- Multiple Solana Whale addresses have dumped more than $ 46 million tokens in one day.

- The Altcoin can dive further if a broader sentiment bearish remains and the most important support levels do not remain strong.

A wave of whale activity has shaken the Solana [SOL] Market recently.

The data on Altcoin’s chains showed that on 5 April several large holders did not put a huge volume of Sol, which caused the fear of a deeper price correction.

According to Lookonchain recently tweetWallet address hujbzd led the Exodus by dumping 258,646 Sol worth around $ 30.3 million.

BNWZVG 80,000 SOL ($ 9.47 million) sold to closely, while 8rwuq5 and 2uhuo1 rose 30,000 and 25,501 Sol respectively – a total of another $ 6.53 million in sales pressure.

This amounts to a combined $ 46.3 million in Sol dumped in a short window.

Is a deeper correction on the horizon?

Such a heavy sale hints typically at the bearish sentiment for Solana – especially when the sales pressure is led by whales.

Since these sales were not stored shortly after Sol, this suggests a lack of interest in long -term retaining, at least for the time being.

At the time of writing, Sol already had difficulty reclaiming the resistance level of $ 120. With new sale that adds pressure, there is a real chance of a retest of the $ 1OO support zone.

If buyers do not defend that range, the dip could continue to stretch, possibly to $ 98 – a psychological threshold.

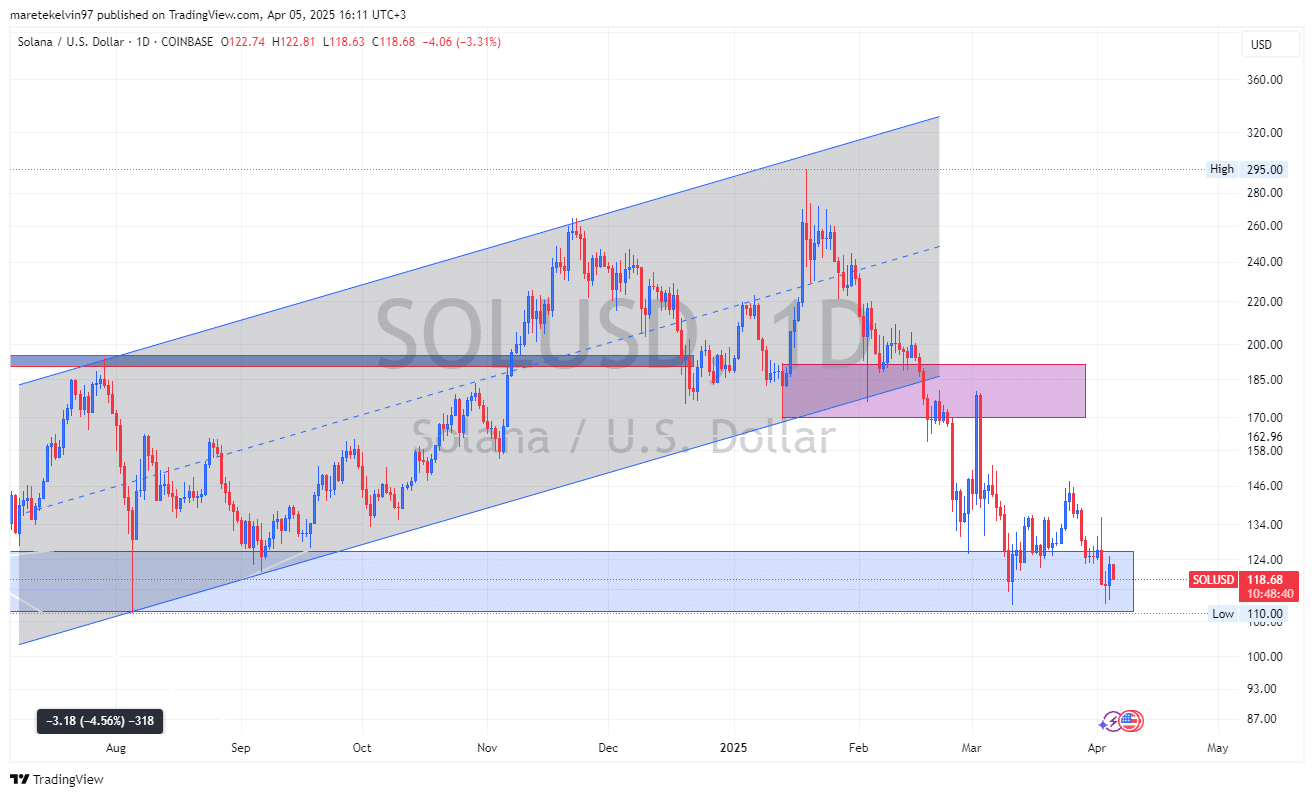

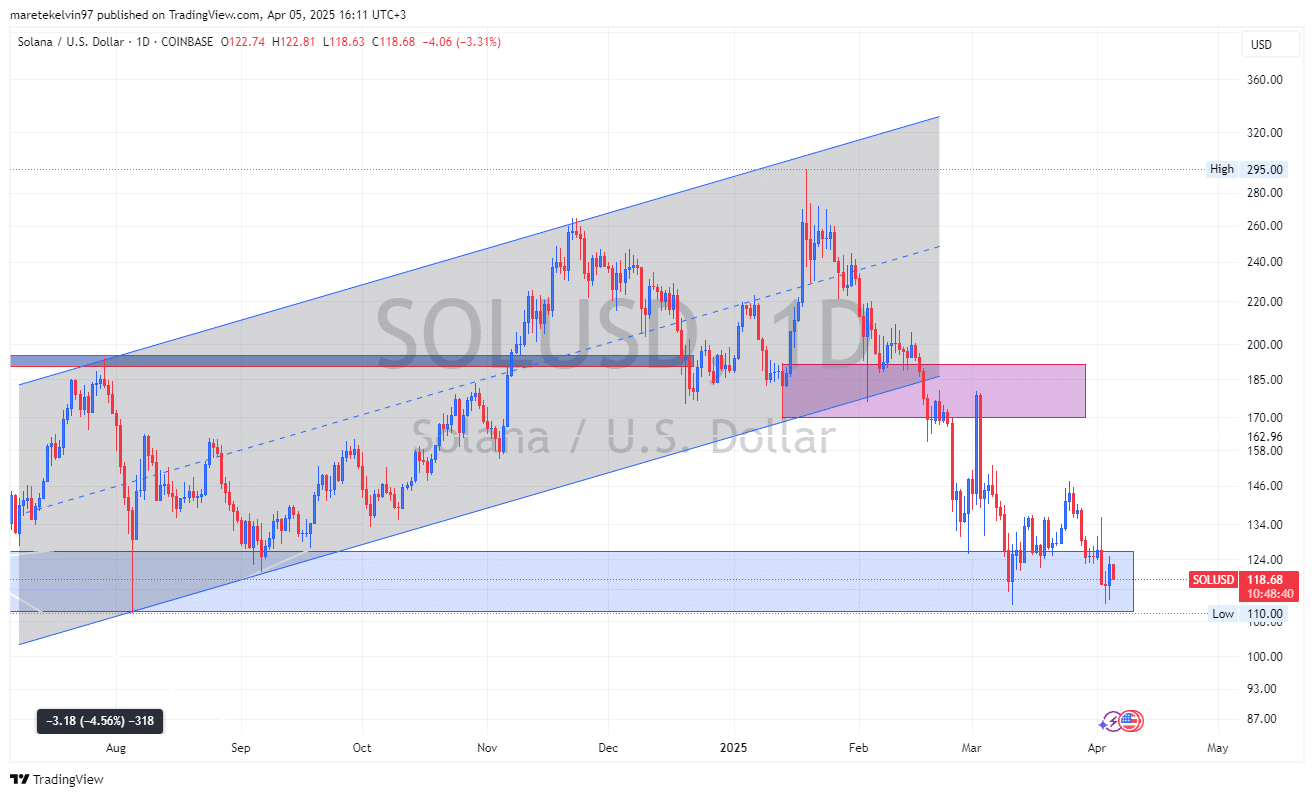

Source: TradingView

Market sentiment leans carefully for SOL

The wider market does not help either. With the King Coin still volatile, Altcoins also seem to follow the suit. While fear crawls back, both retail and institutional investors can stay on the sidelines.

This makes every SOL recovery less likely in the short term, unless a new catalyst arises – perhaps of a positive development of ecosystem or improved macrotrends.

However, it is worth noting that whale activity does not always mean Doom for SOL. In earlier cycles, large landfills sometimes preceded accumulative phases.

Looking if these whales arrive again or if fresh portfolios pick up the play are the key for the market participants.

Technically, SOL prices try a likely reversal in an important demand zone. The zone has seen several rejections and has proved strong several times.

If this is a cyclical pattern, everything is not lost for SOL despite the exodus, and the zone could reject the prices upside down.

For now, both traders and investors have to keep an eye on volume trends and how Sol behaves near the current demand zone at around $ 110.

A bounce with a large volume can indicate a reversal in the short term, while a weak buy can open the doors for Solana to continue to fall below $ 100 important psychological price level.