Getting started in the world of cryptocurrency trading can be intimidating for newcomers. Investing in cryptocurrency is difficult, especially with volatile coins, complex wallets, and confusing exchanges. That’s where cryptocurrency brokers come into the picture. The goal of these platforms is to simplify cryptocurrency trading, making it available to everyone.

However, as cryptocurrencies gain more mainstream appeal, the role of crypto brokers is more important than ever. Brokers have proven to be a great route for traders and investors without advanced technical knowledge in the crypto space. In this article, we will look at the main ways these platforms make crypto trading easier.

Providing a user-friendly interface

One of the biggest obstacles for people trading crypto is complicated interfaces. The problem is that coins are difficult to access between public and private keys, seed phrases and advanced security measures. To solve this problem, everyone trusts cryptocurrency broker provides easy-to-use platforms for buying, selling and managing digital assets.

Intuitive dashboards that let you trade, deposit fiat money, move money and track investments through a clear visual interface are the best crypto brokers. Instead of struggling with complex wallet software, users can simply log into their brokerage account and manage their crypto directly. This makes the learning curve a lot easier.

Enable fast account funding

Yet another hurdle that brokers must overcome is the friction that comes with moving fiat money into the crypto ecosystem. Traders who want to invest in digital coins need to fund their accounts, and this often takes the form of long wire transfers or bank payments. Cryptocurrency brokers accept debit/credit transactions and other popular payment methods and are known for allowing fast account funding.

Leading crypto brokers enable instant deposits by combining with payment processors such as PayPal or Apple Pay. To start trading, users can instantly transfer funds from a linked bank account, credit card or e-wallet. This financial flexibility provides easy entry points for crypto investments.

Offering secure custody services

Traders need to store cryptocurrencies securely, but it is a difficult task. Cryptography protects digital assets between hot and cold wallets, seed sentences and multi-sig protocols. Crypto brokers do this by offering special custody services.

When users deposit coins on a brokerage platform, the assets are kept in offline, high-security storage. Funds are protected by reputable brokers using multi-signature technology, distributed servers and encrypted backups. In this custody model, traders are freed from complex storage problems.

Providing access to many coins and tokens

Another advantage of crypto brokers is that you get access to hundreds of cryptocurrencies on one platform. Some traders may not be exposed to altcoins or lesser-known tokens because they are not listed on popular spot exchanges like Coinbase or Binance.

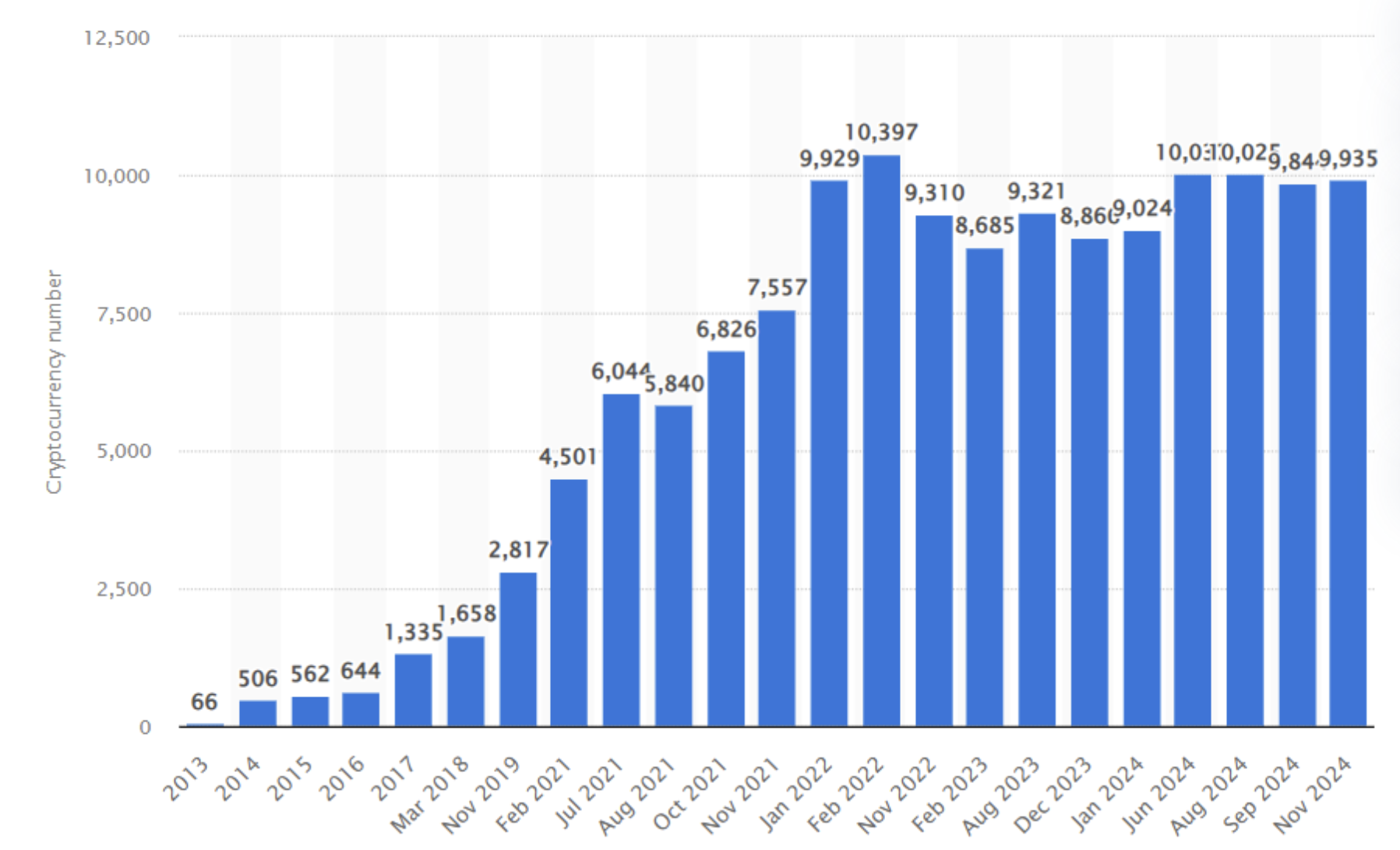

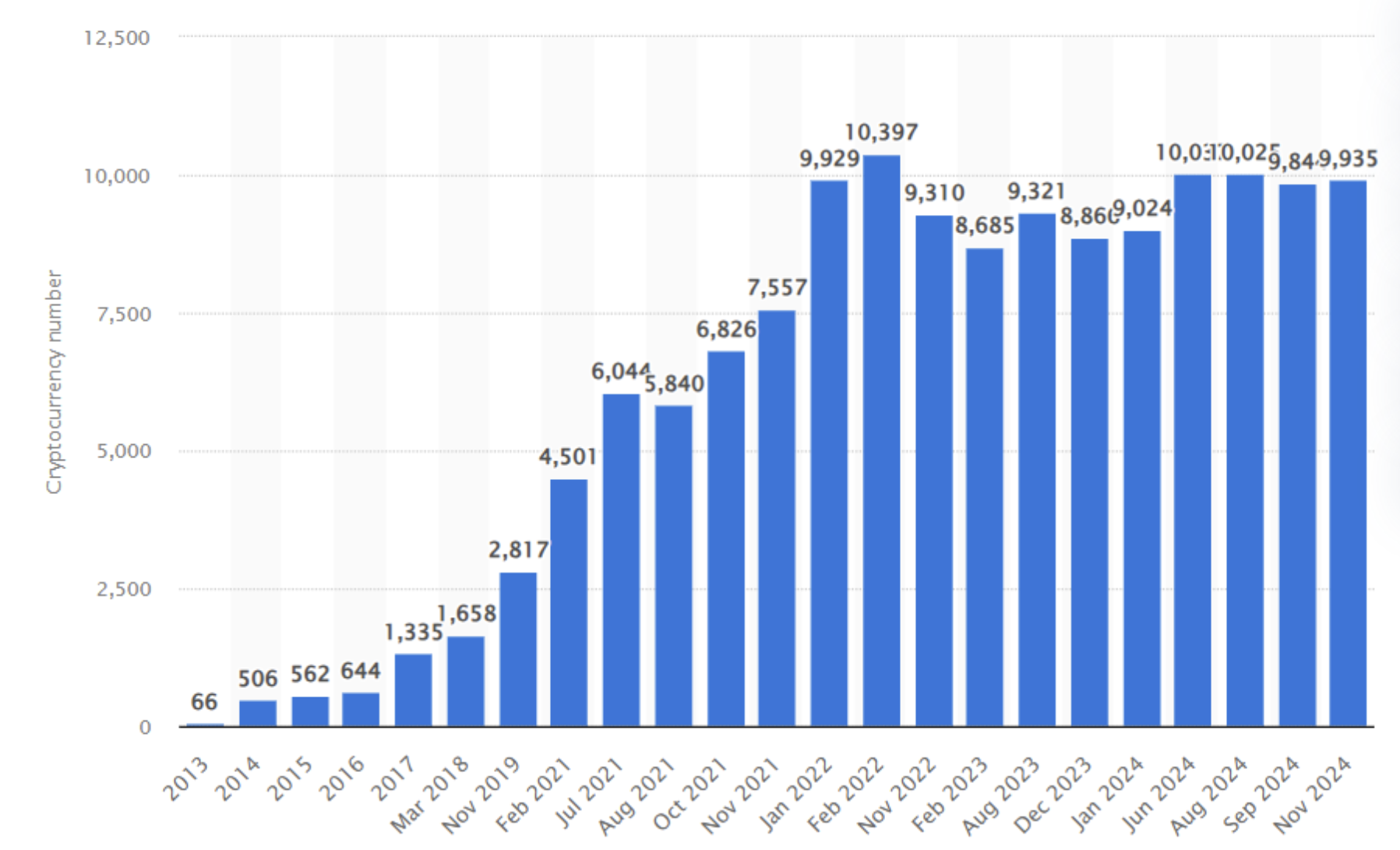

According to Statista, the total number of cryptocurrencies tracked has been exceeded 9,000 tokens about more than 800 exchangeshighlighting the importance of consolidated access through brokers.

Many brokers pool liquidity from multiple sources, including decentralized sources, to provide ample crypto selection. This means that users do not have to create accounts on multiple exchanges to access specific coins. With a diverse range of digital assets and trading pairs in one place, brokers make diversification easier.

Providing educational resources

Many new investors are entering the market unaware of important ideas such as blockchain technology, mining and market volatility as cryptocurrency adoption continues to accelerate. Often cryptocurrency brokers have large learning centers to develop this basic knowledge.

These how-to sites include glossaries, current market reviews, guidelines, and videos. Brokers improve accessibility for bitcoin investing by empowering consumers to make wise trading decisions using dynamic information and data.

Enable automated trading

Automated solutions for hands-off crypto trading are now being offered by brokers. Coinrule is a platform where we can create predefined trading strategies that automatically place orders based on market conditions.

As simple or complex as you like, customizable ‘if this, then that’ rules allow traders to algorithmically react to market movements and automate technical research. This introduces advanced trading methods to beginners. Automation also buys seasoned investors time. Algorithmically driven trading will become widely used as brokers expand these types of tools.

Provide customer support

Even with simplified interfaces, some users will inevitably have questions when maneuvering cryptocurrency brokers. To help traders in real-time, leading platforms offer responsive customer support across multiple channels.

Standard options include email, web tickets, telephone hotlines, and live chat communications. Direct contact with human staff helps brokers quickly resolve account issues, clarify difficult ideas and guide users through the site, maximizing the user experience.

Conclusion

The rise of crypto assets in the modern financial world has made cryptocurrency brokers the key to mainstream adoption. By continuing to simplify trading, secure user assets, expand access to coins, and educate users, these platforms will continue to lower the barriers to crypto investing. Strong custody protections and a simple interface are similar to the brokerage, making them a good digital currency market for both amateur and experienced traders.

Disclaimer: This is a paid post and should not be treated as news/advice.