- Solana remained stable despite increased traffic through Jupiter.

- SOL is down almost 6% in the last 24 hours.

Solana [SOL] recently underwent an airdrop event. The network underwent a stress test due to the significant number of users participating in the airdrop.

This event led to notable changes in certain critical network metrics.

Jupiter falls on Solana

On January 31, Jupiter, the largest decentralized exchange (DEX) on Solana, hosted an airdrop event on the network. The airdrop generated a lot of attention from users.

Before the airdrop, Jupiter achieved remarkable milestones, surpassing major networks like Ethereum [ETH] in daily amounts.

According to data from CoinMarketCapthe newly launched JUP token recorded a trading volume of over $1.2 billion in the past 24 hours.

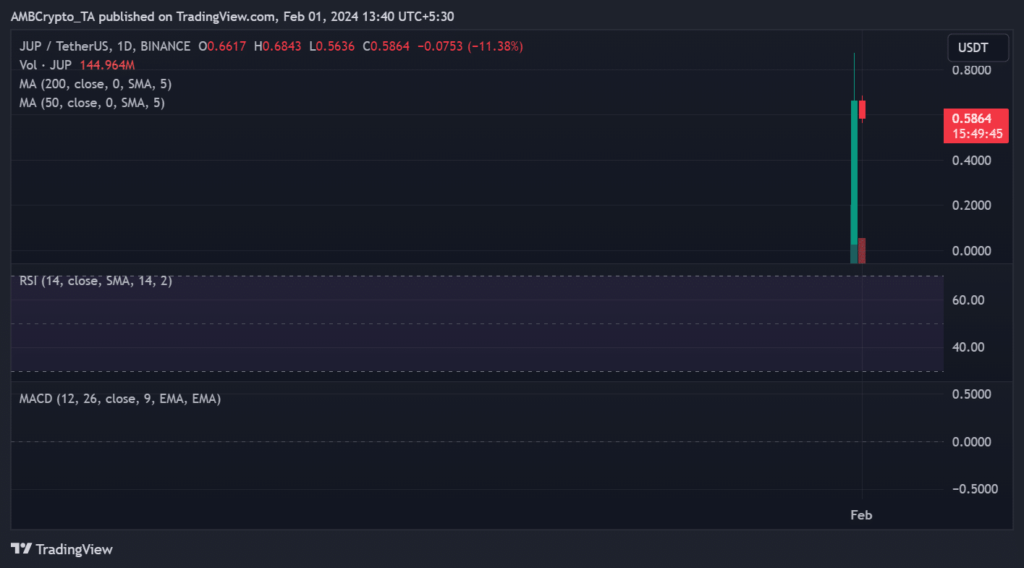

AMBCrypto’s analysis of the JUP token showed that it opened its trade around $0.03. The token rose, reaching $0.8 before closing trading at around $0.66.

However, at the time of writing this, the price was trading around $0.5, which represents a loss of over 11%.

CoinMarketCap’s data also showed that the token had lost more than 60% of its market capitalization in the past 24 hours. At the time of writing, its market capitalization was approximately $790.8 million.

Source: trading view

Solana stays online despite traffic

Solana’s recent airdrop event has drawn attention to previous concerns about the network’s performance. This led observers to doubt its ability to handle the increased traffic.

a message on X (formerly Twitter) revealed that the network experienced a 45% transaction loss during the airdrop. Nevertheless, the network successfully absorbed the entire traffic.

Examination of network uptime revealed that all platforms on the Solana network maintained 100% functionality. A review of the network status also revealed that there had been no downtime in the past 90 days.

Solana sees record volume

AMBCrypto’s investigation of DefiLlamas Data showed that Solana’s volume reached one of its highest points in history on January 31. The chart showed an increase in volume to about $1.5 billion.

This was remarkable given the network’s historical record. The analysis also showed that Total Value Locked (TVL) experienced a significant increase in the lead-up to the airdrop event.

Source: DefiLlama

As of approximately January 23, TVL increased from approximately $1.3 billion to $1.6 billion on January 30. At the time of writing, it was around $1.6 billion, down slightly from the peak.

This data suggested increased activity and value within the Solana network before the airdrop.

SOL doesn’t fly

Despite the airdrop event, AMBCrypto’s analysis of Solana’s daily timetable showed that it had no positive impact on price performance.

Is your portfolio green? View the SOL Profit Calculator

On January 31, the chart showed an opening price of around $102. At the end of the day there was a decline of more than 4%.

At the time of writing, this downward trend continued, with the SOL trading around $95, reflecting a further decline of around 1.9%.

Source: TradingView