Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

Solana (SOL) has been an intensive sales pressure, where the price does not live back the most important resistance levels after weeks of anxiety -driven market conditions. Bulls lost control when Sol dropped below $ 180, a crucial level of support that held earlier. Since then, Beerarish sentiment has been dominated, with speculation increasing over a potential bear market for SOL and the wider Altcoin sector.

Related lecture

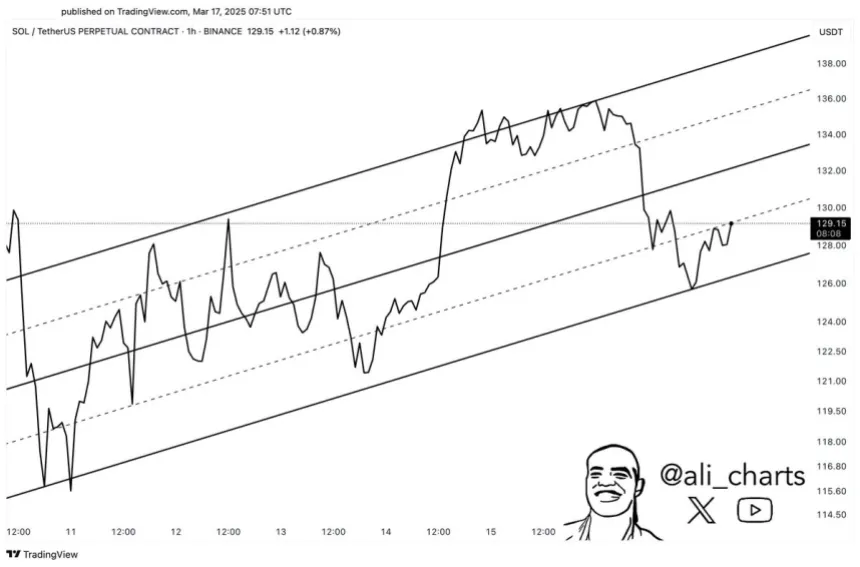

Despite these negative prospects, there might be a spark of hope for Solana Bulls. Top analyst Ali Martinez shared a technical analysis of X, which showed that SOL forms a bullish channel in the short -term time frame. This pattern suggests that if Solana applies within this formation, an increase in higher price levels could follow.

To have this bullish scenario play, Sol must hold the lower trend line of the channel and push to higher resistances. An outbreak of this pattern can indicate a strong recovery, which may possibly reverse the downward trend that the market has dominated. However, if Solana does not retain this structure, the risk of further downward disadvantage remains high. In the coming days will be crucial in determining the short -term direction of SOL.

Solana is confronted with risks in the midst of volatility

Solana has had to deal with ruthless sales pressure since he reached his high of $ 261 in January, now 61% from that peak. Because the hope for a huge bull run blurring continues to grow around a potential bear market. The wider macro -economic environment remains unfavorable, with trade war fears and economic uncertainty that not only push the cryptomarket but also the US stock market down.

Investors are now looking for signs of a reversal and technical indicators suggest a potential recovery in the short term. Martinez’s analysis on X It reveals that Solana forms a bullish channel and views a climb from the base of the channel to the upper resistance at $ 140. If this pattern applies, Sol can push $ 140 and even higher levels, indicating a reliever.

For these bullish prospects to be a matter of, Solana must retain its current trendline support and break through important resistance levels. If Sol does not hold this channel, it can be further down, which enhances the fear of a long -term bear market. In the coming days will be crucial to determine whether Solana can recover the momentum or continue its downward process.

Related lecture

Solana is struggling while bulls fight to regain the momentum

Solana (SOL) currently acts at $ 129, after days of consolidation between $ 136 and $ 111. The price promotion remains uncertain, with Bulls having trouble recovering the check after weeks of sales pressure.

For a possible reversal, SOL must break above the resistance level of $ 140 and push to $ 160, an important level that would indicate a shift in the market structure. If Bulls successfully reclaim these price points, a stronger recovery phase could start, so that new buyers may be pulled on the market again.

However, if Solana does not support $ 125, this can cause a wave of sales pressure, which means that the price is sent to lower demand zones. A break below this level can expose Sol to a drop to $ 110 or even lower, which strengthens the concern that the current downward trend is not nearly over.

Related lecture

The next few trade sessions will be crucial to determine whether Solana can regain the momentum or that further falls are for us.

Featured image of Dall-E, graph of TradingView