- Bitcoin’s Bull Score Index dropped to its 2023 levels when the momentum weakened

- According to Coinbase, the American rates and win reports of April can be factors to pay attention

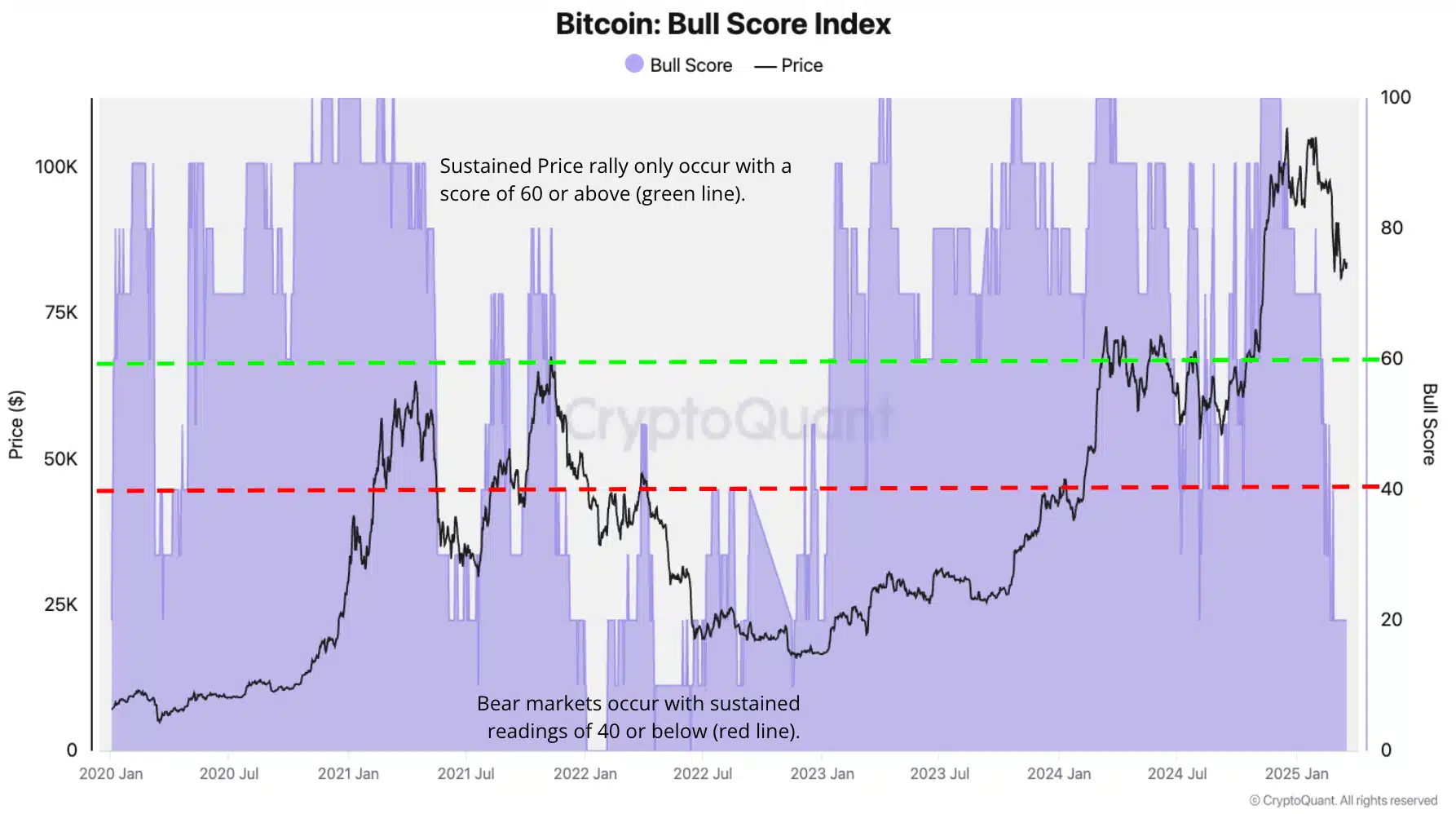

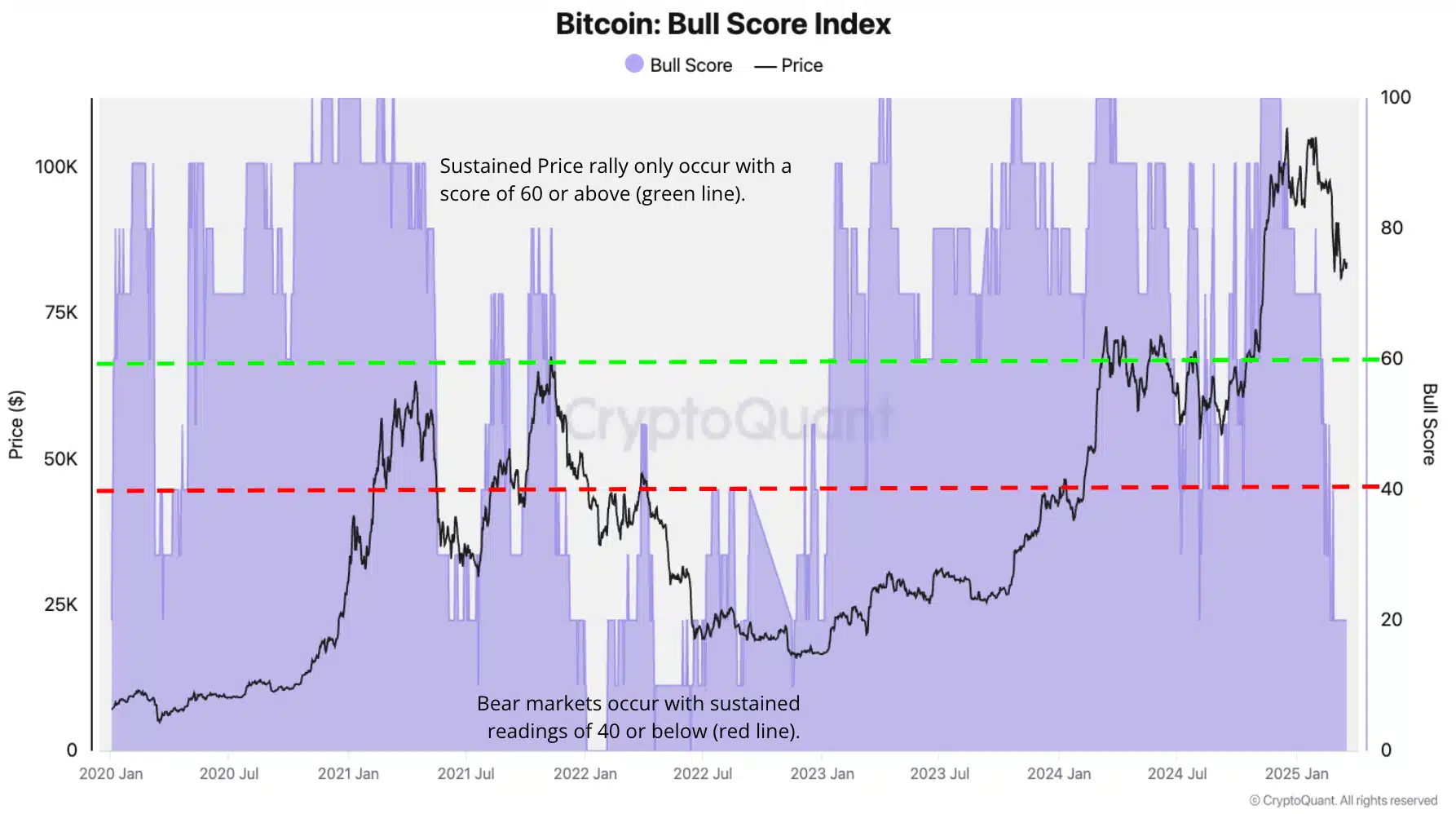

In Q1 of 2025, Bitcoin [BTC] Lost momentum and fell by 23% to $ 84k from $ 109k. According to the projections of cryptoquant analysts, this can mean a probably longer Bearish trend.

In his weekly reportThe analysts noted that the Bitcoin Bull Score Index (BBSI) fell to a low point of 2 years. This emphasized a weak market momentum across the board.

“Currently, the index has been at 20th lowest since January 2023-market conditions are weak, so that the concern is declared that the recent price decrease could be part of a wider Bearish trend instead of a short-term correction.”

Soure: Cryptuquant

The index varies from 0 to 100. It follows bullish drawing such as network activity, demand and liquidity.

Higher values would be considered bullish, while lower measurements would show bearish circumstances. The BBSI lecture of 20 reflected the weak circumstances that were seen in 2022 and early 2023.

What is the next step for Bitcoin?

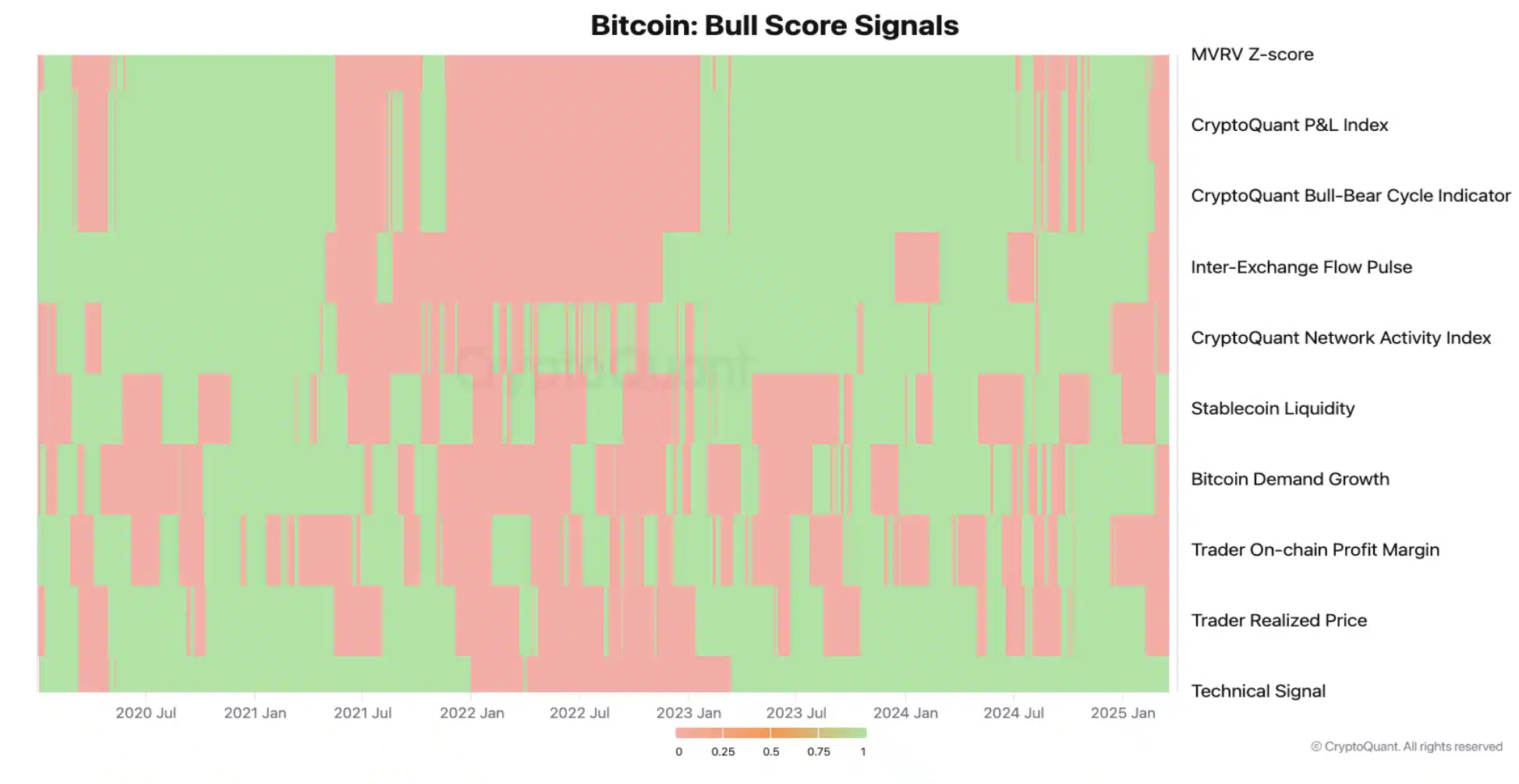

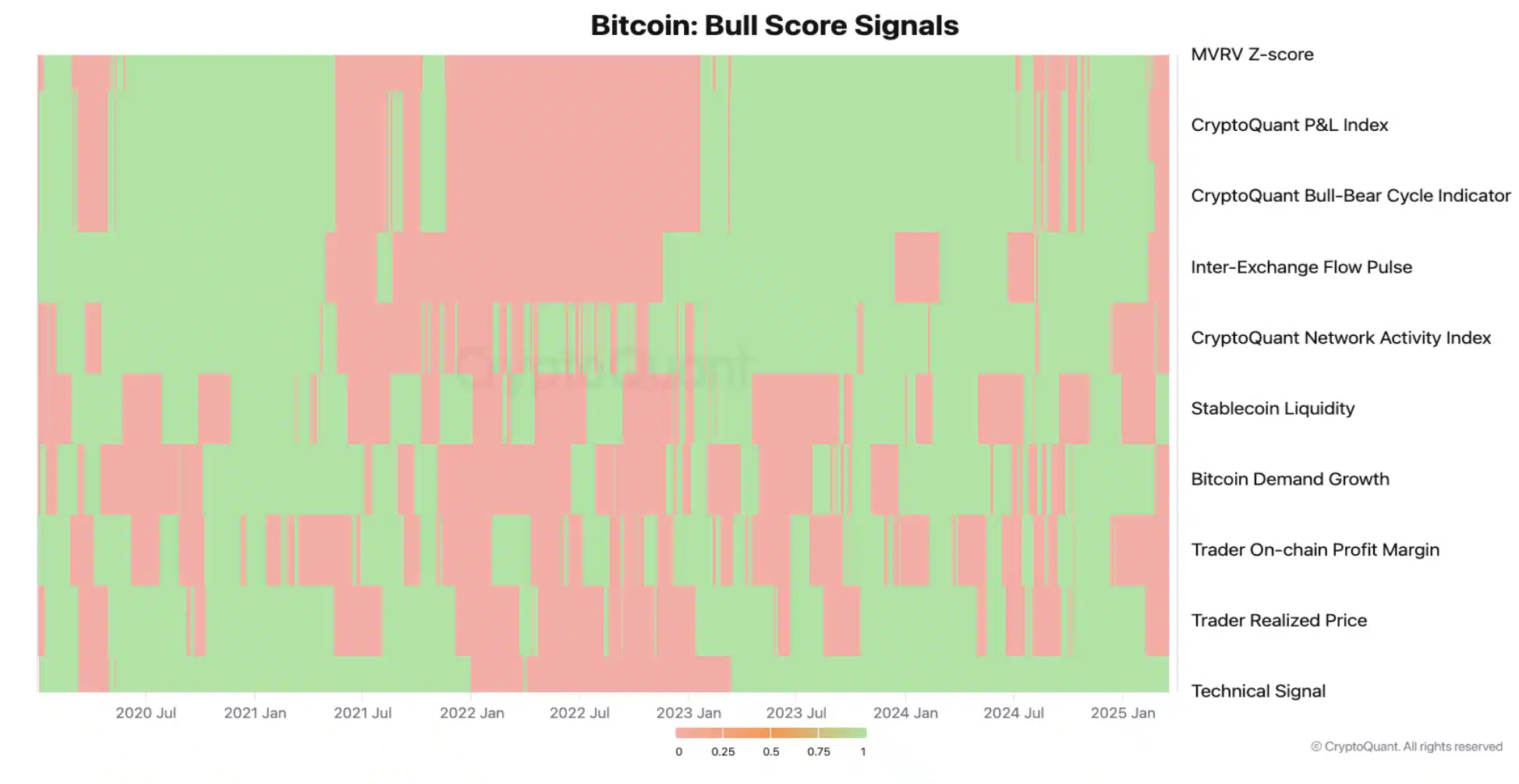

Moreover, the analysts added that other important signals on the chains, apart from the Stablecoin liquidity, have been bearish since mid-February.

Source: Cryptuquant

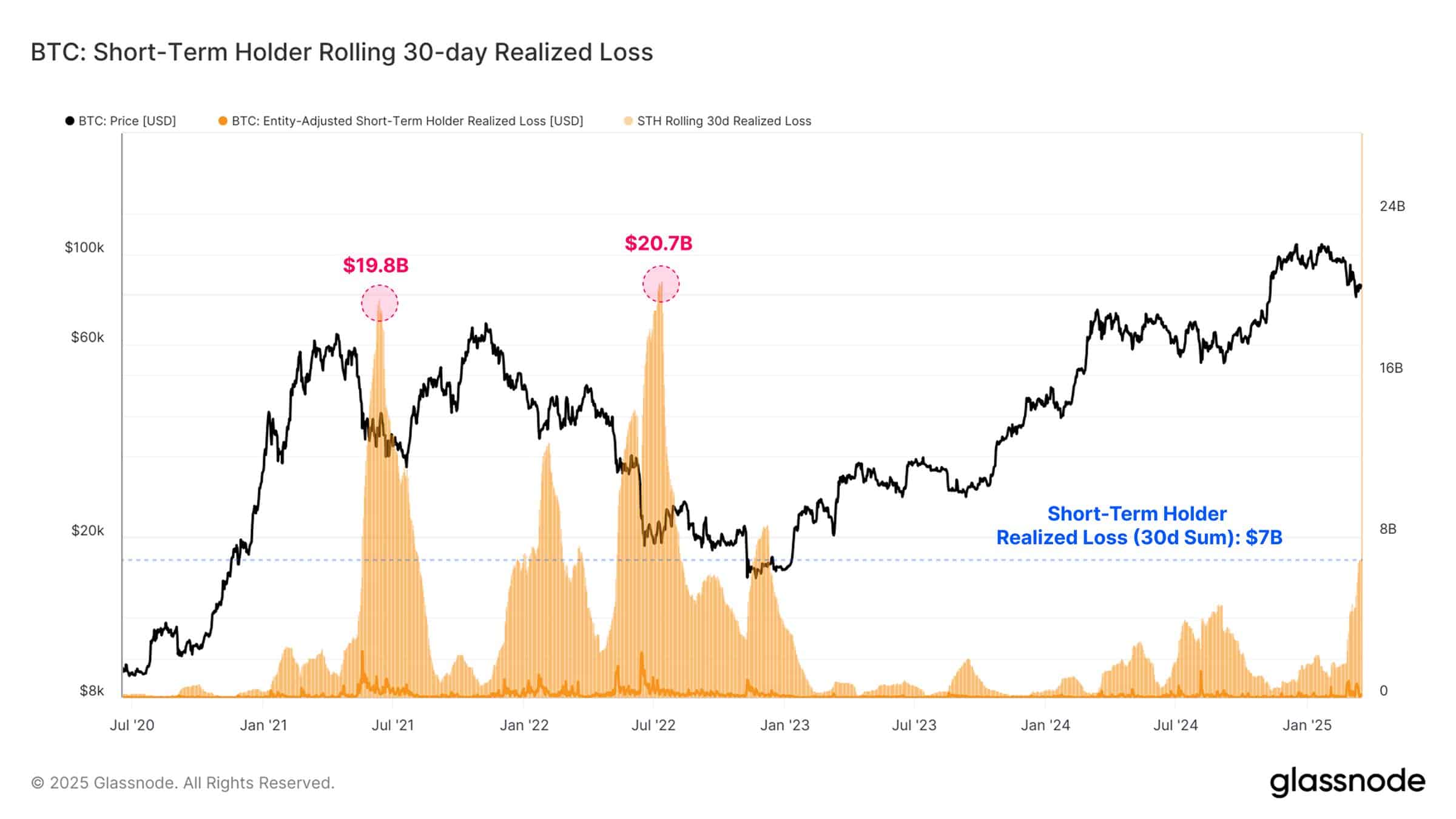

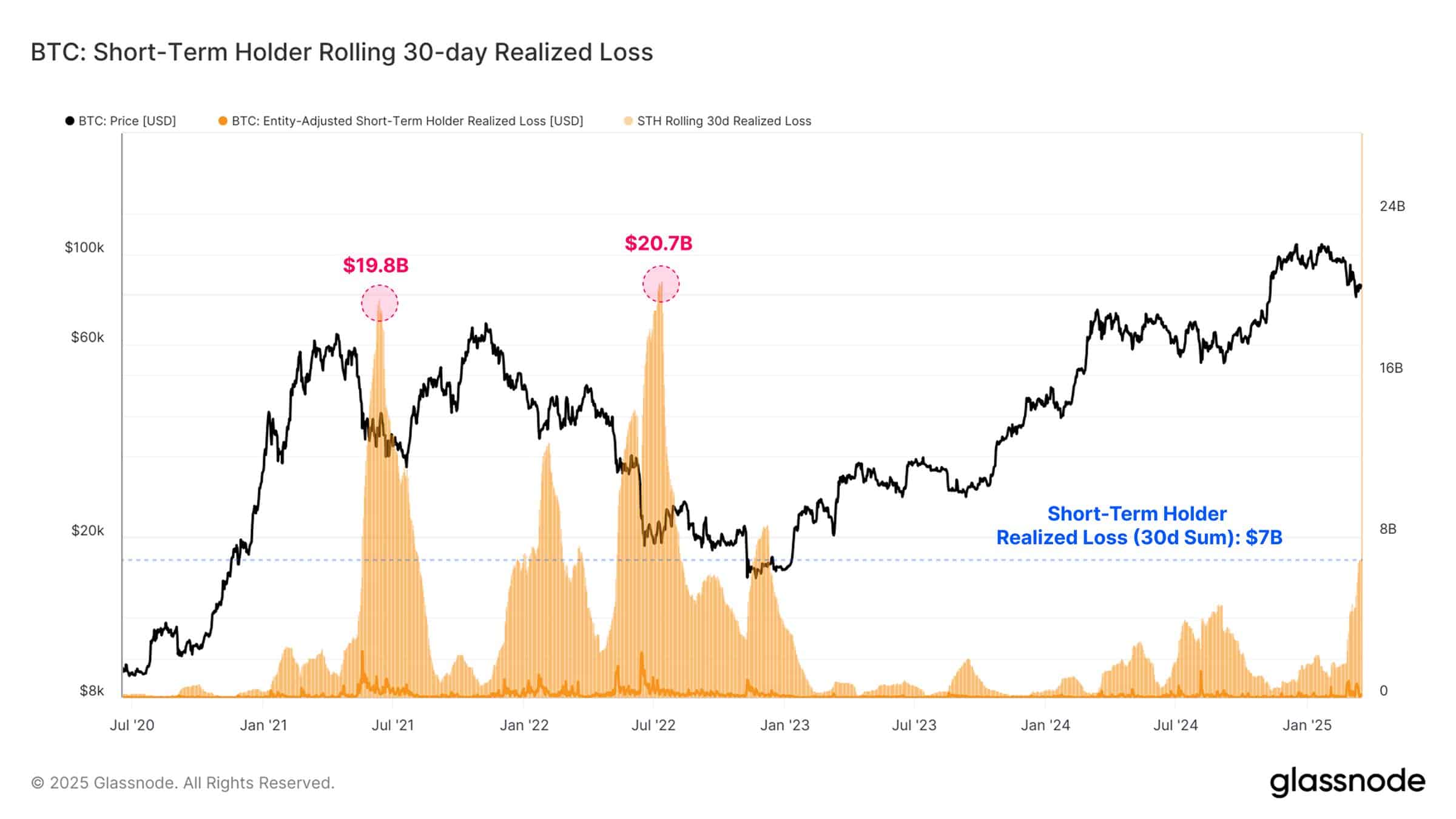

The most distracting group of investors include STH (short -term holders), who have held 6 months or less BTC. The group saw a record loss of $ 7 billion in the last 30 days, according to Glassnode. The analysis company noted Those losses remained within the historic levels that were seen during the previous BTC Bull -Runs.

“The rolling 30-day realized loss for #Bitcoin’s STHS has reached $ 7 billion, which marks the largest persistent loss event of this cycle. However, this remains far below the earlier capitulation events, such as $ 19.8b and $ 20.7 billion losses in 2021-22.”

Source: Glassnode

Coinbase analysts did not, however, shared these optimistic prospects. Macro illness and Trump rates deteriorated the risk-off sentiment for BTC in Q1. Coinbase -analysts in fact warned The new tariff wars at the beginning of April can be a key factor to look at.

“We believe that rates and 1q25 earnings reports (forward guidelines) represent the most important factors for market players to look in the coming weeks.”