- Short-term Bitcoin holders found themselves heavily underwater, according to Glassnode, and pose a significant risk to BTC if they choose to sell.

- However, these traders’ loss-making activity remains below bear market levels despite the fear gripping the market.

Bitcoin [BTC] fell 22% from its all-time high above $73,000. The price drop left short-term Bitcoin holders who bought during the early 2024 rally with a significant amount of unrealized losses.

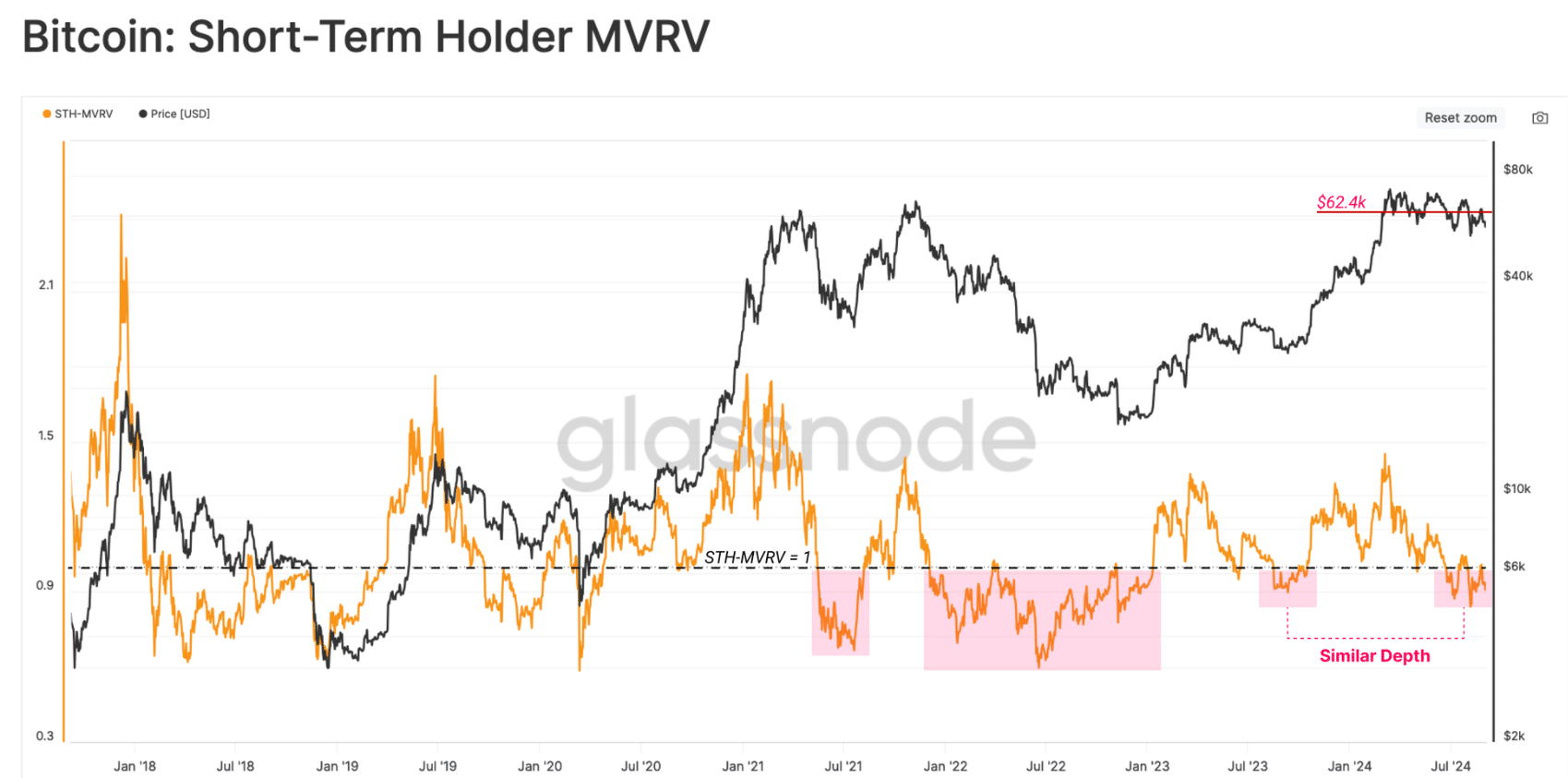

In the weekly onchain report Glass junction noted that the market value to realized value ratio (MVRV) for short-term holders has fallen below the breakeven value of 1.0.

This indicates that the average new investor has not yet broken even.

This cohort will return to profitability once Bitcoin recovers $62,400. BTC was trading at $56,785 at the time of writing, meaning it needs to rise 9% before these traders can make a profit again.

Source: Glassnode

Short-term Bitcoin holders pose a risk to Bitcoin if they choose to sell to minimize their losses. Nevertheless, the unrealized losses do not yet reflect previous bear markets and instead show a choppy trend.

Selling activity remains below bear market levels

While some Bitcoin holders suffer unrealized losses, some sell to minimize downside risk. According to Glassnode, losing events have increased significantly, with more traders dumping once Bitcoin makes a higher low.

However, these sales have yet to reach the extreme levels seen during the 2021 and 2022 bear markets, despite the Bitcoin fear and greed index at the age of 29, with a state of anxiety.

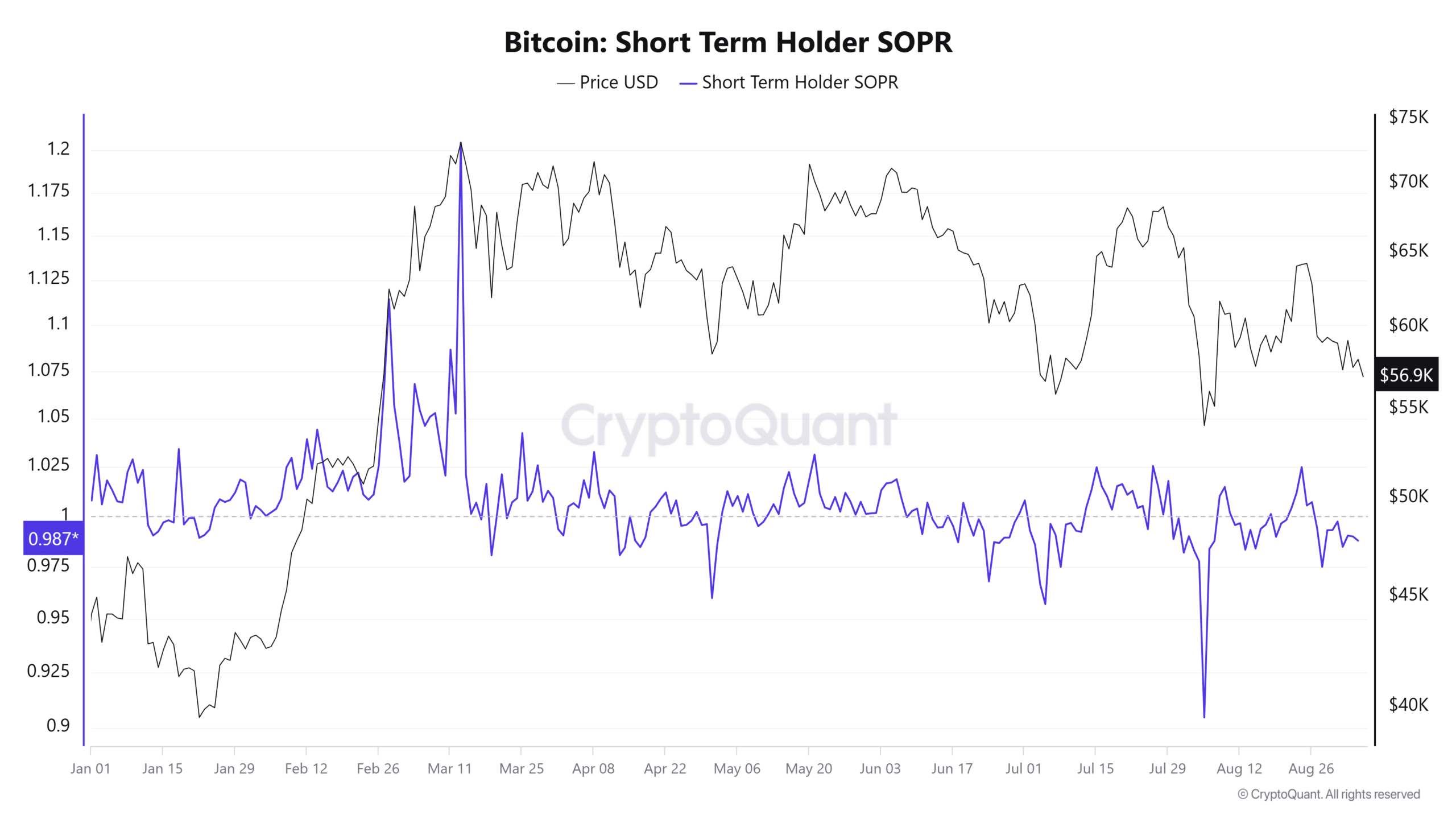

Short-term selling behavior can also be seen in the Spent Output Profit Ratio (SOPR) on CryptoQuant. This measure is below 1, which indicates that some traders are willing to sell at a loss.

However, the ratio has not yet fallen to a record low, indicating that more traders are willing to hold BTC.

Source: CryptoQuant

Long-term Bitcoin holders have also slowed profit-taking activity. The supply of coins in the hands of these traders has also increased significantly, a trend that typically precedes a transition into a bear market.

Glassnode concludes that the decline in losses and profit-taking indicates saturation at current prices and the likelihood that volatility will increase soon.

Bears continue to dominate the BTC price

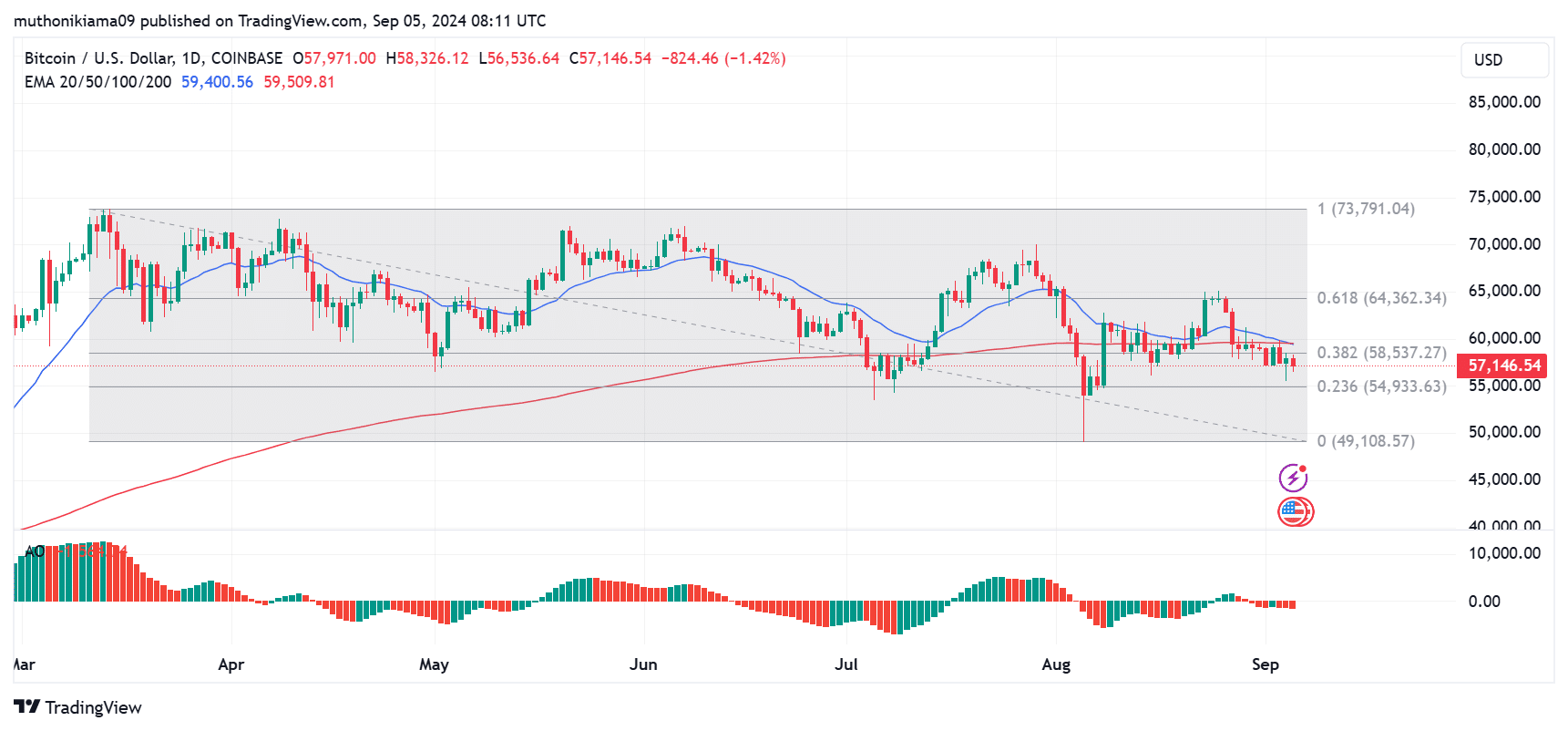

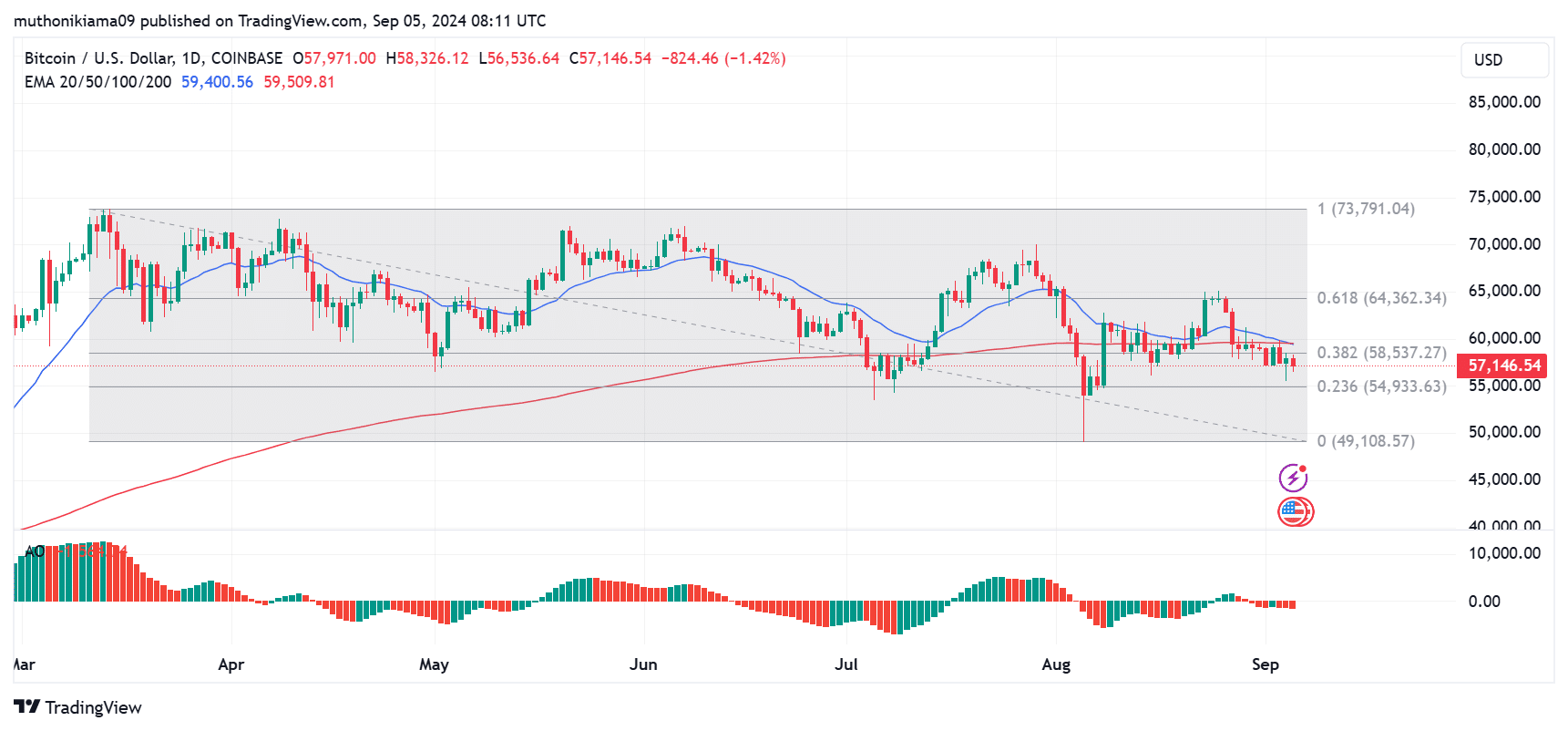

Over the past six months, Bitcoin has been making lower highs on the daily chart. Despite periods of buying activity, bears continued to dominate the market.

The Awesome Oscillator (AO) proved the bearish thesis after being mostly in the negative region since August. The AO histogram bars were also red, which is typically a sell signal as bearish conditions continued to prevail.

The 20-day exponential moving average (EMA) has converged with the 200-day EMA from above, showing a weakening of short-term momentum.

Source: TradingView

The one-day chart also showed BTC rejected at resistance at $58,530, indicating a lack of demand. BTC is now at risk of falling to test resistance at around $54,900 or the 0.236 Fibonacci retracement level.

BTC must hold this support to avoid further decline. However, judging by past trends, BTC has made slight gains every time this support has been tested, indicating a concentration of buy orders at this price.

Read Bitcoin’s [BTC] Price forecast 2024–2025

Nevertheless, Bitcoin holders should still be cautious as the market suggested selling behavior.

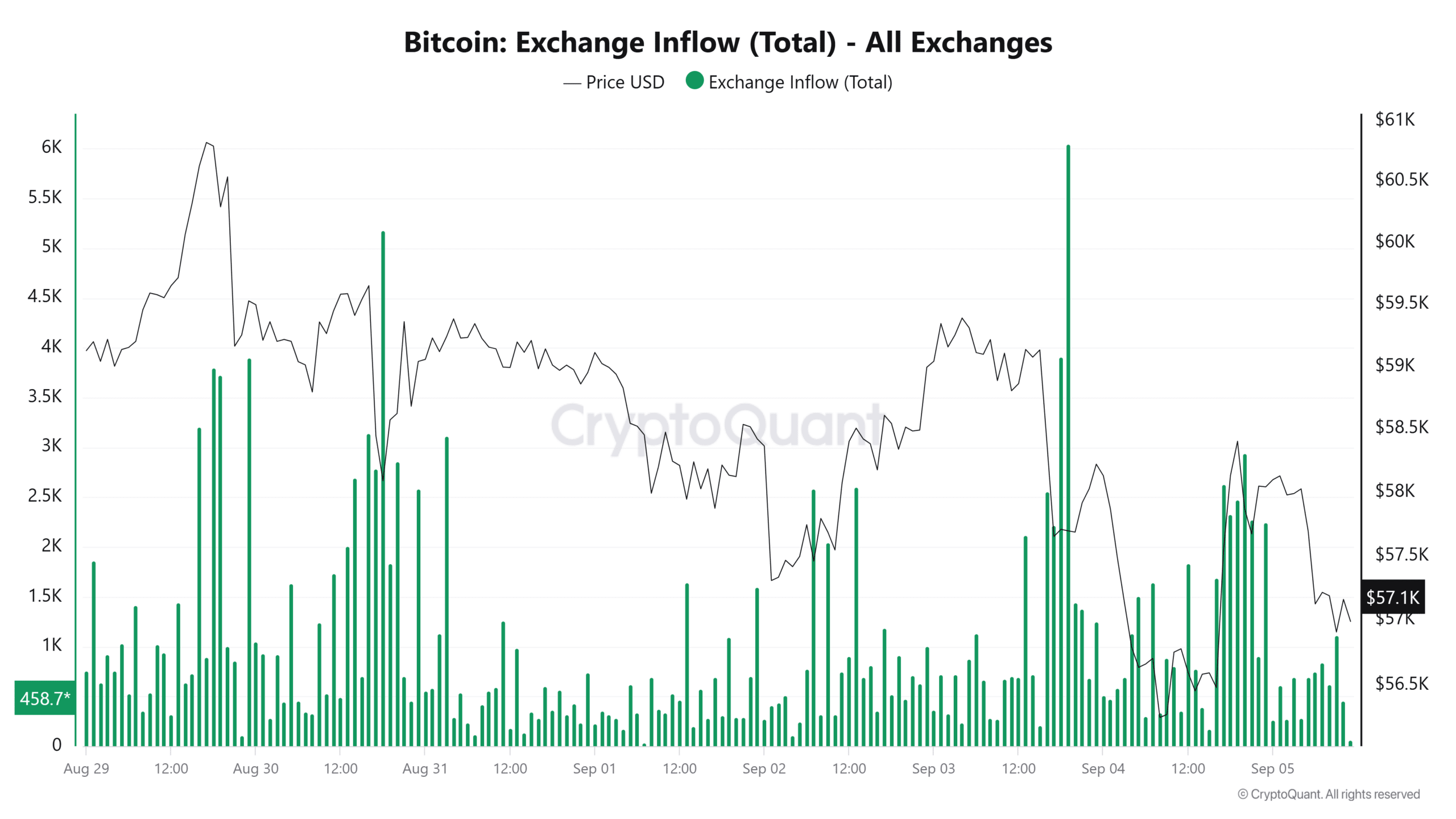

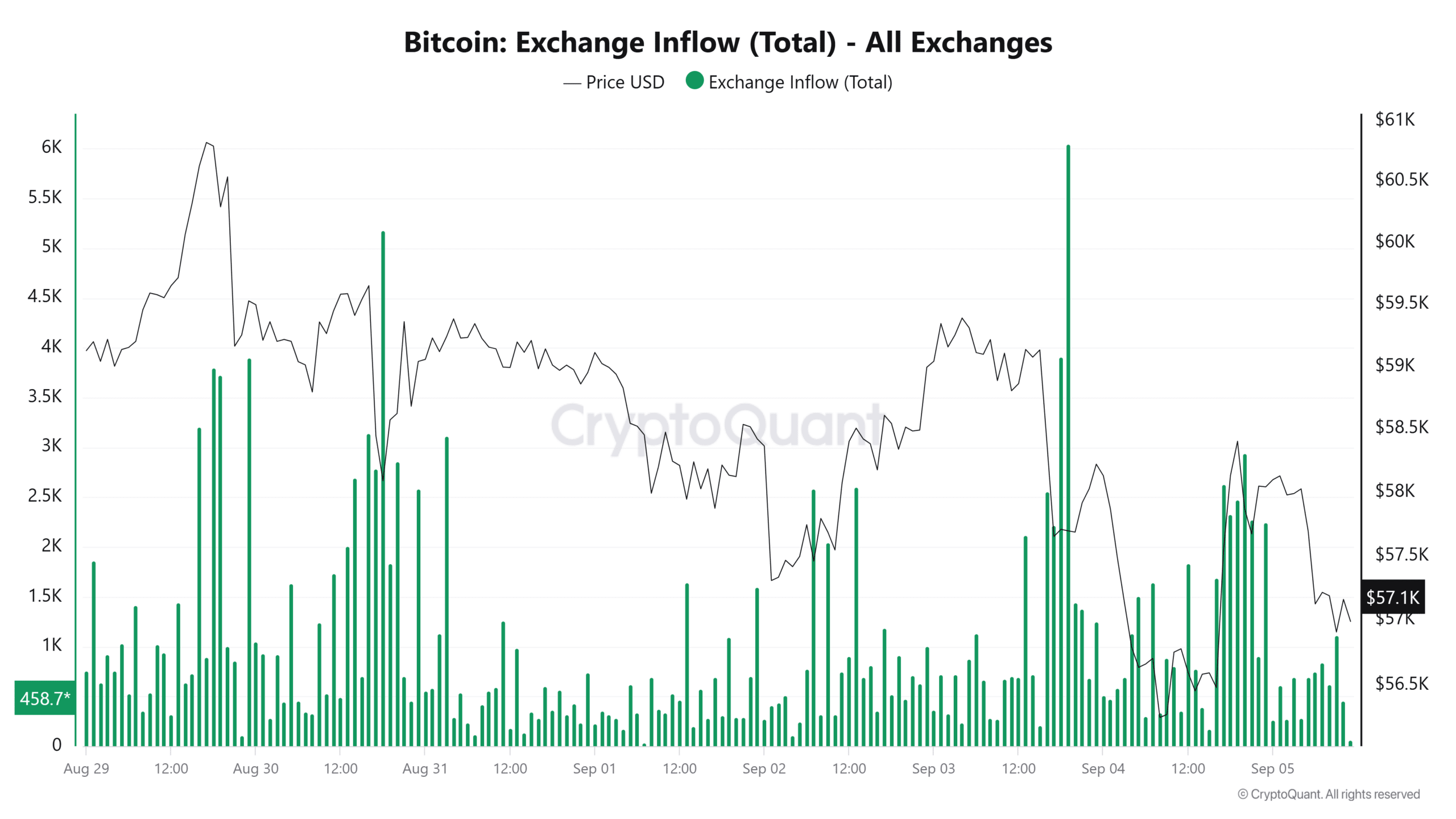

According to CryptoQuant, BTC exchange inflows surged on September 4, indicating bearish sentiment as traders expect further price declines.

Source: CryptoQuant