- Stablecoin entry and open interest suggested an increasing speculative confidence in sui

- Liquidations reset leverage as the financing percentages turned positively and hint to Bullish Momentum

Sky [SUI] Registered the highest stabile inflow between all block chains in the last 24 hours, with a net increase of $ 6.1 million. This sharp intake coincided with most chains such as Ethereum, Solana and BNB chain that saw remarkable outlets – a sign of potential capital rotation.

Such a strong stablecoin movement to Sui shed through to a growing demand and a walk in the activities on the chain.

Moreover, the intake of stablecoin often acts as a dry powder, ready to be used in native assets – adding potential upward pressure. That is why this liquidity can reflect the trust of investors in the prospects in the short term of Sui.

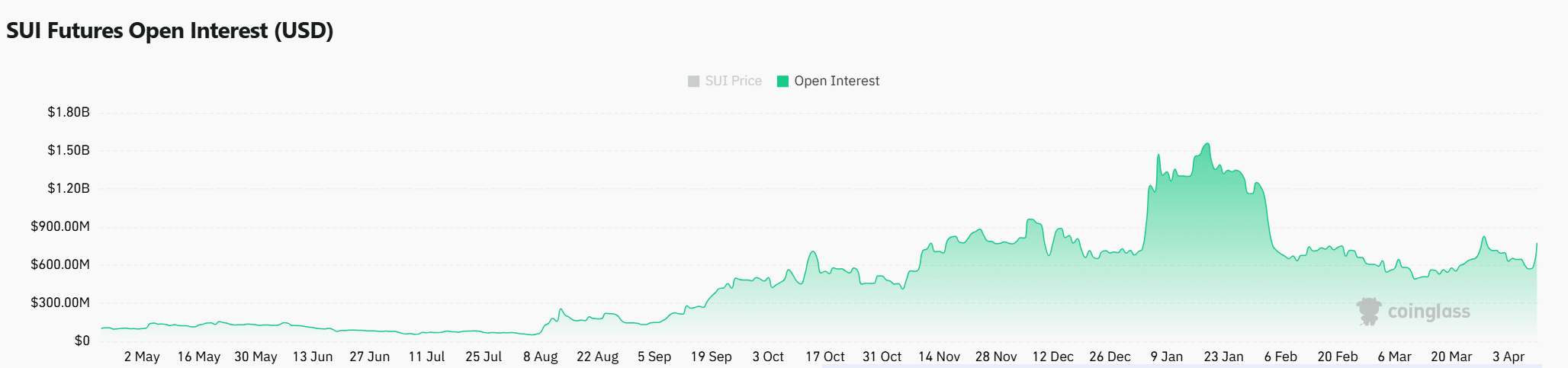

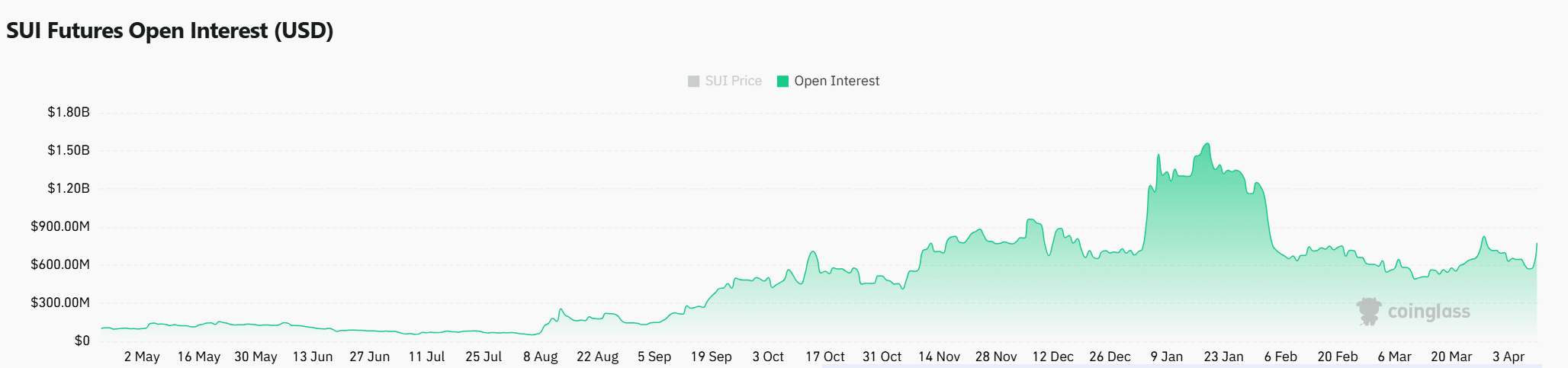

Why is open interest increasing quickly?

Open interest on Sui rose by 30.64%, which yields the total to $ 785.35 million. This sharp increase emphasized aggressive positioning in the derivatives market, especially because traders prepared for possible price volatility. In contrast to Spot -Inflowing, Open Interest reflects the speculative intention, in which traders are covering department or using directional bets.

However, in combination with rising stablecoin inflow, it usually leans bullish. That is why the synchronized jump in both statistics can mean that traders expect a decisive move from Sui in the coming sessions.

Source: Coinglass

Price Promotion Eyes Key Resistance after Bullish Push

Sui recently formed a classic cup and lever pattern on the daily graph, a setup that is often associated with bullish continuation. At the time of writing, Sui traded at $ 2.16, an increase of 12.82% in the last 24 hours. The handle part of the pattern seemed to form in a falling wedge, with a breakout point clearly marked at $ 2.23.

However, buyers still have to protect a strong candle that is close to this level. If the impetus of stand is and the price breaks out, the next important target would be at $ 2.80. That is why this pattern, combined with a growing momentum, could position Sui for a potential trend removal.

Source: TradingView

Are liquidations and financing percentages tailored to the Bullish Momentum?

In the last 24 hours, Sui saw $ 860.6k in long liquidations, compared to only $ 269.3k in shorts. This imbalance suggested that surviving bulls were washed away, especially on large exchanges such as Binance and OKX.

However, liquidation events often act as reset buttons, which releases excessive leverage and the stage is set for a more sustainable move. If the Bullish Momentum returns after the liquidations, this can support a healthier price determination.

Source: Coinglass

In the meantime, Sui’s OI-weighed financing percentage became somewhat positive at 0.0087%on 10 April. This suggested that traders paid to hold long positions, which enhances the presence of bullish sentiment despite recent volatility.

Moreover, the recovery of financing after a liquidation -slip often reflects renewed trust among market participants. Therefore, if both financing and inflow remain increased, the Altcoin can position itself for another leg up.

Conclusion

At the time of writing, Sui seemed to show several promising signs that were on an outbreak. The combination of strong stabile inflow, rising open interest, the repair of financing percentages and a bullish cup and the handling pattern that is also pointed out on growing market confidence.

However, the price still has to confirm a movement above $ 2.23 – a critical resistance level. Although the set -up can be constructive, the confirmation is therefore crucial before it evokes a definitive outbreak.