- Bitcoin price stabilized around $29,000 – $30,000 amid market volatility

- The volume of sellers and takers and declining mining revenues emerged as possible reasons for price suppression

Against the backdrop of significant price swings and heightened volatility, Bitcoin [BTC] has finally found a point of stability, hovering within the $30,000 to $29,000 range. This recent period of relative calm has led to speculation among several experts about the possibility of this moderate volatility extending over a longer period of time.

Read the Bitcoin price forecast for 2023-2024

Rise in selling pressure

A noteworthy comment comes from analyst Maartunn at CryptoQuant, who marked a significant difference between Sell Taker Volume and buyer activity. This persistent discrepancy in trading volumes could lead to continued downward pressure on the price, preventing a decisive break above USD 30,000.

For context, seller volumes are the ratio of sales volume divided by buyers’ buying volume in perpetual swap markets. It reflects the superiority of the selling pressure in the market.

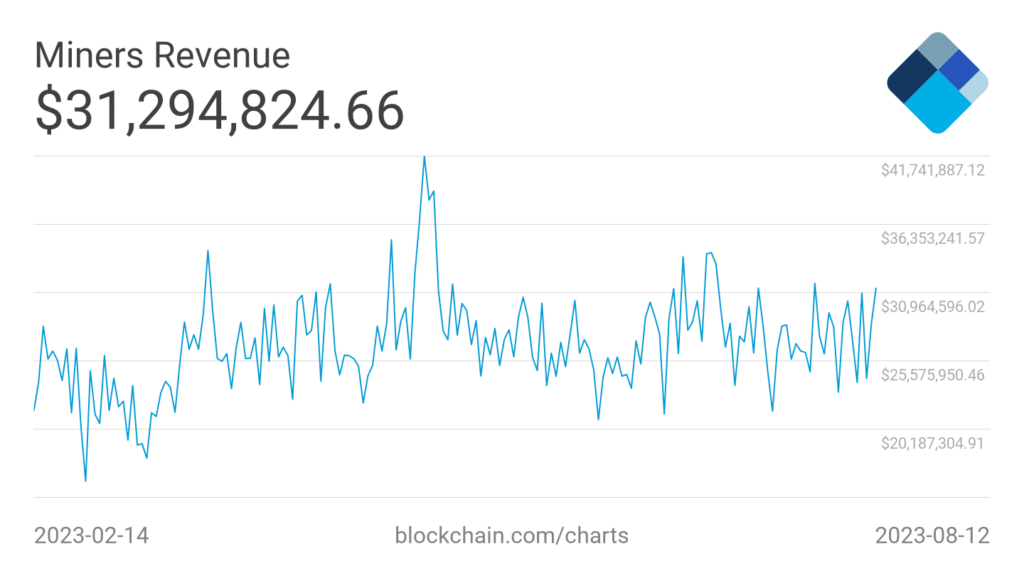

The impact of this continued sales pressure is further underlined by declining mining revenues. Recent data even revealed a decline in miner earnings, with the numbers falling from $41 million to $31 million in recent months. This drop in revenue could potentially incentivize miners to offload their Bitcoin holdings to remain profitable.

Source: BTC.com

Interestingly, despite the challenges of reduced mining revenue, other metrics suggested an underlying resilience within the network. Both hashrate and network growth have shown signs of improvement over this period, reflecting the strength of the Bitcoin ecosystem.

Source: BTC.com

Whales show interest

Contrary to these factors, the whale behavior pointed to a positive future for Bitcoin. For example, Glassnode’s data indicated that the number of addresses with 10 or more BTC coins recently hit a three-year high of 157,012.

This increase in whale activity suggests a growing interest in Bitcoin accumulation among larger investors.

Source: glasnode

A parallel development involved HODLing behavior observed from BTC addresses. In particular, the figures for the number of HODLed or lost coins reached a five-year high at the time of writing.

This showed that current investors tend to hold their holdings for a longer period of time. This behavior also reflected a sense of confidence and long-standing belief in Bitcoin, despite a lack of positive price movements on the charts.

Is your wallet green? Check out the Bitcoin Profit Calculator

Source: glasnode

At the time of writing, Bitcoin’s price was at $29,300. In addition, the speed of transactions had dropped, implying a reduction in the frequency of BTC transfers.

Source: Sentiment