- The US government has transferred $ 8.46 million to Bitcoin from Sae-Heng taken funds.

- The aftermath of the large transfer was reflected in the short period of time, but the long -term feelings remain bullish.

The US government has again transferred a huge amount of confiscated bitcoin [BTC]Generating speculation in the crypto world.

According to a recent tweet From a renowned analyst, $ 8.46 million was transferred to BTC from Sae-Heng seized funds. In particular, the funds were transferred to two different portfolios.

Historically, BTC transactions of high value by governments led to price fluctuations in the short term. Although such transactions reflect the liquidation plans, the direct confirmation of any outright sale has not yet been observed.

However, the statistics remain volatile if the market responds to the transaction.

Bitcoin ETFs at an intersection

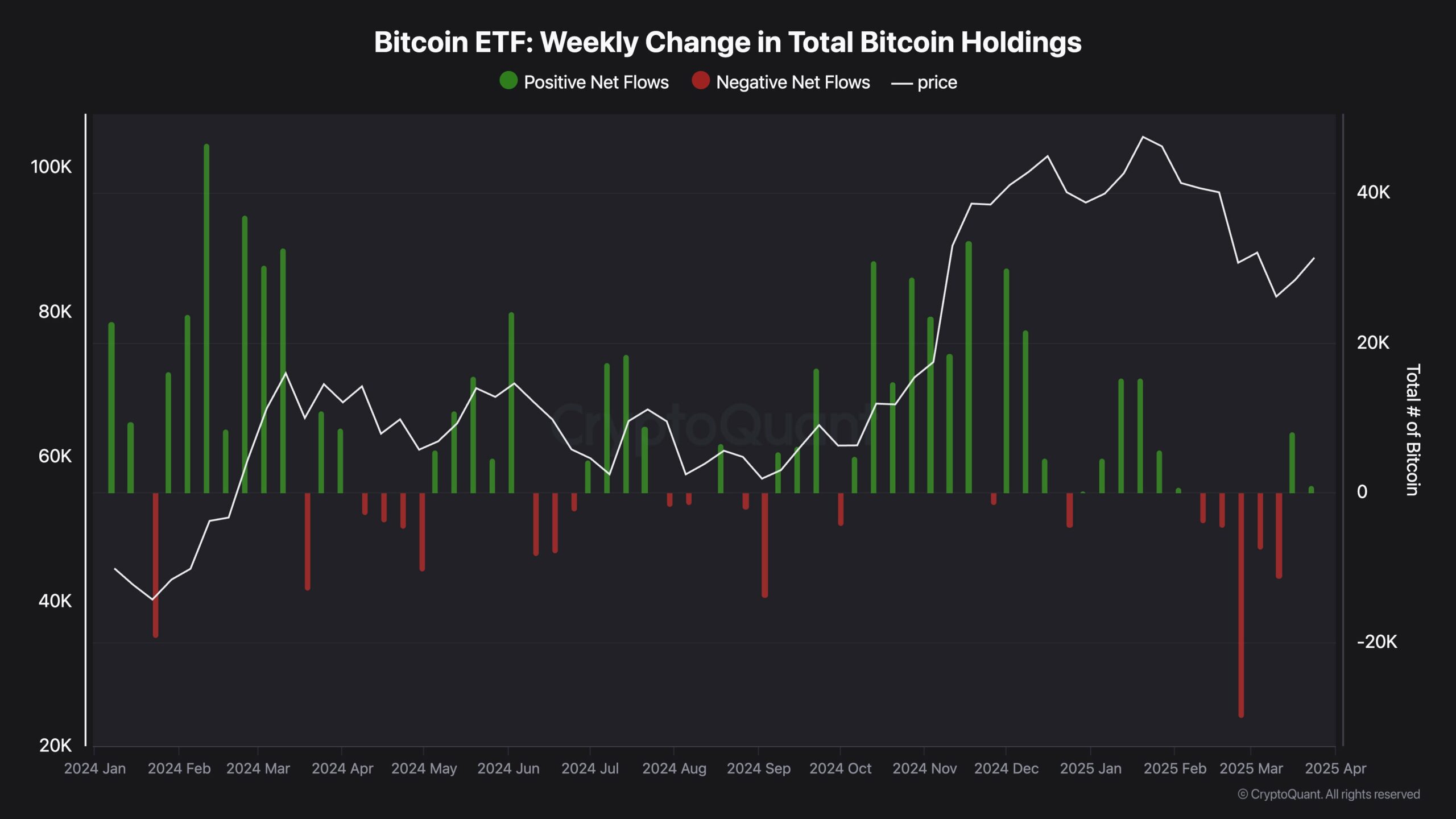

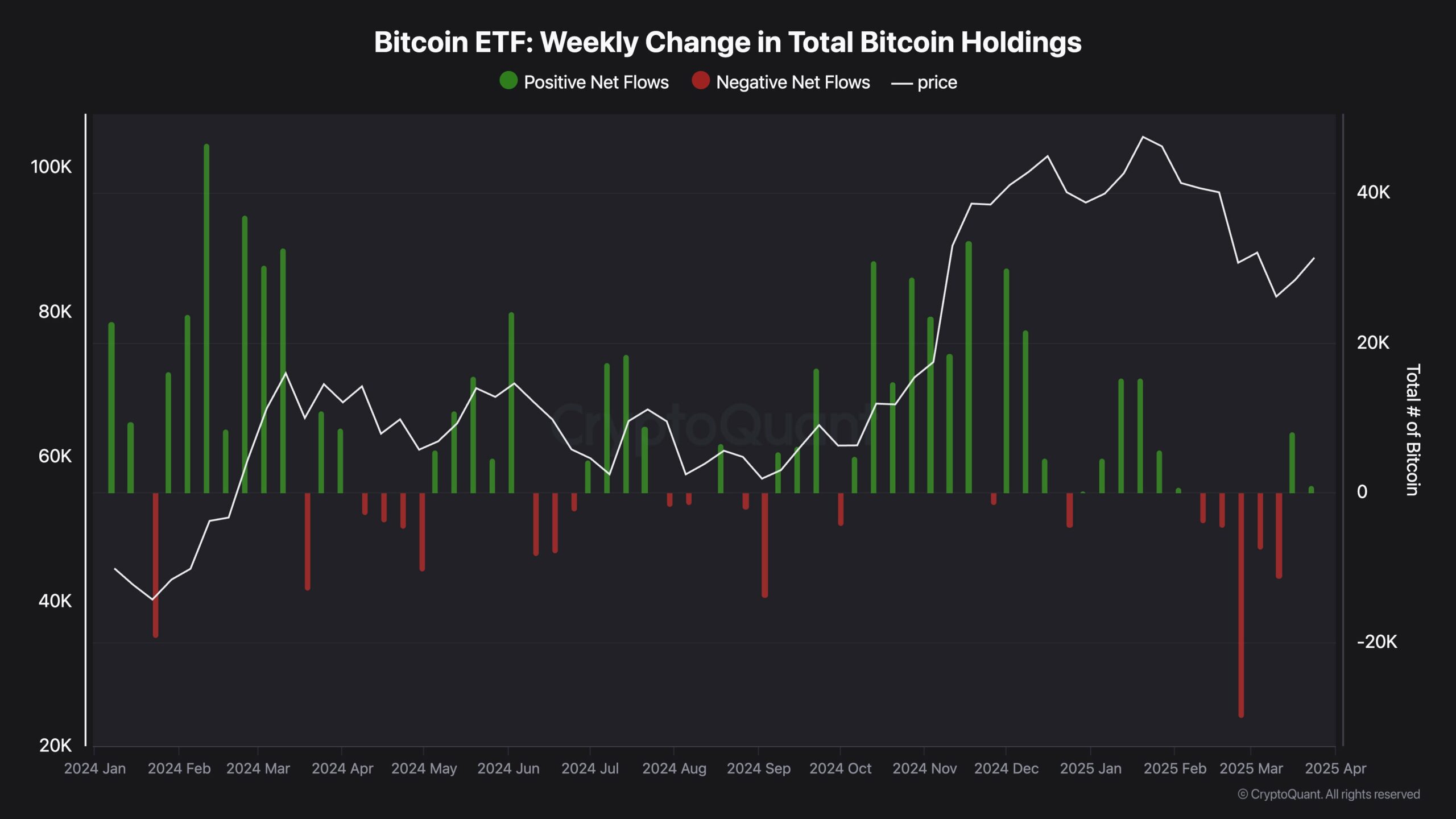

Bitcoin exchange-related funds (ETFs) are at a turning point. Ambcryptos analysis of cryptoquant data shows weekly outflow, since settings adjust their portfolios.

Macroeconomic uncertainty has led to risky investors reducing BTC exposure and balancing their participations.

This shift has led to a decrease in Bitcoin ETF interests, which indicates potential short-term volatility.

Institutions can cover their crypto investments against broader economic risks, which can influence the price movements of BTC in the coming weeks.

Source: Cryptuquant

BTC prices align

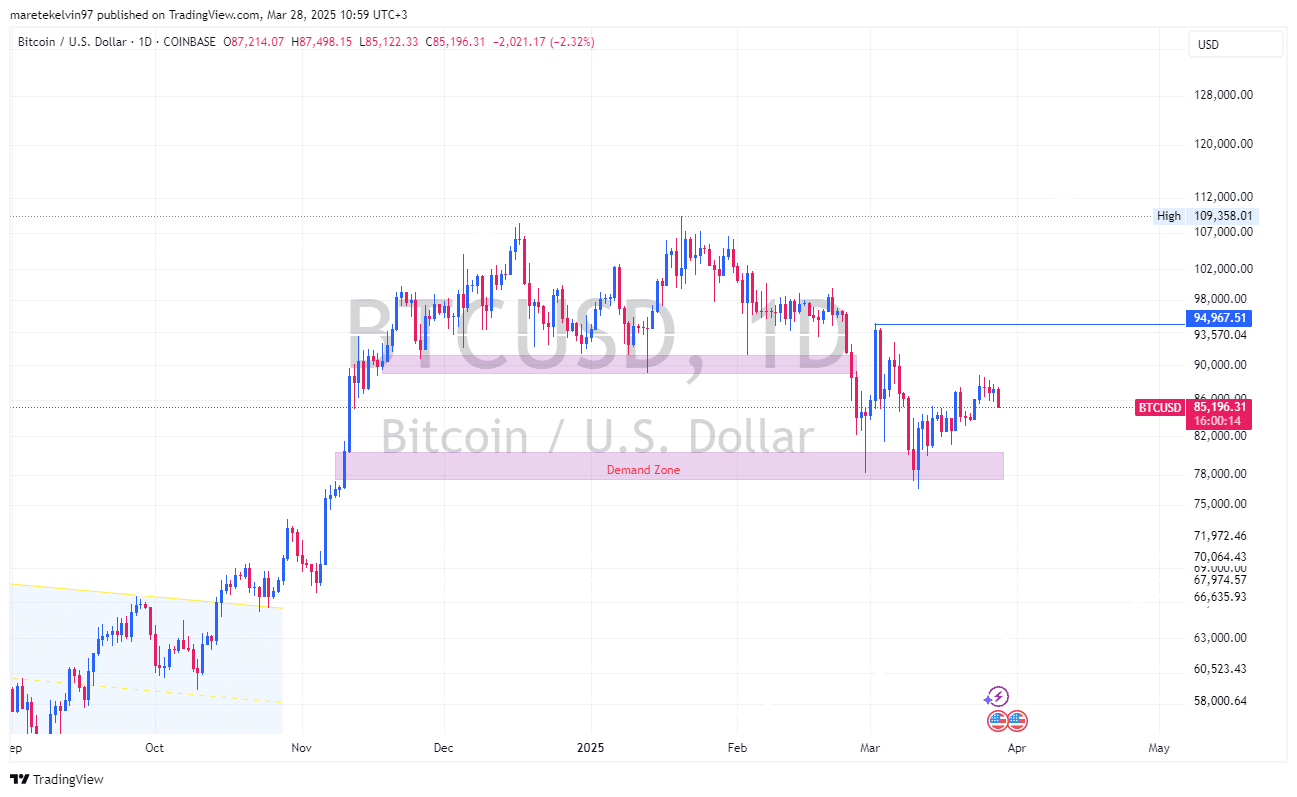

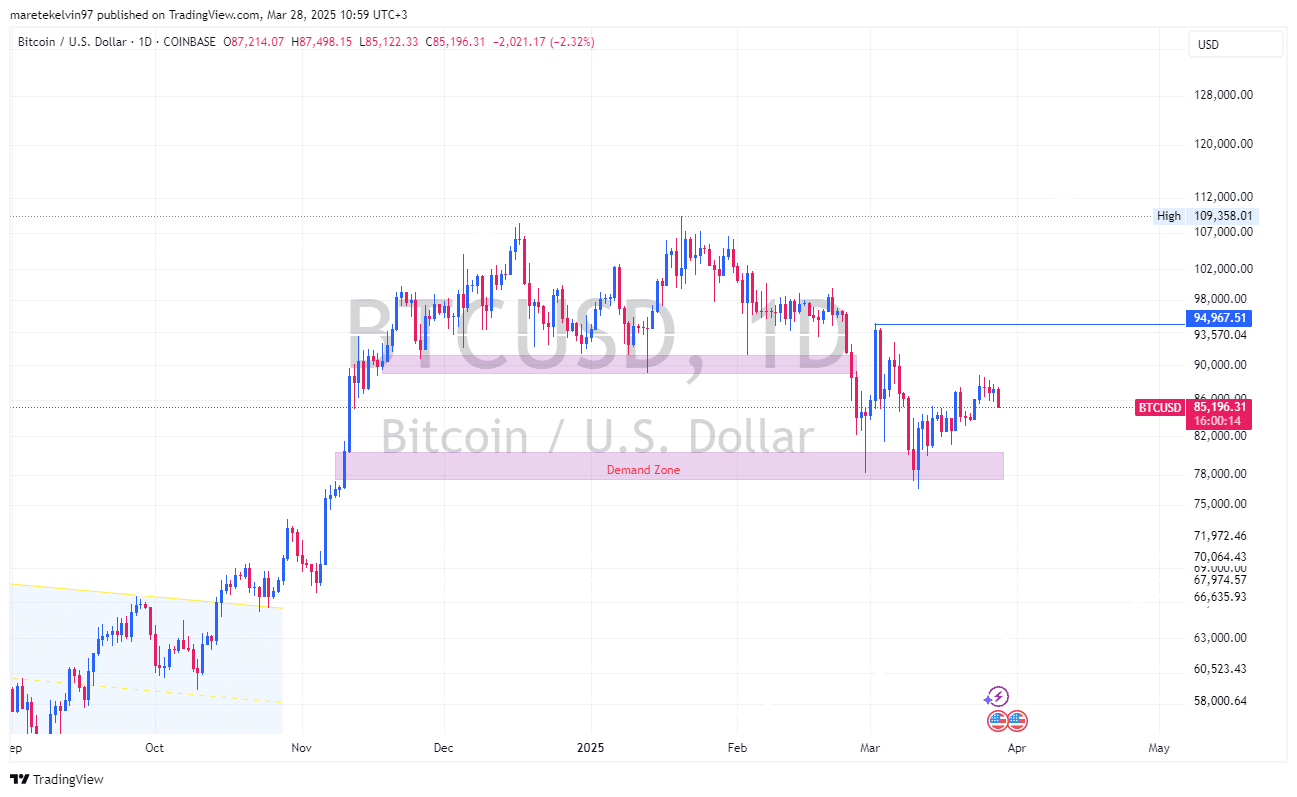

The impact of the recent Bitcoin movement is clearly on the charts. In the last 24 hours alone, the BTC prices have fallen by more than 2%at the time of printing.

This decline is rubbing shoulders with ETF outflows and the Bitcoin transfer from the US government, which relates to traders.

Source: TradingView

Despite the recent dip, the general trend of Bitcoin Bullish, driven by strong foundations and increasing acceptance, remains. BTC prices have demonstrated resilience in recent months, so that their status is maintained as a leading financially active.

Although volatility persists in the short term, the long -term prospects for Bitcoin appear promising. As institutional investors adjust their strategies, the price behavior of BTC is probably influenced by macro -economic factors.

Market consensus suggests a steady trend for the front unless influenced by significant external events. Participants must check institutional flows and government actions involving Bitcoin to better understand the price direction.