Over the past week, the price of Bitcoin (BTC) has witnessed a remarkable rise, leading to increased activity in the cryptocurrency market. One area that offers unique insights into traders’ feelings and expectations about this price movement is the options market. We can gauge how traders position themselves in anticipation of future price movements through metrics such as open interest, volume and strike prices.

Options are financial derivatives that give the holder the right, but not the obligation, to buy or sell an underlying asset (in this case Bitcoin) at a predetermined price on or before a specific date.

Options come in two main forms: call options, which give the holder the right to buy the underlying asset, and put options, which give the holder the right to sell the underlying asset.

The open interest on options represents the total number of outstanding (not yet settled) option contracts on the market. A high OI indicates significant interest in a particular option, indicating strong sentiment (up or down) towards the underlying asset. It gives an idea of the total market exposure or involvement that traders have.

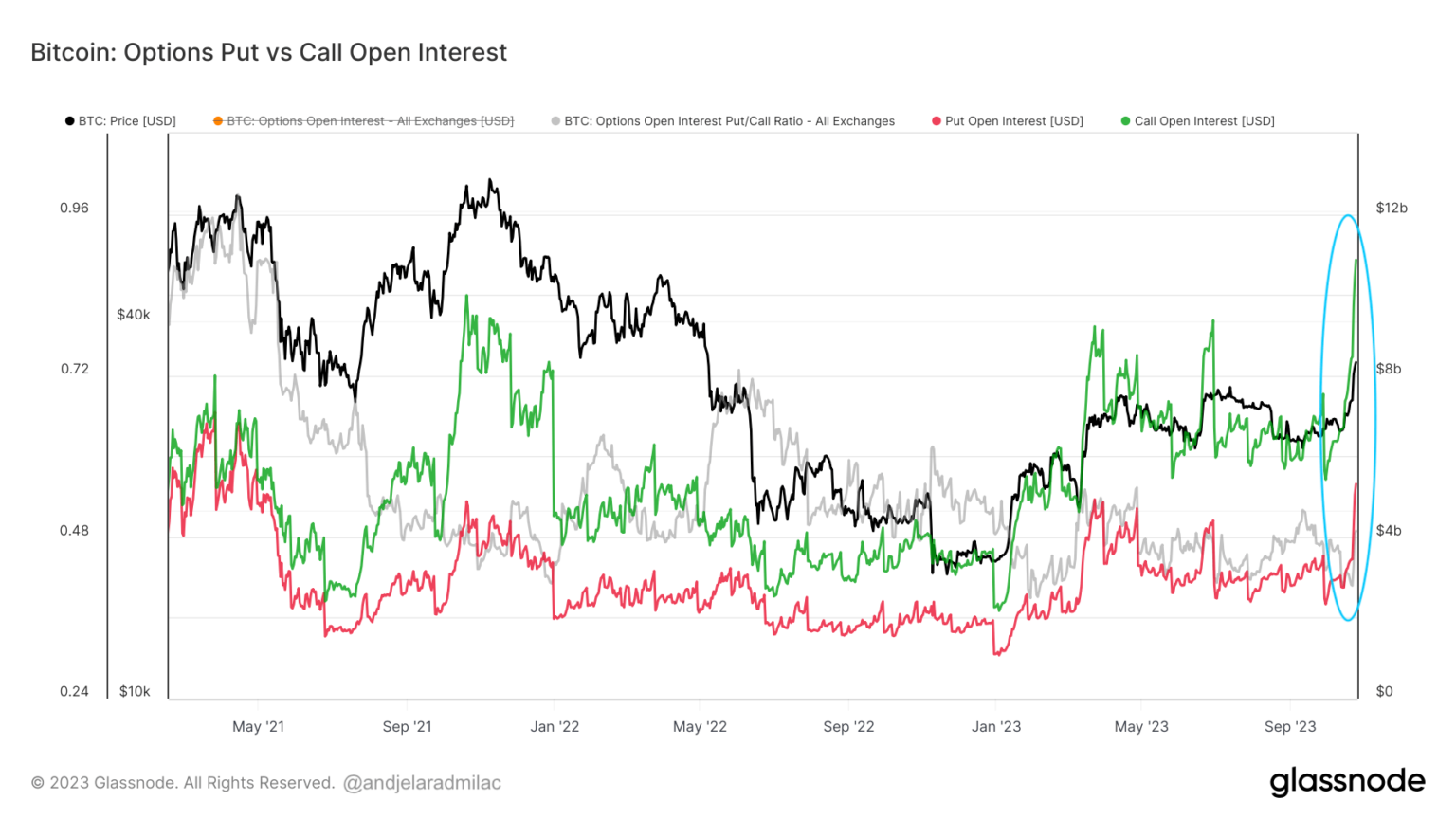

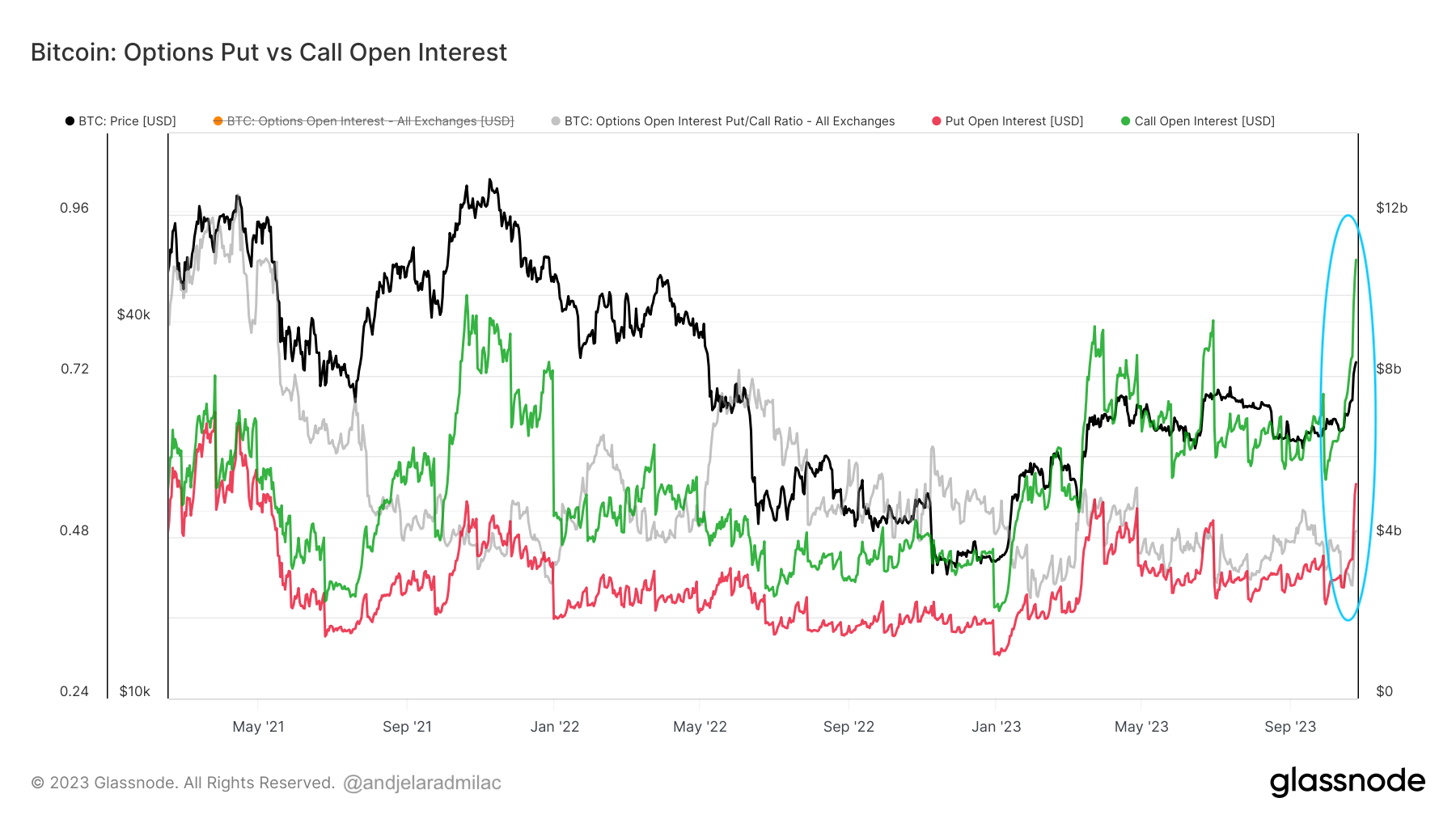

Open interest on calls reached a record high of $10.86 billion on October 25, up from $7.58 billion on October 18. During the same period, open interest on puts rose from $3.34 billion to $5.31 billion.

The bullish trend in Bitcoin’s price from October 18 to October 25 was accompanied by increased open put and call interest. This suggests that traders were actively participating in the market, with a historically unprecedented bullish expectation and a healthy bearish hedge. This could be due to several reasons, such as expected news events and increased volatility, most likely over the upcoming Bitcoin ETF in the US.

The put/call ratio is used to measure market sentiment as it represents the ratio of puts to calls. A ratio above 1 indicates bearish sentiment (more puts than calls), while a ratio below 1 indicates bullish sentiment (more calls than puts). The increase in the ratio from 0.425 to 0.489 between October 15 and 25 suggests that while the market remained bullish (as the ratio is still below 1), there was a relative increase in bearish sentiment or hedging activity compared to the bullish sentiment.

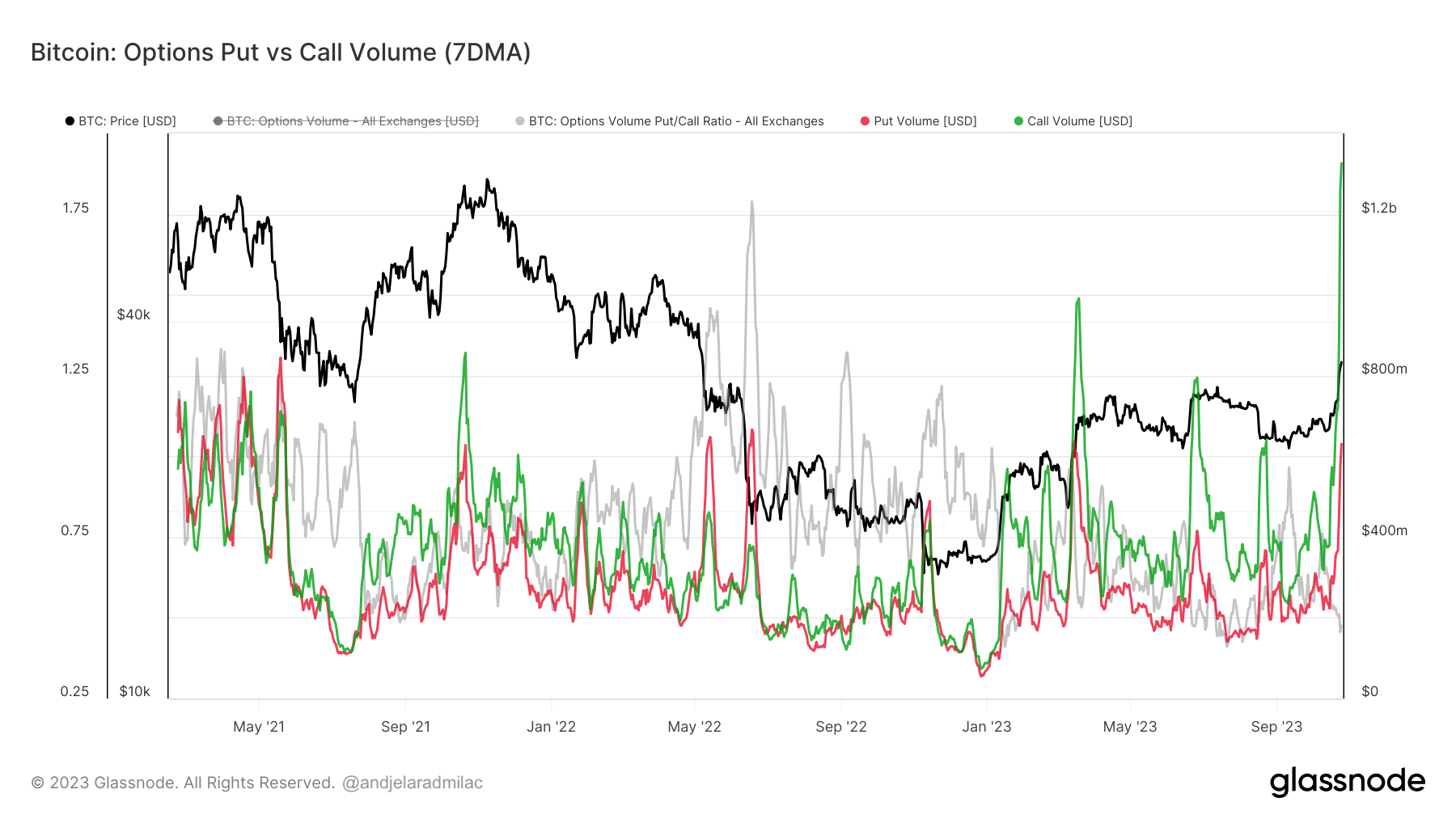

A similar increase was also seen in options volume. While open interest represents the cumulative positions that traders take, volume shows the current activity and liquidity in the market. A sudden spike in volume, especially if accompanied by significant price movement, can indicate strong sentiment and momentum.

From October 18 to October 25, the put/call ratio dropped from 0.538 to 0.475. This signals a shift towards even more bullish sentiment during this period. The volume of both puts and calls increased significantly, but call volume saw a more pronounced increase, reaching the largest in Bitcoin history, as did open call interest. The record call volume on October 25 indicates a particularly active and bullish day in the Bitcoin options market.

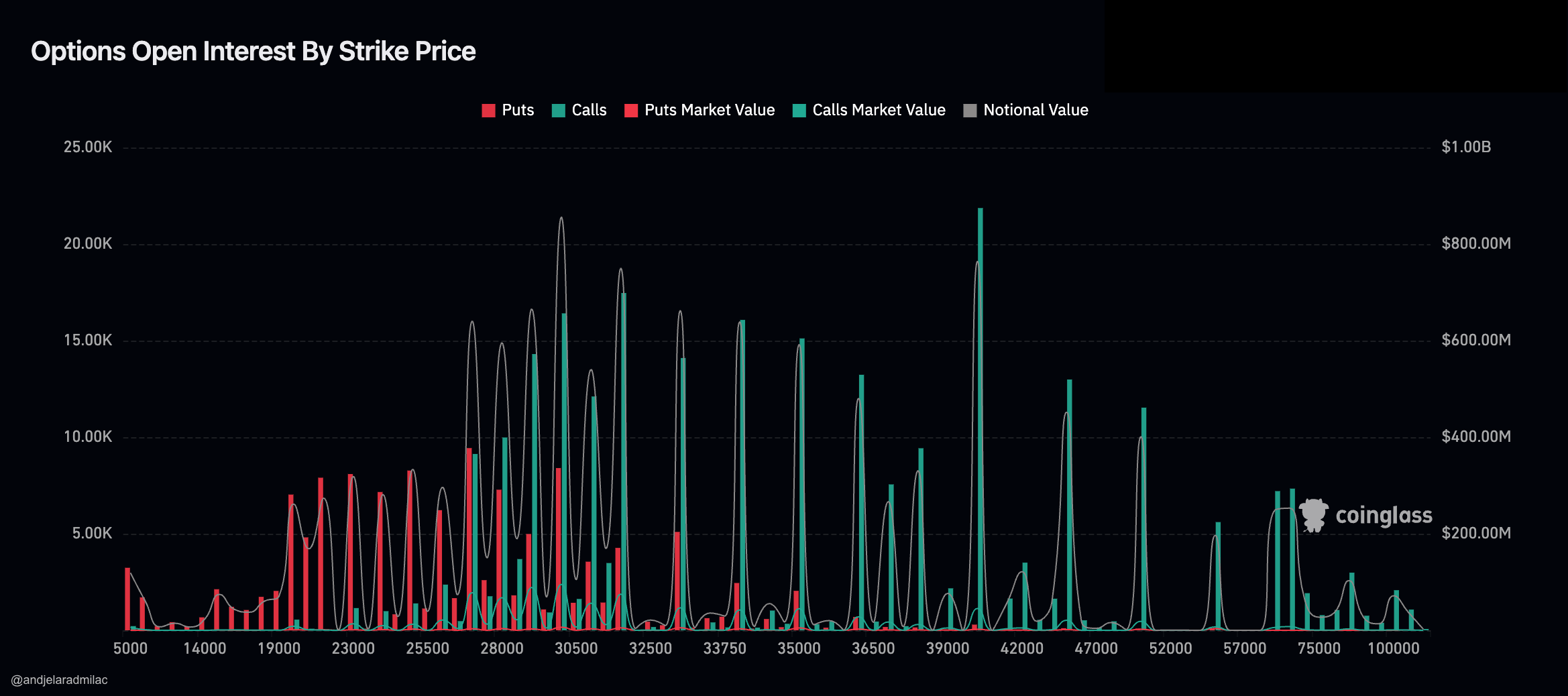

The high open interest at the $40,000 strike price further supports this bullish sentiment. It indicates that many traders expect or hope that Bitcoin will reach or surpass $40,000 by the expiration date of these options. While the high open interest at the $40,000 strike price shows optimism, the increasing put/call ratio we discussed earlier suggests that traders are also hedging against potential downside risks. This means that while many are optimistic that Bitcoin will reach $40,000, they are also preparing for scenarios where this may not be the case. This is evident from the spike in the number of put options at strike prices below $27,000.

The increase in both open interest and volume indicates that the Bitcoin options market is becoming more active and liquid. It also shows a notable increase in interest from institutional and sophisticated traders, as most retail traders rarely stray from the spot markets.

The post Bitcoin Options Market Shows Record Call Open Interest and Volume appeared first on CryptoSlate.