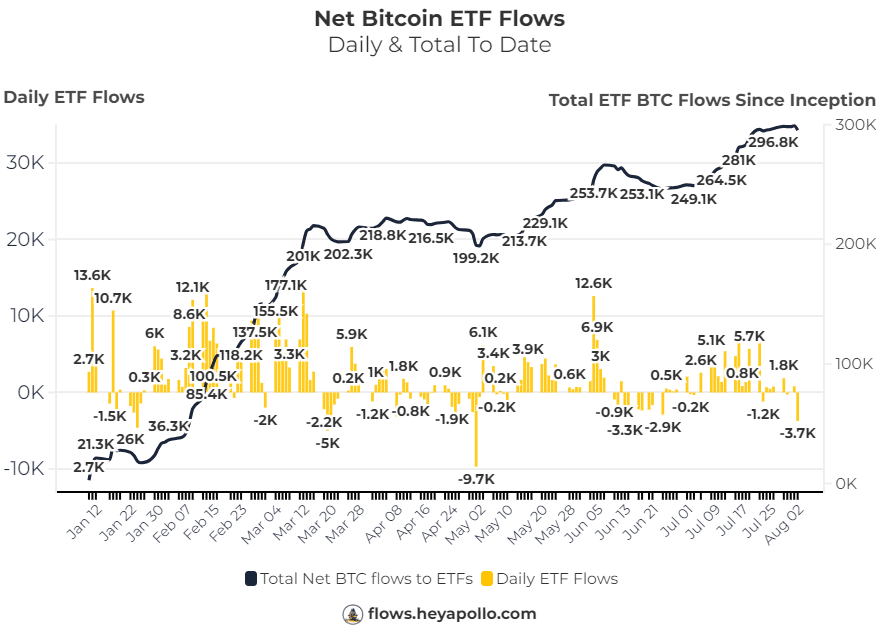

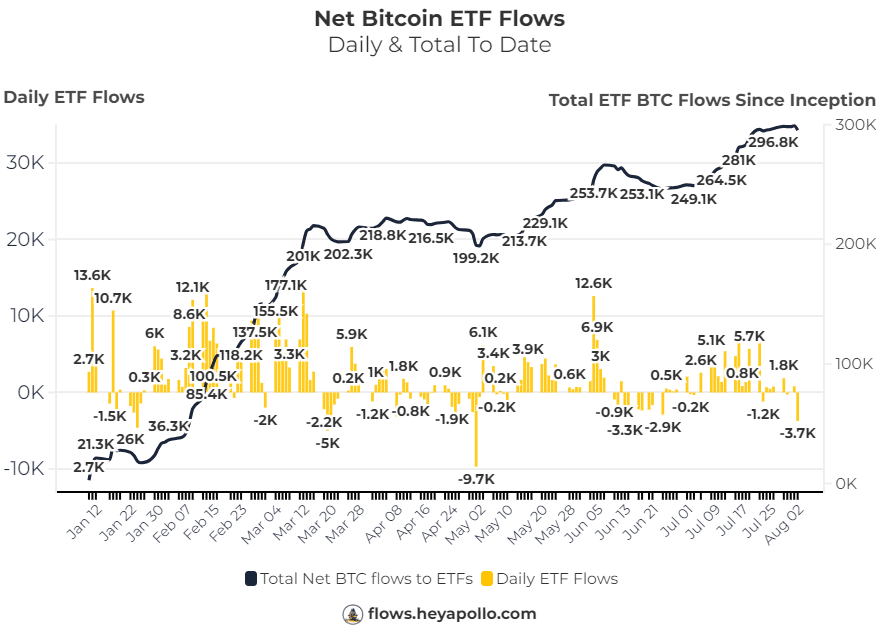

- US Bitcoin ETFs are experiencing the third-biggest sell-off, highlighting the contrasting moves in the crypto markets.

- History is set to repeat itself as analysts predict a bull run similar to 2021 after the Fed cut rates in September.

US ETFs recently traded 3,750 Bitcoin [BTC], marking their third-largest sellout since their inception. Nevertheless, BlackRock bucked the trend by purchasing 683 BTC.

Meanwhile, other major players in the ETF market posted significant sales: Fidelity sold 1,646 BTC, ARK sold 1,387 BTC, Grayscale parted with 569 BTC, Bitwise sold 465 BTC, and VanEck sold 364 BTC.

This substantial sell-off according to Net Bitcoin ETF Flows at Flows.heyapollo.com reflected the divergent strategies and market perspectives of these leading financial institutions.

The contrasting moves highlighted the continued volatility and differing prospects within the cryptocurrency market, especially among institutional investors.

This could lead to a decline in the Bitcoin market in the short term.

Source: Flows.heyapollo.com

Will Bitcoin Reach $44,000 in August?

It’s possible the crypto market will come under pressure next week, but this is when you want to be bullish, not during big green candles based on the $BTC strategic reserve news story.

BTC was bearish from mid-March to April, failed to break the May high, and turned bearish again from mid-June.

The bias remains unchanged and expects a low in August, although we don’t know exactly where this low will land, but soon it will be bullish again.

First, we must enter the demand zone and the period of opportunity. The BTCUSD chart suggested that reaching the $44k zone could lead to a price increase towards $100k.

Source: TradingView

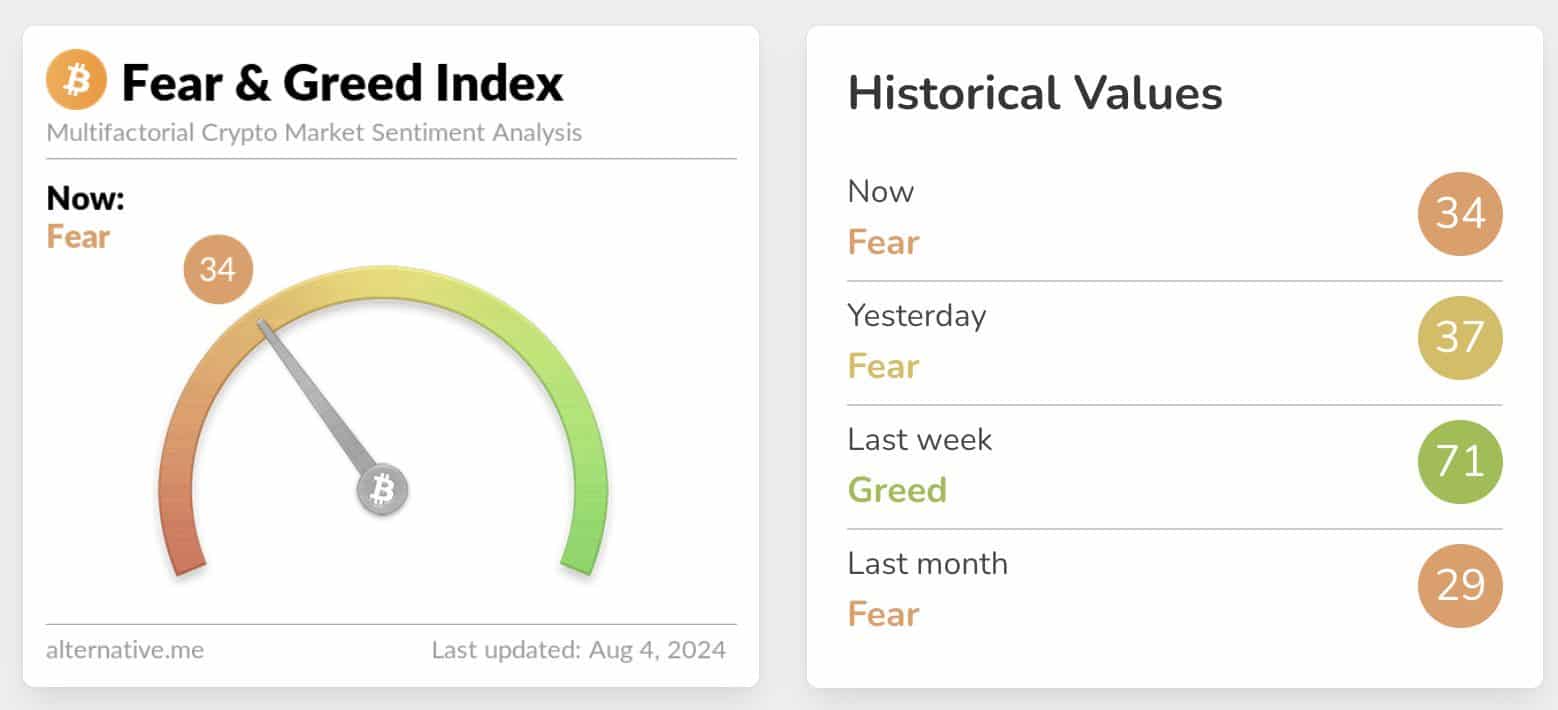

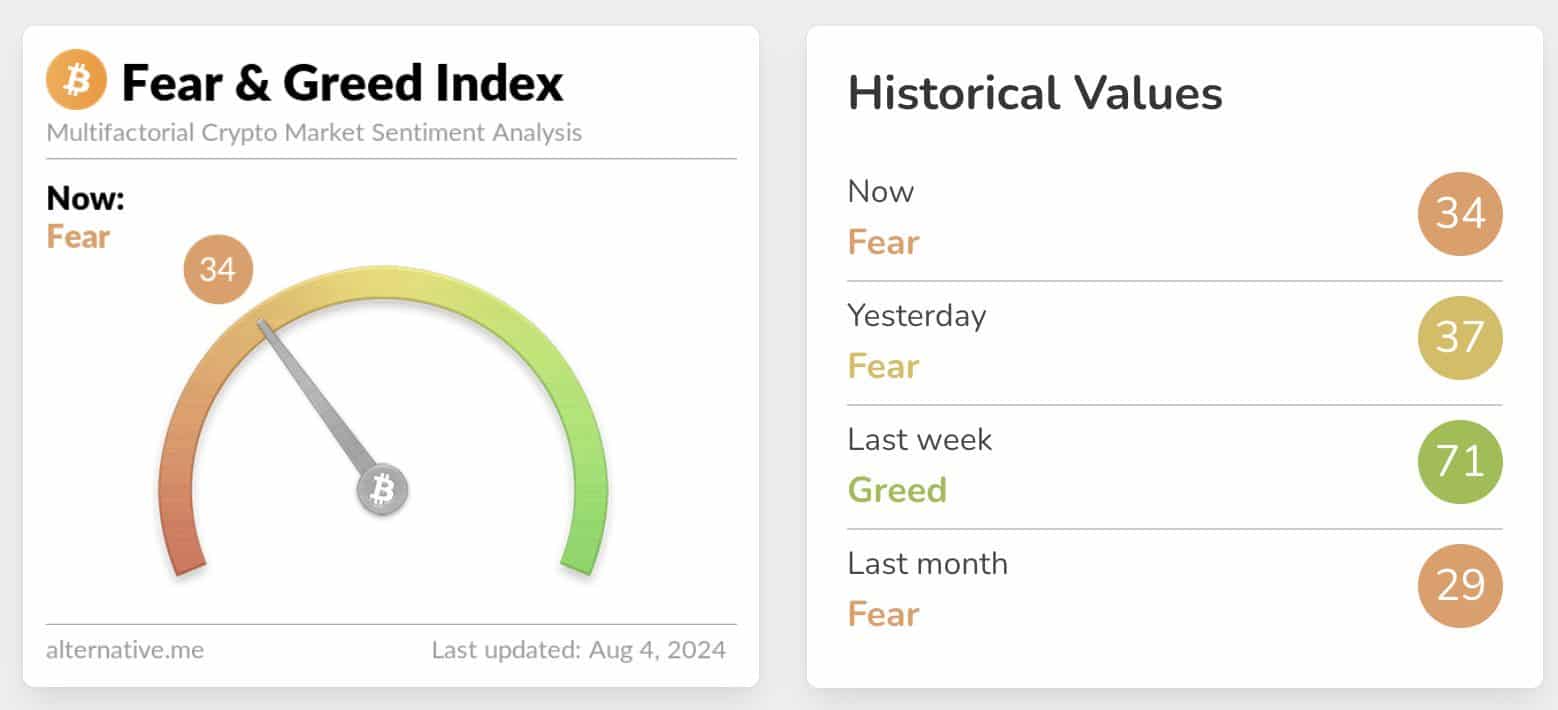

Additionally, the Fear & Greed Index has shifted from a greedy 71 to a fearful 34 in just two weeks, indicating that more and more people are liquidating their holdings amid rising market uncertainty.

Source: Alternative.me

Will the 2021 crypto bull run repeat itself?

However, the history of 2020 seems to be repeating itself, as markets collapsed due to economic fears of COVID-19 and the subsequent economic downturn, but later recovered.

The Federal Reserve responded by cutting interest rates and implementing quantitative easing to support the economy, leading to the crypto bull market of 2021.

Today, markets are plummeting again due to economic fears brought on by a weak jobs report and an economic downturn.

Read Bitcoin’s [BTC] Price forecast 2024-25

The Federal Reserve is expected to cut interest rates and reinitiate quantitative easing in September.

AMBCrypto’s analysis of TradingView data suggested that similar economic fears and monetary responses are at play, potentially paving the way for another market recovery similar to the post-2020 scenario.

Source: TradingView