Bitcoin (BTC) and the cryptocurrency market have a significant upward trendsetting a new annual high and surpassing $1.45 trillion, paving the way for potential gains in the final days of November.

Notably, BTC, the largest cryptocurrency on the market, has reached a notable milestone, approaching the $40,000 level with a price increase to $38,400.

The catalysts behind this recent wave include the expected adoption of the BlackRock Bitcoin Spot exchange traded fund (ETF) within the next 45 days and speculation that BlackRock itself could influence the price of Bitcoin through significant buying pressure on Coinbase.

BlackRock Is Driving BTC’s Recent Price Surge?

According to According to CoinGecko, the global cryptocurrency market cap currently stands at $1.5 trillion, reflecting a change of 2.05% in the last 24 hours and an impressive change of 72.26% compared to the same period last year.

This increase in market capitalization has not only boosted Bitcoin, but has also contributed to gains in other major cryptocurrencies within the Top 100, such as Blur (BLUR), which rose as much as 27%, Mina Protocol (MINA), which rose 9% won, and Bittensor (TAO), which is up 14% in the last 24 hours, to name a few.

As for BTC’s recent rise to one new annual highlightcrypto expert known by the pseudonym ‘Crypto Rover’ has shed light on potential catalysts driving the recent wave. According to Rover, the launch of the BlackRock Bitcoin Spot ETF is expected to occur within the next 45 days.

In this regard, Rover’s analysis suggests that BlackRock, the world’s largest asset manager, could play a role in Bitcoin’s recent rise. The speculation is based on the observation that a significant portion of the Bitcoin buying pressure appears to be coming from Coinbase, the largest cryptocurrency exchange in the United States, with the platform serving as BlackRock’s custody partner.

Promising Bitcoin Price Targets for End of 2025

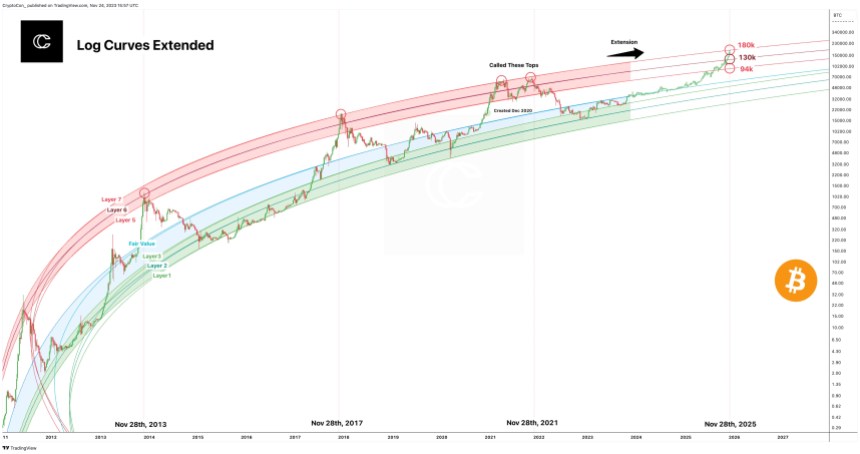

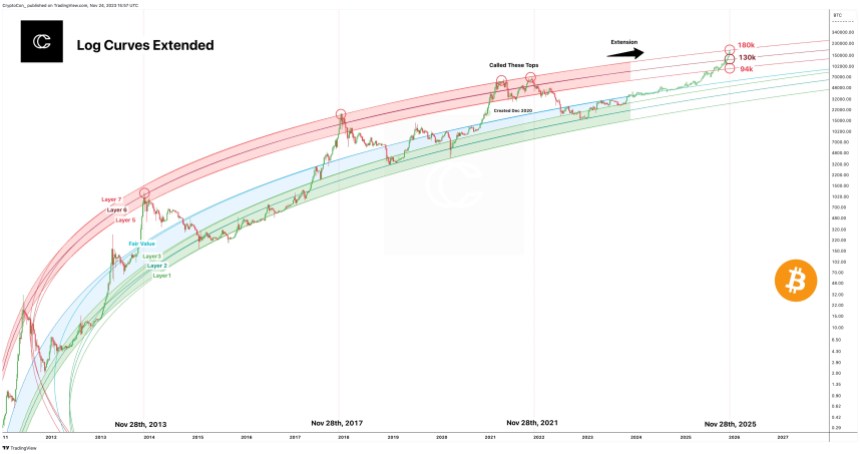

Renowned crypto analyst Crypto Con has unveiled what it claims is the most accurate Log Regression Curves for Bitcoin to date. These curves have provided insight into the future cycle top, an elusive aspect of Bitcoin analysis.

According to According to projections derived from the curve-matching technique, there could be two potential price targets for Bitcoin at the end of 2025: $130,000, also called Layer 6, and Layer 7, with a target price of $180,000.

Says the analyst different models and projections support the $130,000 goal, adding to its credibility. According to Crypto Con, even the most conservative estimate, known as Layer 5 of $94,000, seems less likely.

Based on historical trends, it is unlikely that the entire red band represents potential price ranges, would fail during this cycle. Therefore, it is expected that one of the projected targets will be accurate.

Based on the available information, Crypto Con favors layer 6 of $130,000 as the most likely target for Bitcoin’s price appreciation in late 2025. This projection is consistent with the Halving Cycles Theory and suggests a time frame of approximately 21 days from November 28, 2025 .

Bitcoin has undergone a recent pullback in the past hour after hitting a new annual high. Currently it is trading at $37,800.

Featured image from Shutterstock, chart from TradingView.com