- Projections showed liquidity would reach a local peak in September 2025.

- The Bitcoin cycle is fueled by the available liquidity.

Bitcoin [BTC] has moved within roughly four cycles, with each new cycle marking a new all-time high for prices.

From being used to paying for pizza to multinational investment companies marketing the spot BTC ETF to their clients, the crypto community has been on a number of rides and counting over the past decade.

Every three or four years there is a running of the bulls. And we are on the verge of a new one, which has probably begun. But why do we have these cycles and are they predictable?

The basic answer may not be the whole truth

Avid crypto users would immediately respond that Bitcoin’s halving cycle is timed on a four-year clock.

The mining difficulty and block time have been adjusted so that mining rewards are halved approximately once every four years.

There you go. Each additional miner in the network sees the hash rate and security increase, but the block time is always adjusted.

To justify the mining costs, Bitcoin’s price must rise, and the halving puts even more upward pressure.

But like everything, the answer has more nuances. Bitcoin and the rest of the crypto market represent an extremely volatile asset class. They entail a great risk.

Fraud, security (individual or even exchange, they are all vulnerable to hackers), regulatory scrutiny and volatility are just some of them.

Liquidity is a key component to understanding the four-year cycle

When the economy is in a difficult situation, it is more difficult to secure funds for investments. This means that safer assets are in high demand.

Conversely, when liquidity is plentiful, the public is more open to riskier asset classes, one of which is cryptocurrencies.

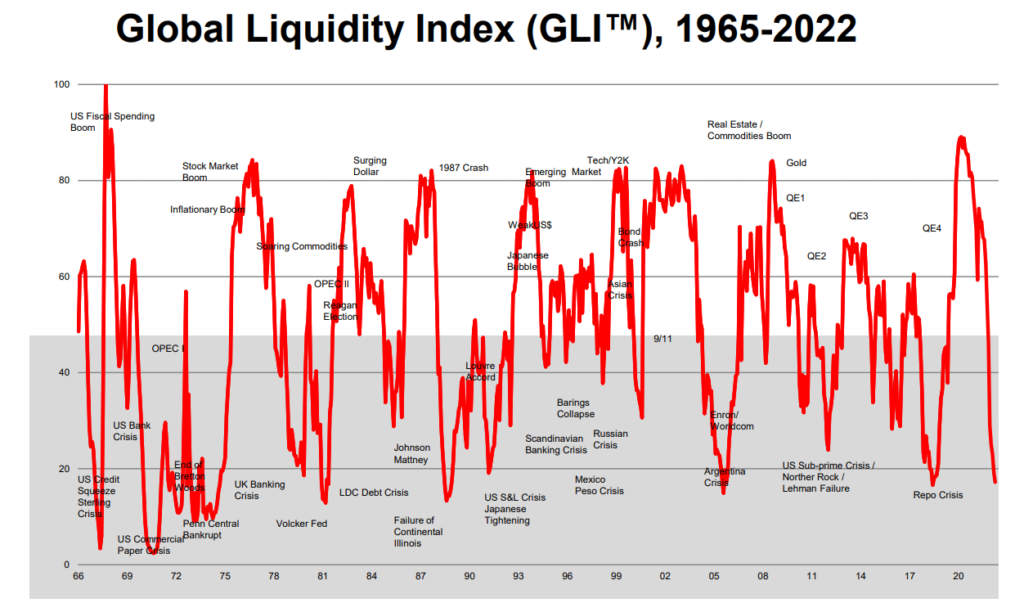

Source: Cross-border capital

The Global Liquidity Index (GLI) chart ranges from 0-100 and displays the Global Liquidity Cycle as a normalized index.

The COVID-19 pandemic pushed monetary policy toward lowering the cost of debt and quantitative easing.

This led to a rise in inflation, which, for example, the US Federal Reserve has fought against in the past two years by raising interest rates. Their position is that interest rates will probably not be increased from 2024 onwards.

Source: Cross-border capital

A 65 month sine wave (repeating cycle) was a rough approximation of each cycle. While it’s not perfect, it doesn’t have to be.

It allows us to extrapolate and get an idea of when the peak or trough of the next cycle might arrive.

Is Bitcoin’s Cycle Top Near?

The data showed that the top of the next cycle would be in the fourth quarter of 2025, around September. This tied in well with an earlier, fun experiment that AMBCrypto tried using the Bitcoin Rainbow Chart.

We also found that Bitcoin took almost three years to go from the low of $3.1,000 in December 2018 to the high of $69,000 in November 2021.

Bitcoin took 1435 days to go from the 2017 cycle high to the 2021 high. This translates to 47.17 months, which is shorter than the index’s 65-month cycle.

However, the most recent GLI high and low in 2021 and 2023 are somewhat consistent with Bitcoin’s MVRV ratio.

Source: CryptoQuant

At the time of writing, the MVRV ratio has been on an upward trend for a year. It didn’t come close to the cycle top value of 3.7, meaning BTC prices likely have more room to rise.

So the September 2025 date may not correspond to a Bitcoin top either.

Read Bitcoin’s [BTC] Price forecast 2024-25

The influx of institutional investors has increased long-term demand for BTC, but has it also extended the roughly three years it took BTC to go from bottom to top in the previous cycle?

Only with time will we know the final answer.