- Solana’s market share increased to 33.76%, compared to just 1.17% a year ago.

- SOL regained its bullish strength and bounced above $100 for the first time in more than two weeks.

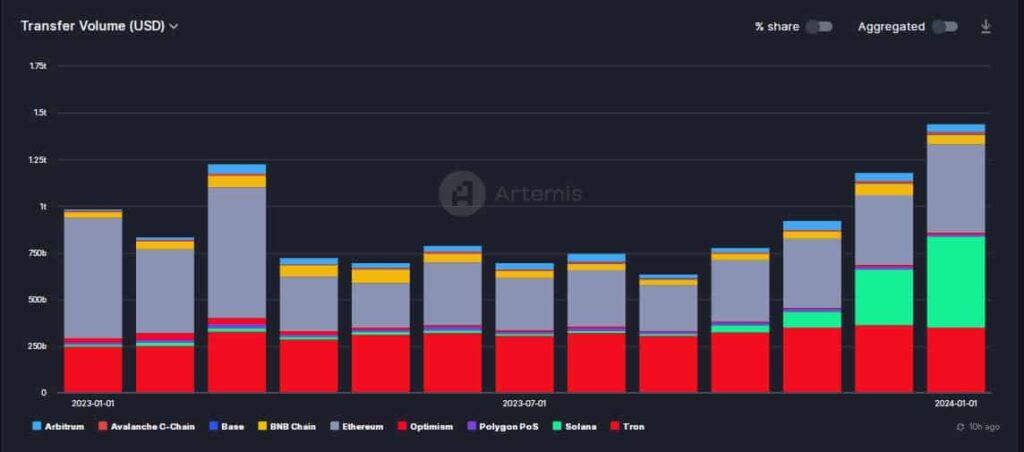

Solana [SOL] became the largest blockchain for stablecoin transfers in January, surpassing Ethereum’s [ETH] and Tron [TRX] For the first time.

According to AMBCrypto’s review of Artemis data, stablecoins worth $497 billion were transferred on the Solana blockchain in January, a record high.

This increased Solana’s market share to 33.76%, compared to just 1.17% a year ago.

Source: Artemis

Solana handles the transfer of stablecoins

Demand for stablecoins has risen dramatically over the past two months, driven largely by optimism over Bitcoin’s spot [BTC] Approval of ETFs.

Positive predictions about the market led many investors to collect top cryptos using stablecoins.

However, unlike the bear market, where Ethereum and Tron held more than 80% of stablecoin volumes, the latest surge was mainly driven by Solana.

AMBCrypto further examined the above chart and noticed a fivefold jump in monthly stablecoin volumes on Solana between November and January.

By comparison, Ethereum’s volume only rose 31%, while Tron’s stablecoin transactions remained essentially the same.

Is USDC behind the turnaround?

USD coin [USDC] was the dominant stablecoin on the Solana blockchain, with over 56% share of the total supply DeFiLlama.

Interestingly, the market capitalization of USDC on Solana has increased by more than 14% in the past month, while most other stablecoins saw a decline.

This strongly indicated that USDC volumes on Solana were the main drivers driving overall stablecoin transfer volumes.

SOL is in good health again

In other good news, the network’s native token SOL regained its bullish strength, bouncing above $100 for the first time in more than two weeks.

How much are 1,10,100 SOLs worth today?

According to CoinMarketCapAt the time of writing, SOL was exchanging hands at $104, marking a 30% gain over the past week.

As expected, the bullish price action caused traders to go long on this asset. SOL’s bullish bets outpaced bearish bets over the past two days, AMBCrypto noted using Coinglass data.

Source: Coinglass