- Toncoin maintained a Bearish daily market structure.

- The high volume on the recent jump gave some hope to Ton Bullen.

Toncoin [TON] Holders did not do well. Data showed that 96% of the holders were under water, but the token saw a price of 25% in the last four days.

Yet the severity of the downward trend on the daily graph was uninterrupted.

How high can the current bouncing go? The resistance level of $ 3.85 was one of the leading candidates for a bearish reversal.

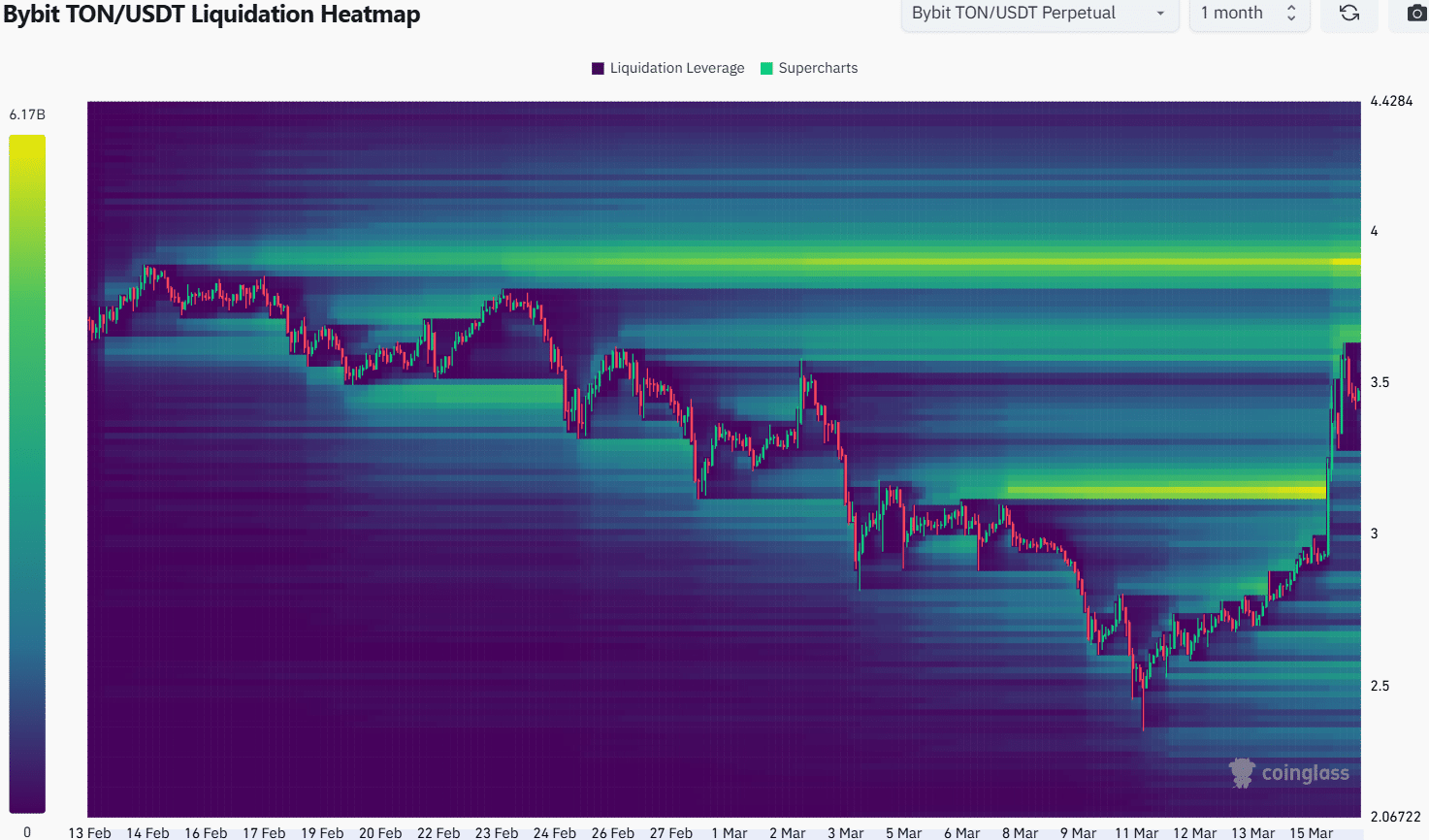

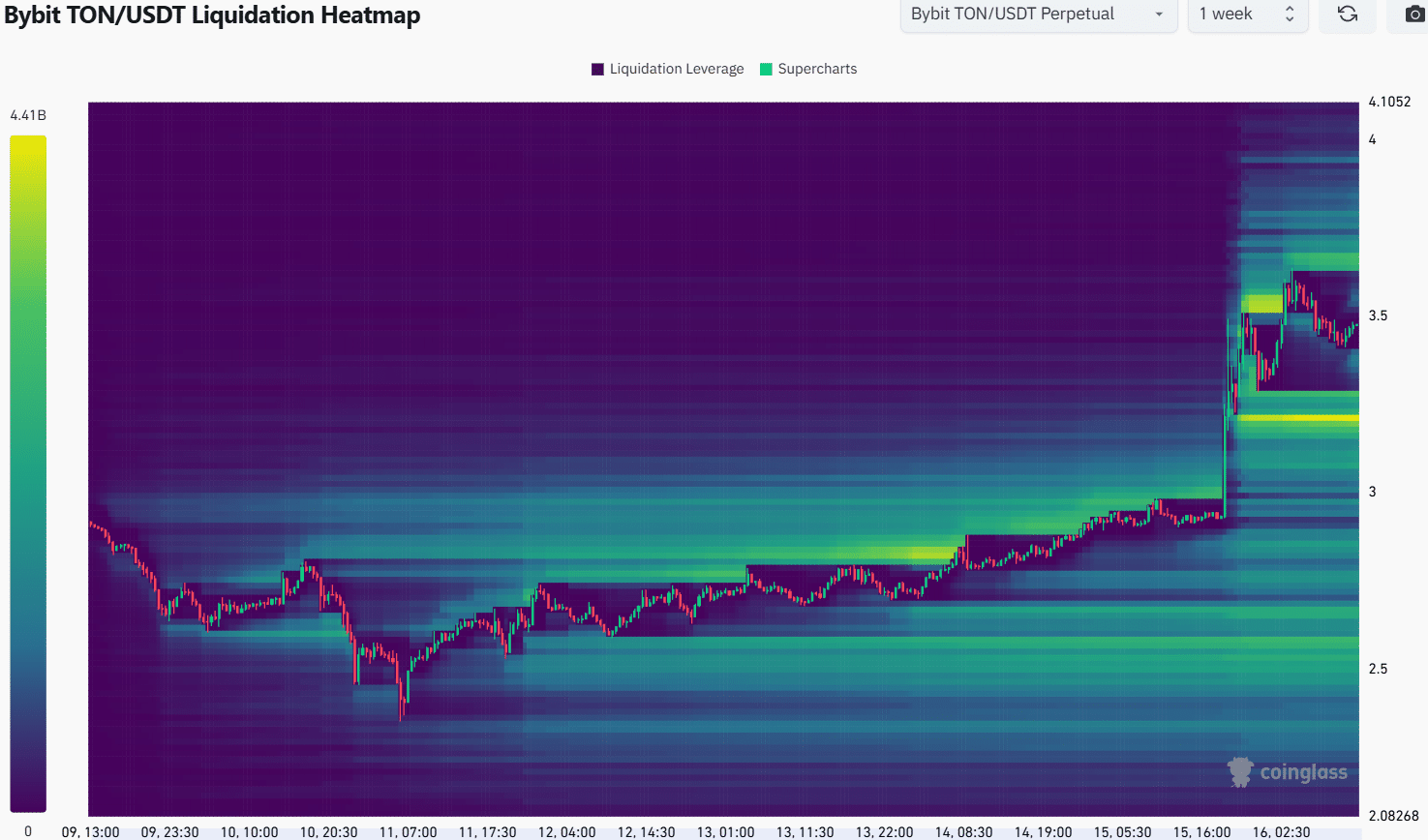

Ambcrypto investigated the relevant liquidation heats to understand Ton’s potential price movements.

Toncoin to climb to $ 3.6 for Beerarish reversal

Source: Ton/USDT on TradingView

The recent lower high at $ 3.95 from February was a potential target for Ton in the coming days. The MacD remained under zero but formed a strong bullish crossover.

It was a response to the rapid profit in recent profit, but the prevailing trend in this time frame remained Bearish.

Due to the high trade volume in recent days, the BBV jumped above the lows from December. In addition, it led some hope for a bullish.

The Fibonacci racement levels were deported based on the rally from February to June 2024. The bouncer above 78.6% was encouraging in the short term, but there was resistance overhead.

The purpose of $ 3.95 must be violated to achieve a bullish market structure shift.

Even if this happened, the $ 4.5 zone would probably act as a food zone. In general, the chances of a rapid recovery of the Ton were slim.

The 1 -month liquidation Heatmap emphasized the liquidity bags at $ 3.66 and $ 3.9. The former level was just above the highlights on Saturday and the last marked the lower high a month ago.

Together these two levels were the most important candidates for a bearish reversal to start.

Zooming in on the heat of 1 weeks, we can see that the levels of $ 3.2 and $ 3.67 were the ones to pay attention to. The liquidity of around $ 3.2 was comparable to that around $ 3.6.

Because $ 3.6 was closer, Ton was more likely to climb higher to wipe the liquidity before he dropped to $ 3.2.

Swing traders can wait for such a movement and then look for a reversal in the bottom time frames, aimed at a retracement of the move. Usually such strong reversations have a good chance to prevent on Monday.

A step further than $ 3.7 would invalidate the idea of a retracement to $ 3.2 looking for liquidity.

Disclaimer: The presented information does not form financial, investments, trade or other types of advice and is only the opinion of the writer