- Data indicated that BTC is now in an oversold region, which could indicate an impending price recovery

- The total profit offering showed that BTC is not yet at the cycle low, leaving room for significant upside

Market sentiment has gradually turned bullish. In fact, Bitcoin is up 2.57% over the past 24 hours, pushing its price to around $97,500 at the time of writing. However, this price increase is not fully supported by the market momentum, which fell by 23.23% during the same period.

A broader market analysis based on historical trends underlined the potential for further growth. What this means is that BTC may still have the opportunity to hit a new all-time high in the coming weeks.

An ‘undervalued’ position

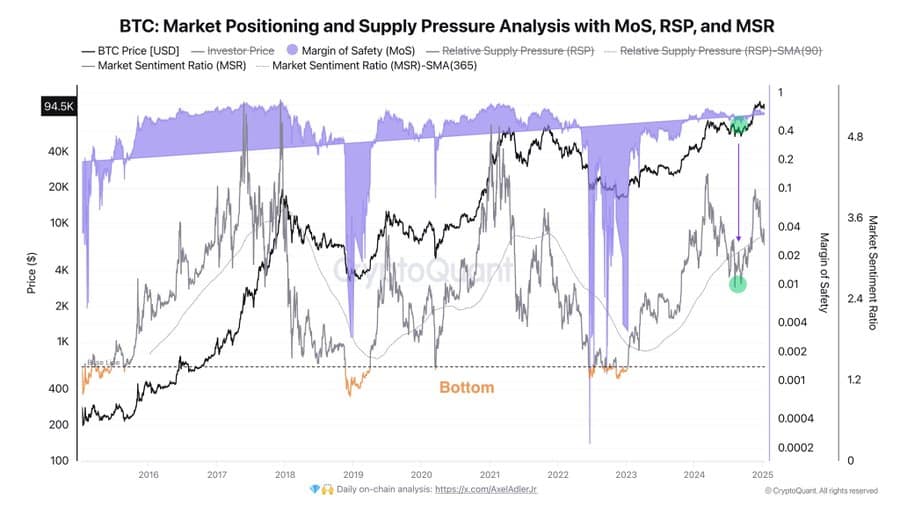

Data from CryptoQuant’s Market Position and Supply Pressure metrics suggested that Bitcoin (BTC) may be undervalued. This assessment is based on the Margin of Safety (MoS) and Market Sentiment Ratio (MSR) indicators.

The margin of safety (MoS) evaluates whether BTC is overvalued or oversold relative to a critical baseline. When the MoS moves above this line it indicates overvaluation, while a position below it suggests the asset is undervalued.

At the time of writing, the MoS (represented by the purple cloud) was below the baseline, valued near the $90,000 zone (baseline). This implied that BTC is now in an oversold position – a sign that a rally may be coming.

Source: CryptoQuant

Similarly, the Market Sentiment Ratio (MSR) measures the level of optimism or pessimism in the market by comparing its value to the annual Simple Moving Average (SMA). At the time of writing this stood at 1.4.

A value above the SMA indicates prevailing optimism, while a value below reflects market pessimism. At press time, the MSR was below the annual SMA – a sign of pessimistic sentiment.

Historically, as indicated by the green dots on CryptoQuant’s chart, these conditions, when the MoS falls below the baseline and the MSR trends below the annual SMA, present a strong buying opportunity. In such cases, BTC has often seen significant rallies on the charts.

The same pattern seems to be forming in the market now – a sign that BTC could be poised for a new uptrend.

Far from the market top?

Data from Glassnode’s Total Supply of Bitcoin in Profit, a key metric for identifying BTC’s cyclical tops and bottoms, suggested that Bitcoin is still far from reaching its market top.

According to the same, BTC has not yet reached the red trendline, which historically marks these critical levels.

Source: Glassnode

If BTC hits this red trendline, it would mean a majority of holders are making profits. Historically, such scenarios have led to major market sell-offs. Especially as traders start to realize profits, putting downward pressure on the price.

Currently, BTC remains well above this trendline, indicating a favorable position for further upside as addresses holding this supply are incentivized to continue holding in anticipation of higher gains.

Exchange netflows findings

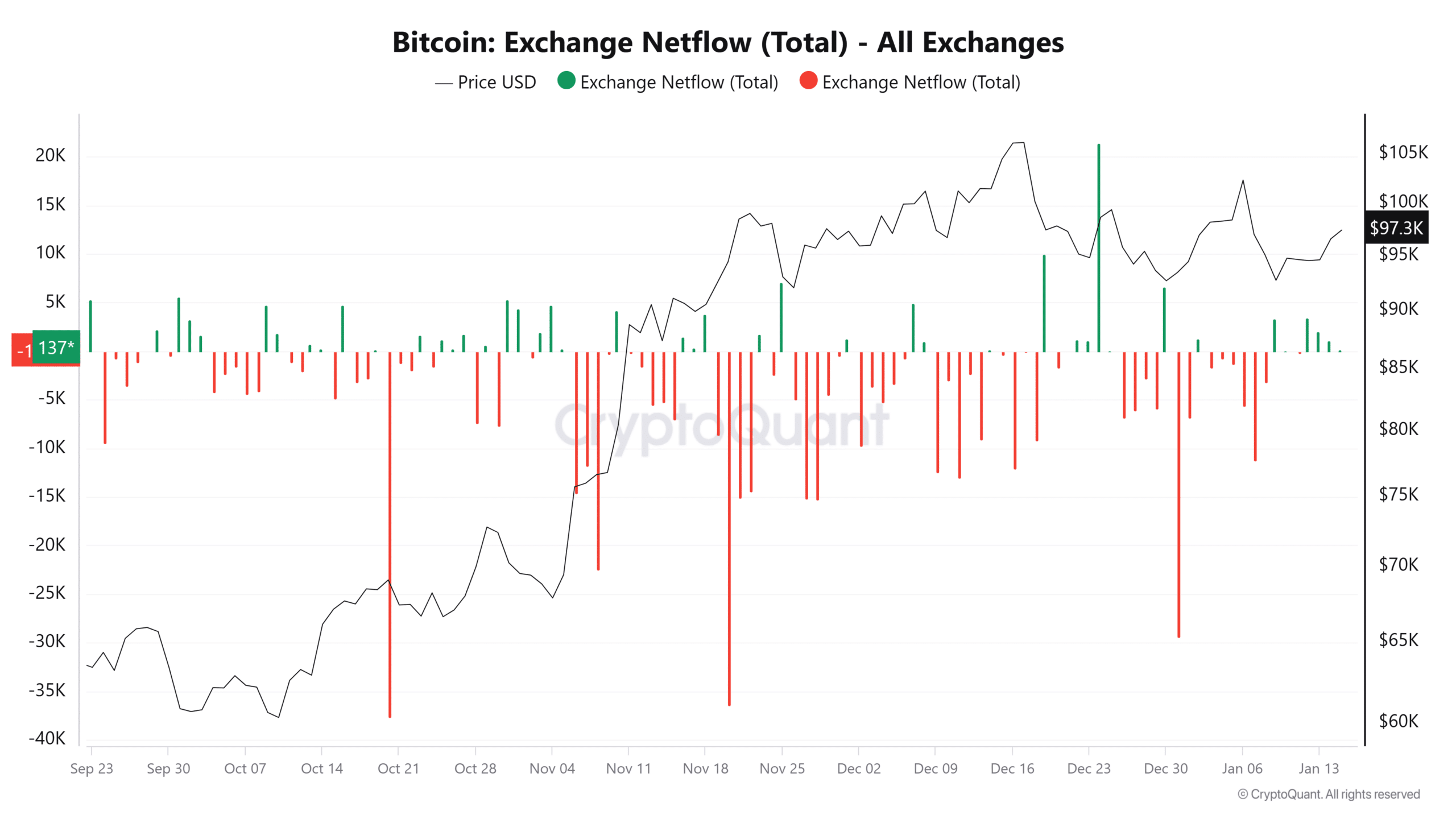

Finally, the exchange network flows showed that As of January 12, there has been a consistent decline in net currency flow – down significantly from around 3,431.69 BTC to just 137 BTC.

A continued decline in net flows means reduced selling pressure as more investors move their BTC from exchanges to private portfolios. This behavior can be interpreted as a growing belief among the holders.

Source: Cryptoquant

If the net flow on the exchange turns negative, it would mean that spot traders are becoming increasingly confident – a sentiment that has historically correlated with a higher BTC price.

Simply put, BTC remains in a strong position to continue its upward recovery, supported by easing selling pressure and rising market confidence.