- Sui, Helium and Zcash were the biggest winners last week.

- Lido DAO, Aave and Maker made up the list of biggest losers.

Certain tokens have notably deviated from trend in a week marked by volatility and downturn in the broader cryptocurrency market.

Sui (SUI) emerged as the standout performer, rebounding impressively after consecutive days of decline, while Lido DAO (LIDO) and AAVE suffered significant setbacks.

Biggest winners

Sui (SUI)

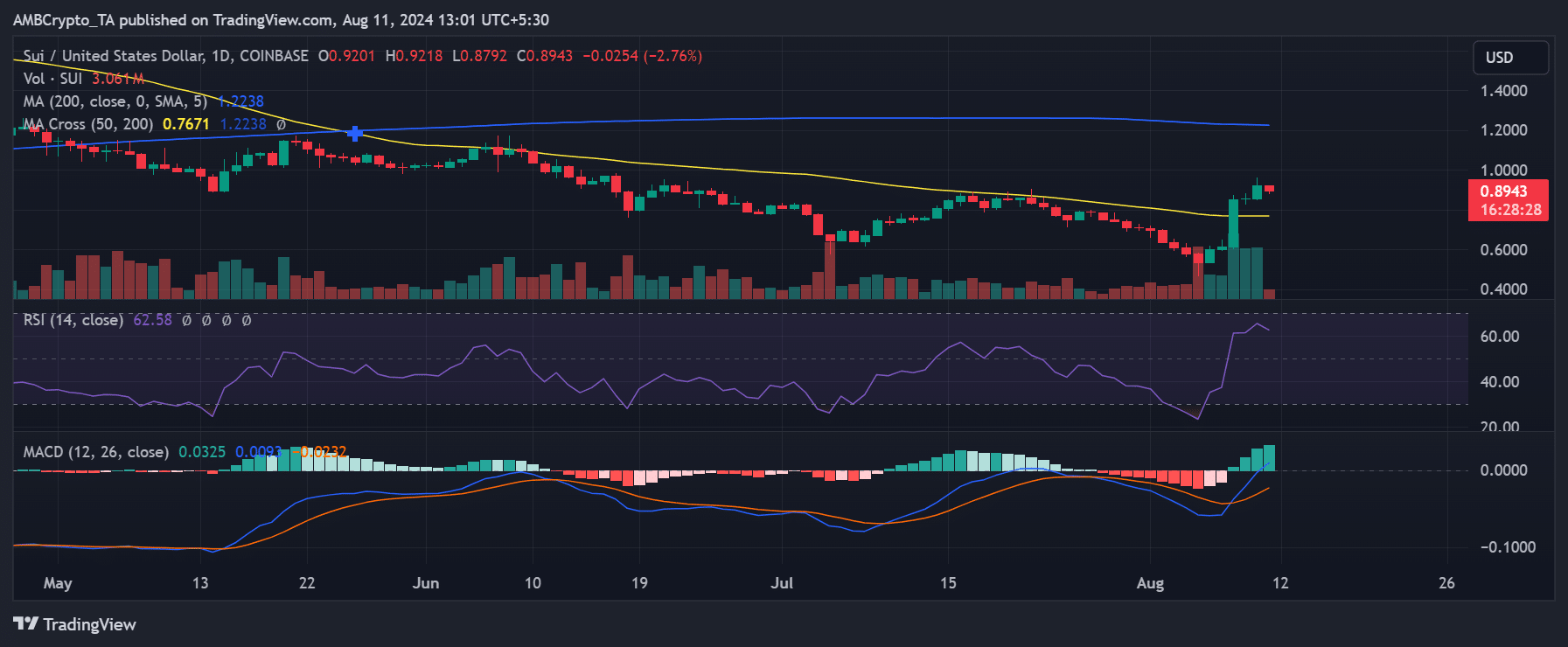

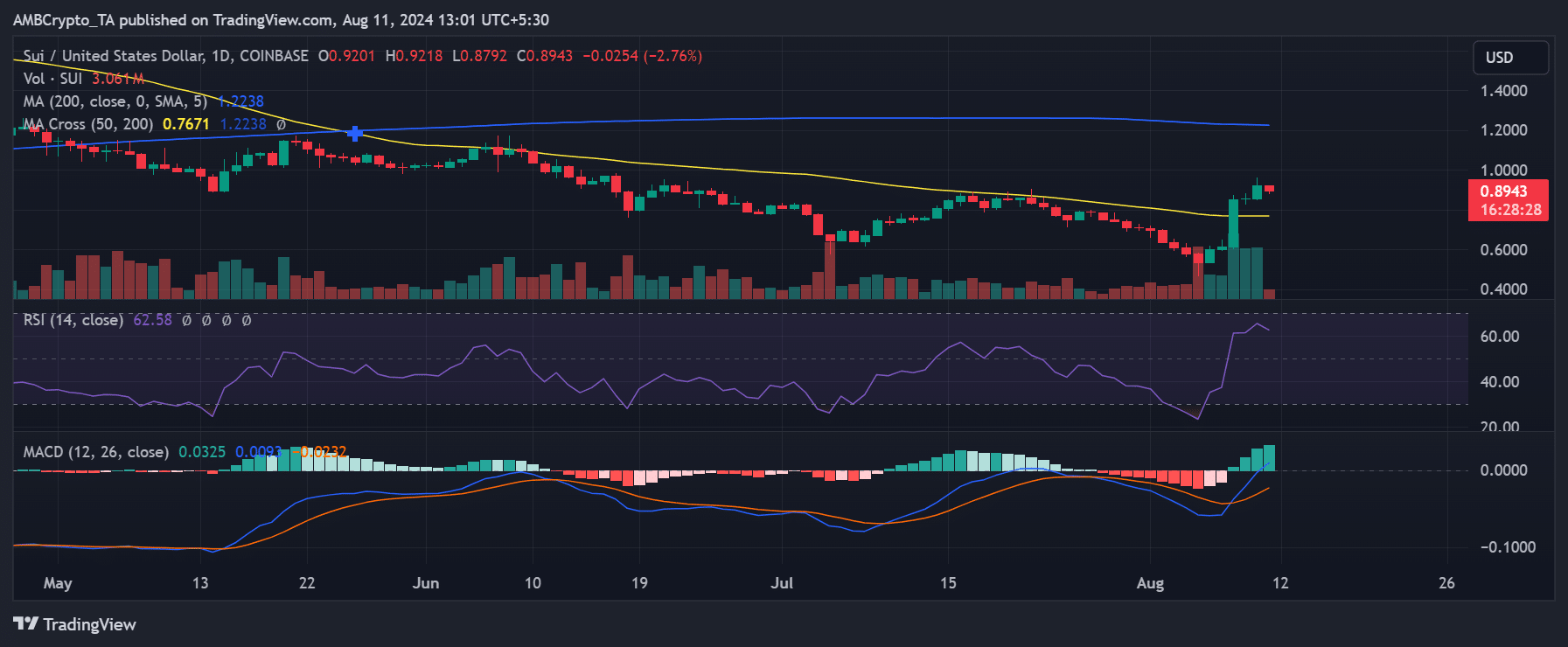

Analysis of Sui (SUI) on a daily time frame shows a significant reversal after a prolonged decline. The week started with a continuation of the downward trend, with the SUI falling 5.39% and falling further the next day by more than 7%.

These declines marked the tenth day in a row, sending the price down to $0.53.

However, on August 5, the trend reversed dramatically, with SUI gaining 12.55%, raising its price to around $0.6. The most substantial increase occurred on August 8, when SUI rose 38.58%, pushing its price to around $0.8.

The week ended with an increase of 7.42%, bringing the closing price to around $0.9.

Source: TradingView

This series of increases led to SUI ending the week with an overall gain of over 44%, which SUI said CoinMarketCap.

Moreover, according to the latest data, SUI’s market capitalization was over $2.3 billion, with a trading volume of over $319 million. Trading volume has increased by more than 16% in the past 24 hours.

Helium (HNT)

Helium (HNT), like Sui, had a challenging start to the week. It recorded a significant decline of 7%, dropping its trading price to around $4.2.

Despite this initial setback, Helium quickly turned its fortunes around, recording consecutive gains throughout the week. Additionally, the trend reversal included two days of double-digit gains.

The week ended with a slight decline of 3.98%; However, Helium managed to maintain its high price level and closed the week around $6.5. This recovery marked Helium as the second biggest gainer of the week, up more than 34%.

According to the latest data from CoinMarketCap, Helium’s market capitalization exceeded $1 billion, although it saw a slight decline in the past 24 hours. Additionally, trading volume dropped by more than 50%, totaling approximately $13.7 million.

Zcash (ZEC)

Zcash started the week on a downward trend, starting at around $31. However, like other top performers in the cryptocurrency market, ZEC saw significant upward trends throughout the week. By the end of the week, the price was trading around $41, marking a substantial recovery.

According to the latest data from CoinMarketCapZcash emerged as the third biggest gainer of the week, with an impressive increase of over 27%. This remarkable price increase has boosted the market capitalization to over $672 million.

Despite this strong price performance, trading volume for Zcash showed a significant decline, falling by over 40% in the last 24 hours to around 80.9 million.

Biggest losers

Lido DAO (LIDO)

Lido DAO (LIDO) had a challenging week and topped the losers’ list. The week started with LIDO trading at around $1.2, but saw a downward trajectory, eventually closing the week at around $1.1. This represented a drop of almost 18% in the week.

LIDO’s market capitalization also reflected this negative trend, coming in at approximately $988 million, with only minor declines despite the decline in the asset’s price.

In addition, LIDO trading volume fell over the week by more than 7% to approximately $70.3 million.

Maker (MKR)

Maker (MKR) had a rough week, starting at over $2,200, but suffered significant declines in the following days. By the end of the week, MKR’s price had fallen to around $1,961. This downward move positioned MKR as the second-biggest loser of the week, down more than 13%, according to data from CoinMarketCap.

Trading volume for MKR also fell substantially, falling more than 30% in the past 24 hours to around $45 million. Additionally, Maker’s market cap reflected adverse price movements of approximately $1.8 billion.

Aave (AAVE)

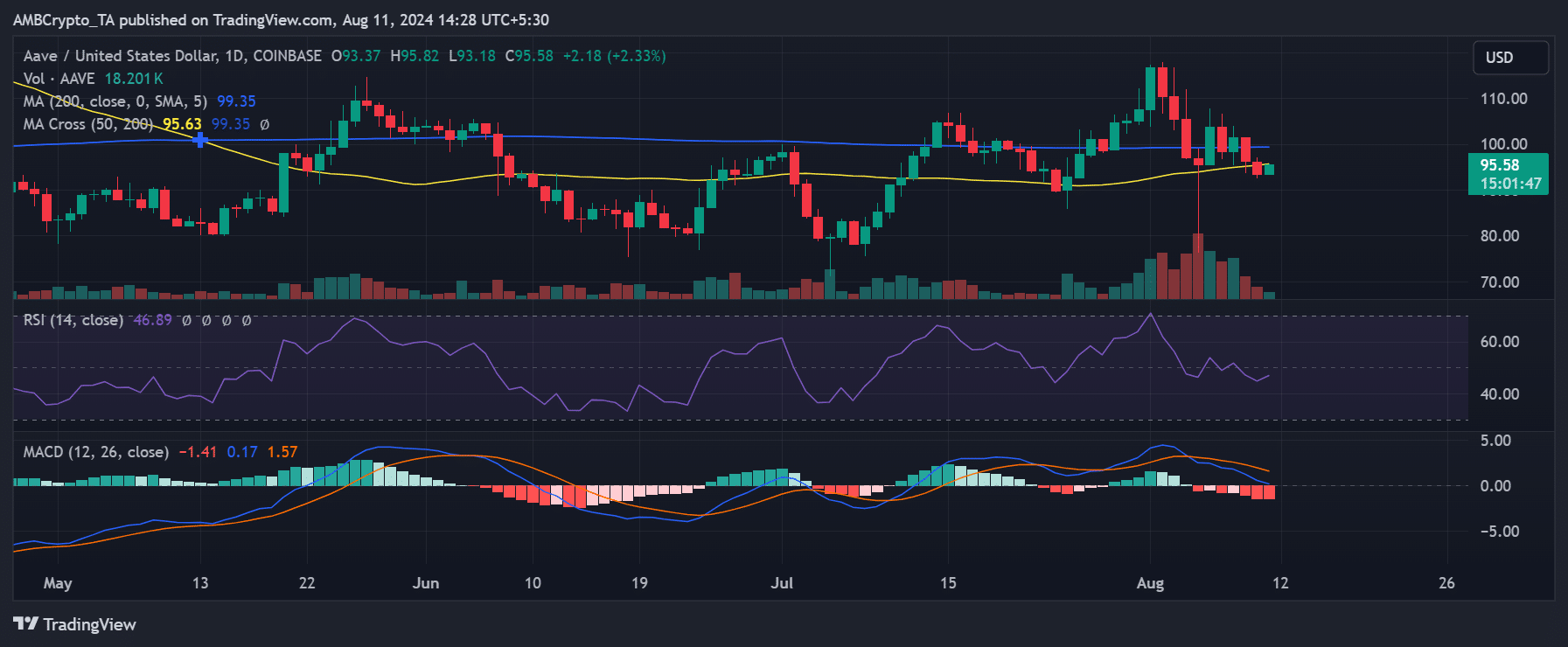

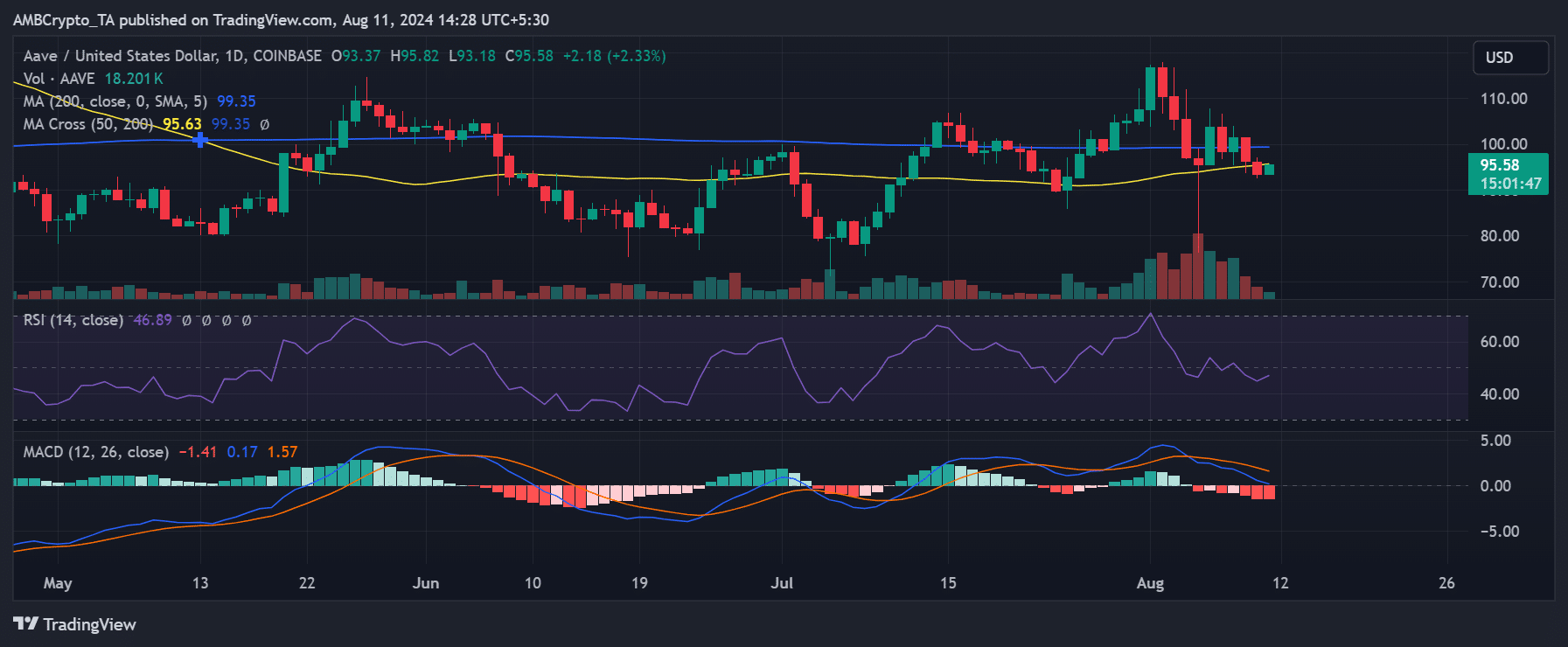

Aave (AAVE), the biggest gainer the week before, experienced a reversal of fortunes and ended up among the biggest losers this past week.

Analysis of the price trend showed that Aave started the week with a sharp decline of 8%, from around $105 to around $97. While there were some upward trends during the week, they were insufficient to bring Aave’s price back to the $100 range.

By the end of the week, Aave was trading around $93, marking a further decline of over 2%. This culminated in a total weekly loss of more than 12%, according to data from CoinMarketCap, making it the third biggest loser of the week.

Source: TradingView

Also, the Relative Strength Index (RSI) was recorded at 46, indicating a bearish trend. Furthermore, Aave’s market cap was reported at approximately $1.4 billion.

In addition, trading volume also fell significantly, by more than 18% to approximately 87.2 million.

Conclusion

Here’s the weekly recap of the biggest winners and losers. It is crucial to take into account the volatile nature of the market, where prices can change quickly.

So it’s best to do your own research (DYOR) before making any investment decisions.