- The supply of BTC on exchanges declined, while the off-exchange supply increased.

- Selling sentiment dominated the derivatives market, however.

From Bitcoin [BTC] price has been moving sideways for quite some time as the coin moved comfortably below $30,000. However, despite the slow-moving price action, MicroStrategy announced its plans to acquire a significant amount of BTC.

Is your wallet green? Check the Bitcoin Profit Calculator

MicroStrategy’s actions are often considered a leading indicator for bitcoin. Will MicroStrategy’s decision to acquire more BTC motivate retail investors to increase their accumulation?

MicroStrategy’s Bitcoin buying trend looks interesting

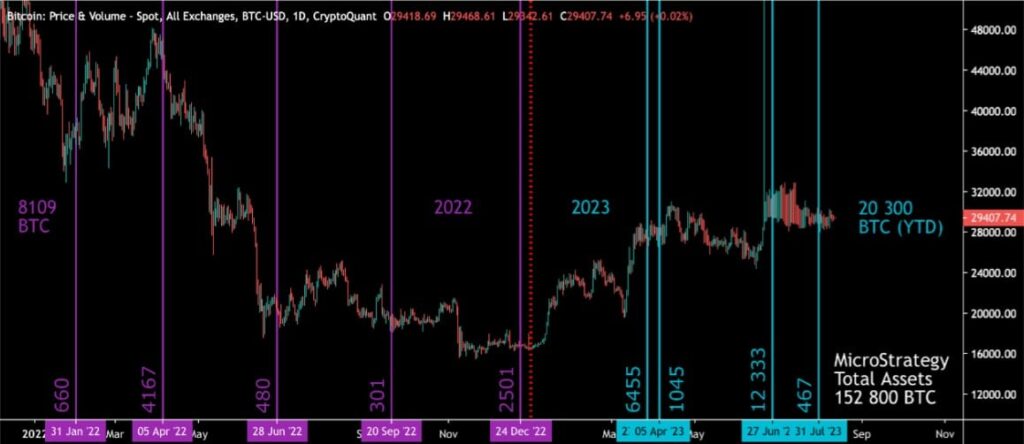

An analyst at CryptoQuant recently pointed out analysis about MicroStrategys BTC buying trend. The company announced an additional purchase of 467 bitcoins, increasing the company’s assets under management to 152,800 units. These coins were purchased by MicroStrategy for a total amount of $4.53 billion, or an average price of $29,672 per coin.

MicroStrategy increased its purchase rate this year, acquiring a total of 20,300 BTC. According to the analysis, compared to 2022, when the company added 8109 BTC to its balance sheet, the year-over-year growth in August 2023 exceeded 150%.

Source: CryptoQuant

MicroStrategy made this decision to increase accumulation ahead of the upcoming BTC halving. Historically, the price of BTC has always reached new highs a few months after halvings. For reference, after the 2020 halving, Bitcoin experienced a phenomenal rise in late 2020 and early 2021, breaking previous records and producing a rally of around 600% in just under 7 months.

Given the growth potential, MicroStrategy might have jumped at the chance to acquire more coins while keeping the price of the king of cryptos below $30,000.

Do private investors buy Bitcoin?

As institutional investors increased their holdings, a look at Bitcoin’s stats revealed that retail investors were also accumulating. According to Santiment’s chart, BTC‘s supply on exchanges decreased while supply outside exchanges increased.

This statistic suggested that the coin was under buying pressure. In addition, whale activity around BTC also remained high, which seemed optimistic.

Source: Sentiment

Read From Bitcoin [BTC] Price prediction 2023-24

BTC’s exchange rate reserve also decreased, further showing that investors were buying the coin. However, the buying pressure may not have an impact BTCshort-term price positive. The SOPR was red, meaning more investors were selling at a profit.

Things in the derivatives market also looked bearish as BTC’s buy/sell ratio turned red. At the time of writing, BTC was trade at $29,372.01 with a market cap of over $571 billion.

Source: CryptoQuant