- Toncoin has witnessed a price correction of 1.07% in the last 24 hours.

- Large trades and active addresses indicate a long-term bullish run.

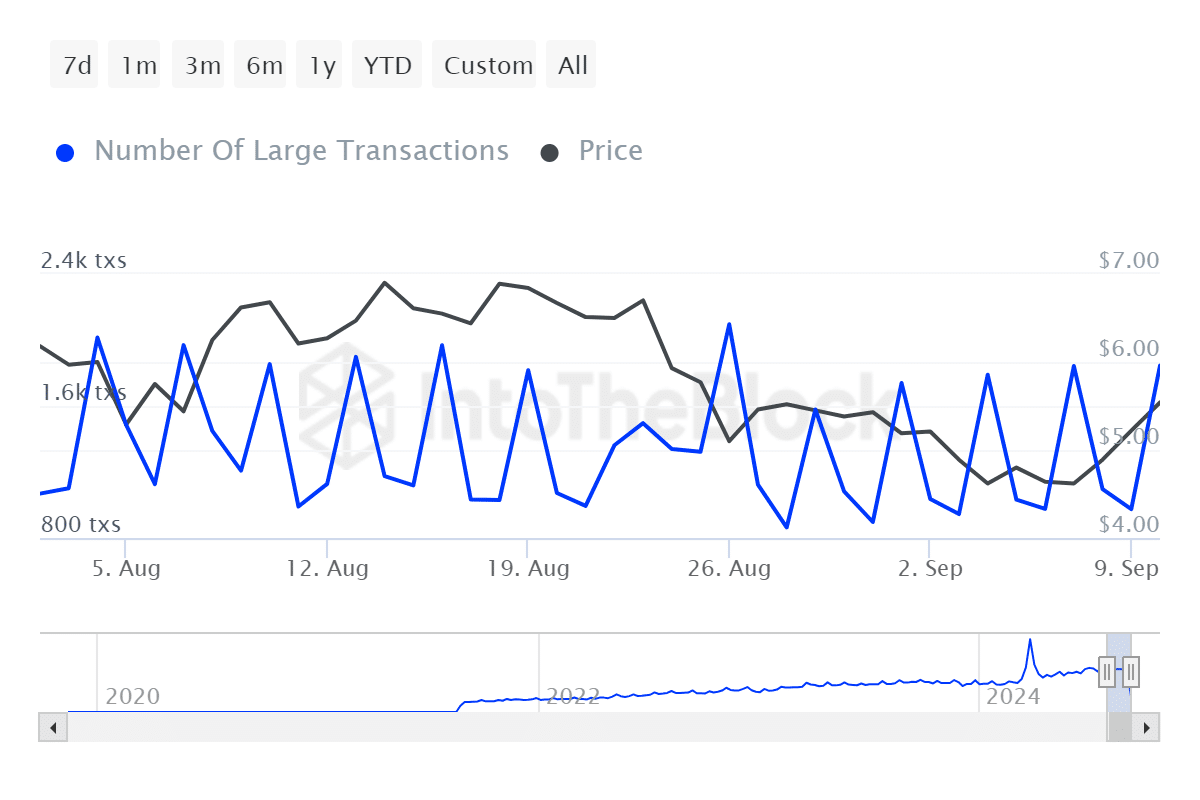

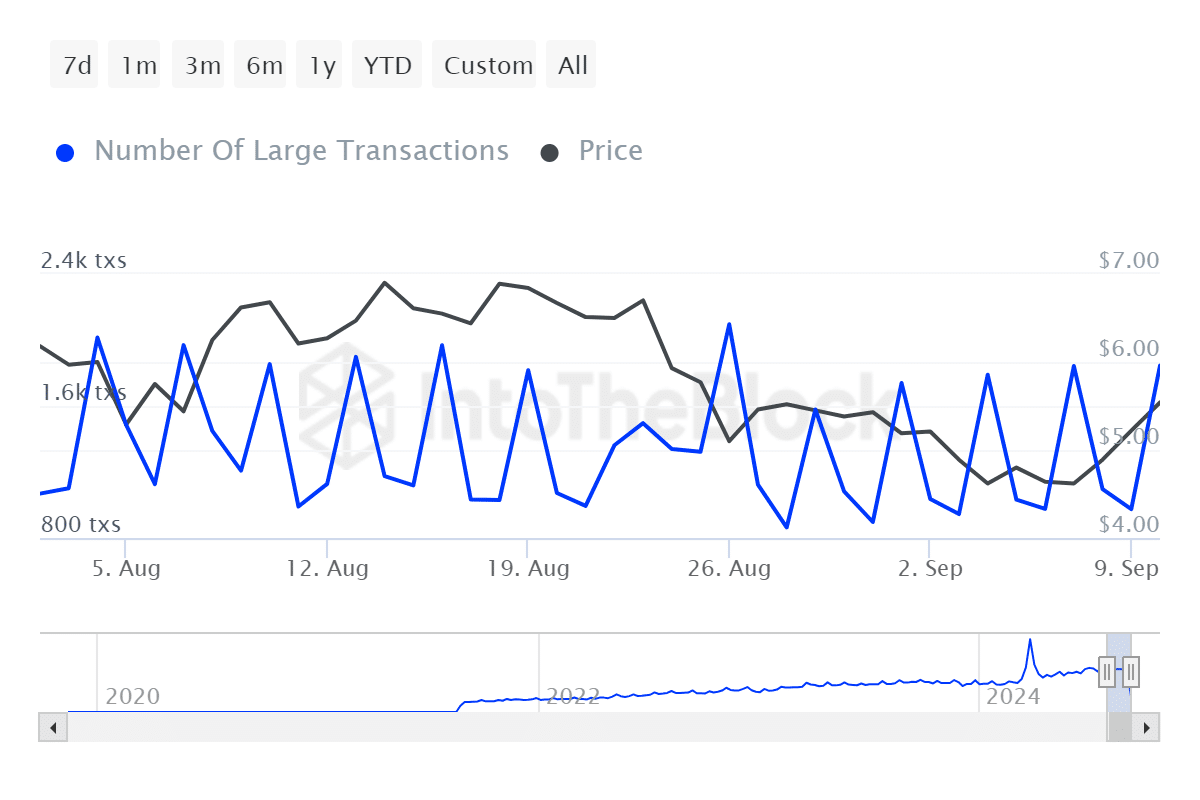

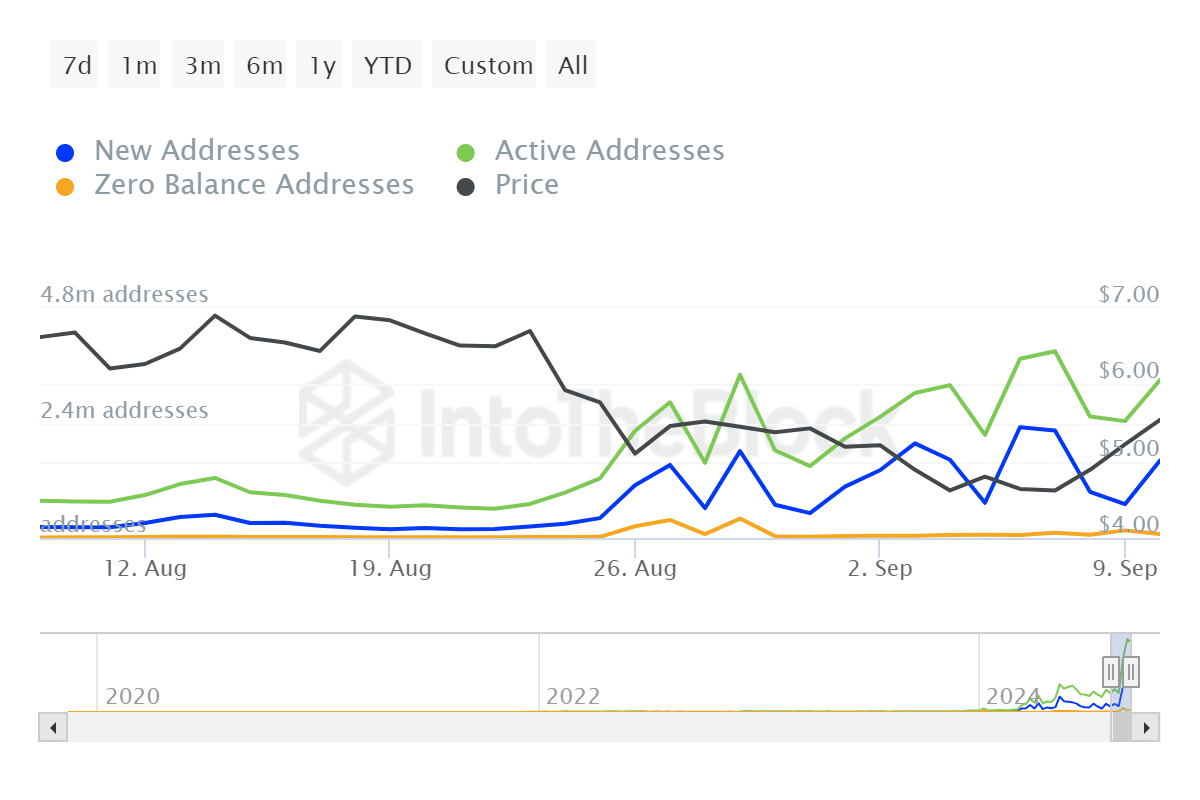

Tonmint [TON] has witnessed a 108% increase in the number of large transactions. Similarly, the number of active addresses increased by 35.13%, from 2.44 million to 3.3 million.

This significant increase in the number of major players, confirmed by the increase in market trading activity, could bring significant price movement for TON.

Toncoin Price Forecast Shows…

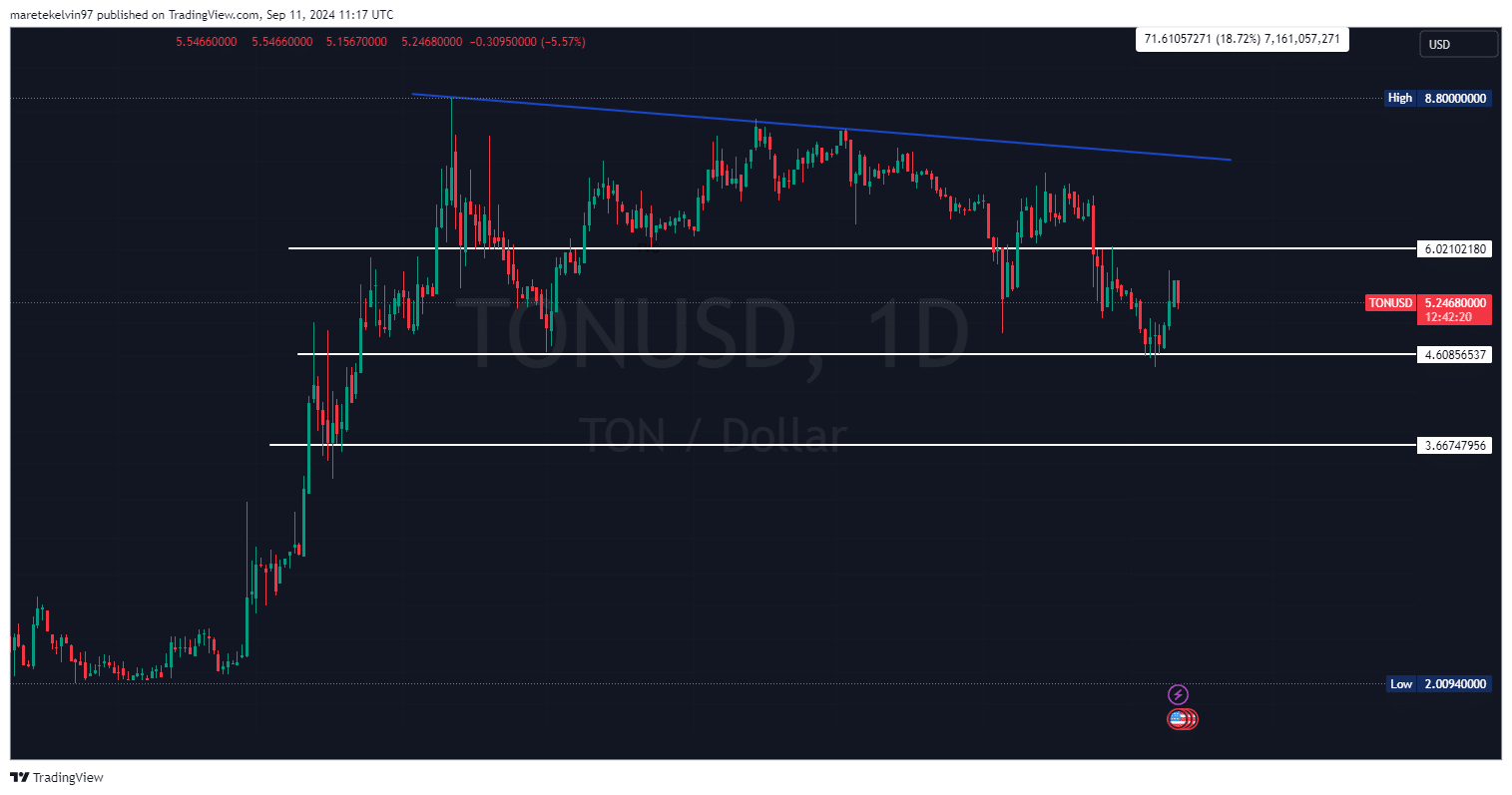

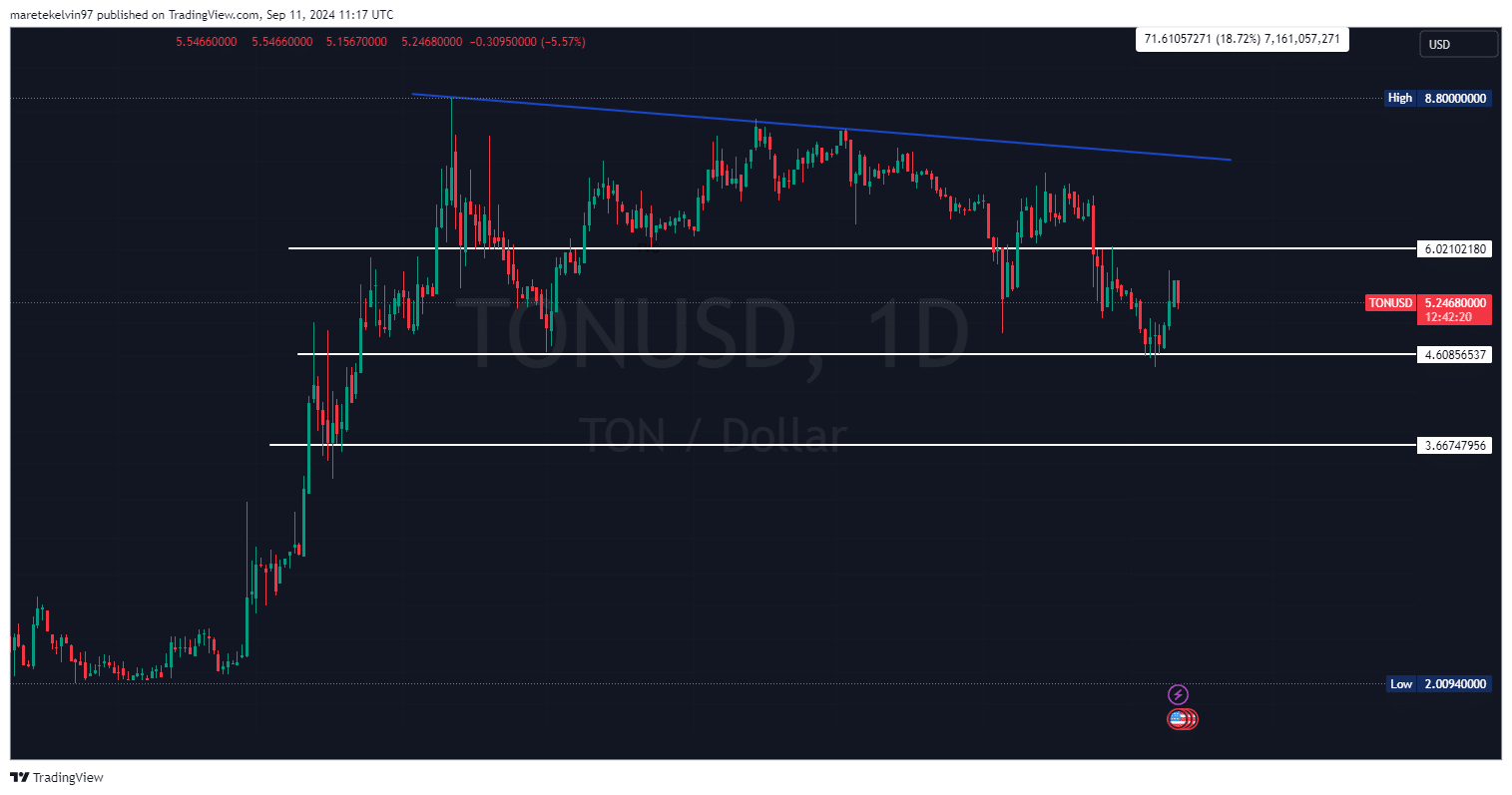

Toncoin price was approaching a key level at the time of writing after a massive bullish rally. The altcoin rallied 22% over the past three days before changing its trajectory.

According to CoinMarketCap, the altcoin is down 1.06% in the past 24 hours, despite a sustained rise of 14.18% in the past seven days.

Source: TradingView

Whale on the move as trading activity rises

Toncoin bulls have defended the market with their increased large trades, as shown in the IntoTheBlock data. The number of large transactions increased from 975 to 1,85,000 transactions.

The market’s whale positions suggest that they are anticipating a general price increase towards the next resistance level at $6.02.

Source: IntoTheBlock

Adding further fuel to the bullish bias, Toncoin trading activity has increased dramatically, with the number of active addresses increasing significantly by 35% in the last 24 hours according to IntoTheBlock data.

Source: IntoTheBlock

Source: IntoTheBlock

Bulls vs Bears

Despite the aforementioned bullish sentiments, Toncoin has experienced a declining long-short ratio since September 9. This could indicate a short-term price correction before the market resumes its upward trajectory.

The price correction may be nearing its end, as evidenced by increased whaling and trading activity.

Source: Coinglass

Is your portfolio green? View the TON Profit Calculator

The increasing whale activity and trading activity comes along with the price action analysis. All indicators point to a continuation of the bullish run.

However, Toncoin may see some correction in the short term before recovering to its target price around $6.02.