- Lido’s TVL fell by 5% in between October 9 and 16.

- This is mainly due to the protocol’s decision to stop working on Solana.

Leading liquid staking protocol for Ethereum [ETH]Lido Finance [LDO], saw its total value locked (TVL) drop by 5% between October 9 and 16. The decline was largely due to Lido’s decision to cease operations on Solana [SOL].

Is your portfolio green? View the LDO profit calculator

Following a community vote on the matter, Lido announced on October 16 the decision to cease operations on Solana, as its continued existence on the Layer 1 (L1) blockchain has become a financially unviable venture.

Furthermore, in its latest weekly update on X (formerly Twitter), the protocol noted that the TVL drop was also a result of “falling token prices.” Between October 9 and 16, the values of ETH, Polygon [MATIC]and SOL fell by 4%, 8% and 6% respectively.

Rough period of seven days for Lido

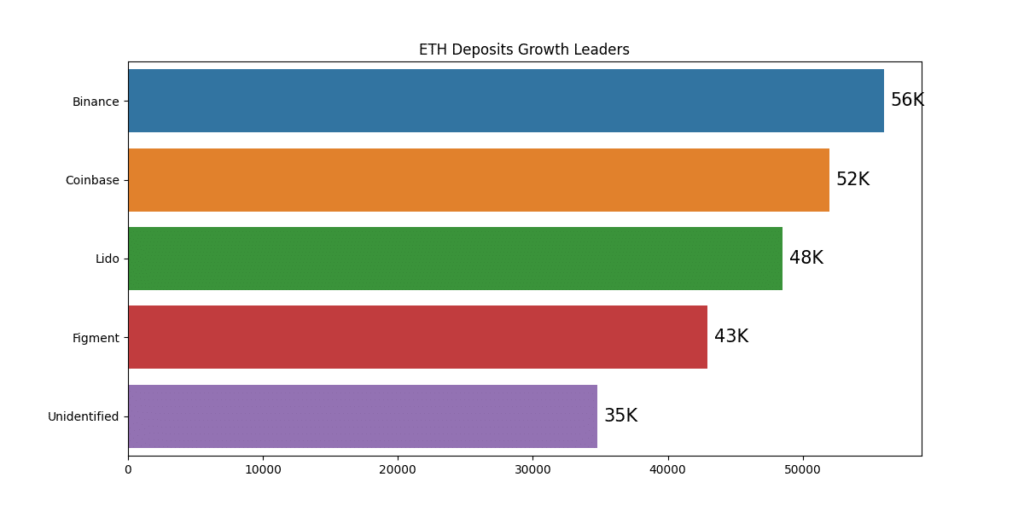

Despite previously driving net new deposits to the Ethereum Beacon Chain for several weeks, Ether deposits made via Lido to the Proof-of-Stake (PoS) network fell significantly over the reporting period.

With a net new stake of 48,480 ETH in Ethereum via Lido between October 9 and 16, the decentralized finance protocol (DeFi) trailed Coinbase and Binance, which recorded net new deposits of 56,000 ETH and 52,000 ETH respectively, according to data from Dune Analytics.

Source: Dune Analytics

Furthermore, the annual percentage rate (APR) of the ether established in the protocol [stETH] assessed on a seven-day moving average witnessed a decline. Lido said the decline was “due to a combination of low gas prices and reduced EL rewards.”

During the reporting period, Lido’s staking APR fell 4%, data from Dune Analytics shows. At the time of writing, Lido’s sETH APR stood at 3.44%, down 52% from its peak of 7.17% on May 12.

Source: Dune Analytics

In terms of Layer 2 (L2) platforms, data from Dune Analytics showed an increase of 0.46% and 3.24% in the amount of sETH bridged to Arbitrum [ARB] and Polygon, respectively.

On the other side: optimism [OP] recorded a 1% decrease in the amount of bridged sETH during the reporting period.

New demand for LDO trickled in last week

An on-chain assessment of LDO’s network activity recorded a surge in new demand for the DeFi token over the past week. According to data from Santimentthe daily number of unique addresses involved in LDO transactions increased by 9%.

Similarly, the daily number of new addresses created to trade LDO tokens increased by 23% over the same period.

Source: Santiment

How much are 1,10,100 LDOs worth today?

The influx of new demand fueled a 7% rally in the value of LDO between October 11 and 16. However, the token’s price peaked at $1.64 on October 16, after the Lido decision on Solana was announced.

The price of the token has been trending downward since then. LDO was trading at $1.54 at the time of writing CoinMarketCap.

Source: CoinMarketCap