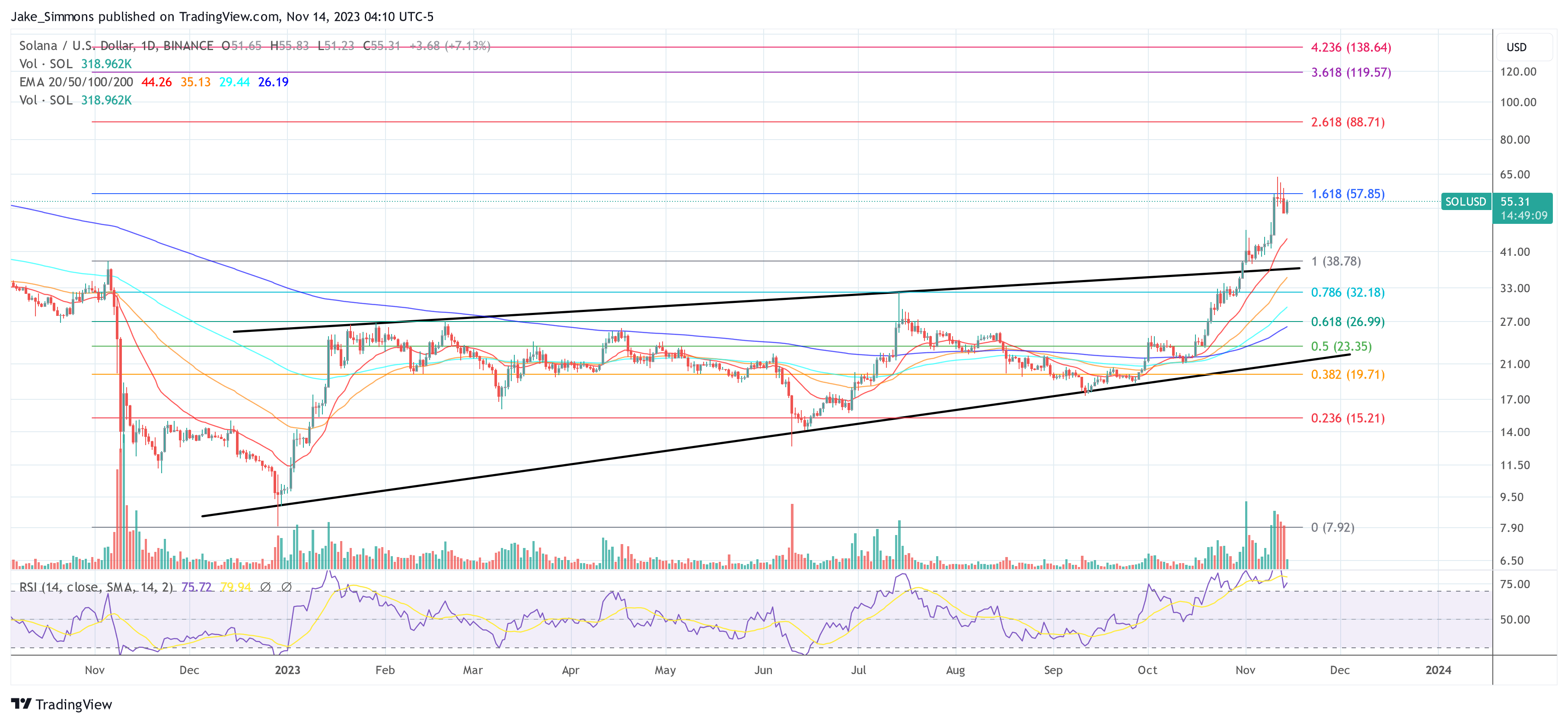

After a significant drop to $51.27, Solana (SOL) is currently witnessing a remarkable recovery in its market price, currently trading at $55.31 (+7%). This rebound follows a period of intense volatility, with SOL peaking at $63.80 last Saturday, an impressive 270% rally over 61 days, before falling nearly 20%.

The FTX Factor in the Solana Price Movement

FTX has likely had a significant impact on SOL’s price volatility. A report from Lookonchain, an on-chain analytics service, indicates that FTX’s liquidity in SOL has drastically decreased, leaving Solana worth just $185,000 in their public addresses. “FTX deposited 250,000 SOL ($13.6 million) on Kraken 7 hours ago. Currently, FTX public addresses on Solana have only 3,408 SOL,” Lookonchain reported.

FTX has deposited 250K $SOL($13.6 million). #Kraken 7 hours ago.

Currently, FTX’s public addresses are listed at #Solana have only 3,408 $SOL ($185K) left.https://t.co/A4CyCXgVzS pic.twitter.com/4EVtrwoYyX

— Lookonchain (@lookonchain) November 14, 2023

Crypto influencer MartyParty commented on the situation, criticizing FTX’s strategy to liquidate SOL holdings for creditor payments as “one of the most idiotic moves in crypto history.” According to his observations, FTX’s liquid SOL has been fully released to the market, which means an end to its influence on SOL price dynamics.

Meanwhile, crypto analyst Bluntz pointed out that despite FTX’s consistent selling of SOL ranging from 250,000 to 700,000 per day over the past three weeks, the price of SOL managed to remain resilient. He suggests that with the depletion of FTX’s unlocked tokens, a significant price increase for SOL could be imminent: “Once this seller is gone, I can only imagine how hard it’s going to pump. Don’t make this a middle bend.”

FTX’s remaining SOL positions

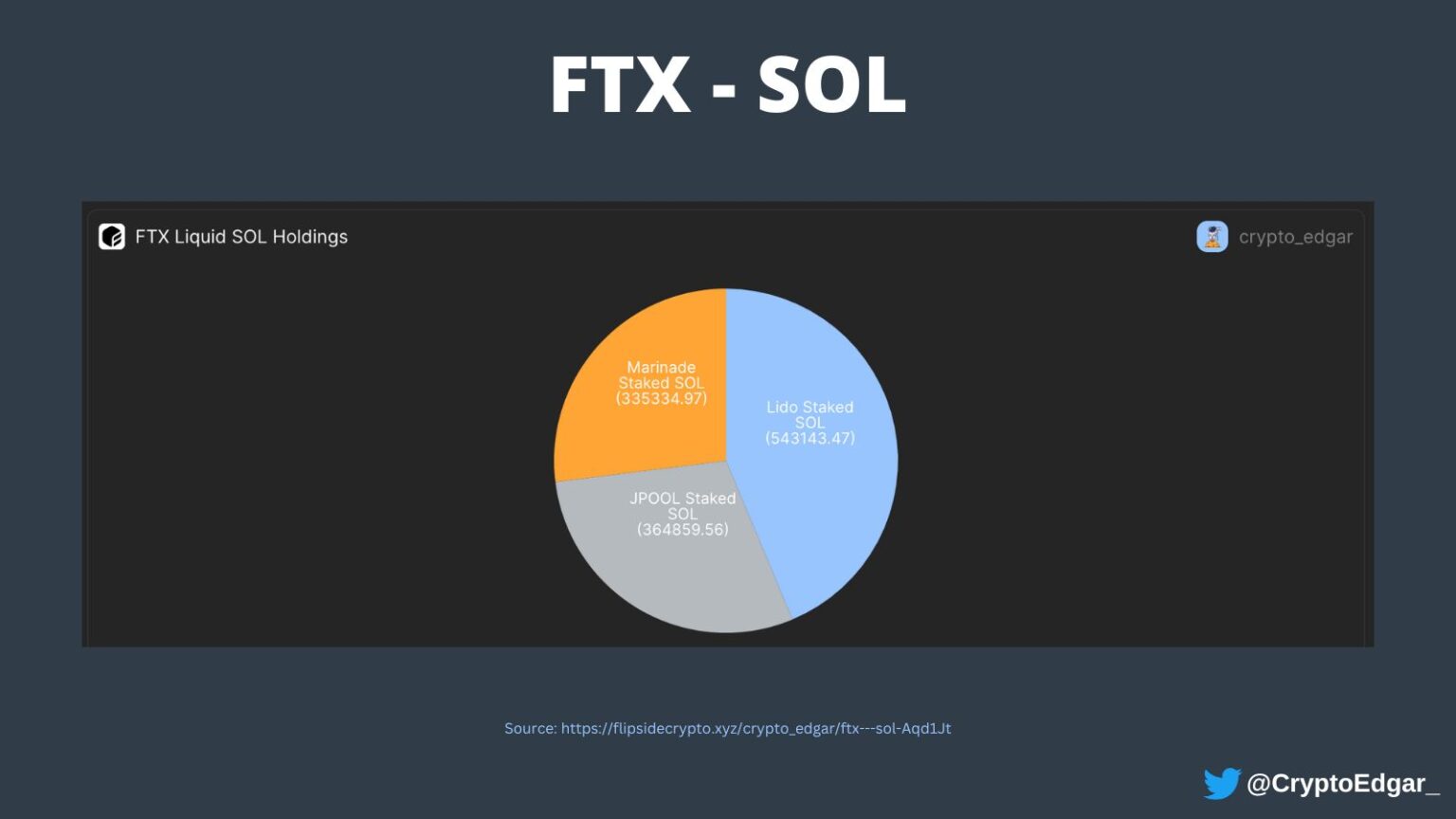

Even though FTX has sold 6.996 million SOL in the last few weeks, they are still sitting on a huge pile of Solana. Crypto Edgar provided one Overview of FTX’s SOL holdings, highlighting that while the bulk of SOL transfers from FTX’s cold wallets have been completed, a significant amount remains invested in various liquid equity solutions, which may be available for future sale.

“The FTX cold wallets are running out of SOL, but they still contain some amount of liquid SOL invested in liquid stake solutions Lido Finance, Marinade Finance and JPool. A total of 1.25 million SOL is still blocked, but it can also be easily withdrawn and sold,” the analyst noted.

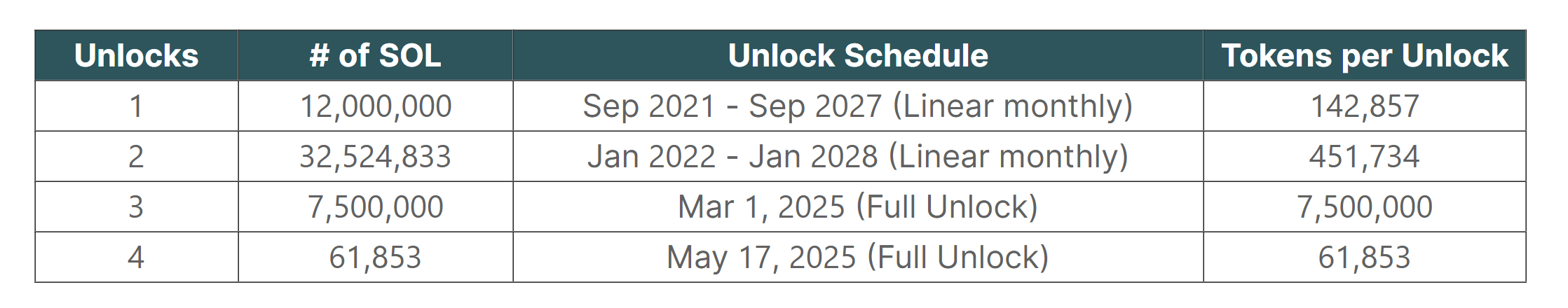

Moreover, it is important to note that FTX still holds 42.2 million SOL, worth $2.19 billion under lockup. Under the SOL release schedule, 618,400 SOL will be released every month. This regular monthly unlock accounts for approximately 1.1% of FTX’s entire SOL holdings. In particular, a major event is planned for March 1, 2025, during which 7.5 million SOL will be unlocked.

In conclusion, while some influencers are celebrating the end of the FTX sale, this is not the full reality. While much of the selling pressure has been well absorbed by the market in recent weeks, there is no end in sight yet. The FTX factor for the Solana price still exists.

Despite this, the SOL price has shown tremendous strength in recent weeks given the massive selling pressure from FTX. At the time of writing, SOL was trading at $55.31, making the 1,618 Fibonacci extension level at $57.85 once again the key resistance for the bulls.

Featured image from Shutterstock, chart from TradingView.com