In 2023, AI has seen the rise, with programs like Bard and ChatGPT providing answers to all questions ranging from what the weather is like to writing college essays. We all know that AI is based on machine learning, but how much can we trust the advice it gives? We wanted to know if we can trust these programs, so we gave ChatGPT a budget of $10,000 to invest in stocks and $10,000 to invest in cryptocurrencies, then followed the advice given.

Before following this advice, it is worth noting that ChatGPT states that the information provided does not constitute financial advice and that it is always recommended to consult a financial advisor. ChatGPT also suggests doing your own research to make more informed decisions about which stocks are worth investing in.

The program provides further advice for cryptocurrencies, emphasizing the volatility of cryptocurrencies and the importance of considering your financial situation when making investment decisions. It is also recommended to regularly review your portfolio based on market conditions and investment performance.

The malfunction

It took some training, but eventually we got ChatGPT to specify exactly how much of my budget I should invest in each stock/coin, the breakdown is as follows:

| stock | percentage | Total invested |

| Apple inc |

10% |

$1000 |

| Amazon.com Inc |

10% |

$1000 |

| Microsoft Corporation |

9% |

$900 |

| Alphabet Inc |

9% |

$900 |

| NVIDIA Corporation |

8% |

$800 |

| Tesla Inc |

7% |

$700 |

| NextEra Energy, Inc |

7% |

$700 |

| Amgen Inc |

4% |

$400 |

| Johnson & Johnson |

4% |

$400 |

| Moderna, Inc |

4% |

$400 |

| Pfizer Inc |

4% |

$400 |

| Gilead Sciences Inc |

3% |

$300 |

| PayPal Holdings Inc |

3% |

$300 |

| General Motor Company |

3% |

$300 |

| NIO Inc |

3% |

$300 |

| first solar energy, inc |

2% |

$200 |

| Enphase Energy Inc |

2% |

$200 |

| Shopify Inc |

2% |

$200 |

| Vestas Wind Systems A/S |

2% |

$200 |

| MercadoLibre, Inc |

1% |

$100 |

| Johnson Controls International plc |

1% |

$100 |

| Square, Inc |

1% |

$100 |

| Rivian |

1% |

$100 |

| Mint | percentage | Total invested |

| Bitcoin |

20% |

$2000 |

| Ethereum |

20% |

$2000 |

| Binance coin |

10% |

$1000 |

| Litecoin |

10% |

$1000 |

| Solana |

10% |

$1000 |

| Dot |

10% |

$1000 |

| Ripple |

10% |

$1000 |

| Cardano |

10% |

$1000 |

The proposed stocks are rather expected; higher investment in stable stocks and lower investment in stocks with more volatility. However, the cryptocurrency investments are a bit more interesting as of the 1000+ coins currently on the market, it has given me a short list of eight to invest in.

The experiment

The first week

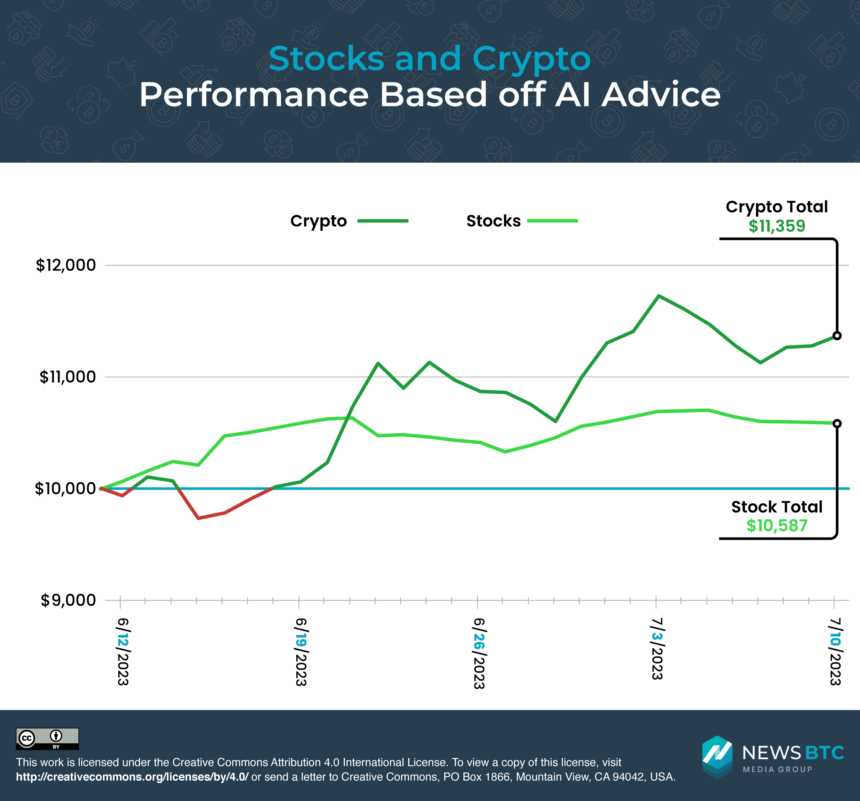

The experiment started off on shaky legs with stocks ending up with a $159 gain and cryptocurrencies posting a $64 loss after day one. Five of the eight cryptocurrencies invested in posted losses, with Binance Coin the worst performer, while our $956 investment suffered a $44 drop.

Stocks rose during the week, but fell toward the close ($25 down compared to the previous day), bringing the final weekly total to $10,220. This is a $220 increase over the initial investment, a solid start for our experiment.

Our crypto investment did not perform nearly as well in the first week, falling by only three days ending with a profit on the $10,000 initial investment. The fourth day was the worst of our entire experiment, with a grand total of $9,741. Only two of the invested coins made a profit that day, with Ethereum making a $114 loss on the initial investment. Our week ended on a slightly more positive note with a grand total of $10,021, up $21 from the initial investment.

The second week

During the second week, the total reached $10,643 by the end of the second day. This is $423 more than the total at the end of week one. This high was short-lived, however, as the final value fell for the remainder of the week, ending at $10,492. While $272 is more than the first week’s final value, it’s $151 less than the second day’s total.

After a shaky start, our investment in cryptocurrency far outperformed our investment in stocks in the second week, peaking at $11,118 on the fourth day. This then dropped on the fifth and final day, making the final value for the week $10,987, up $967 from the first week.

The third week

At the start of the third week, we saw more declines for our equity investments. Nine of our 23 investments fell on the second and third day. The second half of the week performed better, rising to $10,559 in total on the last day.

Our cryptocurrency investment performed similarly, falling at the start of the week and rising towards the end. The final value fell to $10,609 on the fourth day and then rose dramatically to $10,974 by the end of the fifth day. The final value for the week was $11,402, up $415 from week two.

The last week

The last week of our equity investments was a disappointment, with total value falling slightly to a final figure of $10,587. This is an overall $587 increase over our initial investment, which is a 6% total ROI.

On the first day of the last week, our crypto investments increased by $314 to total $11,719, which is the highest grand total we reached in our experiment. This was the high point though, as we fell throughout the rest of the week, ending up with a total of $11,359, a 14% ROI.

Overall performance

Shares

While we ultimately made a profit on our equity investments, there were ten investments that made a loss on the initial investment, nearly 45% of the investments made. The worst performing stock was Pfizer Inc. which dropped from the third week and ended with a -10% ROI. This was after the company announced that they were cessation of development of type 2 diabetes and obesity candidate lotigliprone on safety concerns.

Rivian proved the best performing stock, with an ROI of 88%, initially priced at $14.03 per share but rising to $25.51 during the month. This is after the company announced that Q2 2023 was the best financial quarter in the company’s history.

Cryptocurrency

On the other hand, we were much luckier with our crypto investments, with only one of the investments making a loss, accounting for 13% of the initial investment. This was Ripple (XRP), there are several reasons for that, one of them is that the transaction volume is from XRP 90% down.

The coin with the highest ROI is Solana (SOL) with a ROI of 39%, which is an increase of $389. SOL is considered a relatively stable coin with strong community support making it a good coin to invest in.

Hits or misses?

Although it is possible that Bitcoin was presented as one of the largest investments, because it is the largest cryptocurrency. It was actually a great crypto to invest in as the price went from $26k to $30k, this was due to news that a new, more secure, crypto exchange launched, with investments from Invesco and WisdomTree.

There is one stock we think could have been missed in ChatGPT’s suggestions, this is Meta, the company that owns Facebook and Instagram. They recently released a new app as part of Instagram called Threads, a Twitter competitor. It was released at the perfect time, after the news that Twitter was restrictive the number of Tweets users could see.

This is not one of the stocks that ChatGPT suggested investing in, so we wanted to see what could have happened if ChatGPT had suggested investing in META stocks. Using historical data from the past month, we calculated that if we invested $1,000, we would have $1,100 at the end of the experiment. This is more than we made from the $1,000 we invested in stocks of Amazon and Apple.

Methodology

We started by asking ChatGPT about scholarship opportunities. Initially, it gave a generic answer to the types of industries that should be invested in and why. From these sectors, we asked it to recommend specific companies from each. We then sent back the list of all proposed stocks and requested a weighting of a $10,000 investment.

We discovered that one of the proposed stocks, Waymo, is not a publicly traded company, we had to go back to ChatGPT and request that this stock be removed and a new one added. It was replaced by Johnson Controls International plc.

It was a much easier process to get answers about which cryptocurrencies to invest in. Since ChatGPT gave us an initial list of coins, and when asked how much to invest in each coin, it provided a general strategy for investing in crypto. 40-50% should come from Bitcoin and Ethereum combined and 10-20% for each of the remaining coins. We have decided to put 20% in Bitcoin, 20% in Ethereum and 10% in the remaining coins.