- SOL is up more than 5% in the past 24 hours.

- Most market indicators remained bullish on the token.

Solana [SOL] has fared well against the current bearish market as the price has risen more than 5% in the last 24 hours, according to CoinMarketCap. While this was a bullish sign, the token could be witnessing a downfall, and here’s why.

Solana pumps!

The ETF approval negatively impacted the prices of most cryptos as their price charts turned red. However, Solana behaved differently when it started a bull run.

At the time of writing, SOL was trading at $96.88 with a market cap of over $41.8 billion, making it the fifth largest cryptocurrency.

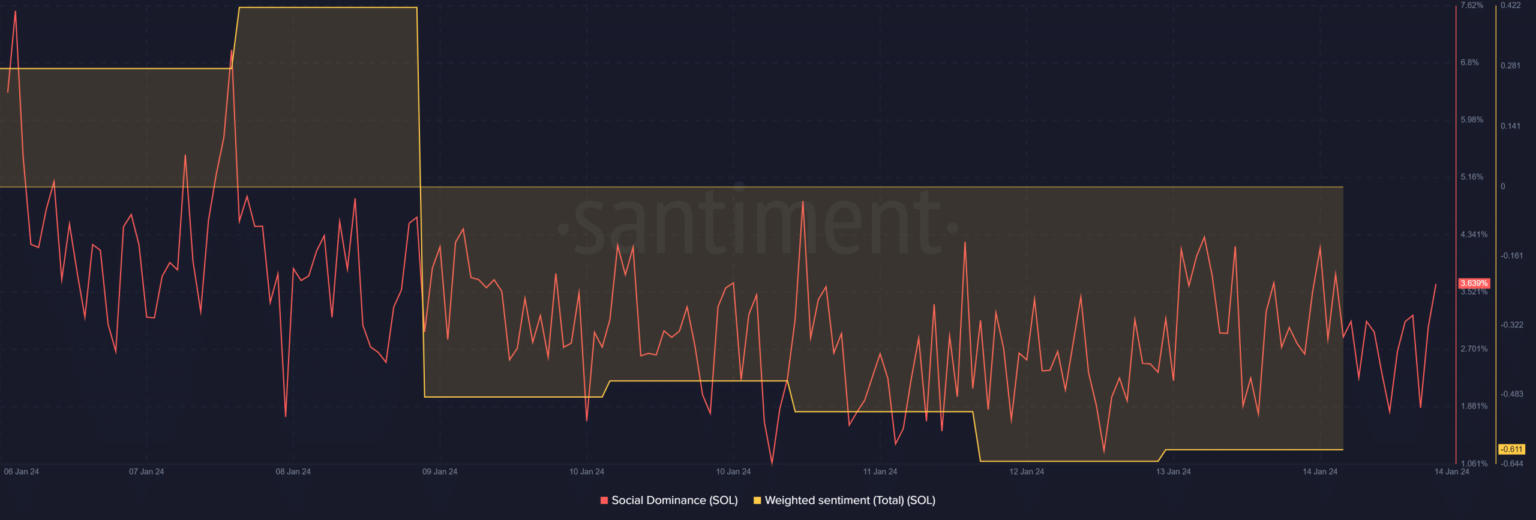

As the price of the crypto rose, AMBCrypto planned to monitor the social metrics. Despite the price increase, SOL’s social dominance declined last week, meaning its popularity declined.

Weighted sentiment also remained low, meaning that bearish sentiment around the token was dominant in the market.

Source: Santiment

Will the price of Solana drop further?

According to the latest data set, SOLThe price of SOL showed a pattern that suggested that the price of SOL could decline. Crypto Tony, a popular crypto analyst, recently posted a tweet highlighting the scenario.

According to the tweet, Solana’s price could fall to $76, which could be a great opportunity for investors to accumulate more SOL.

A pullback to $76.00 would be a good buying opportunity, if we can hold it of course pic.twitter.com/hqx4zw0DL6

— Crypto Tony (@CryptoTony__) January 13, 2024

Therefore, AMBCrypto checked SOL’s statistics to understand whether the possibility of SOL falling to $76 was feasible. According to our analysis, the chances of SOL falling to the above level seemed low as the Binance Funding Rate remained high.

This meant derivatives investors bought SOL at the higher price at press time. Moreover, SOL’s Open Internet rose in parallel with the price, indicating a continuation of the current trend.

Source: Santiment

Realistic or not, here it is SOL market cap in terms of BTC

To better understand what to expect from Solana, AMBCrypto checked SOL’s daily chart. Remarkable, SOLThe Money Flow Index (MFI) and the Relative Strength Index (RSI) recorded slight increases, suggesting a potential price increase.

However, the rest of the statistics were not so positive. Solana’s MACD showed a clear bearish crossover. The Chaikin Money Flow (CMF) also headed south, indicating that the token’s bull rally may soon end.

Source: TradingView