- Terra Classic Foundation has delegated 30M LUNC to hexxagon.io.

- Despite the impressive amount delegated, LUNC remained bearish.

Terra Classic Foundation announced continued support for Galaxy Finder and station. In a recent announcement, the foundation announced a massive delegation of 30 million LUNC tokens to hexxagon.io.

On their official X page (formerly Twitter), Terra Classic Foundation stated,

“We have delegated an additional $30 million LUNC to @hexxagon_io to operate and maintain Galaxy Station (https://station.hexxagon.io) and Galaxy Finder (https://finder.terra-classic.hexxagon.io)”

This delegation is crucial as it supports Hexxagon in managing its ecosystem.

Since the collaboration between the Joint L1 Taskforce and Hexxagon last year, it has been critical in developing and maintaining finder and galaxy stations.

Galaxy Station is the center for interaction and governance within the classic Terra ecosystem. It helps users navigate the Terra Classic network, including transactions, addresses and other activities.

With the recent delegation, the amount delegated to the platform amounts to 930 million LUNC. The delegation indicated that the team is fully committed to continued security and development within the classic Terra ecosystem.

Therefore, developing a solid, user-centric infrastructure for a better experience will be crucial.

Impact on LUNC?

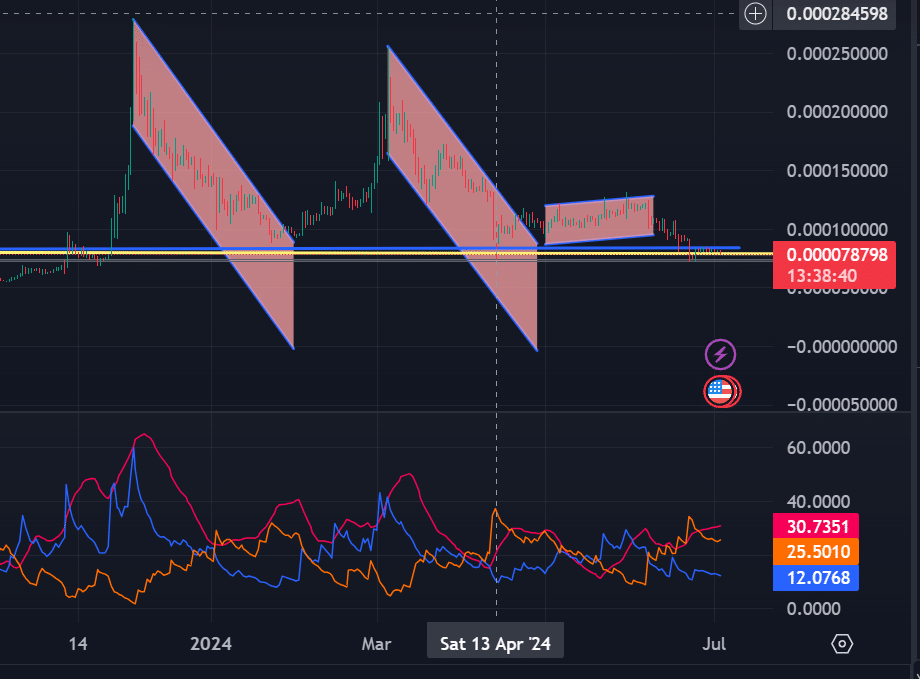

In particular, massive delegation can impact price charts, both in the short and long term.

Although the delegation shows confidence in the network, which can attract investors, AMBCypto’s analysis indicated that LUNC’s market sentiment remained unchanged at the time of writing.

At the time of writing, LUNC was trading at $0.0000801, having fallen 0.70 in 24 hours. Furthermore, it has fallen 1.47% over the past seven days.

However, trading volume increased by 8.02% to $15 million over the past 24 hours.

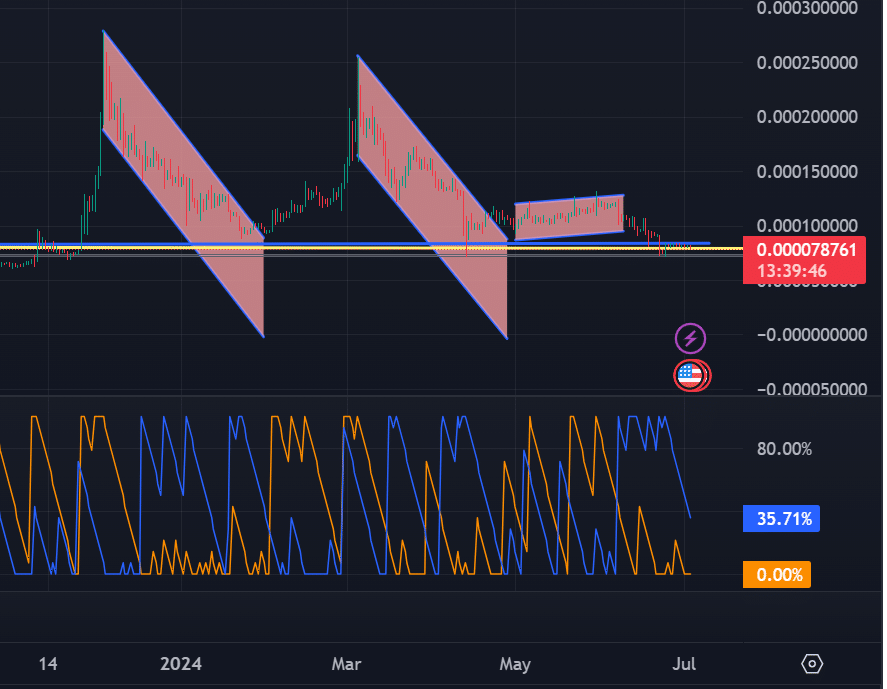

Source: Tradingview

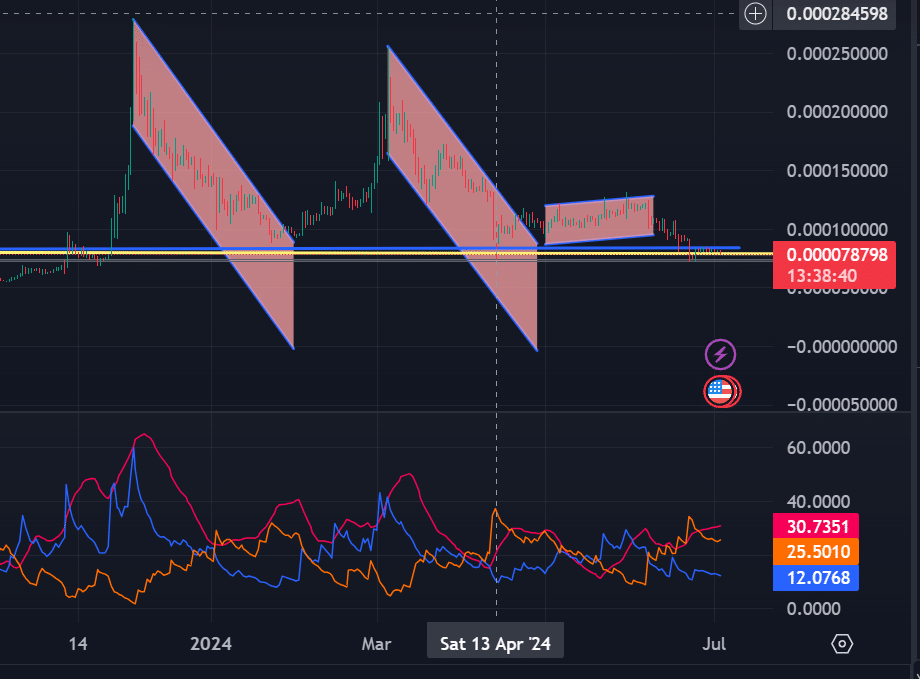

Our analysis also showed a strong bearish trend. Looking at LUNC’s Directional Movement Index, the negative index (red) at 30 was above the positive index at 12, showing that the downward trend was strong.

Source: TradingView

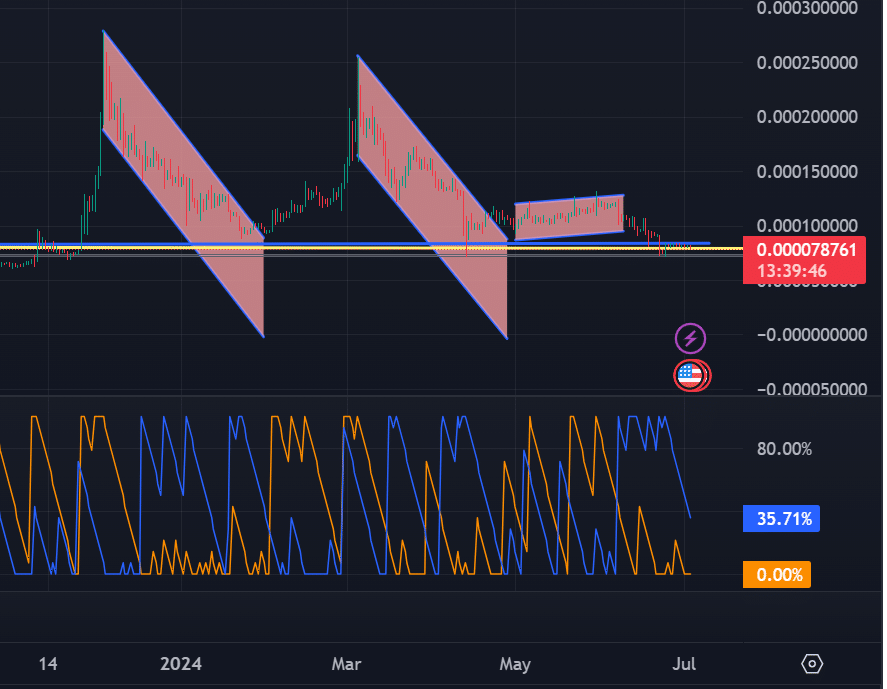

The Aroon line further proved this, as the Aroon down (blue) sat above the Aroon up line at 35, which is zero – a bearish signal.

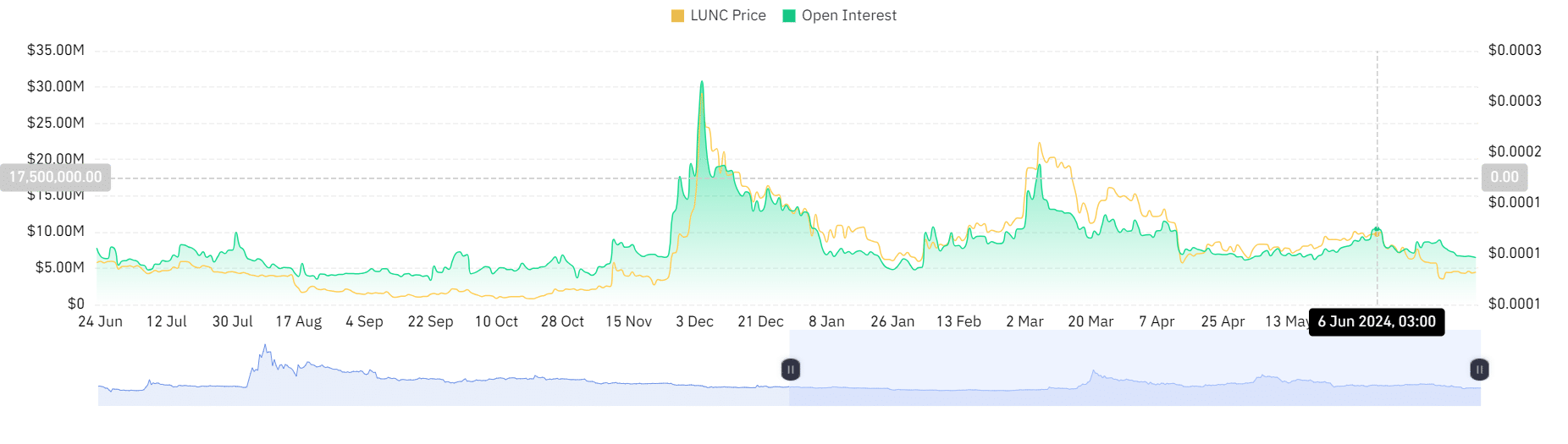

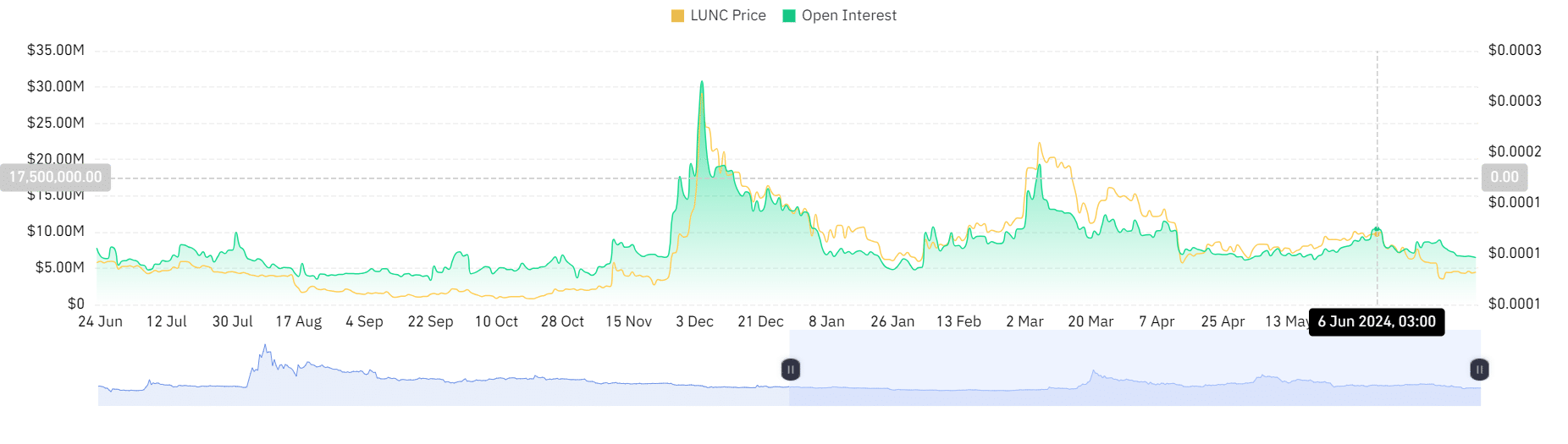

Source: Coinglass

Looking further, Coinglass data shows that LUNC’s Open Interest has continuously declined over the past seven days from a high of $8.89 million to $6.4 million at the time of writing.

Reduced Open Interest shows that holders are closing their positions without opening new ones.

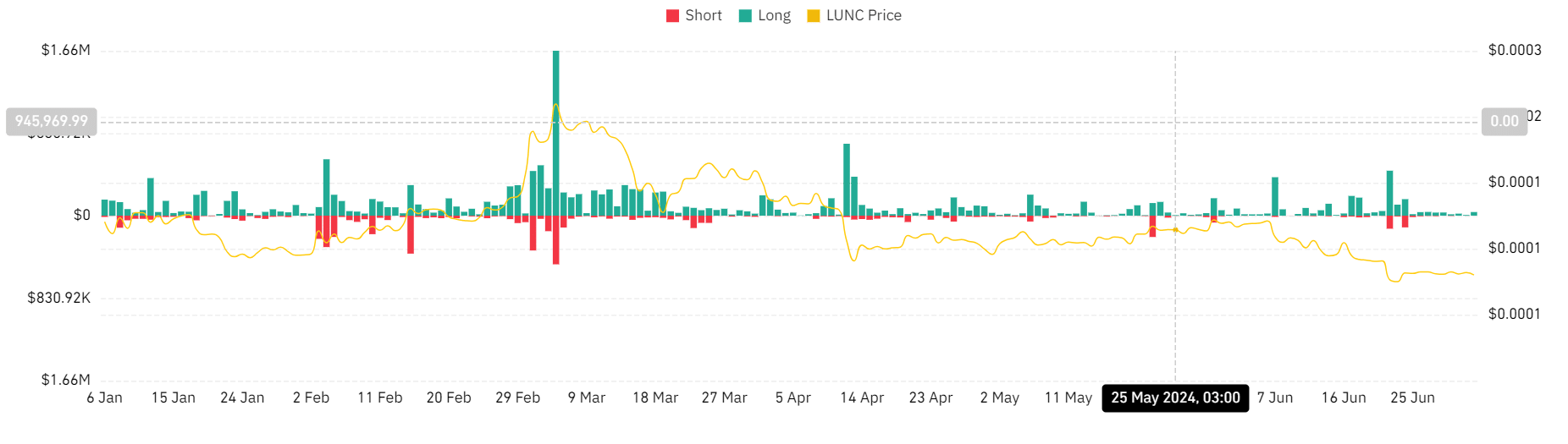

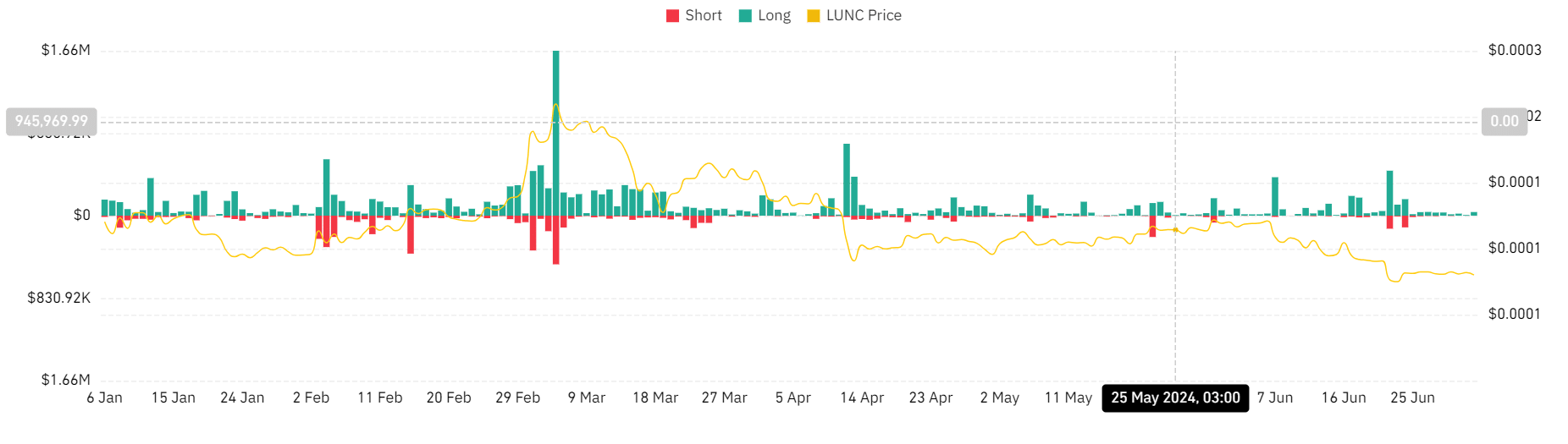

Source: Coinglass

Finally, LUNC reported higher liquidation on long positions in the last 24 hours by $36k, while short positions were at zero.

The same liquidation trend has occurred over the past seven days, showing that market sentiment has been largely bearish.

Could prices increase after the delegation?

While the 30M delegation has potential economic implications on the price charts, LUNC’s remained in a downtrend.

Is your portfolio green? View the LUNC Profit Calculator

If the bearish trend continues, LUNC will break critical support at $0.0000793 and further decline to LSL around $0.0000747.

However, if the market experiences a correction after the delegation, LUNC will rise to the next significant resistance level around $0.0000837.