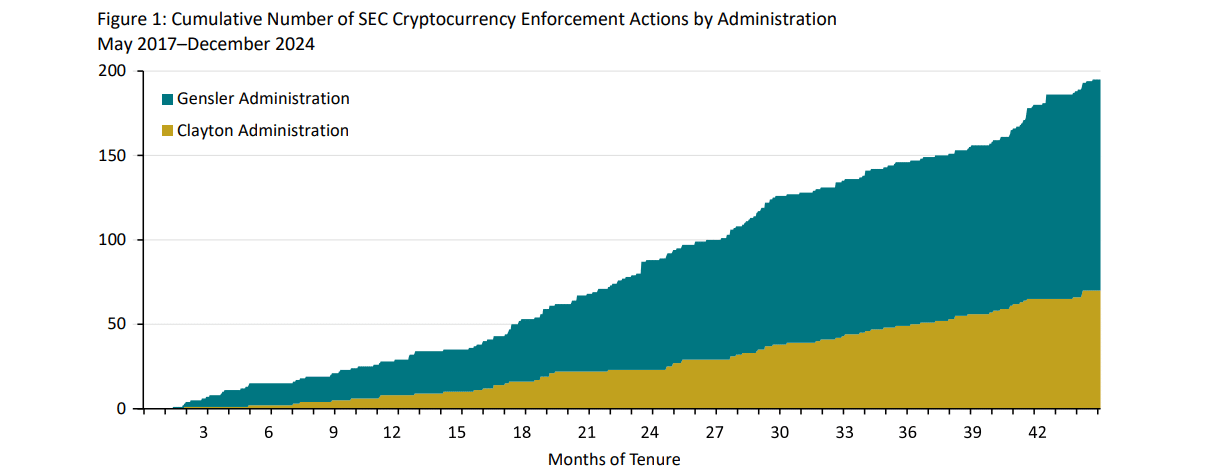

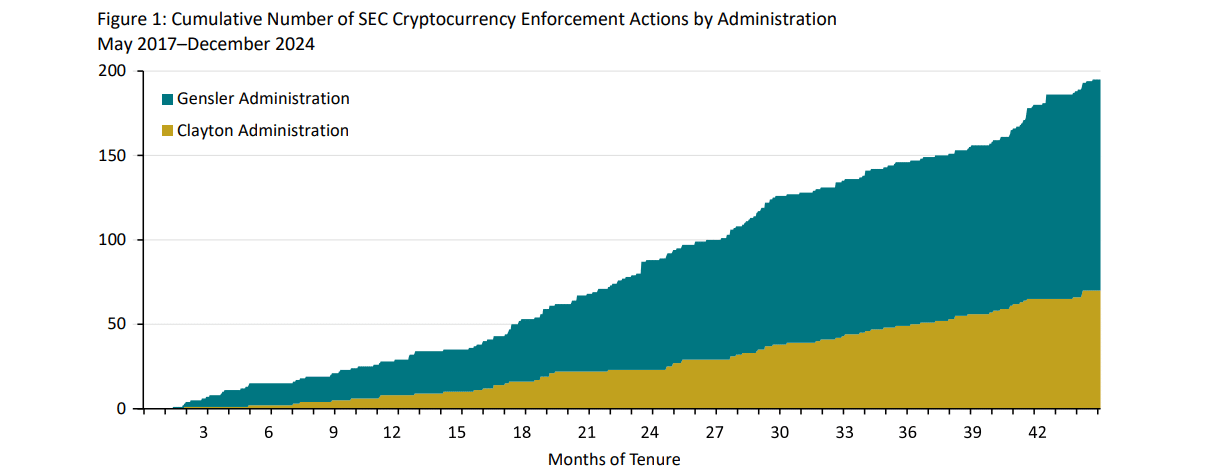

In 2024, the cryptocurrency landscape witnessed significant shifts in the regulations, with crypto enforcement actions of the SEC crucial milestones in the midst of a broader market maturation.

The committee took 33 enforcement measures in 2024. It marked a strategic evolution of its earlier focus on ICO’s to more complex deficiency and strike operations.

Sec-crypto enforcement patterns indicate adulthood of the market

That of the sec Enforcement approach in 2024 showed a remarkable refinement, with a reduction of 30% in the total number of actions compared to the peak of 47 cases in 2023.

However, the monetary impact increased considerably, with fines that reached a record amount of 4.98 billion dollars – largely as a result of the historical settlement of Terraform Labs of 4.55 billion dollars.

Source: Cornerstone report

Fraud and offering non-registered effects remained the top priorities of the SEC, with 73% of enforcement actions fraud and 58% relating to unregistered effects.

In particular, the SEC focused for the first time on non-funded tokens (NFTs), where makers were sued for offering non-registered effects.

While the SEC continued to focus on individuals and companies, there was a remarkable shift to charging companies instead of individuals. In 2024, 43% of enforcement actions were only directed against companies, against 23% in 2023. This indicates a growing focus on institutional players in the crypto room.

Fraud and offering unregistered effects also remained the top priorities of the SEC, with 73% of enforcement actions fraud and 58% relating to unregistered effects.

In particular, the SEC also focused on (NFTs) for the first time and accused makers to perform unregistered securities offers.

While the SEC continued to focus on individuals and companies, there was a remarkable shift to charging companies instead of individuals. In 2024, 43% of enforcement actions were only directed against companies, against 23% in 2023.

This suggests a growing focus on institutional players in the crypto room.

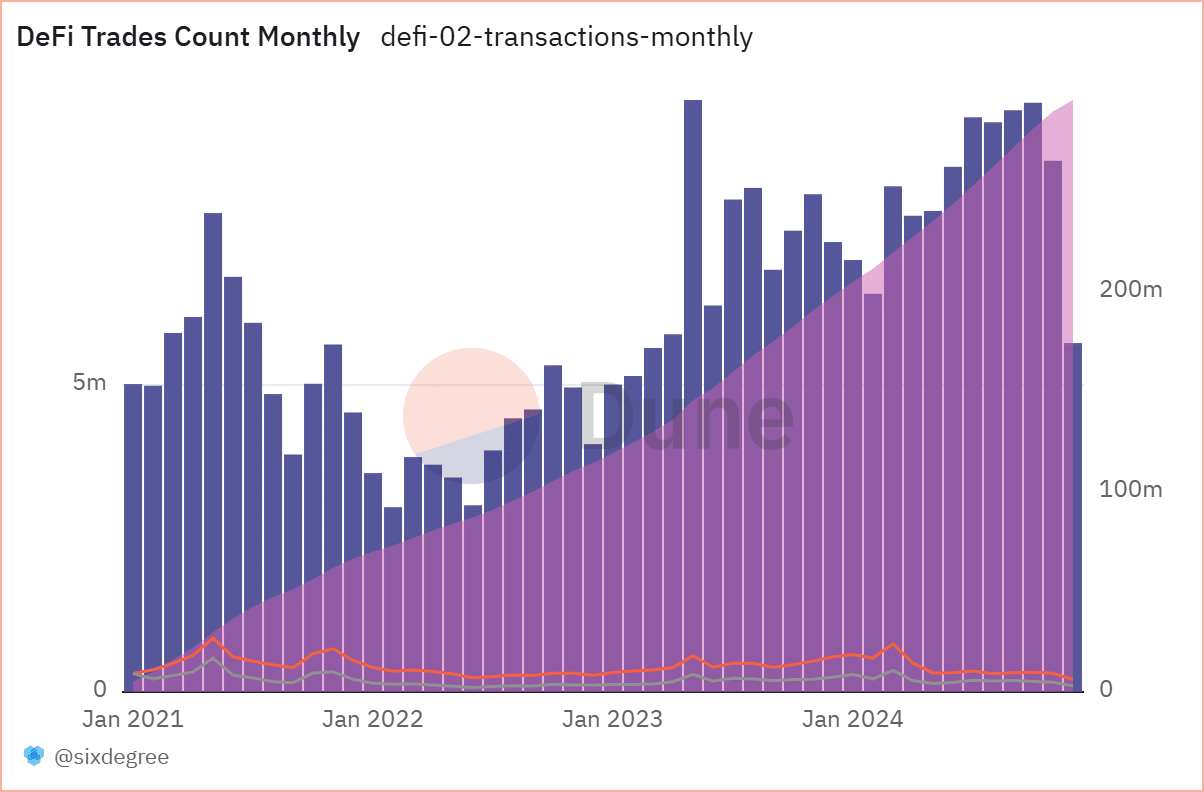

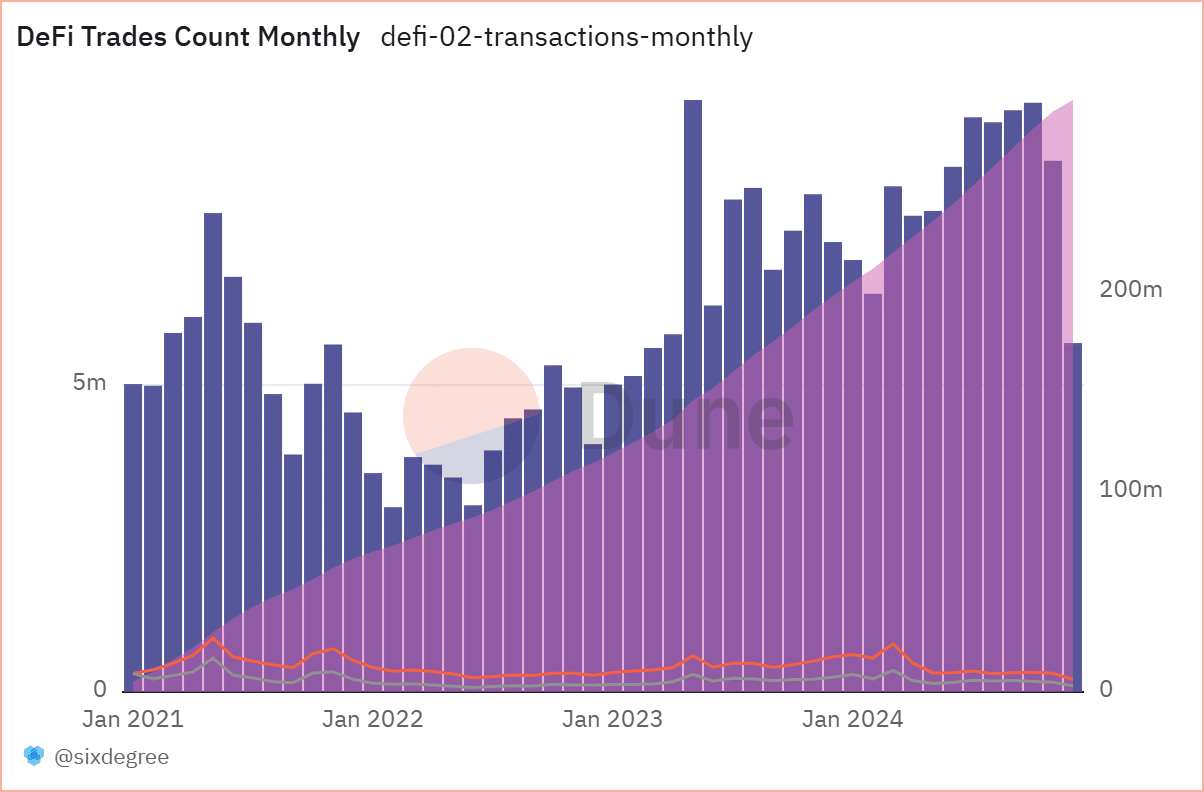

Resilience of the Defi sector in the midst of supervision by the supervisors

Despite the increased supervision by the regulators, the Defi activity has shown a remarkable resilience, whereby the number of monthly transactions enforced a steady growth until 2024.

The sector showed a particularly strong momentum in the second half of the year and reached nearly 200 million monthly transactions – a clear indication of a growing institutional acceptance despite the headwind of the regulations.

Source: Duneanalytics

Market impact and capitalization trends

The broader cryptomarkt has responded positively to the clarity of the regulations, whereby the total market capitalization has reached $ 3.5 trillion.

This considerable recovery compared to previous years indicates that strengthening regulatory supervision can contribute to the maturity of the market rather than impeding growth.

A trade volume of $ 147.3 billion underlines the continuing market activity despite stricter supervision.

Source: Coinmarketcap

The enforcement strategy of the SEC evolves into more advanced market segments, in particular in deficiency and strike services.

The combination of record sentences and growing market capitalization indicates an increasing ecosystem in which compliance with regulations and market growth can co -exist. The data paints a picture of a market that adapts to supervisors, while innovation and growth are preserved.

Now that the crypto-market capitalization is achieving new milestones and the Defi activity shows continuing growth, the enforcement actions of 2024 seem to have contributed to the maturity of the market rather than hindering the development.