- This week, data reveals a huge increase of 440% in cake whale activity, and points to a potential market base.

- Cake could rise by 40%and reach the level of $ 4.25, if it breaks and closes a daily candle over $ 3.

In the midst of the continuous market uncertainty, Cake, the native token of pancake swap, received considerable attention from crypto -whales and was now about to have a solid upward momentum.

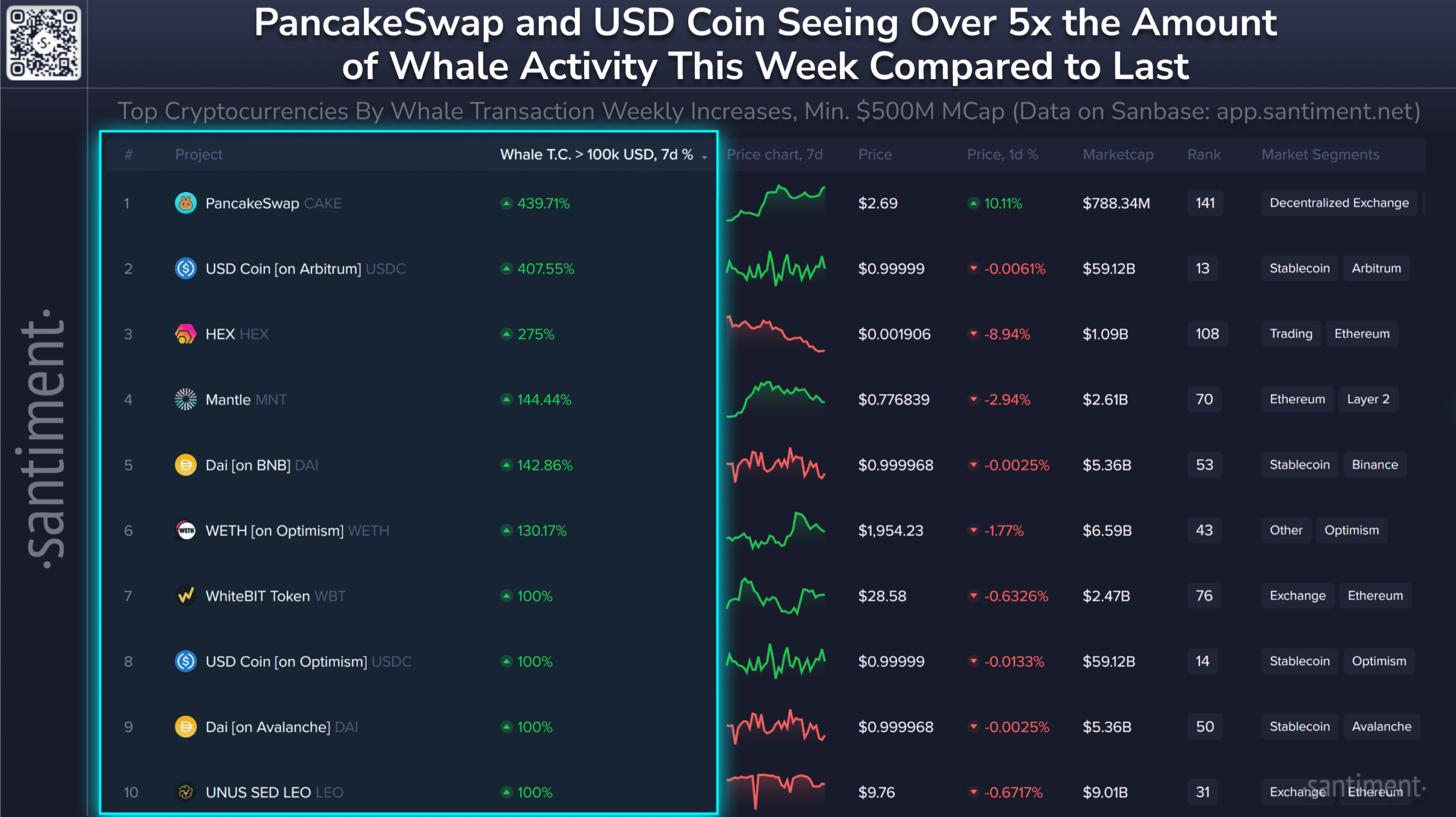

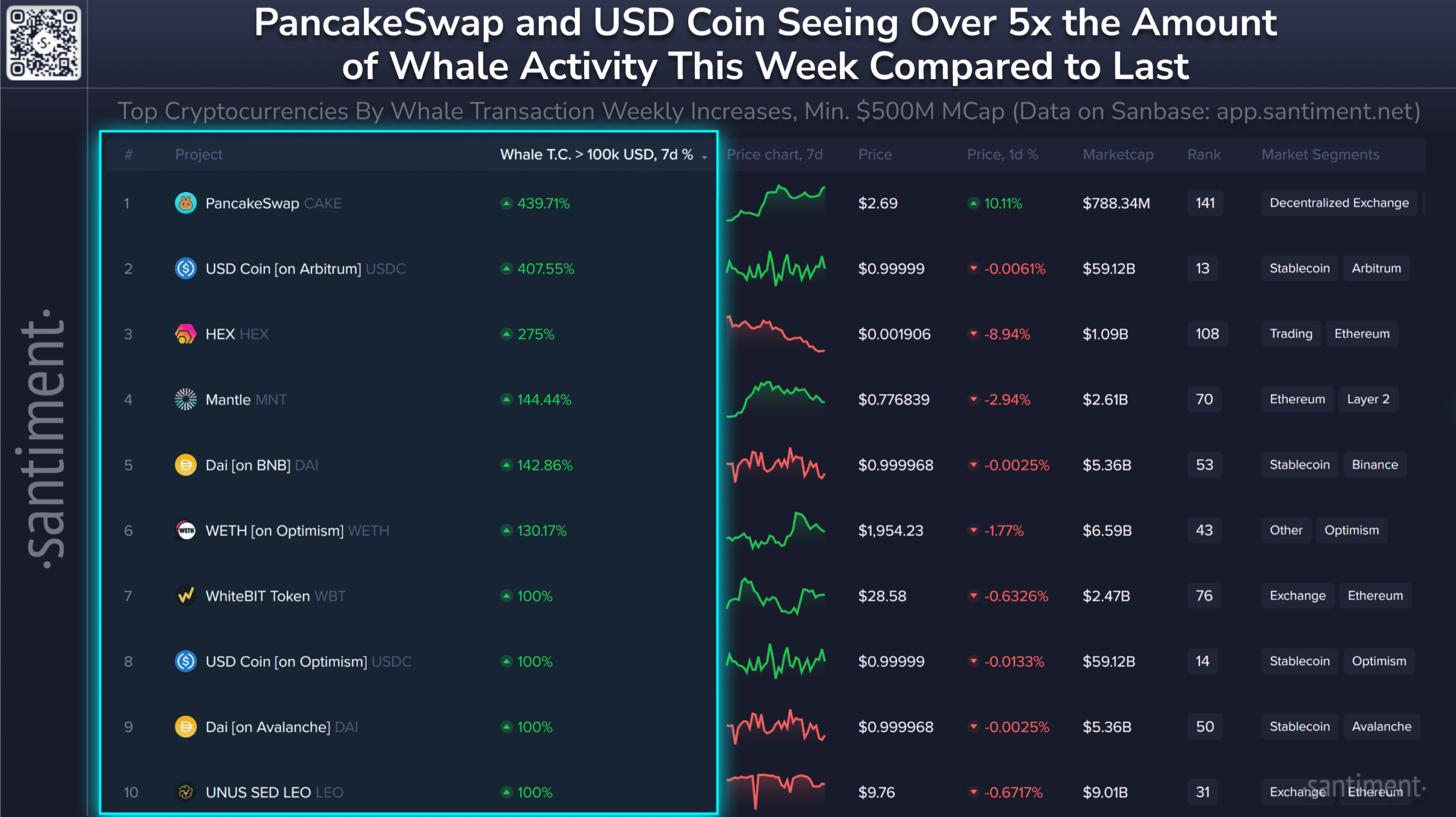

Cake whale activity nails with 440%

Data from the on-chain analysis company Santiment revealed that whale activity in Cake has risen by 439.70% in the past week, indicating a potential soil for the active and an ideal buying option.

Source: Santiment

This substantial increase in whale activity can cause the purchasing pressure and further stimulate upward momentum.

Data from coinmarketcap shows that this increased whale activity the cake has already risen by 38% in the past week, so that it is brought to a crucial level.

Pancakes WAP Technical analysis and price forecast

With this substantial upward momentum in the past week, it has actively reached a crucial resistance level that has a strong history of sales pressure and the subsequent price decrease.

This time, however, the sentiment seemed to shift in cake due to rising whale activity.

According to technical analysis of experts, cake looked bullish when it approached the crucial resistance level of $ 3.

If whale activity remains strong and the price spends this resistance, there is a high possibility that it could actively rise by 40%and reach the level of $ 4.25 in the coming days.

Source: TradingView

From the moment of the press, cake was traded above the 200 exponential advancing average (EMA) on the daily period, which indicates an upward trend.

The Altcoin traded almost $ 2.62 and registered a modest price destination of 0.65%in the last 24 hours.

During the same period, however, the trade volume fell by 55%, indicating a lower participation of traders and investors compared to the previous day.

This fall in trade volume may be the result of high volatility in the price of the active in the cryptomarket.

Heerdersverlordes from traders

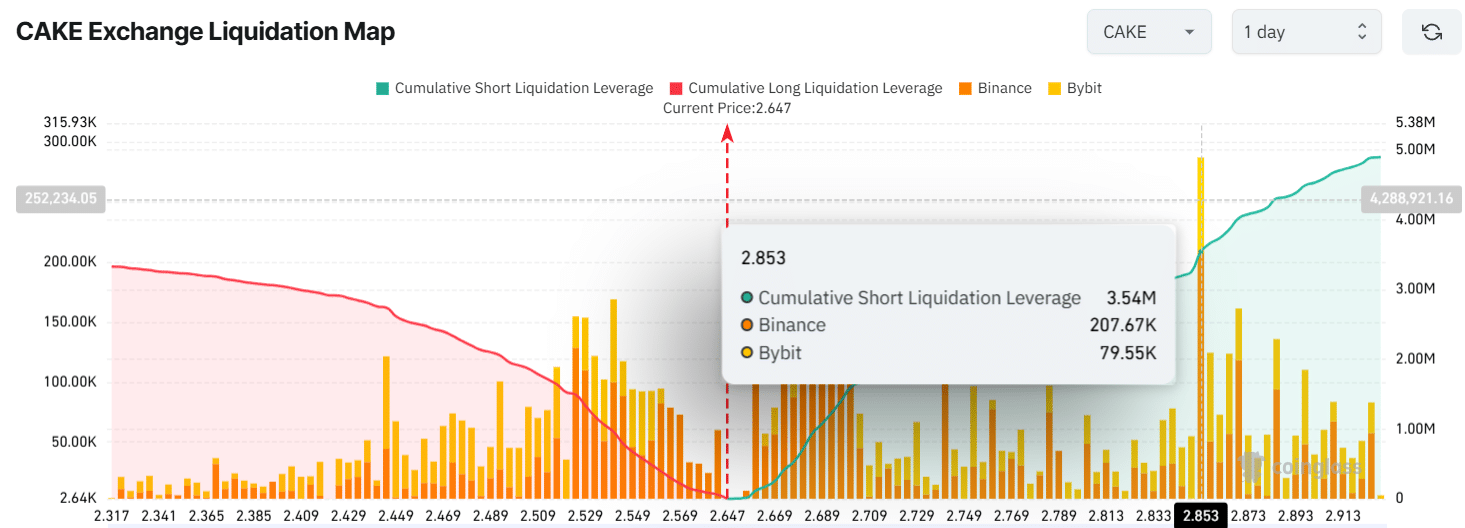

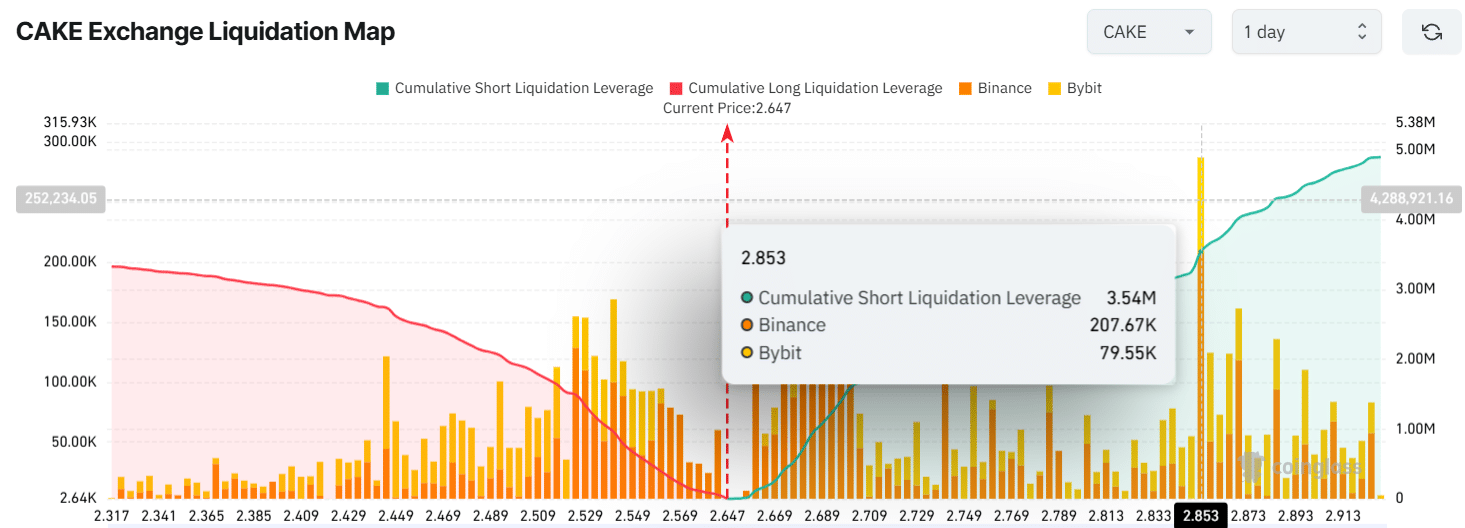

Despite the bullish sentiment and the price action, intraday traders seem to have a bearish prospect because they bet on the disadvantage.

Data from the on-chain analysis company Coinglass showed that traders were used too much for $ 2,445 at the bottom, with $ 2.75 million in long positions.

In the meantime, $ 2.85 is another over-level level where Bears have built positions, which currently have $ 3,55 million in short positions.

Source: Coinglass

This suggests that bears dominate and believe that the price of the actual $ 2.85 will not exceed.