- Uniswap’s trading volume briefly rose above Jupiter’s.

- The drop in UNI demand has led to a double-digit price drop over the past month.

Leading Ethereum-based decentralized exchange (DEX) Uniswap [UNI] briefly regained its top spot as the DEX with the highest trading volume on February 3, after being replaced by Solana-based DEX Jupiter [JUP].

As previously reported, Jupiter’s trading volume exceeded $500 million on January 29, capturing an 18% market share of the total DEX trading volume on that day. Uniswap lagged behind with a trading volume of $443 million.

This increase was due to anticipation surrounding Jupiter’s JUP token airdrop event, which took place on January 31.

According to data from Coin geckoIn the early trading hours of February 3, Uniswap’s trading volume briefly surged past Jupiter.

However, this has now been corrected, with Jupiter topping the rankings of DEXes with the highest trading volume in the past 24 hours.

At the time of writing, Jupiter’s trading volume was $538 million. Uniswap came in second with a trading volume of $531 million within the same period.

UNI’s demand is falling

At the time of writing, UNI was exchanging hands at $6.18, witnessing a 16% price drop in the past month, per CoinMarketCap.

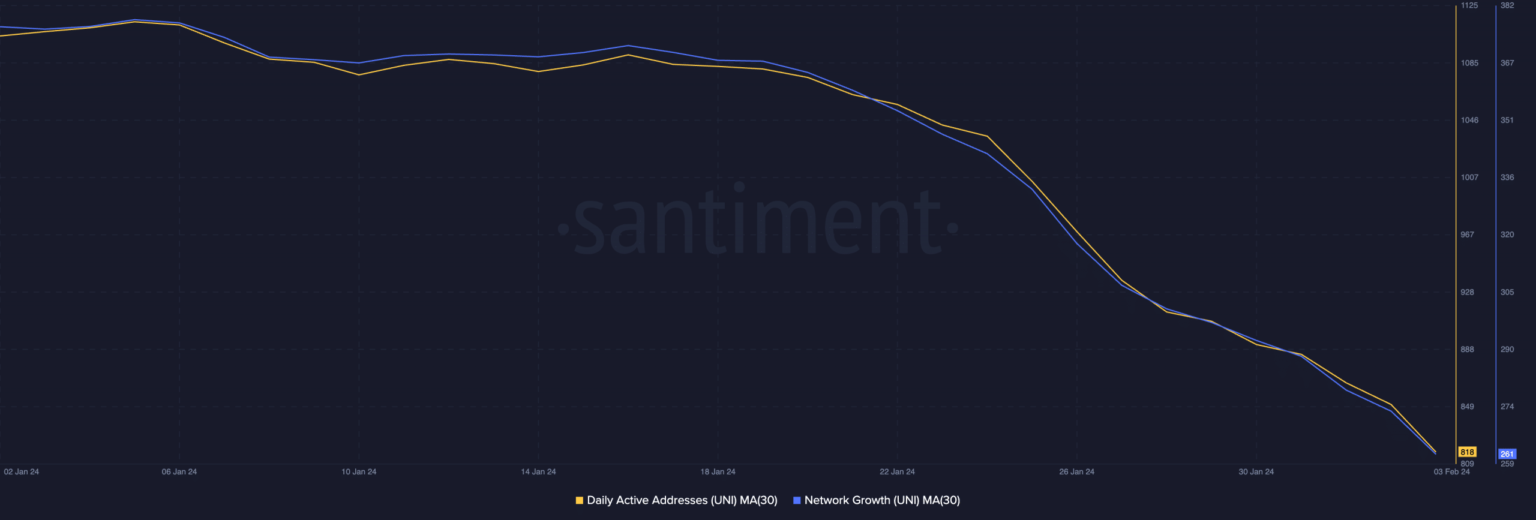

A review of the token’s network activity based on a 30-day moving average revealed a steady decline in demand for the altcoin over the past month. According to Santimentthe daily number of addresses involved in UNI transactions has fallen by 23% over the past 30 days.

Similarly, new demand for UNI also declined. Information from the same data provider showed that the token recorded a 27% drop in the daily number of new addresses created to trade UNI over the past month.

Source: Santiment

AMBCrypto’s review of trend indicators on a daily chart confirmed the bearish sentiment in the UNI market. For example, the token’s Moving Average Convergence Divergence (MACD) line crossed below the trendline on January 21, ushering in a bear cycle.

Realistic or not, here is UNI’s market cap in BTC terms

Additionally, the MACD line was below the zero line at the time of writing, showing that selling pressure was significantly greater than any accumulation efforts.

Key momentum indicators were noted below their respective midlines, confirming the decline in demand for UNI. The token’s Relative Strength Index (RSI) was 48.71, while the Money Flow Index (MFI) was 41.19.

Source: TradingView

With a negative weighted sentiment of -0.81%, according to Santiment data, UNI’s value could fall further if broader market sentiment does not improve in the near term.