- Trump’s election chances correlate with Bitcoin’s potential rise to $92,000 or higher

- 95.19% of Bitcoin holders are currently ‘in the money’, indicating strong market sentiment

With the US presidential election less than two weeks away, the race between the two leading candidates is heating up every day.

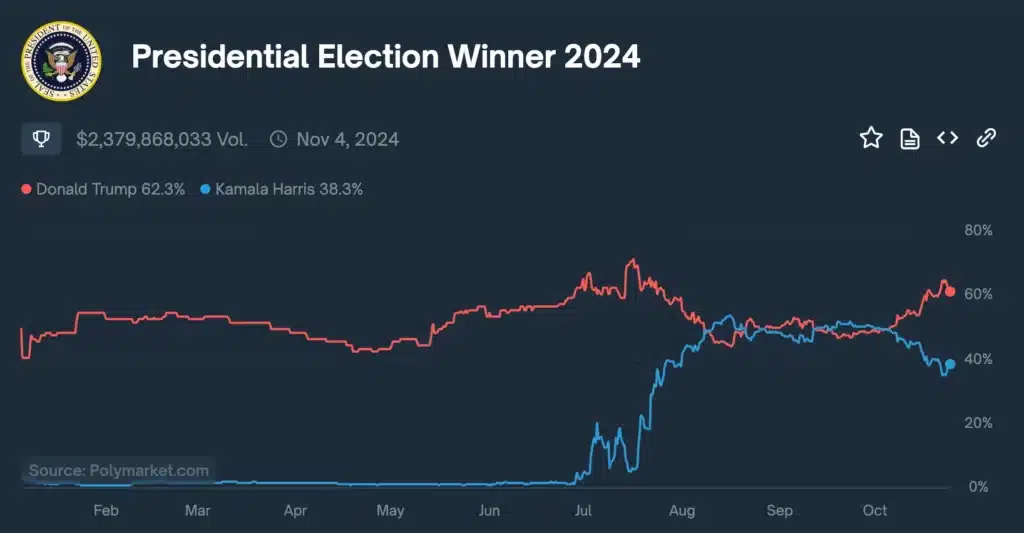

Prediction markets, including Polymarket and Kalshi, all predict that Donald Trump will win. In fact, his projected support now hovers around 62.3%, while Kamala Harris is hovering around 38.3%.

Source: Polymarkt

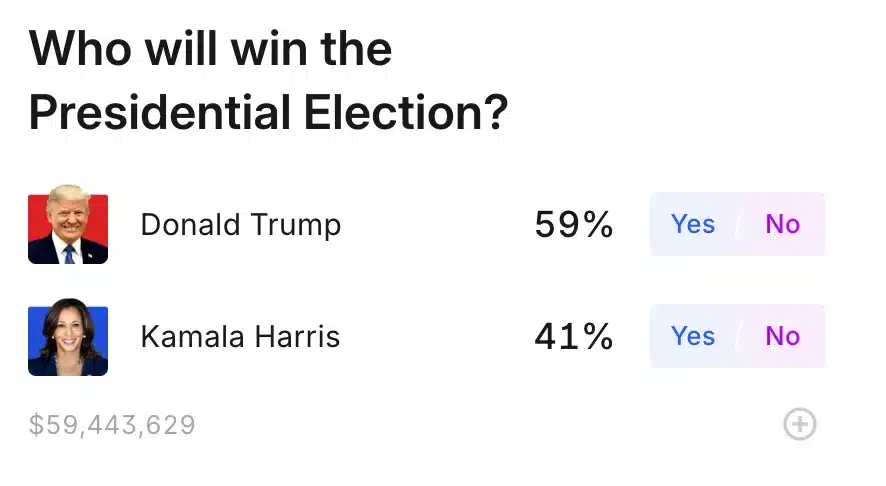

Kalshi’s most recent update further reinforced this trend, putting Trump at 59% and Harris at 41%.

Source: Kalshi

Bitwise execs are putting their money on Trump

Thanks to Trump’s rising odds, the head of Alpha Strategies at crypto asset manager Bitwise predicts a potential Bitcoin [BTC] golf. He predicts the cryptocurrency could rise to $92,000 should Trump secure victory in November.

In a recent X post, Jeff Park noted:

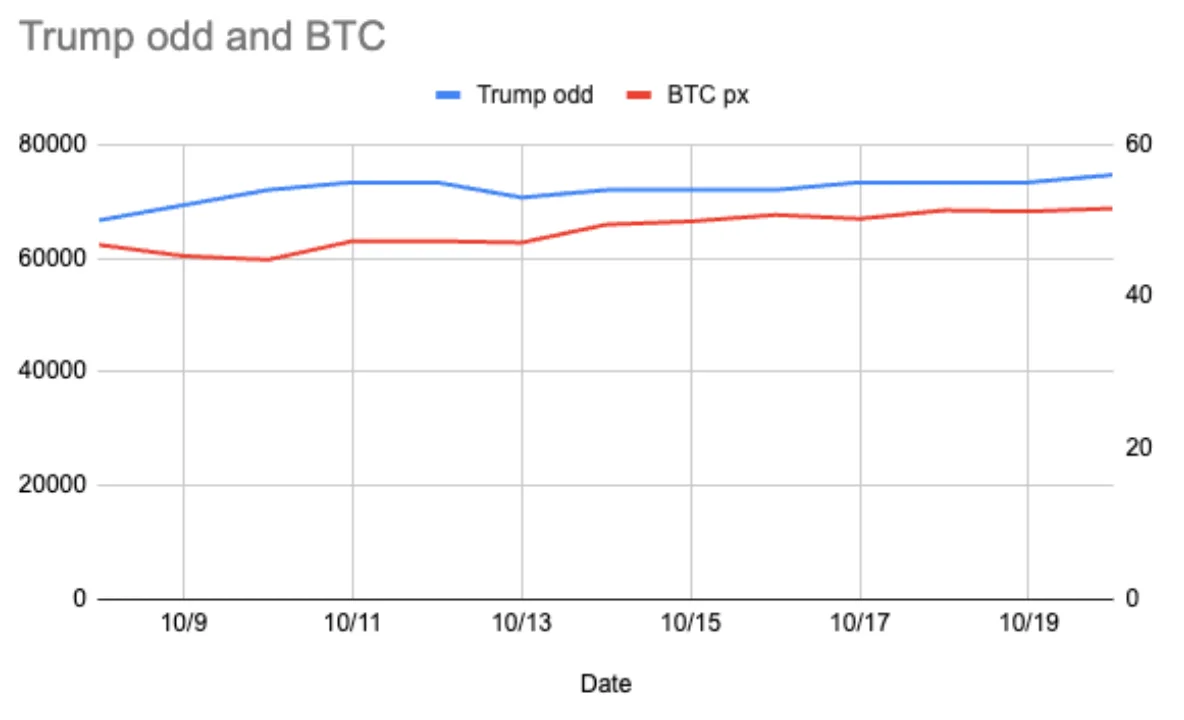

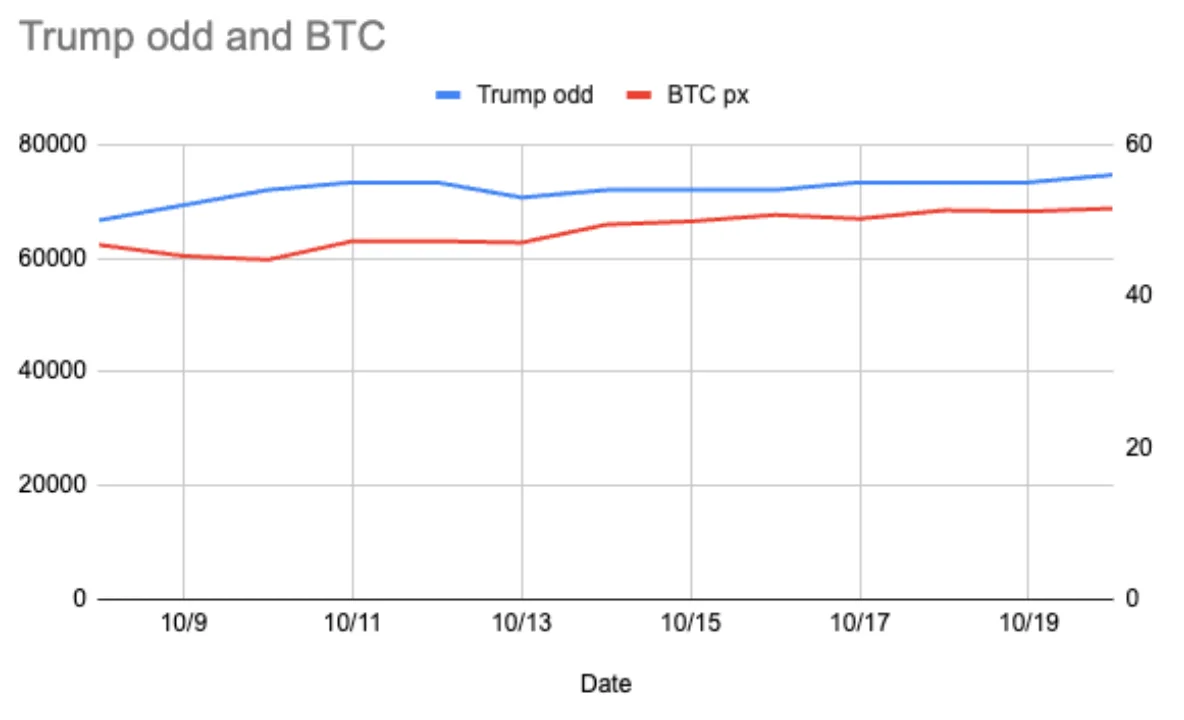

“Charting the price of $BTC against Trump expectations (via @Polymarket) from 8/15 to 10/20 reveals some wild swings – especially when Harris and Trump took turns taking the lead. Applying merger-arb style probability calculations, I expect a Trump win could push BTC to ~$92,000. Take that as you will.”

Source: Jeff Park/X

Furthermore, Bitcoin millionaire Erik Finman believes that a Trump victory could push the price of BTC to $100,000.

He said,

“His policies will ignite the crypto market and drive massive growth across the board.”

CoinShares reports and other investors believe the same

A recent CoinShares report also revealed a significant increase in digital asset inflows, amounting to $407 million. This has been driven by increased investor interest tied to a potential Republican victory.

This influx is a sign of growing confidence in the possibility of favorable regulatory changes under a Republican Party-led administration.

In addition, Alex Thorn, head of Firmwide Research at Galaxy Digital, introduced a policy scorecard comparing the presidential candidates’ cryptocurrency positions. In doing so, he shed light on how each candidate’s approach could impact the future of the sector.

This was further confirmed by the price action of BTC, which had been struggling to break the $60,000 mark for some time. Shortly afterwards, however, the price rose above $65,000 – a rise that coincided with Trump’s rising election chances.

Is Elon Musk behind this?

Interestingly, Elon Musk’s influence also appears to have played a role in boosting Trump’s campaign momentum.

For those who don’t know, Musk attended a rally for the Republican candidate in Butler, Pennsylvania. Here, he made a bold show of support by wearing a “Make America Great Again” hat and calling himself “Dark MAGA,” further cementing his support for the candidate.

What lies ahead for BTC?

Bitcoin has been somewhat bullish lately thanks to Trump’s strong lead in the prediction markets and in exit polls. For example, at the time of writing, the crypto was valued at just under $67,500.

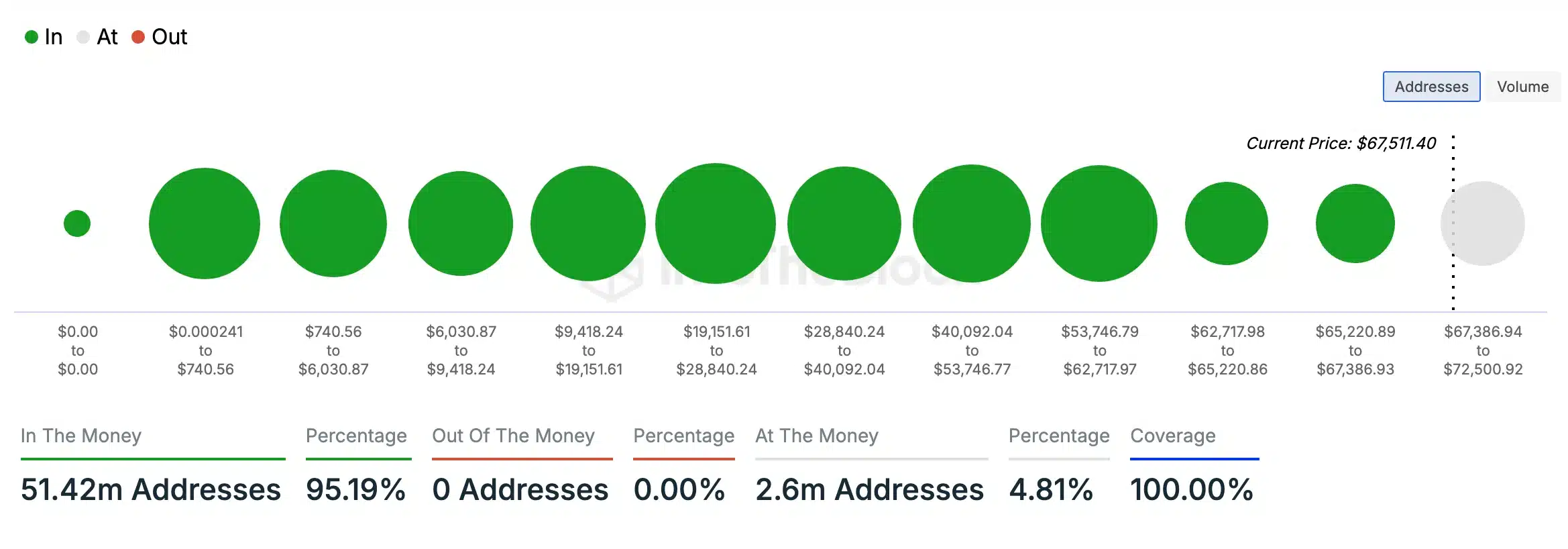

Data from IntoTheBlock, analyzed by AMBCrypto, supports this bullish trend, showing that an overwhelming 95.19% of BTC holders are currently in the money. This means that their Bitcoin holdings are worth more than their initial purchase price.

On the contrary, 0% of holders are “out of the money” – a sign of strong market sentiment, indicating the possibility of further price increases for Bitcoin.

Source: IntoTheBlock