- Despite the recent price increase, TON’s number of long-term investors fell on the charts

- In the event of a sustained bull rally, TON could reach $6.85 soon

The crypto market has once again fallen victim to a correction as most crypto price charts were red at the time of writing. However, Tonmint [TON] had other plans as it was one of the few cryptos that managed to stay bullish.

Therefore, it is worth taking a look at what helped TON and whether this bull rally would continue.

Toncoin takes the lead

CoinMarketCaps facts revealed that top cryptos like Bitcoin [BTC] And Ethereum [ETH] had difficulty raising their prices. Meanwhile, TON behaved differently as its price rose more than 6% in the last 24 hours.

At the time of writing, Toncoin was trading at $6.70 with a market cap of over $16.8 billion, making it the 8th largest crypto.

AMBCrypto reported earlier that Binance, one of the world’s largest exchanges, listed TON. This important development played an important role in TON becoming bullish. However, the recent increase did not result in many addresses making a profit, as IntoTheBlock’s data showed that only 35% of investors were ‘cashed’.

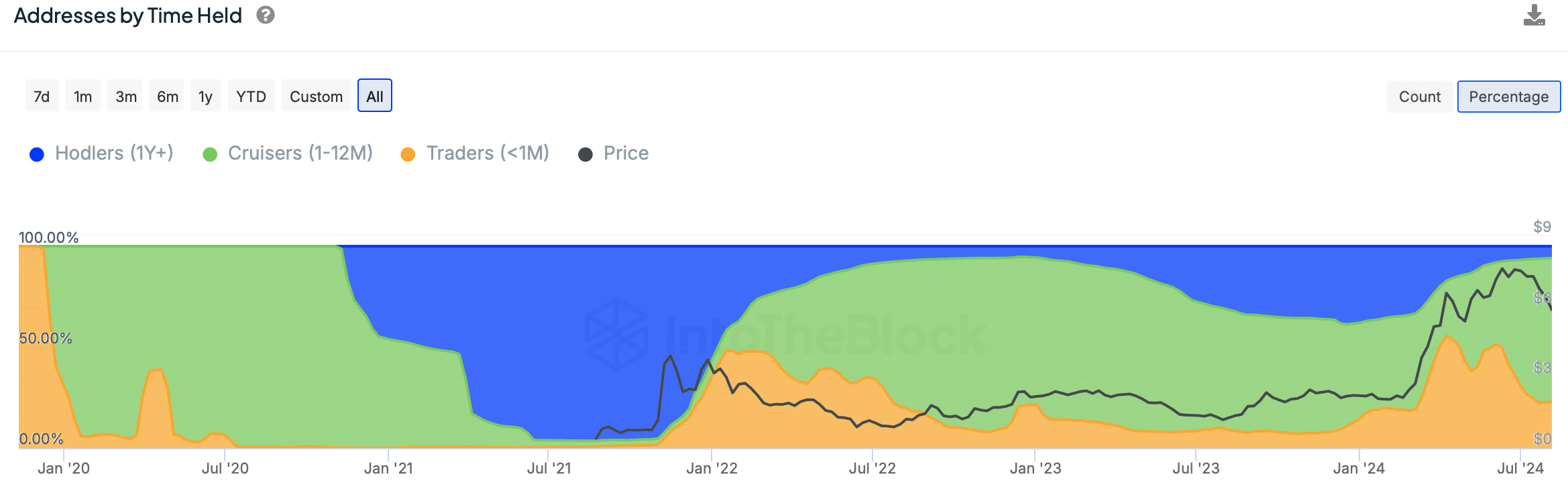

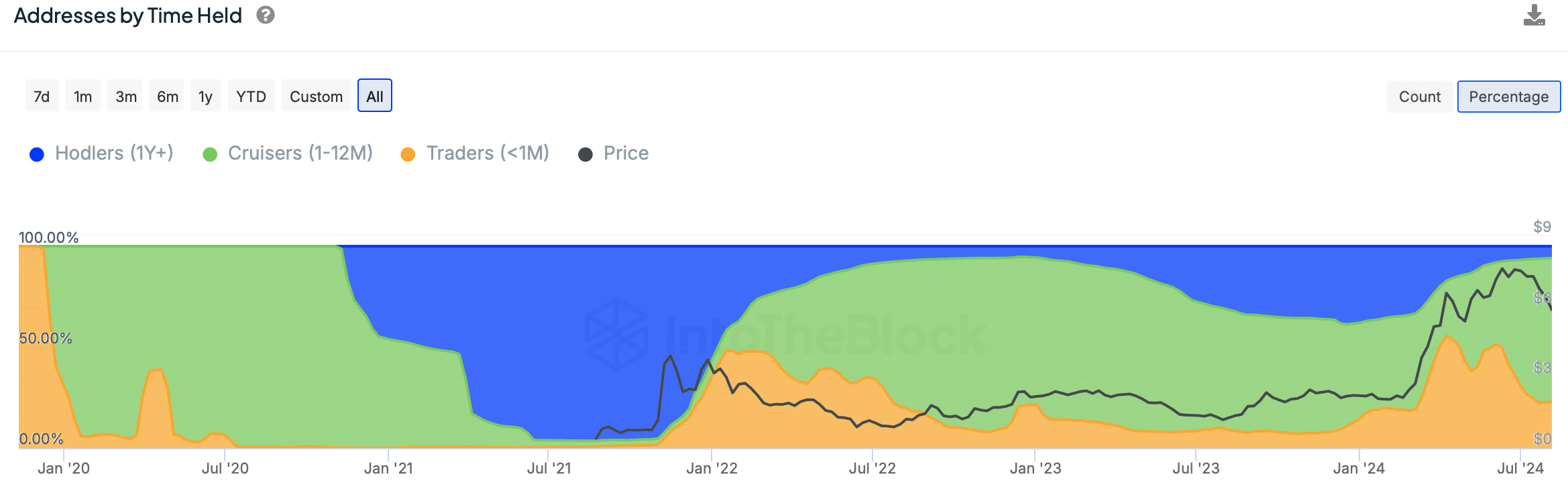

Notably, investors who have been holding TON for more than 1 year have also fallen, indicating they sold the coin at a profit.

Source: IntoTheBlock

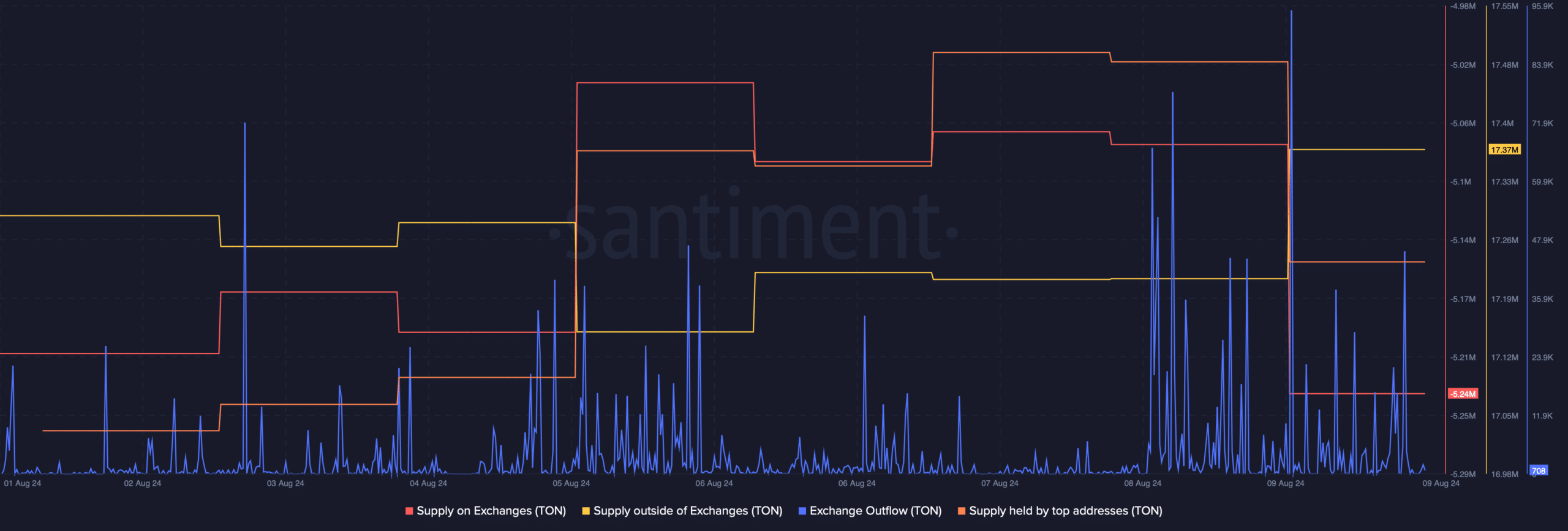

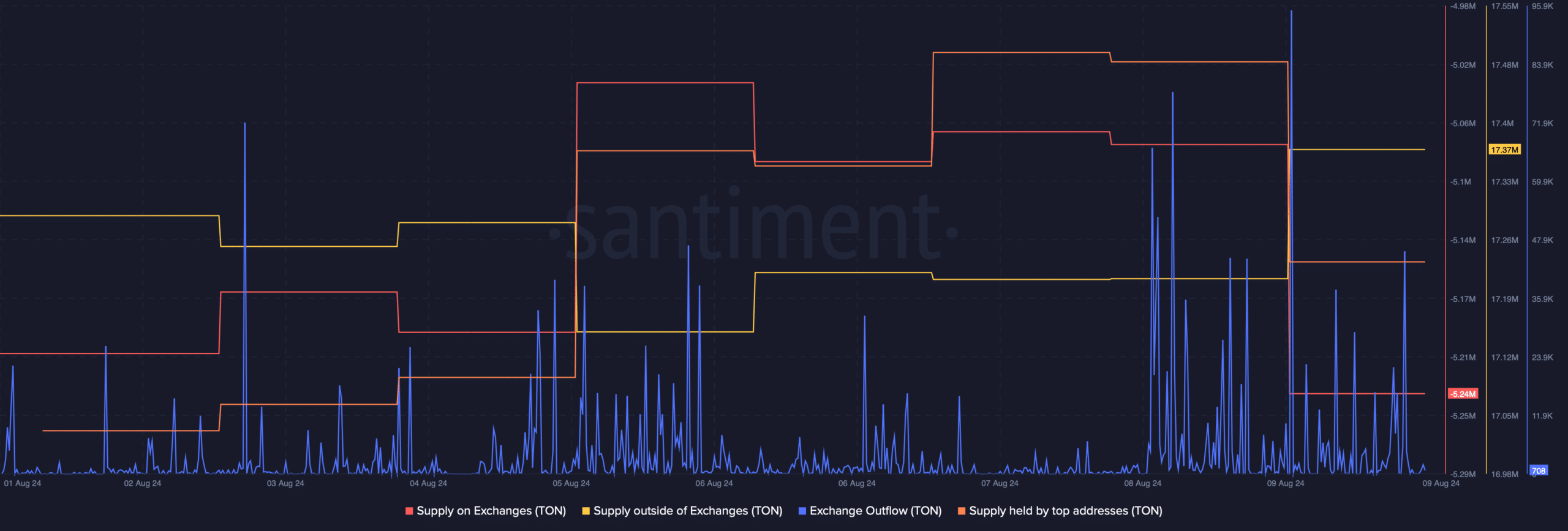

AMBCrypto then analyzed Santiment’s data to better understand investor behavior.

We found that buying pressure on the token was appreciated in recent days. This was evident from the decline in supply on trade fairs and an increase in supply outside the trade fairs.

Moreover, outflows from the TON exchanges also peaked, further indicating an increase in buying pressure. However, after a sharp peak, the supply of Toncoin at top addresses fell. This indicated that the top players in the crypto space were selling, possibly signaling a price correction in the coming days.

Source: Santiment

Will TON’s bull rally continue?

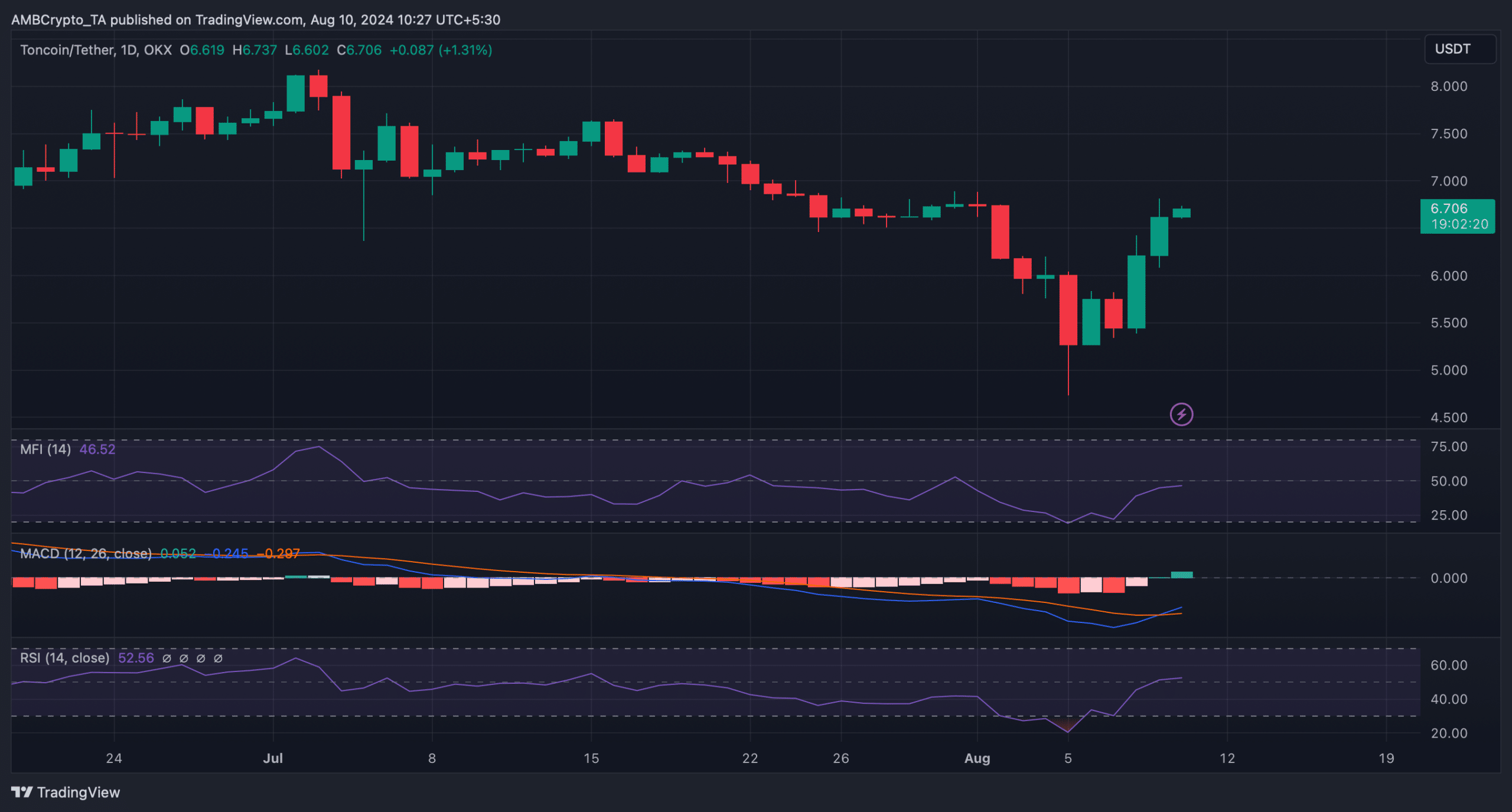

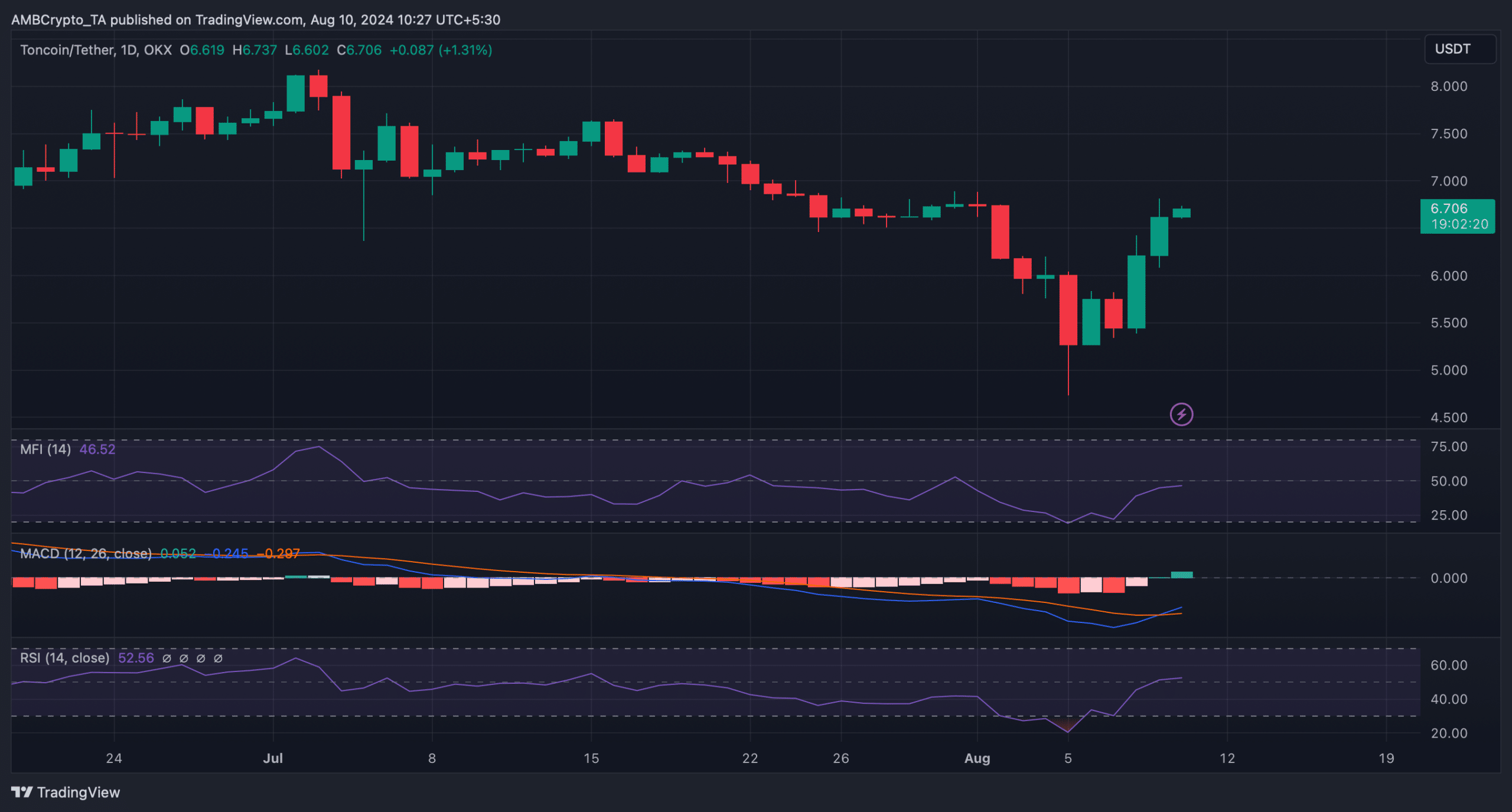

Next, we looked at Toncoin’s daily chart. While some numbers were bearish, most market indicators remained bullish. For example, the technical indicator MACD showed a bullish crossover.

The Relative Strength Index (RSI) also registered an increase. TON’s Money Flow Index (MFI) also followed a similar trend, further suggesting that the chances of continued price appreciation were high.

Source: TradingView

Is your portfolio green? View the TON Profit Calculator

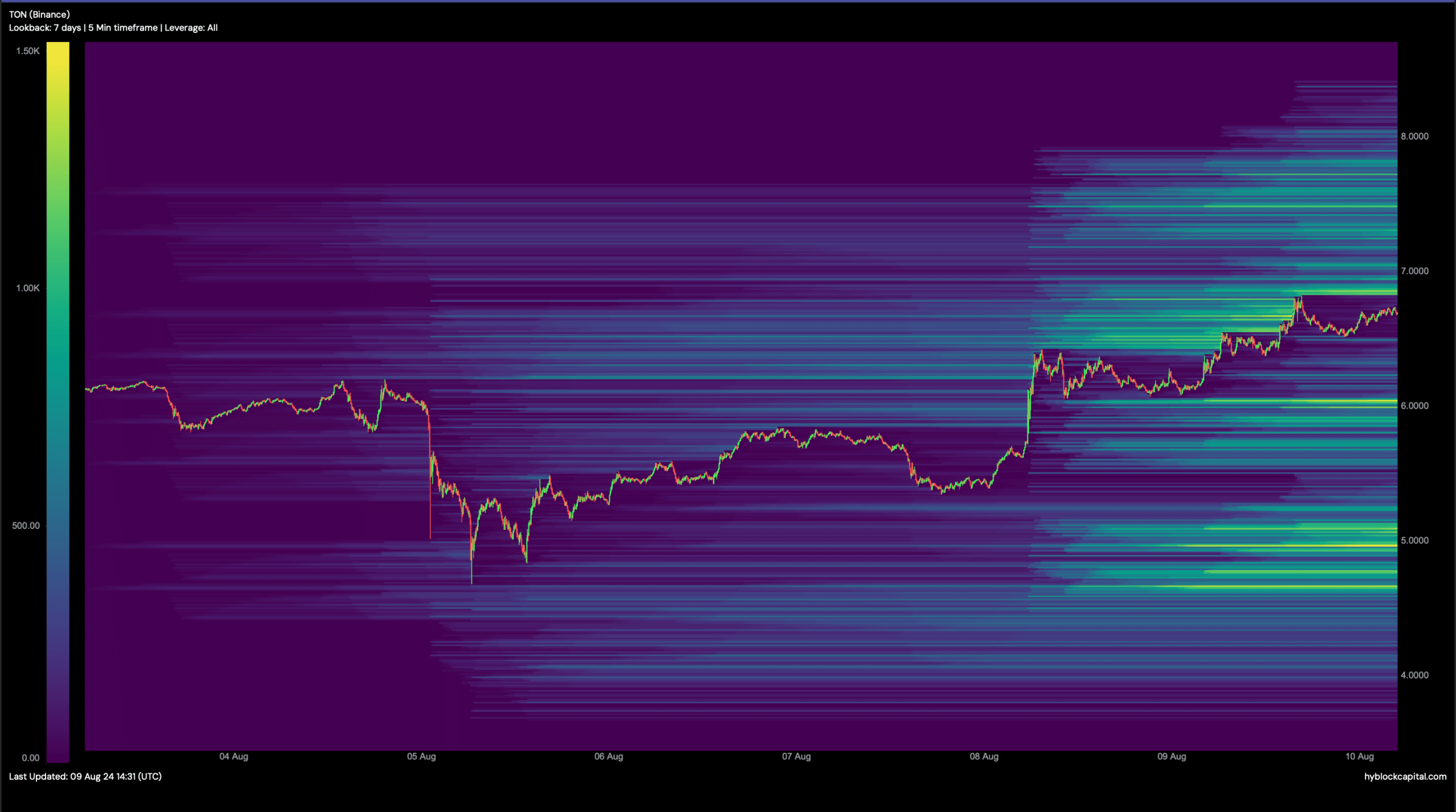

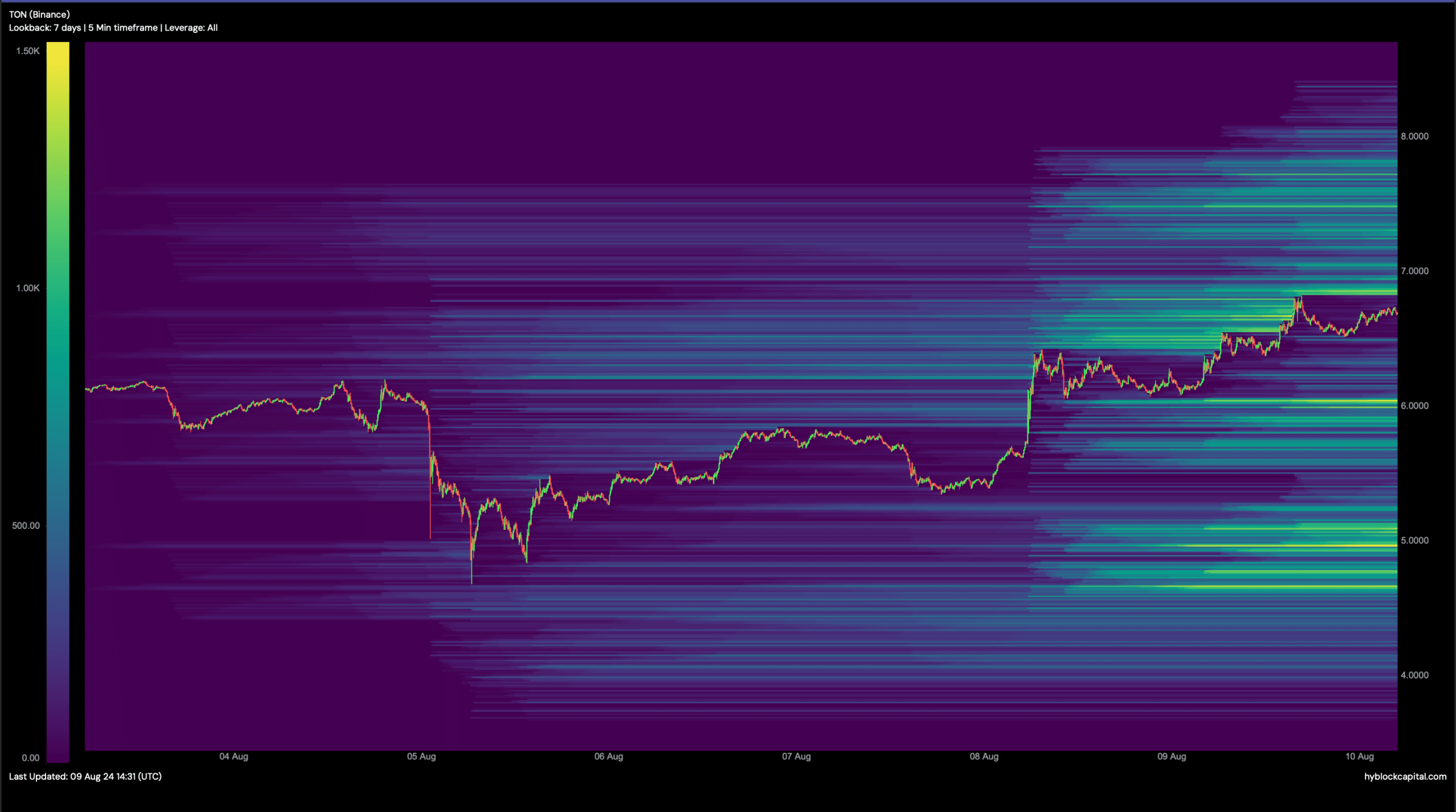

Finally, AMBCrypto’s look at Hyblock Capital’s data revealed that TON would face a massive liquidation increase of $6.85.

Therefore, it would be crucial for Toncoin to rise above that market to continue its bull rally. In the event of a bearish takeover, investors could see TON fall to $6.02.

Source: Hyblock Capital