- POL’s active addresses and total addresses registered exponential growth

- POL’s transition has attracted many users, with some analysts also eyeing a turnaround

Over the past few months, many in the crypto market have been eagerly awaiting the upgrade from Polygon’s MATIC to POL. As previously reported by AMBCrypto, the migration from MATIC to POL officially went live on September 4, 2024.

This transition meant that MATIC was upgraded to POL as a network token for Polygon. Simply put, every transaction that takes place on Polygon PoS now uses POL as its native gas token.

Now, this transition may have given Polygon’s token new life after a persistent disadvantage in the charts. Before the migration, MATIC was heading south, declining 10.75% on the weekly charts and 7.38% on the monthly charts.

However, since the transition, the altcoin has made modest gains. At the time of writing, POL was trading as high as $0.3773, having risen 1.45% in 24 hours. Moreover, the market capitalization increased by 3.44% to $2.1 billion during the same period.

Undoubtedly, current market conditions have shown favorable for POL, indicating the importance of the upgrade. For example, Santiment’s analysis showed an increase in network growth and also an increase in the total number of holders.

Assessing the prevailing market sentiment

According to Santiments analyzing Polygon’s ecosystem, POL has seen exponential growth on the networking front. At the time of writing, 487 new daily addresses had been created, allowing the altcoin to bypass MATIC’s figures within two weeks.

Source: Santiment

Additionally, thousands of MATIC wallets have liquidated their wallets since August 15 to facilitate the exchange. Over 1,826 POL portfolios were created in the same period, representing a 64% increase in the charts.

Source: Santiment

Similarly, the markets have seen POL supply held by over 1 million wallets drop from 98% to 92% in two weeks. This usually happens when small and medium traders rush to jump into a new asset. The trend will slow down after Binance lists its pairs. As previously reported by AMBCrypto, Binance will delist MATIC pairs starting September 10.

Another reason leading to increased interest in the altcoin is the current price volatility. In recent weeks, altcoins have experienced extreme volatility.

Finally, traders are attracted to POL because of its long-term benefits. For example, the token enables multi-chain staking while giving users more control over governance.

What do POL cards indicate?

As highlighted by Santiment, POL has seen some favorable market developments in the last three days since the migration.

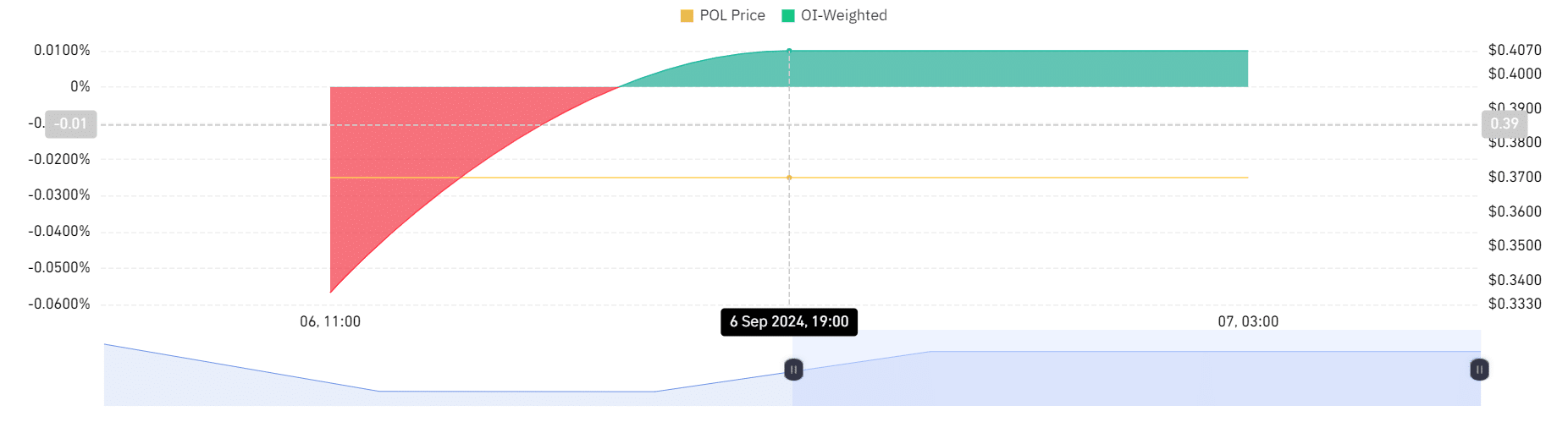

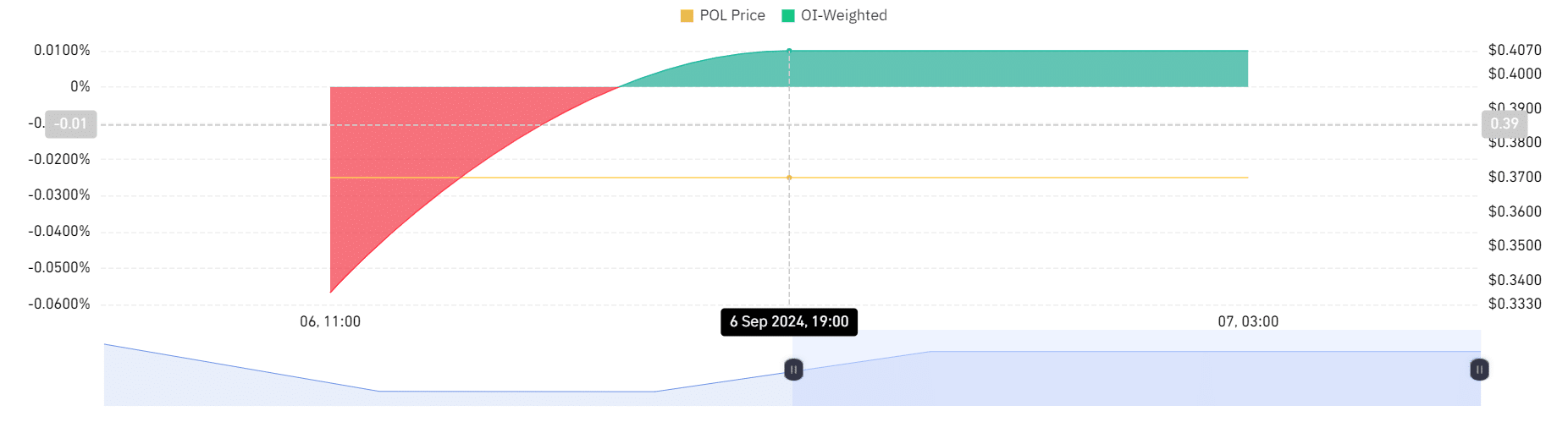

Source: Coinglass

For starters, the OI-weighted funding rate has remained positive over the past two days, with only one day reporting a negative value.

Here, the positive OI-weighted financing rate indicates increased demand for long positions. This also means that investors are betting on prices to make further gains – a sign of positive market sentiment.

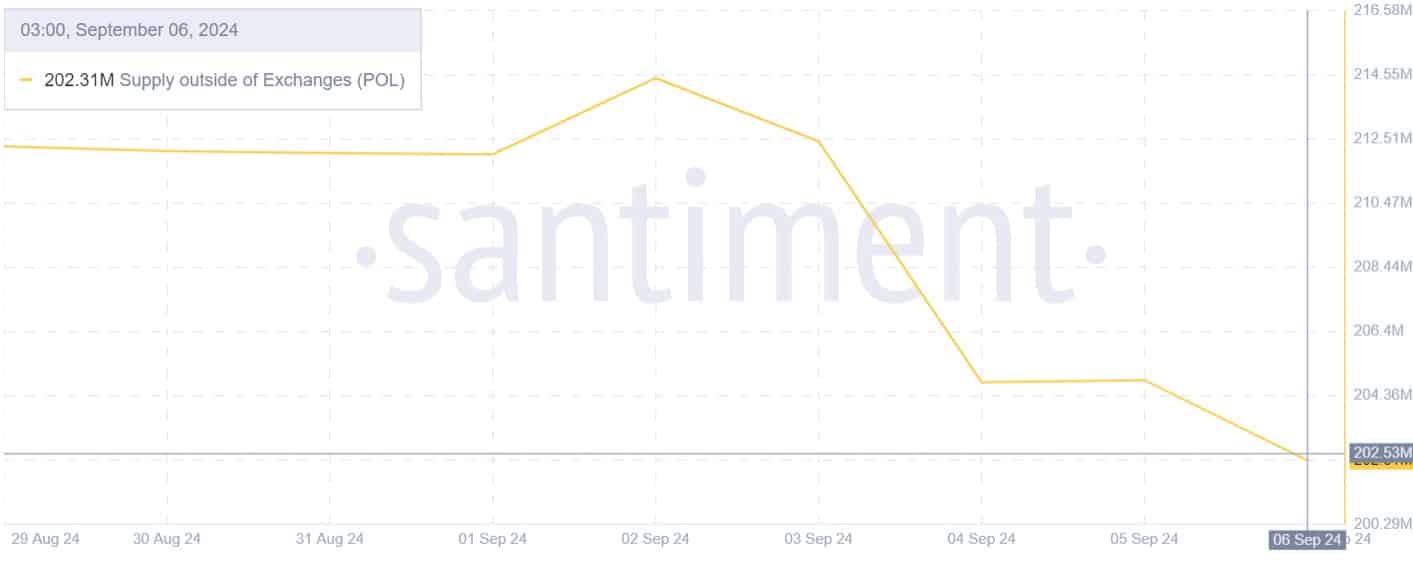

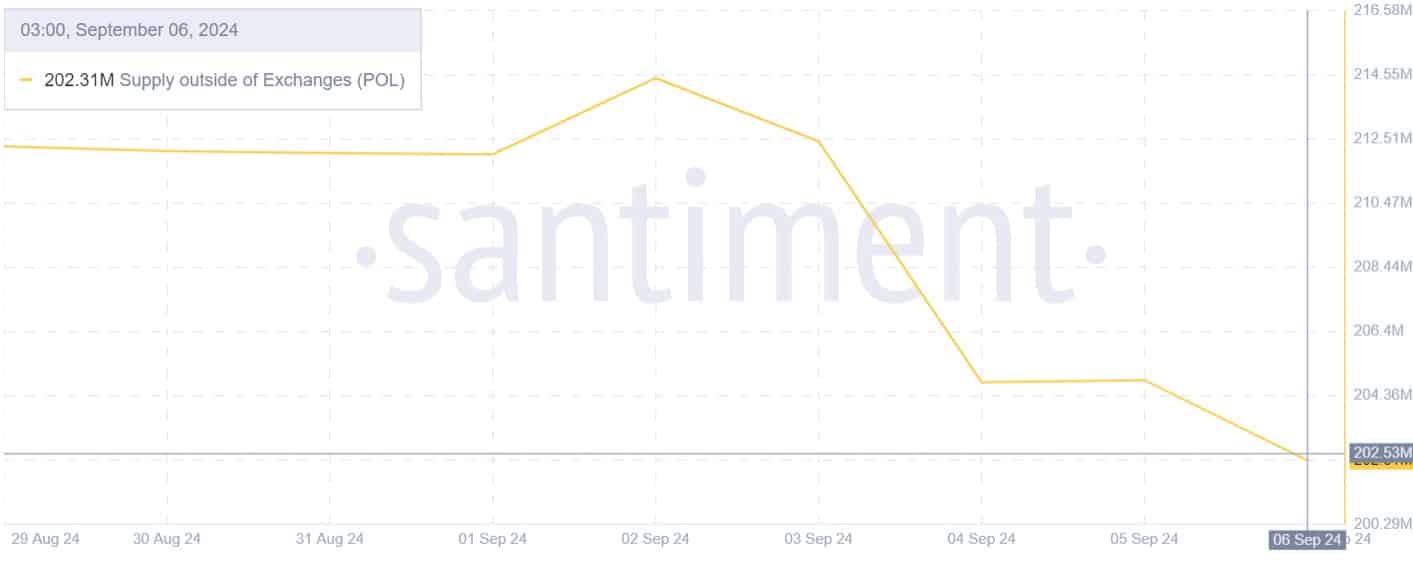

Source: Santiment

Additionally, POL’s off-exchange offerings have fallen from $214 million to $202 million since the migration. This market behavior suggests that investors are taking a long-term view and are less likely to sell in the short term. Such an approach signals investor confidence in the altcoin’s future prospects.

Therefore, under favorable market conditions, the altcoin could be well positioned to break out of the USD 0.38 resistance level and reach USD 0.4 in the near term.