- Analysts’ comments indicated that Ethereum ETFs could launch on July 2

- Bitcoin appears to be underperforming ahead of ETH ETF approval

Following SEC Chairman Gary Gensler’s promising comments (“sometime this summer”) on Ethereum’s approval timeline [ETH] spot Exchange Traded Funds (ETFs), Bloomberg’s senior analyst Eric Balchunas is in the news today after specifying a possible launch date.

Balchuna’s prediction: reality or not?

According to BalchunasEther ETFs could start trading in the United States as early as July 2. He said,

“We’re moving our over/under date for the spot Ether ETF launch to July 2, when we heard that the staff was sending issuer comments on S-1s today, and they’re pretty light, nothing major, and asking in a week to return. .”

This news has sparked optimism within the cryptocurrency community, especially regarding Ethereum’s upcoming market opportunity.

In fact, the analyst also alluded to the fact that the aforementioned launch would be timed as closely as possible to align as closely as possible with July 4, the Independence Day of the United States.

“Good chance they’re working on declaring them effective next week and getting it off their plate over the holiday weekend. Anything is possible, but this is our best guess so far.”

Bitcoin ETF vs Ethereum ETF

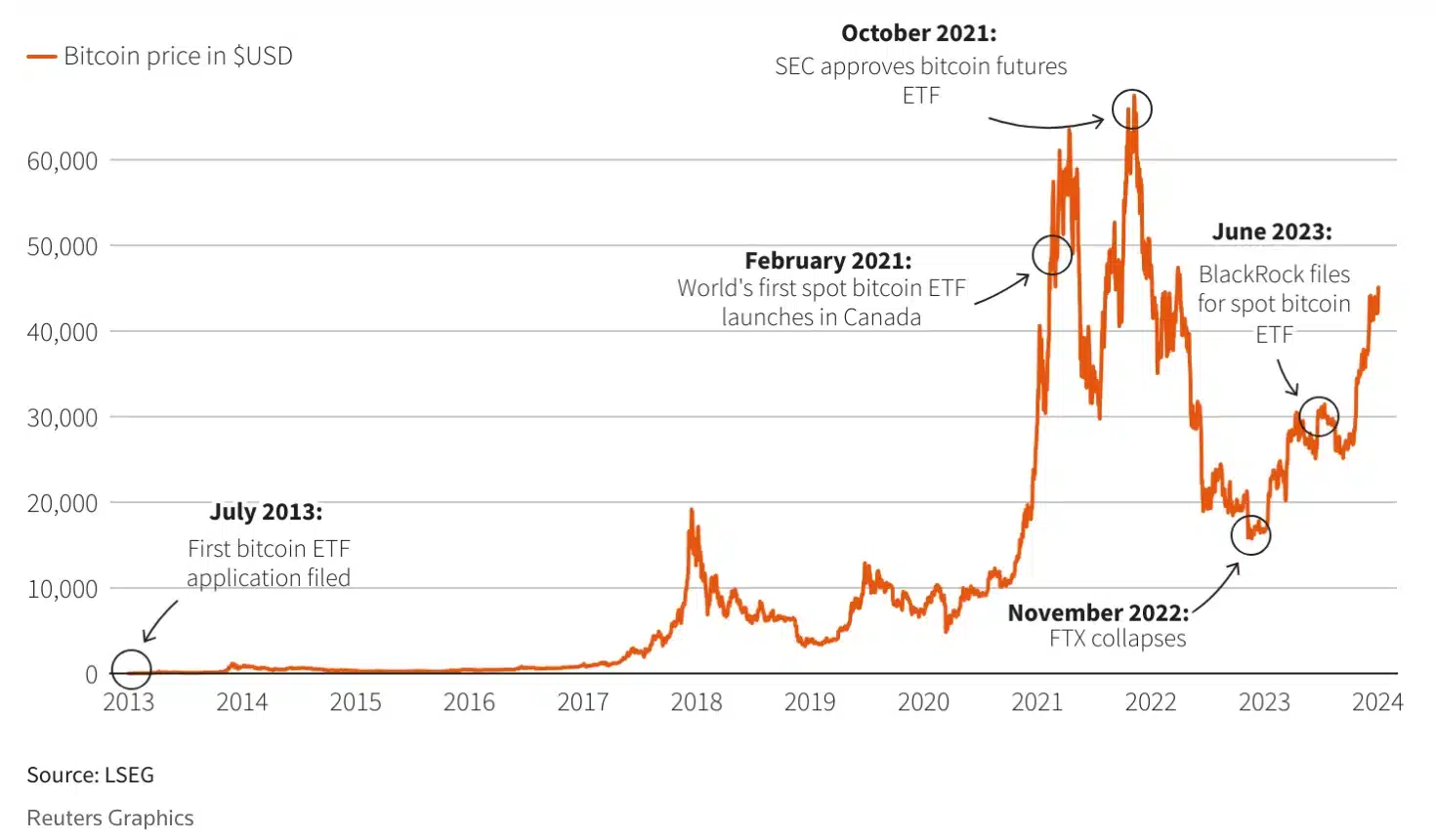

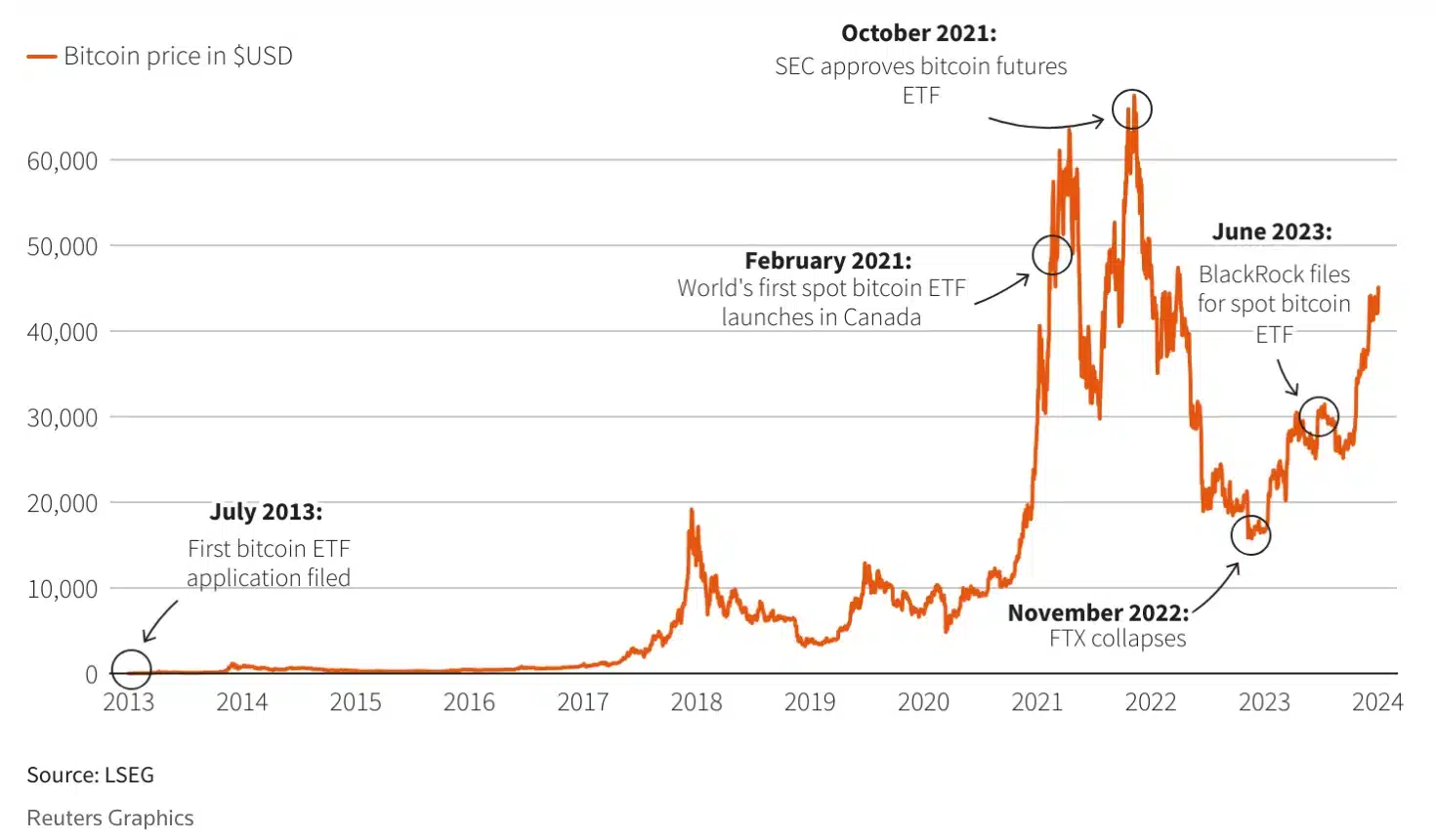

The delay in the approval of ETH ETFs does not come close to Bitcoin’s long journey [BTC] Approval Process for ETFs.

All the way back in July 2013, Cameron and Tyler Winklevoss, founders of the Gemini crypto exchange, filed their first application with the SEC to establish a spot Bitcoin ETF.

Fast forward to January 2024, after nearly a decade of regulatory scrutiny and multiple filings, the SEC finally approved 11 Bitcoin ETFs.

Source: Reuters

Drawing parallels between the approval processes of Bitcoin and Ethereum ETFs, it is notable that following the approval of the BTC ETF, Ethereum saw a significant rally, up 9.1%, while Bitcoin underperformed.

And now, ahead of ETH ETF approval, Ethereum, the second-largest altcoin, stands out amid a market downturn.

At the time of writing, Bitcoin and many other cryptocurrencies were in red candlesticks on their daily charts. On the contrary, Ethereum was in the green after a modest increase of just over 1%.

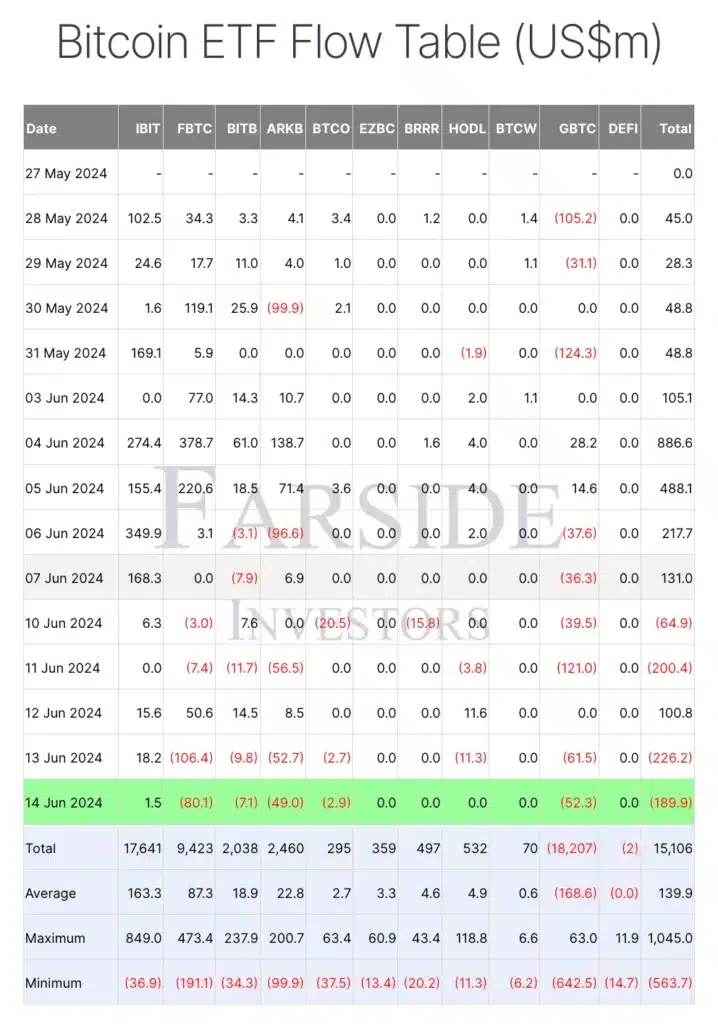

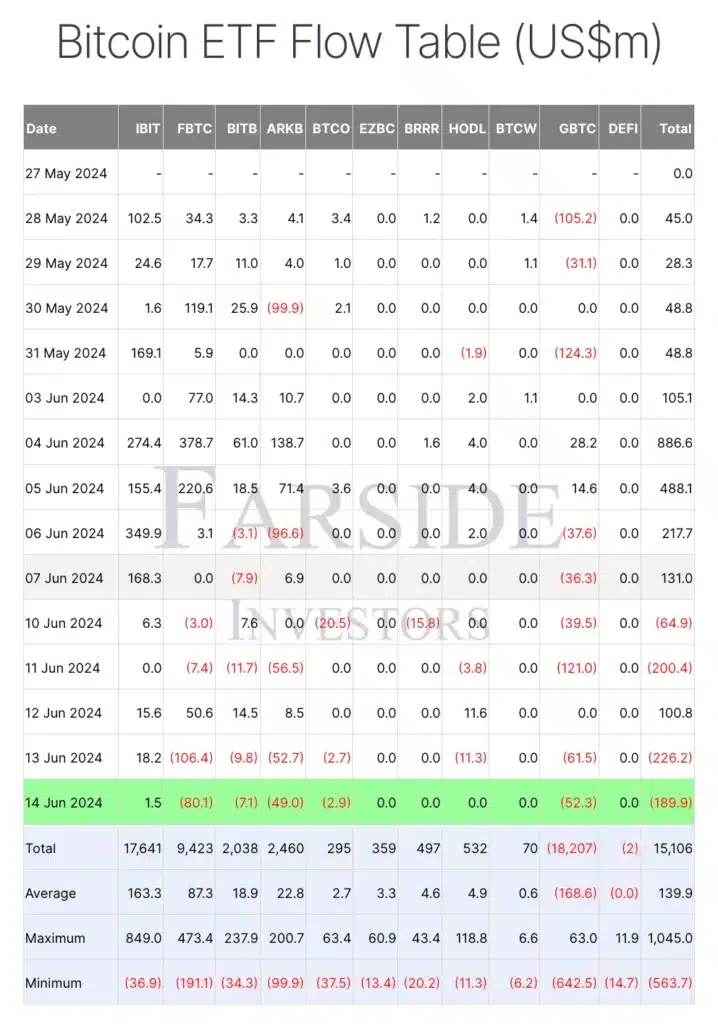

Moreover, a recent report from Farside InvestorsSpot BTC ETFs saw two consecutive days of outflows on June 13 and 14, totaling $416.1 million.

Source: Farside Investors

Popular analyst Willy Woo also commented. He claimed,

Source: Willy Woo/X

The future remains uncertain

Overall, while crypto market dynamics are constantly changing, it is still too early to definitively conclude whether investors are moving from Bitcoin to Ethereum.

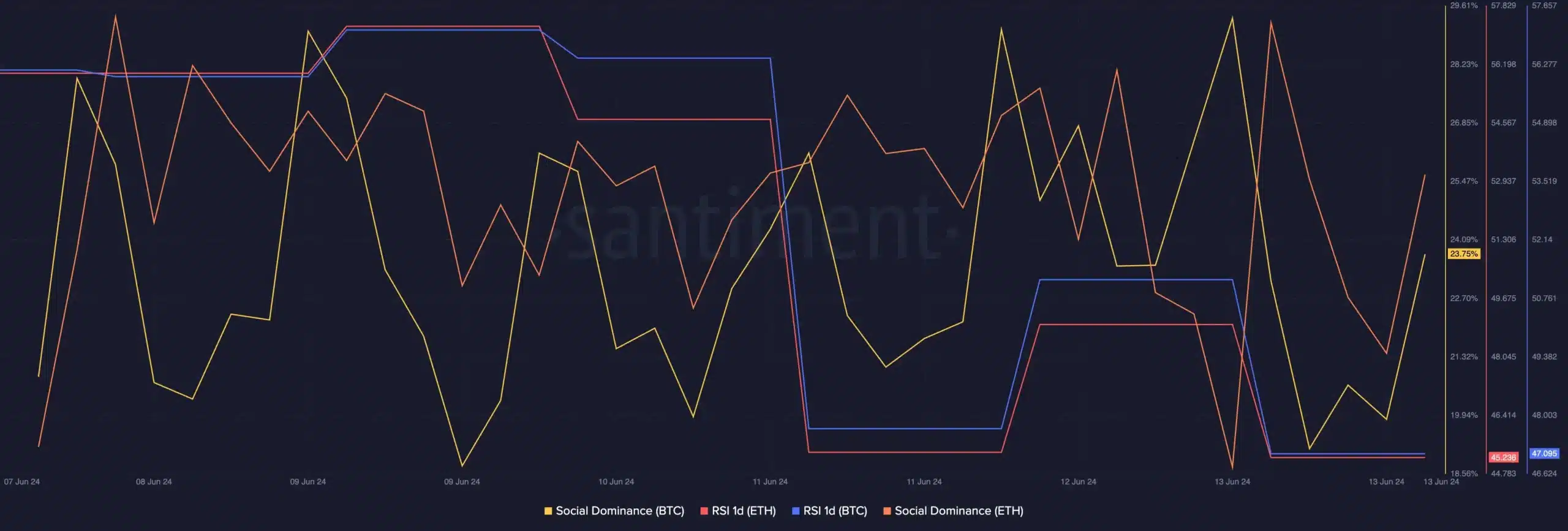

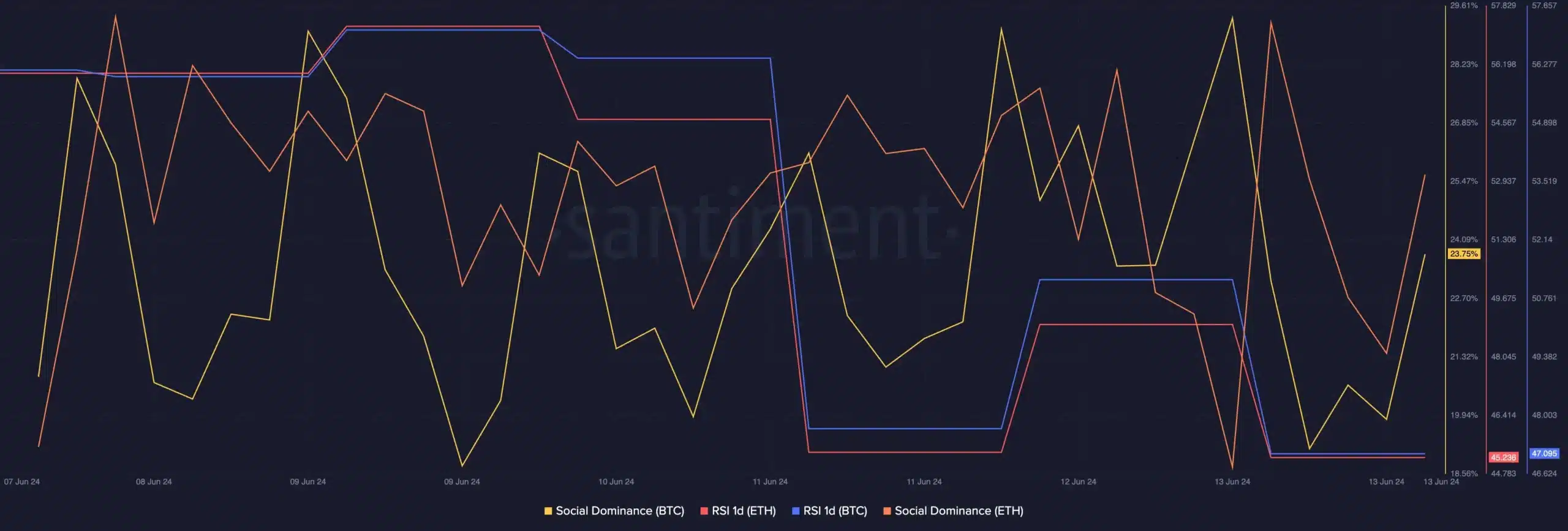

However, it is worth noting that AMBCrypto’s analysis of Santiment revealed that the social dominance metrics for both ETH and BTC were moving north. Despite this, the Relative Strength Index (RSI) remained flat, indicating no clear signs of bullish or bearish momentum.

Source: Santiment