- Bitget Token, XDC Network and XRP emerged as this week’s biggest winners

- AI16Z, ThorChain and Virtuals Protocol suffered the biggest losses last week

The cryptocurrency market delivered another action-packed week of trading, with several tokens staging impressive rallies, while others faced significant selling pressure. As institutional interest continues to drive market dynamics, we take a closer look at the most notable price moves that have defined this week’s trading landscape.

Biggest winners

Bitget Token (BGB)

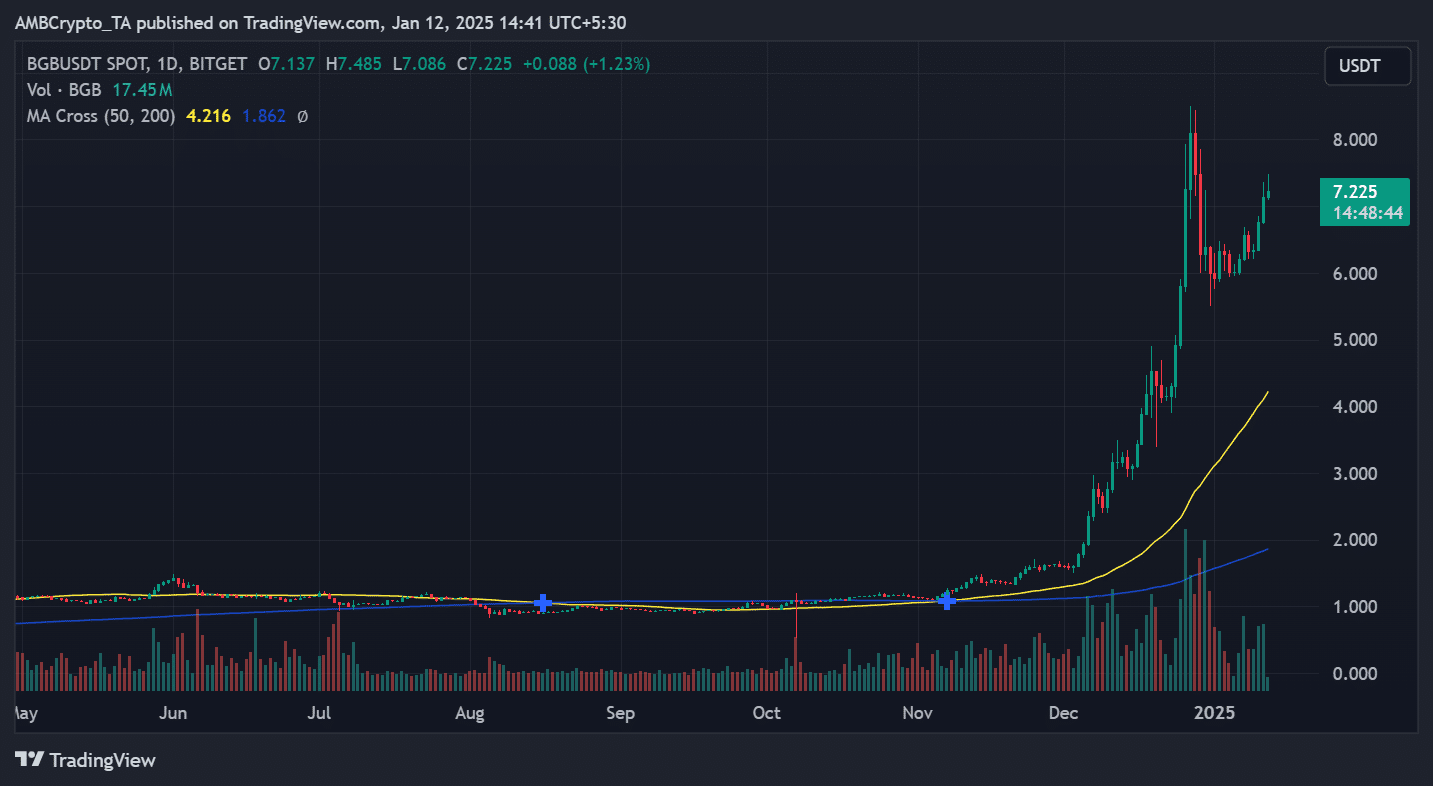

BGB emerged as this week’s standout, exceeding expectations with a notable rise from $6,011 to $7,137. The token’s journey has been particularly striking since its November breakout, consistently setting higher lows and breaking previous resistance points.

Source: TradingView

December saw a dramatic increase in trading activity, with volume rising along with price – a clear sign of growing market confidence. BGB traded well above the moving averages of $7,225 and maintained strong bullish momentum, which was reflected in the weekly gain of 20%. The chart showed a golden cross pattern, traditionally a reliable indicator of continued upward movement.

While the steep price increase would raise eyebrows, the steady volume growth hinted at genuine market interest rather than speculative frenzy.

However, traders should keep a close eye on potential consolidation phases that often follow such dramatic developments. The token’s performance stands out even more given the broader market conditions, making it one of the most resilient assets in the prevailing trading landscape.

XDC Network

XDC’s impressive rally continues to turn heads, securing its position as this week’s second-best performer with a solid 12% gain. The token broke the crucial barrier of $0.10 and rose from $0.0968 to $0.101. This shows remarkable strength in a generally volatile market.

Trading volume remains healthy at 820.55K XDC, indicating continued market interest rather than short-term speculation. At the time of writing it is data showed that volume was approximately $53.7 million, up more than 5% in the last 24 hours. The chart also showed an uptrend, confirming the bullish momentum.

XDC also appeared to hold a comfortable position above both its 50-day and 200-day moving averages, while the current daily move of -0.66% indicated minor profit-taking.

XRP

XRP secured its place among this week’s top performers with a dramatic rise at the end of the week, despite a shaky start around $2.3. The altcoin’s fortunes turned sharply on January 11, when a 10% increase pushed the price towards $2.5. However, at the time of writing, the price experienced a pullback to $2.4953 (-3.13%).

Trading volume remained strong at 52.94 million XRP, indicating significant market involvement during the rally. XRP appeared comfortably above its key moving averages of 2.2409 (50 days) and 1.0037 (200 days), maintaining its long-term bullish structure despite recent volatility.

The chart also showed an impressive recovery after the November consolidation phase, paving the way for the prevailing upward trajectory.

Biggest losers

AI16Z (AI16z)

AI16Z emerged as this week’s biggest casualty, plummeting from $1.8 to $1.1 in a dramatic selloff that erased more than 37% of its value. The token briefly teased investors with a sharp 20% jump that pushed the price above $2, only to face relentless selling pressure for the rest of the week.

Trading at $1.1688 with a modest gain of +0.76% at the time of writing, the token’s trading volume stood at 239 million. Data indicated a decline of more than 29% in the past 24 hours, reflecting intense market activity during the recession.

The chart painted a picture of extreme volatility, with the token recording wild price swings typical of a market struggling to find stable ground. The lack of clear support levels after the recent sharp decline hinted at the potential for further volatility in the future.

ThorChain (RUNE)

RUNE’s brutal sell-off continued this week, landing the company among the worst performers with a staggering 33% decline. The token, which opened at around $4.9, faced relentless selling pressure that accelerated as the week progressed, eventually pushing the price down to $3,395 (-1.48% per day).

Trading volume reached 3.71 million RUNE, highlighting the intensity of this downward move. The technical picture looked particularly bleak as the token crashed through both its 50-day and 200-day moving averages (5,496 and 4,734 respectively), erasing months of gains in a matter of days.

Finally, the sharp reversal from the December highs indicated a significant shift in market sentiment, with the break below key support levels potentially opening the door to further downside developments.

Virtual Protocol (VIRTUAL)

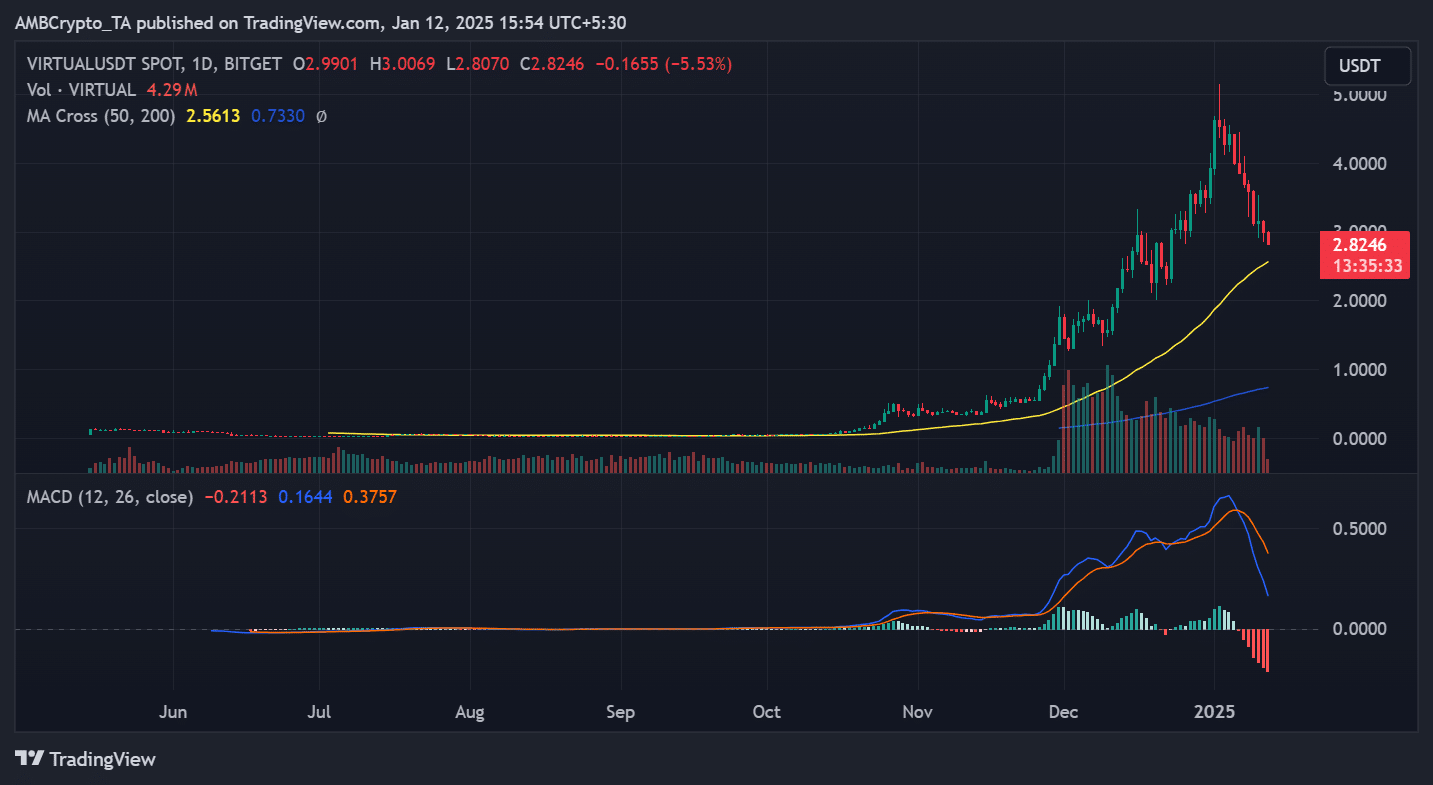

VIRTUAL’s latest price action painted a clear picture of deteriorating market confidence, with the token posting a steep 31% decline this week. When the token started opening around $4, it immediately faced selling pressure and fell 9% during the first trading sessions. The VIRTUAL charts traded at $2.8246, after dropping 5.53% on the day, showing continued selling interest.

At the time of writing, the technical setup seemed particularly concerning as the price fell below several key support levels.

The MACD indicator (-0.2113) turned sharply negative, confirming the strong bearish momentum. This bearish crossover on the MACD underlined the potential for continued downside pressure in the near term.

Source: TradingView

Looking at the moving averages, VIRTUAL traded well below both the 50-day (2.5613) and 200-day (0.7330) moving averages, although the long-term uptrend structure remained intact as the price is still above 200 -day MA lay. . The volume profile during this decline showed increasing sell-side participation, especially during recent sessions.

The rapid decline from the December highs indicated a possible capitulation phase, although the lack of a clear bottom pattern makes it difficult to identify reliable support levels. The price action from November to December formed a crash top, with the current decline possibly representing the correction phase of that pattern.

Any potential recovery would require the token to reclaim the 50-day MA as support. In fact, the immediate price action suggested that further consolidation could be likely before a meaningful rebound occurs.

Conclusion

Here’s the weekly recap of the biggest winners and losers. It is crucial to take into account the volatile nature of the market, where prices can change quickly.

So it’s best to do your own research (DYOR) before making any investment decisions.