- Toncoin’s volume indicators were contradictory, but the higher time frame trend remained bearish.

- Momentum and market sentiment recently indicated that further losses were likely.

Tonmint [TON] showed a downward trend over multiple time frames. Recent reports indicated that bearish momentum was gaining momentum, but Futures market data offered some hope.

Bitcoins though [BTC] faced bearish pressure after hopes for a bullish September were dashed. Market-wide sentiment saw TON fall below the range it formed in early June.

Prices go below the $6 level

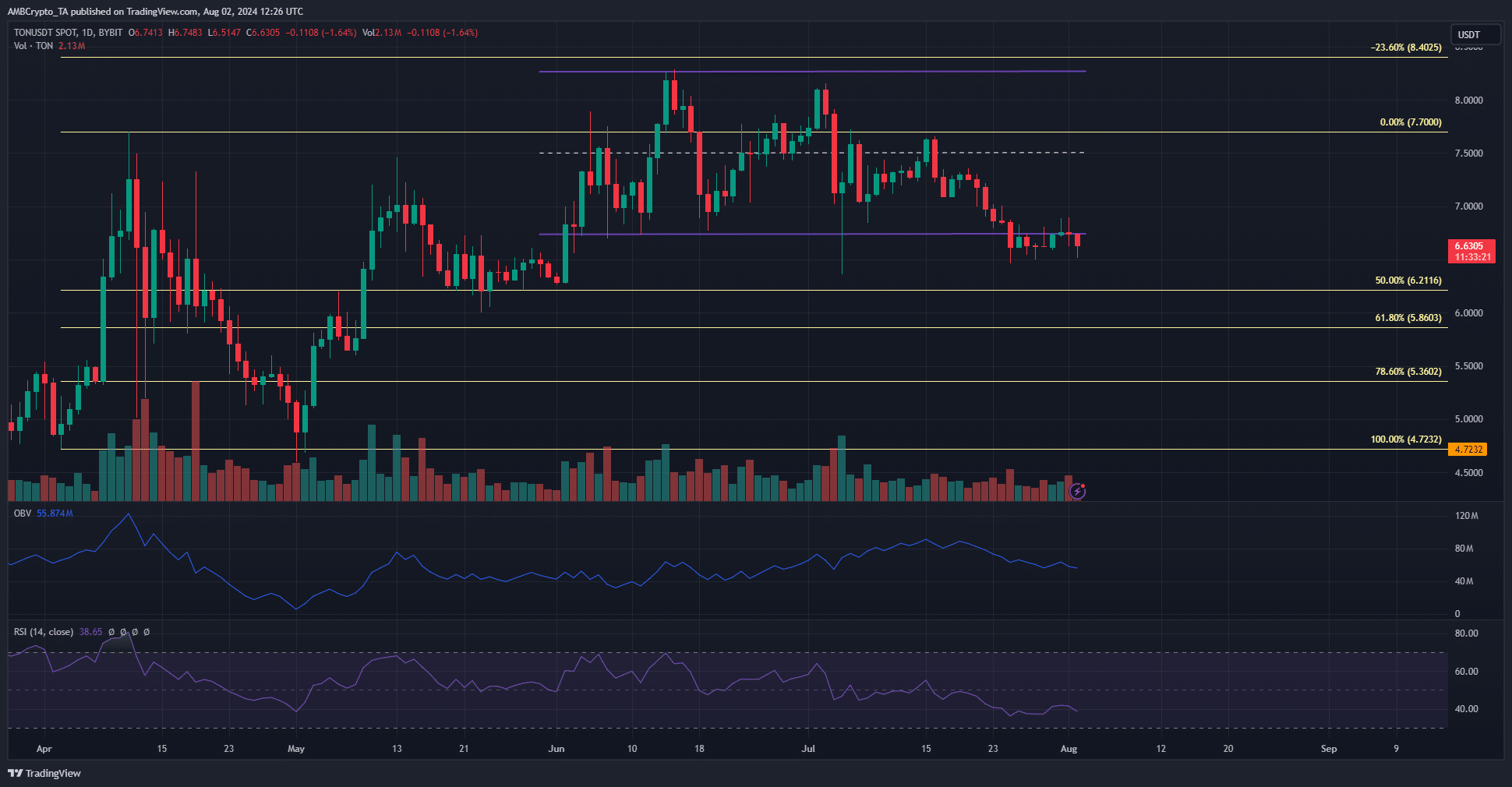

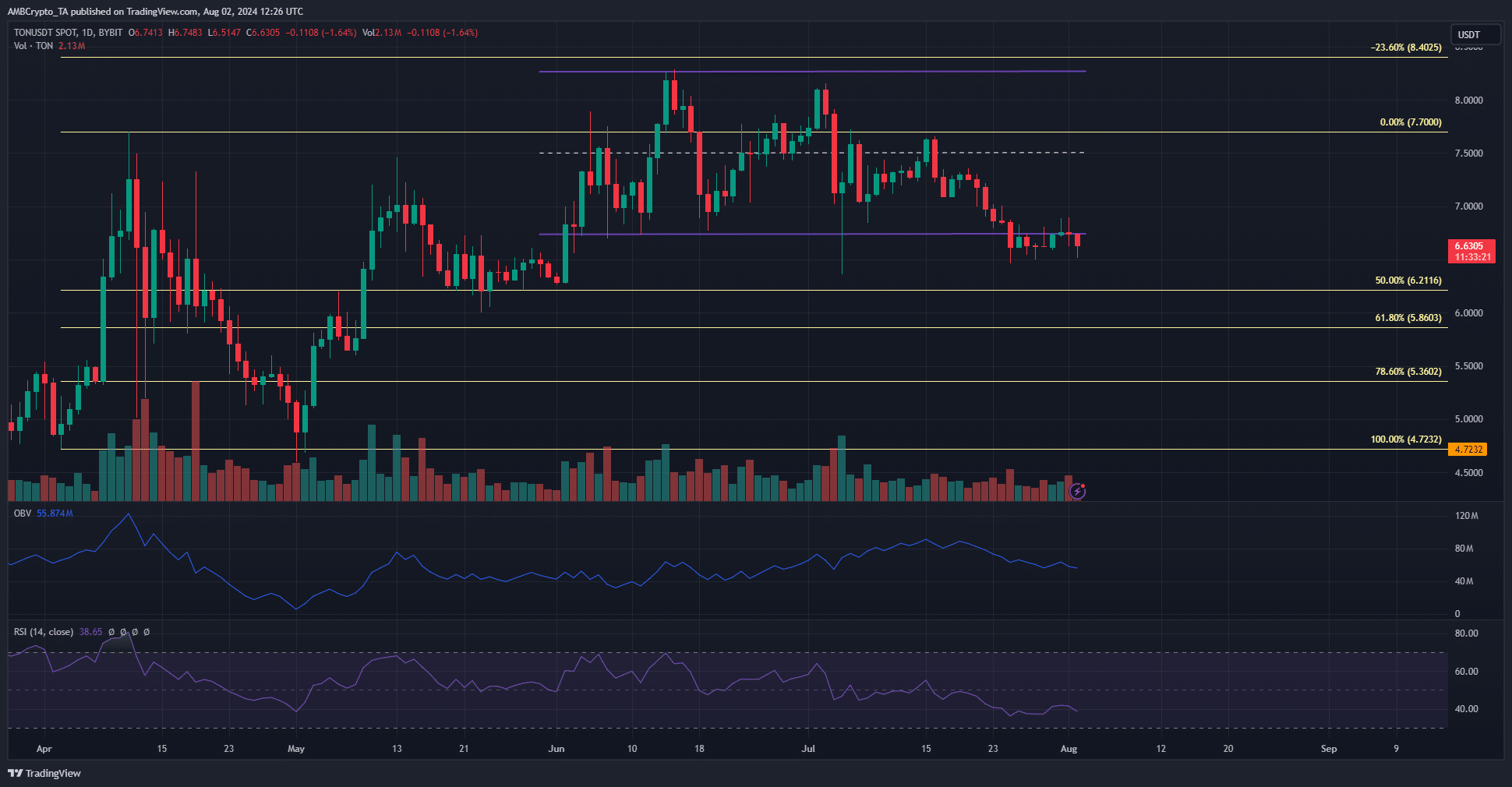

Source: TON/USDT on TradingView

Since early June, Toncoin has been trading within a range of $6.74 to $8.27. This past week, the lows of this range were broken and turned into a resistance zone.

As a result of this development, the OBV continued its downward spiral. This was a strong sign that this was not an anomaly, but a continuation of the downward trend of the past month.

The daily RSI was also bearish. The Fibonacci retracement levels outlined the next support levels at $6.21, $5.86 and $5.36. Failing to defend range lows, a move below $6 was likely in August.

What will revive TON’s bearish bias?

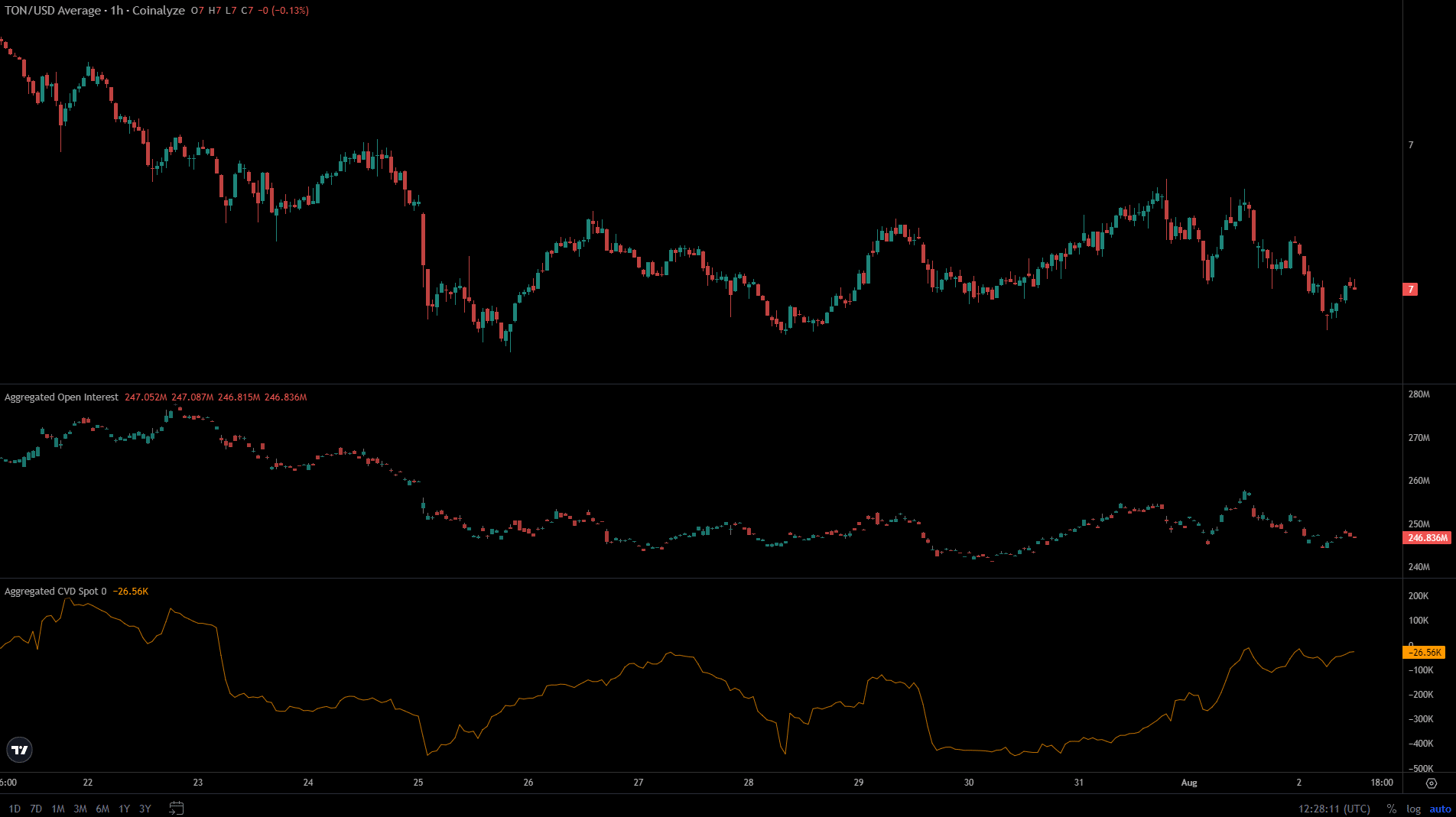

Open Interest has fallen from $257 million to $246 million over the past two days. This was accompanied by a Toncoin rejection at the short-term resistance at $6.84, an area that has served as resistance since July 26.

Is your portfolio green? View the TON Profit Calculator

So far, all factors painted a bearish future for TON. However, the spot CVD rose surprisingly quickly.

The findings were opposite to those of the OBV. This increased buying pressure over the past few days may not be enough to spark a price recovery, but could introduce a move back towards the $6.8 region in the near term.

Disclaimer: The information presented does not constitute financial advice, investment advice, trading advice or any other form of advice and is solely the opinion of the writer.