Bitcoin price took a big hit yesterday despite a positive surprise in the US consumer price index (CPI), following a rumor that the US government had sold 9,800 BTC related to Silk Road. Since then, the market has struggled to recover from the shock.

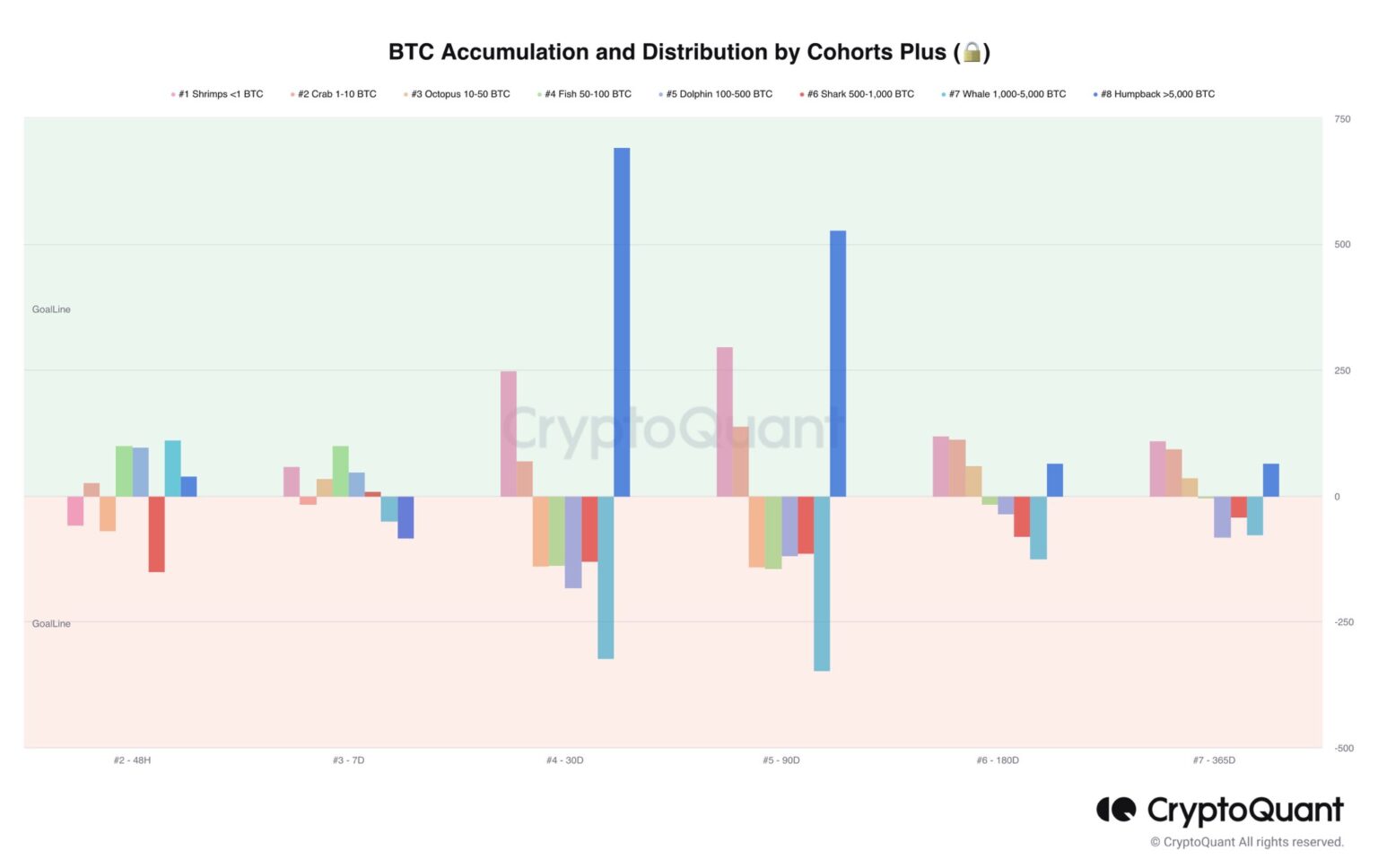

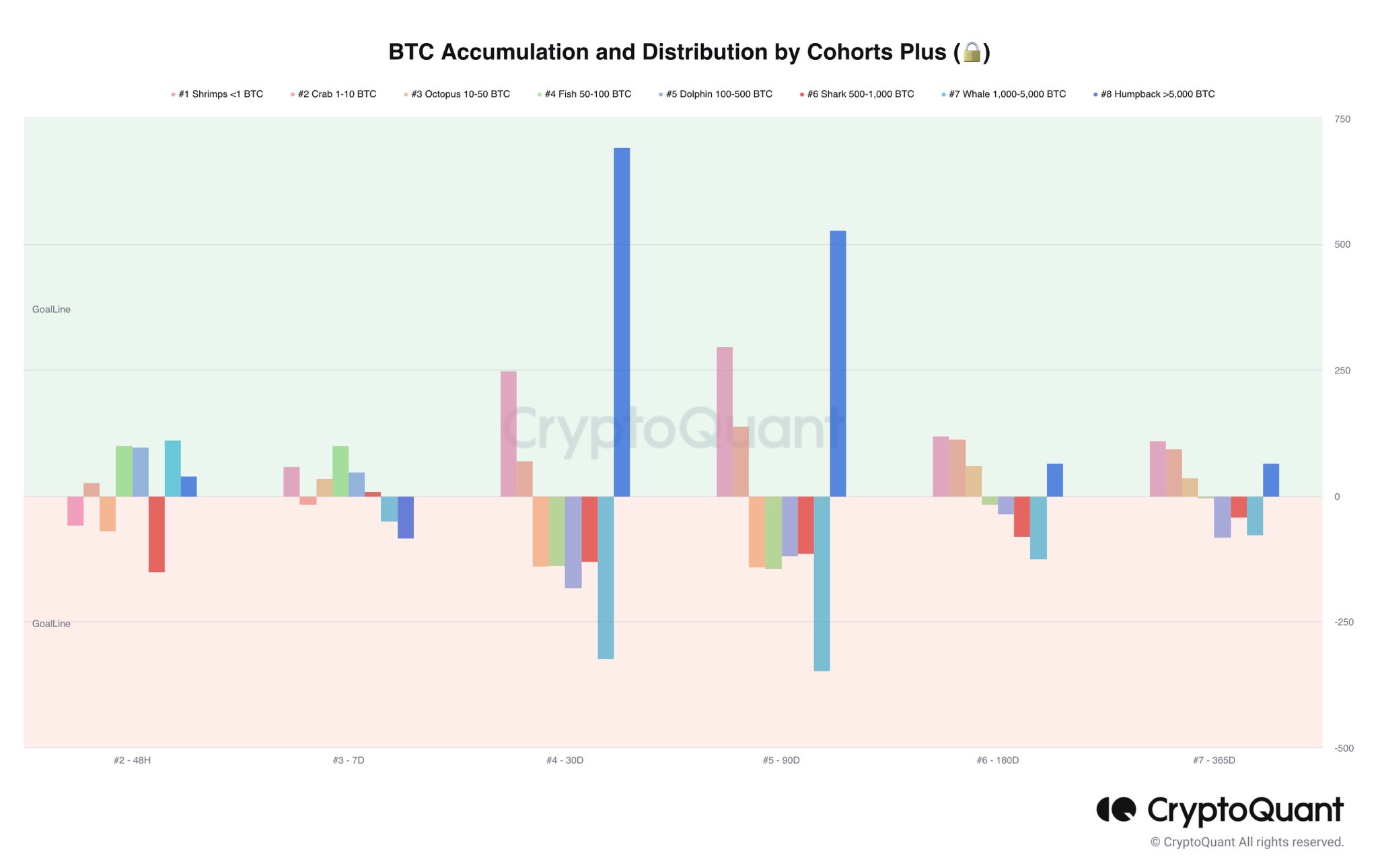

However, one group of investors shows no fear: whales. The big money investors are considered one of the most reliable indicators of when it is a good time to buy Bitcoin. On-Chain analyst Axel Adler stated: “BTC accumulation and distribution – no changes. Big players keep buying BTC from smaller players.”

The chart below shows that investors with more than 5,000 BTC have bought large amounts in the past 30 and 90 days (alongside smaller investors <10 BTC), while all other cohorts have shed BTC.

What Do Bitcoin Whales Know?

Of course, one can only speculate what the Bitcoin whales know that others don’t. But the fact is that Bitcoin saw an upward trend after the CPI release yesterday, until the fake news (manipulation?) about the sale of Bitcoin by the US government broke.

But yesterday’s CPI print may have significantly more implications than meets the eye. The market has been betting on an early pivot from the US central bank (Fed) for some time now. The market is currently betting on three interest rate cuts by the end of the year (3x 25 basis points to 4.25-4.50%).

While the US banking crisis reinforces this bet, whales have been able to bluff the Fed for some time. As Tony Spilotro, editor-in-chief and technical analyst of NewsBTC recently pointed out via Twitter, the Fed (and the masses) rely on lagging indicators.

Remember: CPI is a lagging indicator. The stock market is a leading indicator.

— Tony “The Bull” (@tonythebullBTC) May 10, 2023

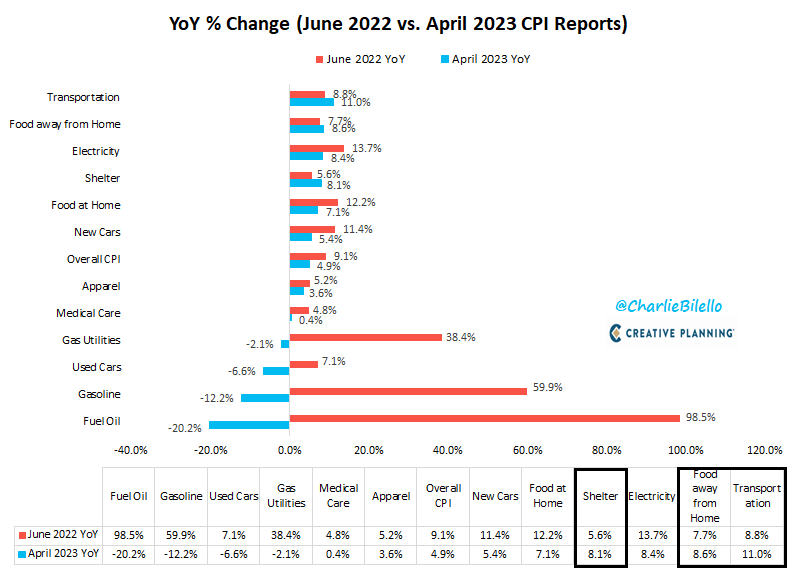

Charlie Bilello, chief market strategist at Creative Planning, stressed on Twitter that the US consumer price index has fallen from a high of 9.1% in June last year to 4.9% in April. The reason for this decline, according to the renowned analyst, is the lower inflation rates of fuel oil, gasoline, used cars, gas supply, medical care, clothing, new cars, home food and electricity.

Inflation rates for transport, eating out and accommodation have increased since last June, but declines in the other major components have offset those increases. The fact that the US core inflation index (excluding food/energy) is still at 5.5% yoy is mainly due to housing CPI (+8.1% yoy), according to Bilello ):

Why is Shelter’s CPI still going up when actual rental inflation has been lower for some time? Shelter CPI is a lagging indicator that vastly underestimated true housing inflation in 2021 and the first half of 2022.

As Biello added, after 25 consecutive increases (year-over-year), the shelter CPI showed its first decline in April, from 8.2% in March (the highest level since 1982) to 8.1% in April. If lodging inflation finally peaks, it will have a big impact on the overall CPI, as lodging makes up more than a third of the index.

Deflation coming soon?

This opinion is echoed by Thomas Lee, Fundstrat’s head of research. In an interview, Lee said that inflation will come down faster than most people think and that the Fed’s pause will be more comfortable for investors because it will lead to a soft landing.

For Lee, this is one of the main implications of yesterday’s April CPI report. Carl Quintanilla of Fundstrat added:

40% of the CPI basket (by weight) is in outright deflation. This is a huge development. Housing and Food are not ’emptying’, even though real-time measurements show this. That would add another 50% or so if they do.

For Bitcoin, a rapid drop in inflation rates and a soft landing as predicted by Lee could be extremely bullish. Whales could use this phase to accumulate, while private investors sell for fear of a looming high-inflation recession.

At the time of writing, Bitcoin price was trading at 27,550, back in the lower range.

Featured image from iStock, chart from TradingView.com