- The recovery of Solana is under pressure from large -scale sale and weak sentiment.

- In addition to Technically, Solana was engaged in controversy.

Solana [SOL] Has deposited 36% this month and ranks as the worst performing topactive. An increase of 2% in the trade volume, in combination with an Oversold RSI and a Bullish MacD -Crossover, indicates potential dip that buys around $ 120.

With risk -still low, can Sol Bulls only use technical means to introduce a recovery?

Beyond the charts: key factors in the game

Pumpfun recently continues to feed the sales pressure on Solana transfer 196,370 Sol worth $ 25.3 million for Kraken.

A total of 2,629,656 SOL worth $ 511 million for $ 194 and hit the 264,373 Sol for $ 41.64 million USDC at $ 158, which contributes to the current decline.

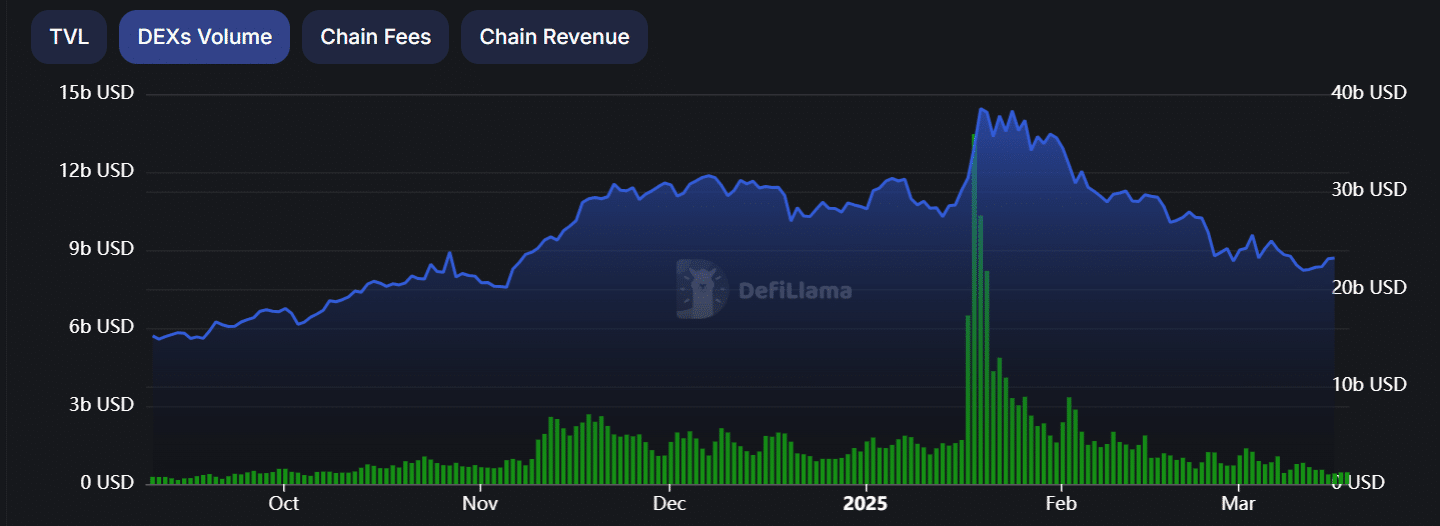

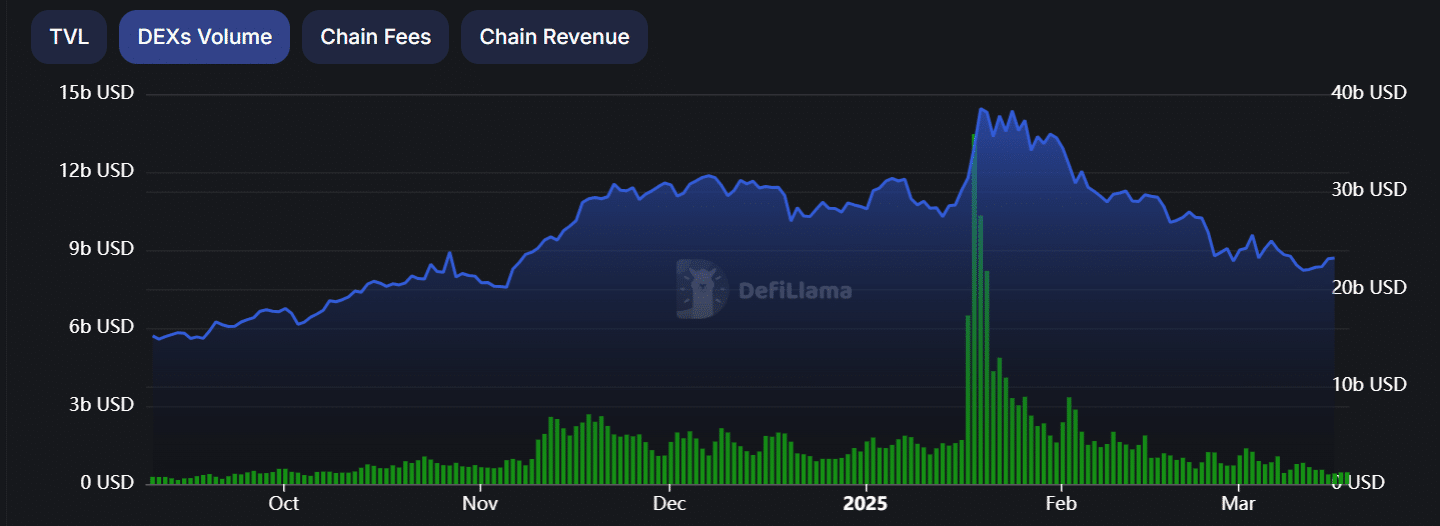

With increasing liquidity on the sales side in a risk-off market, a rebound looks uncertain. In the meantime, the Dex volume of Solana and TVL have been reduced to before the elections, which indicates weakening network activity.

Historically, the recovery phases of Solana are characterized by double figures growth in TVL and DEX volume, which often indicates a market base.

On March 15, however, the Dex volume fell below $ 1 billion, so that concern was expressed about a potential trend removal.

Source: Defillama

Unless traders intervene with a strong buy-side momentum, further disadvantage remains. In addition to the uncertainty, Solana is now confronted with a recoil on a controversial advertisement on X (formerly Twitter).

The advertisement, which gained 1.2 million views, received an overwhelming negativity, forcing Solana to remove it. However, the damage was caused and, however, influenced the market sentiment.

Composite bearish signals, weighed sentiment has reversed Negative, the strengthening of the lack of bullish confirmation and suggests that investors remain careful about a possible rebound.

Review of the next step from Solana

The Solana price action emphasizes a persistent imbalance of the offer. While Bitcoin consolidates, Solana still has to see strong burglaries of strategic investors.

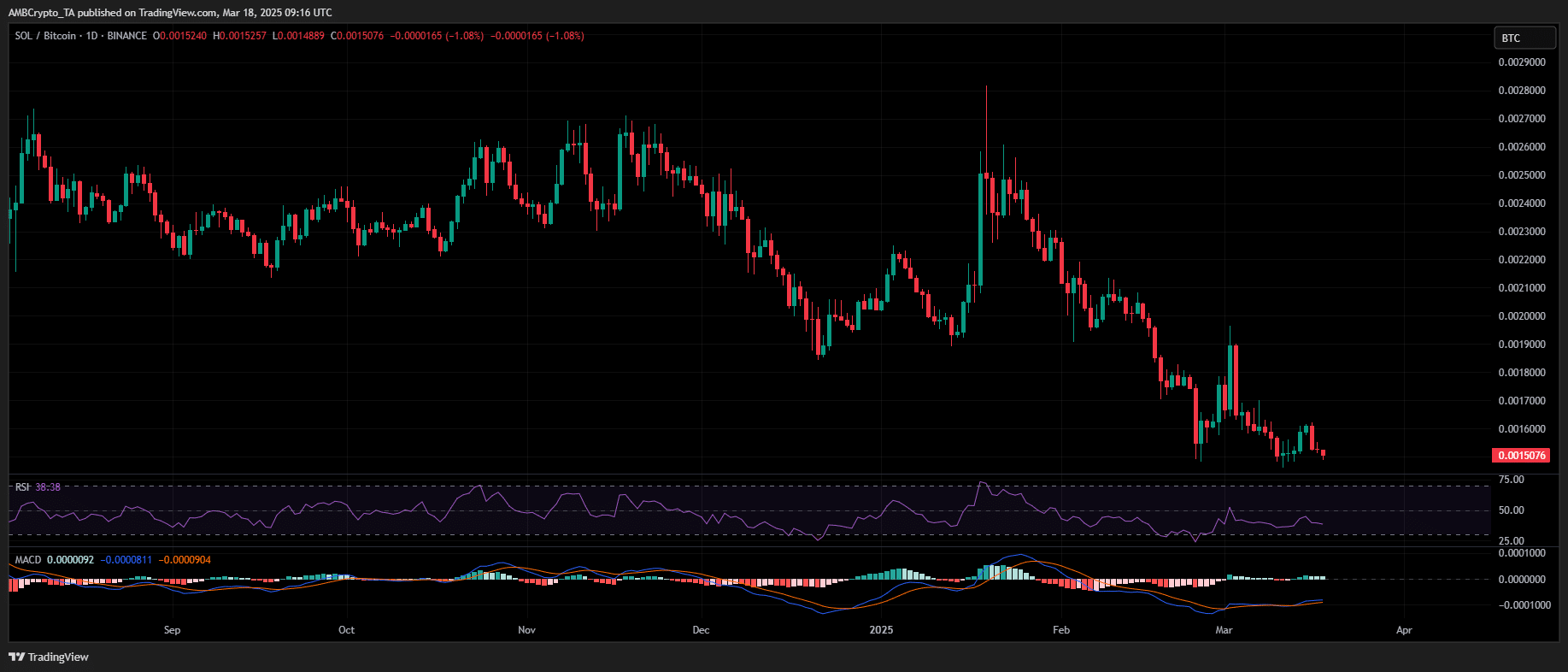

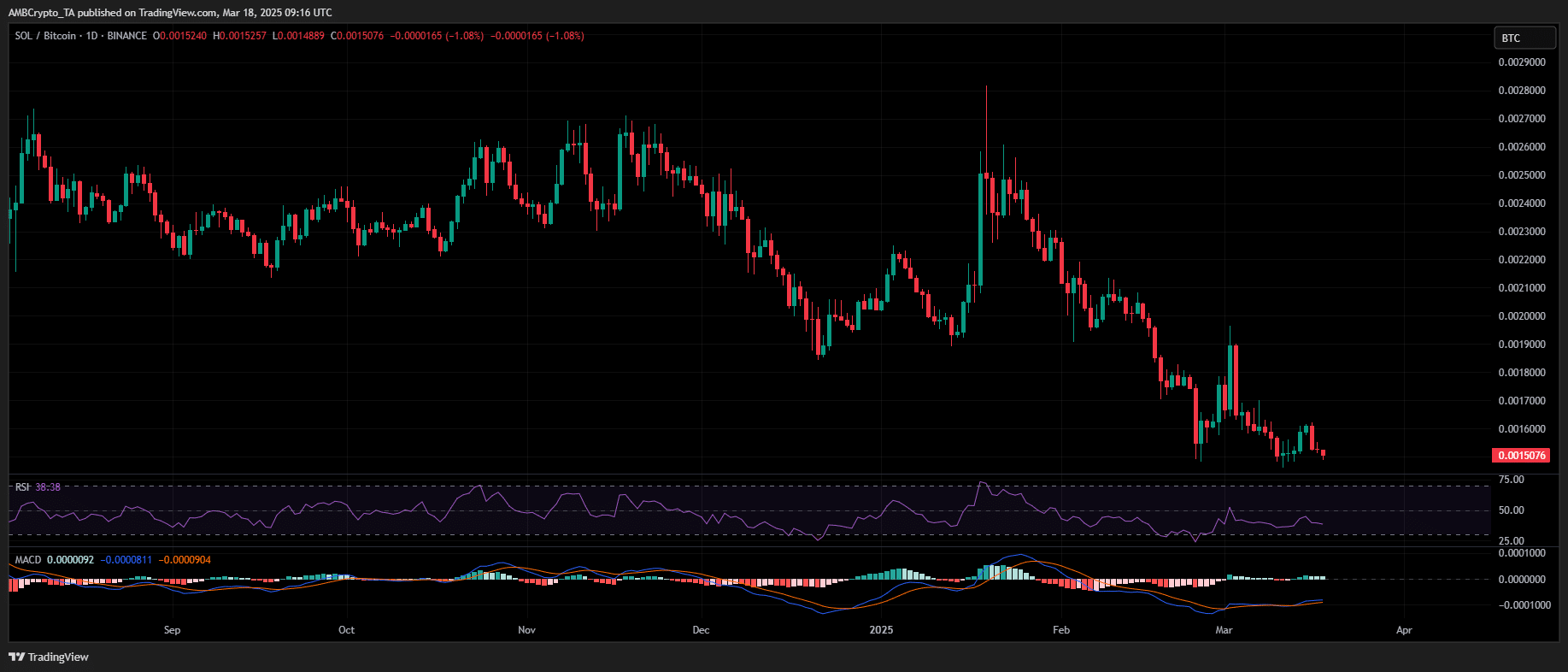

Despite a monthly fall of 30%, the reduced prices did not cause strong accumulation. The SOL/BTC purple continues to print lower lows, which recently prints to a two-year layer, signaling of weakening relative strength.

Source: TradingView (SOL/BTC)

With large -scale sale and bearish sentiment that dominate, the absence of conviction of risk -managed traders weakens the chances of SOL to reclaim the most important resistance levels.

Given the current market dynamics, a further withdrawal to $ 120 or lower seems to be more and more likely.