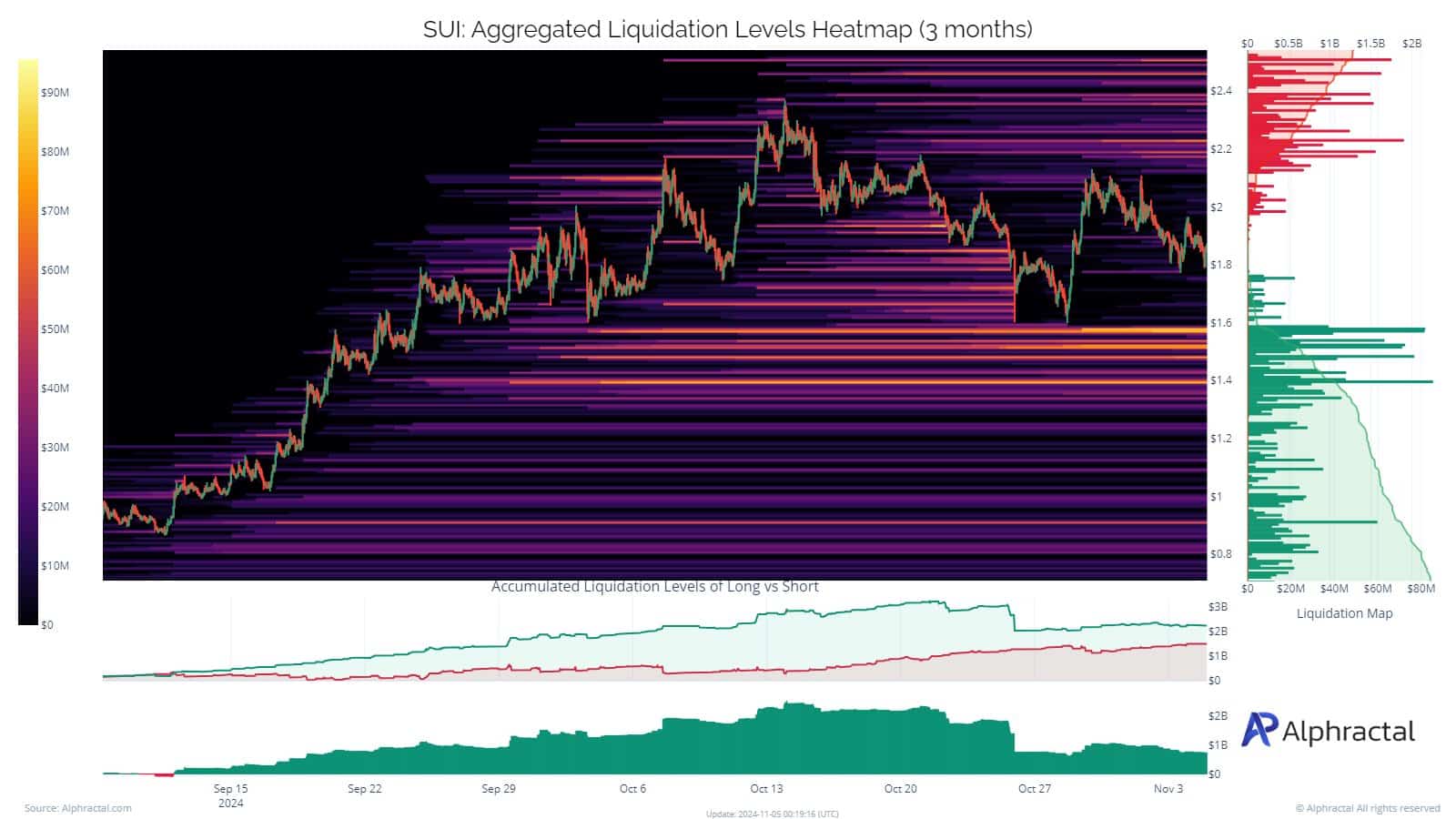

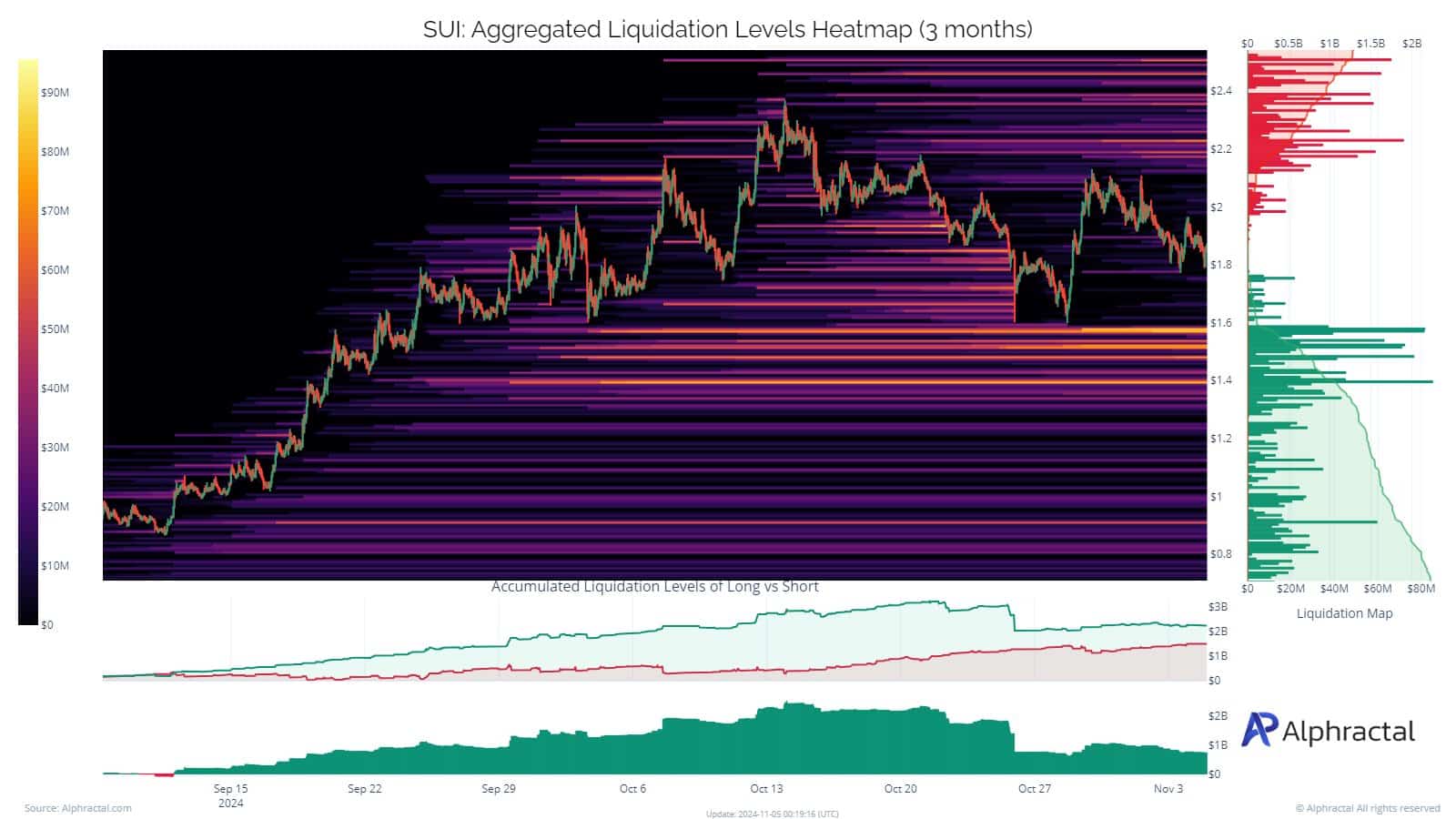

- There was enormous liquidity from long positions with leverage of $1.6.

- A drop below this level could create wild liquidation risk for leveraged bulls.

SUI has been one of the best performing Layer-1s in 2024 at times obscuring Ethereum and Solana [SOL] on some fronts.

In fact, it was one of the assets that reached record highs during the market recovery in October. This ensured that the SUI price retracement was subsequently seen as irresistible to sidelined speculators.

As a result, many speculators opened long positions around $1.6, and liquidity has been building around support for some time.

According to AlphractalThe massive liquidity at $1.6 support could lead to a wild liquidation if the price falls below the level.

Source: Alpharactal

Is SUI’s liquidation imminent?

Alpharactal argued that $2.2 also saw massive liquidity accumulation when long positions were opened at this level. However, these positions were wiped out in the recent pullback. Will $1.6 suffer the same fate?

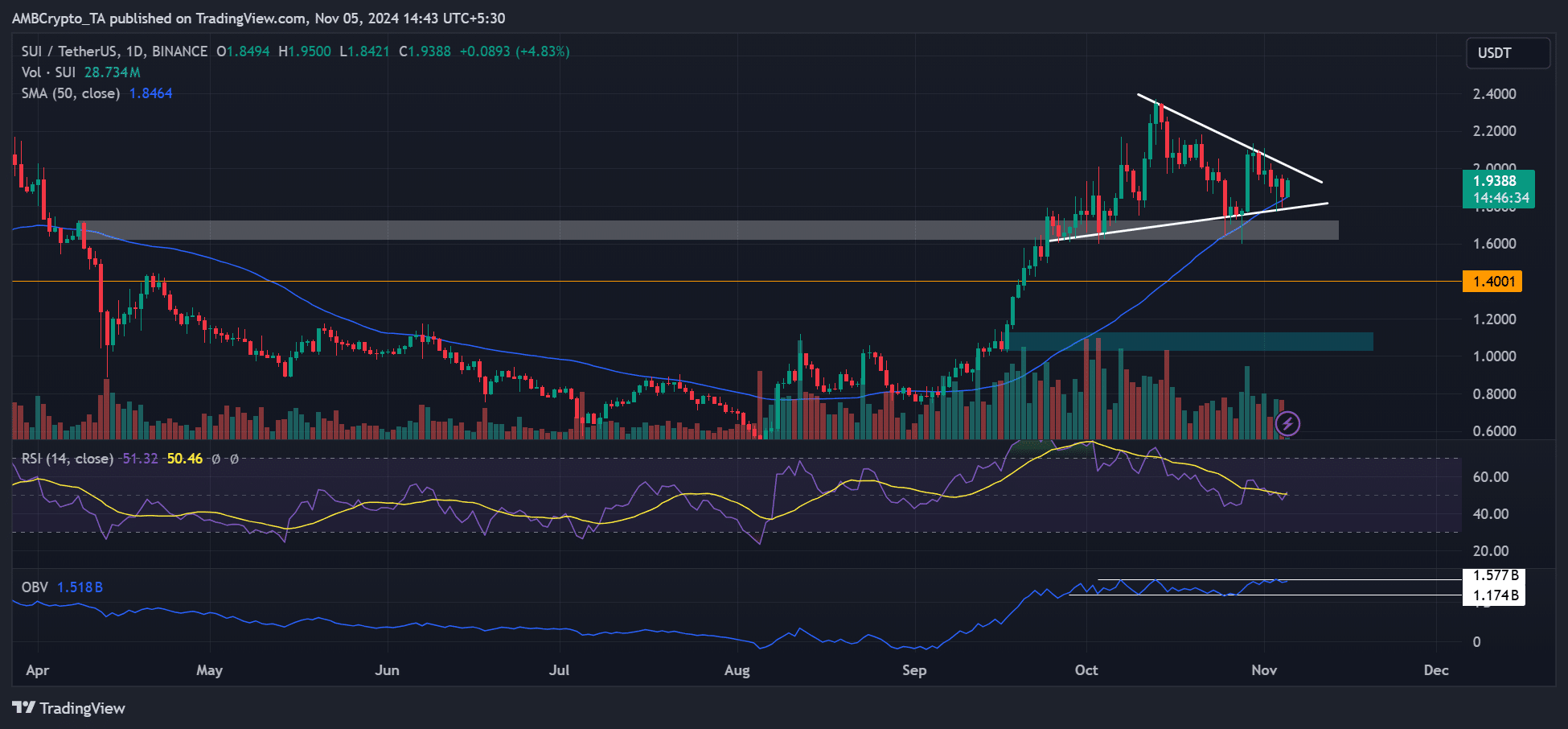

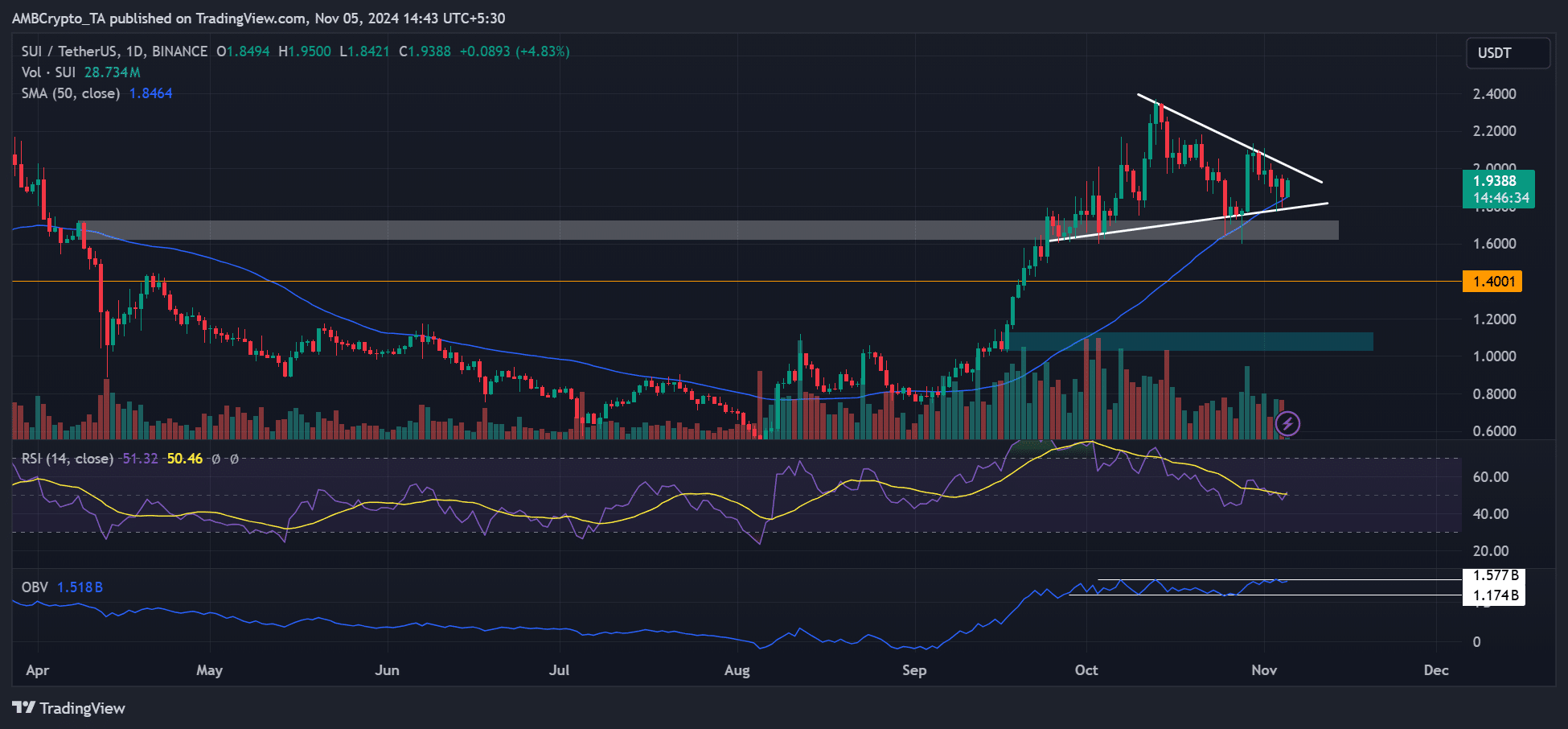

Source: SUI/USDT, TradingView

On the price chart, a daily order block (OB) formed in April has acted as SUI support in September and October ($1.6, white zone).

Furthermore, the 50-day EMA (Exponential Moving Average) has been a crucial dynamic support lately, softening the price declines in late October and November.

In other words, $1.6 was a key support for the fourth quarter and generated a lot of buying interest and long positions. A crack underneath could drag SUI towards the next support at $1.4.

Demand on the spot market for SUI is stagnating, as evidenced by the sideways movement on OBV (on balance volume). This meant that SUI prices could go either way depending on market sentiment after the US elections.

Mixed market interest

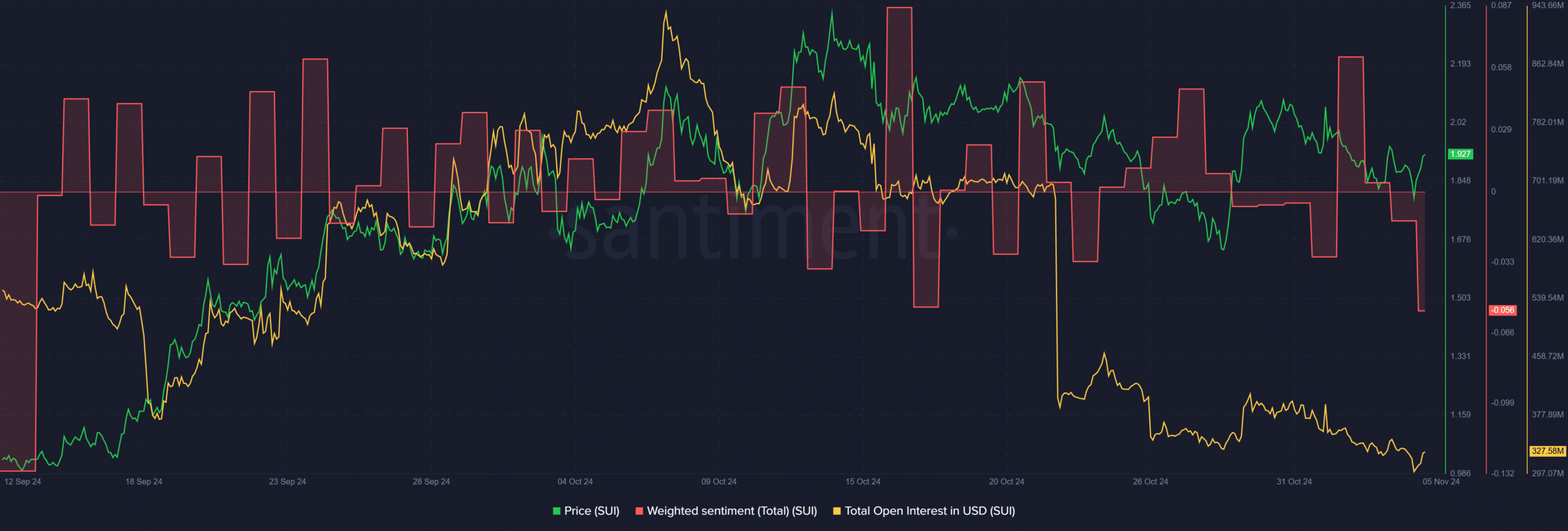

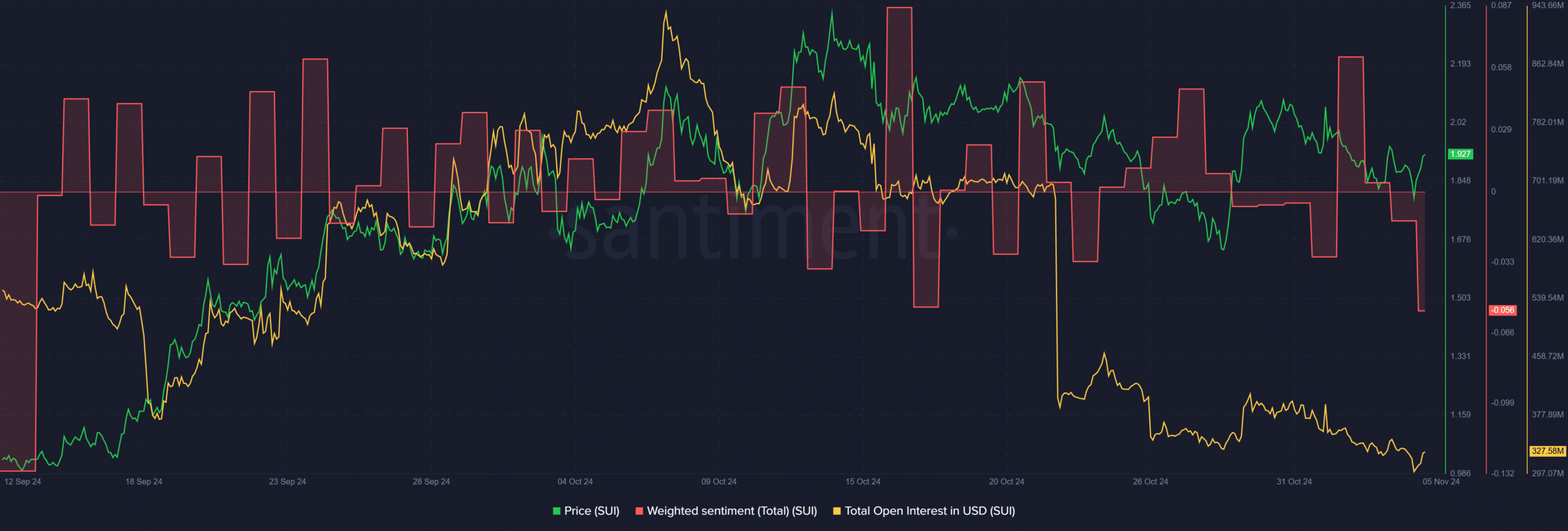

Source: Santiment

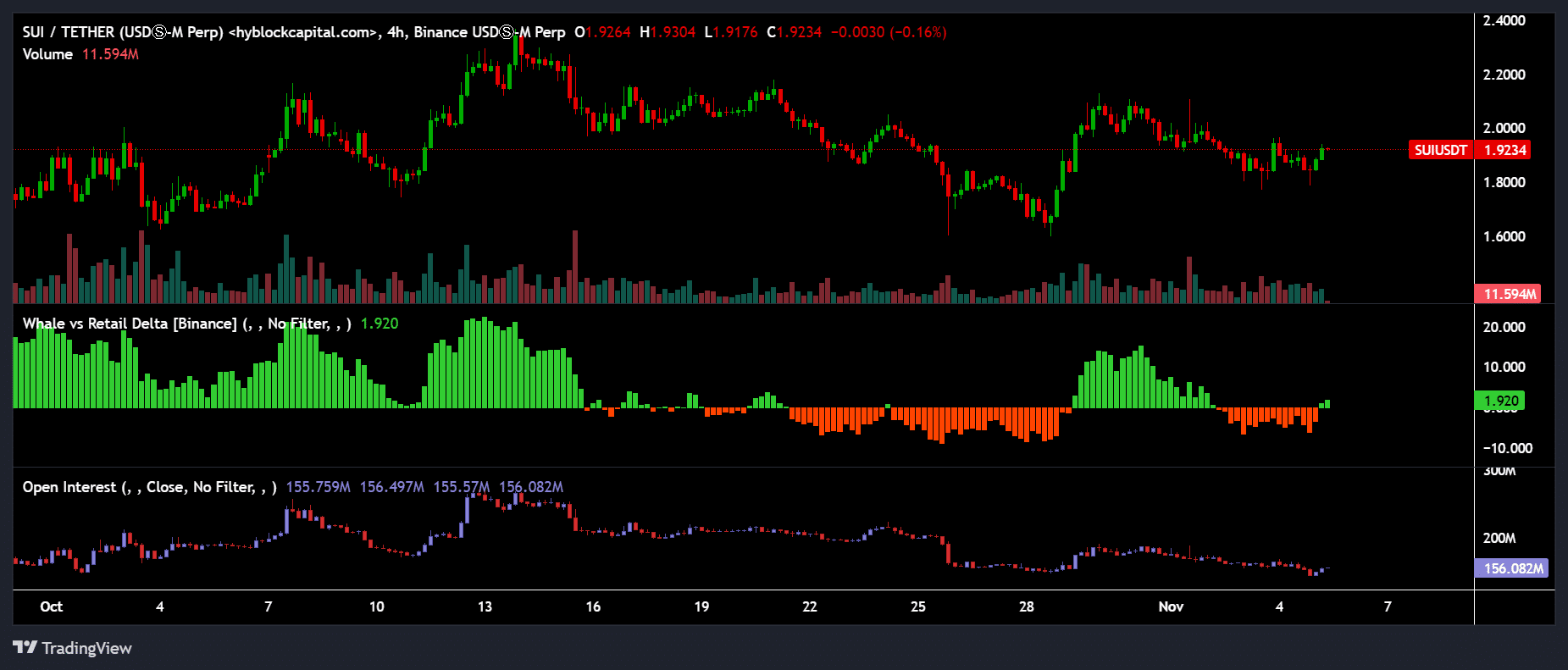

Santiment’s data shows the same caution in the short term. Since October, SUI’s open interest (OI) has been on a downward trend. With market sentiment also falling at the time of writing, SUI speculators were cautiously looking ahead to the US elections.

Read Sui [SUI] Price forecast 2024-2025

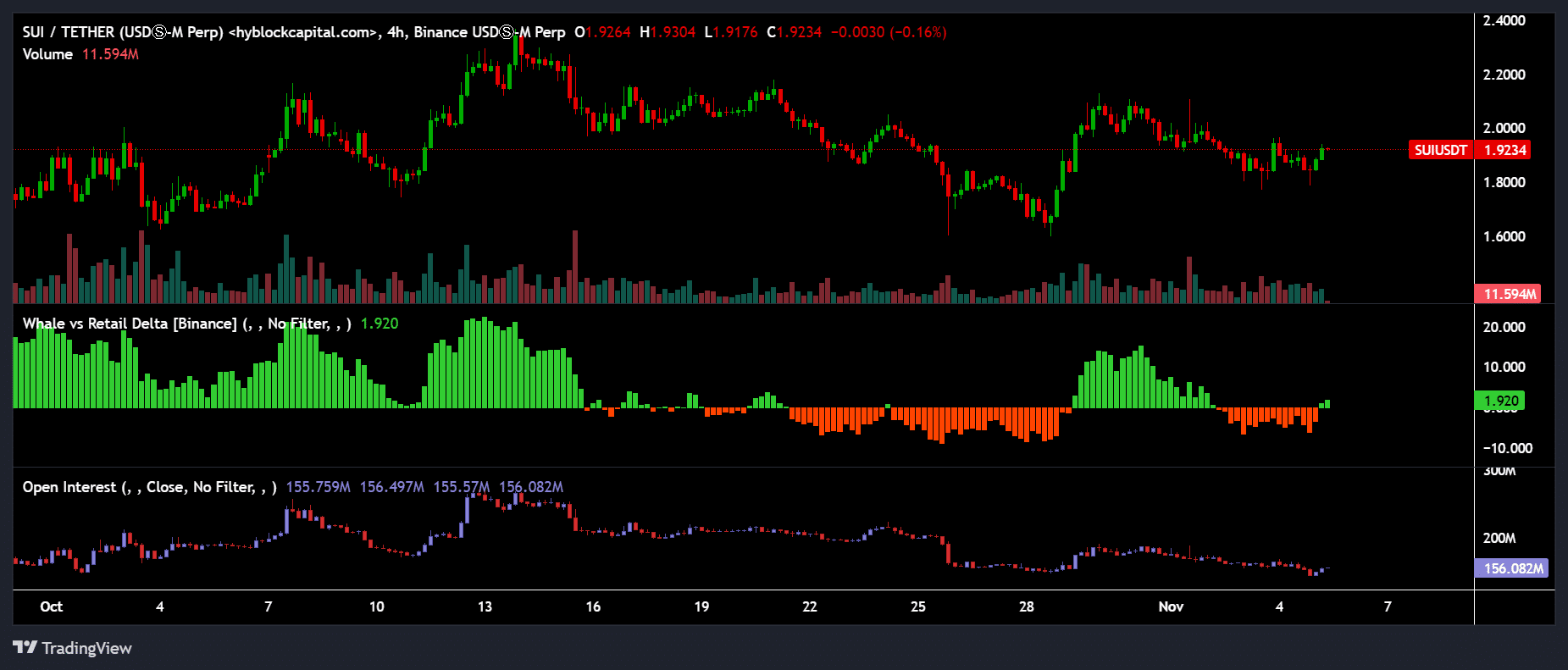

However, whales seemed interested in adding positions, despite the general caution. This was implied by a positive reading of the Retail vs Whale Delta metric, which measures long positions of whales relative to retail.

Source: Hyblock

In short, there was mild whale interest in SUI. However, the price was at a crucial point as any decline below the $1.6 support could expose several leveraged bulls to losses.