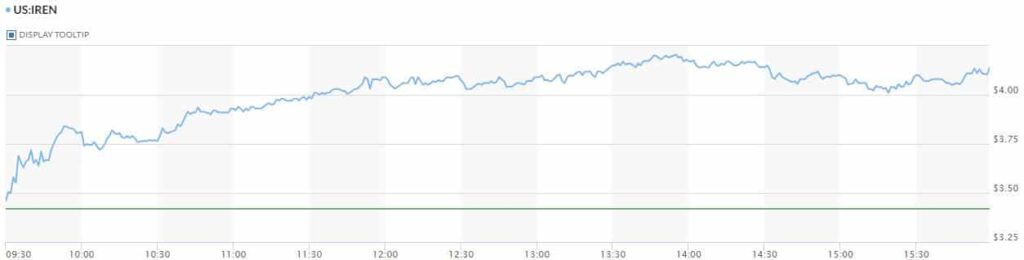

- Shares of the company rose as much as 18% in a day on Nasdaq, from $3.55 to $4.20.

- Iris Energy has three data centers in BC, Canada and one in Texas, USA, the focus of the latest effort.

Shares of Bitcoin mining company Iris Energy (IREN) rose as much as 18% in a day as the company announced its plans to increase its hash rate capacity by 63% to 9.1 EH/s by early 2024.

Iris Energy is currently developing 80 MW of data center space to complete Phase 1 of its 600 MW plant in Childress, Texas.

The company said in a press release,

“The near-term focus remains on data center construction, while maintaining flexibility regarding the timing of mining purchases, which is dependent on funding and market conditions.”

Iris’s current hash rate capacity is 5.6 UH/s, which is in line with its February 2023 projections, when the company expected significantly tripling its capacity from a measly 2.0 EH/s.

In November 2022, the company was forced to reduce its capacity by 3.6 EH/s after being forced to shut down multiple mining units used as collateral for $103 million loans.

According to Iris, the lender behind those debts is still looking for solutions. The lender has attempted to ensure that any additional Bitcoin mining revenue earned by Iris is used as collateral to secure lending opportunities. However, Iris believes that these claims do not deserve attention.

Iris Energy is also considering expanding into energy-intensive computing applications such as artificial intelligence.

Mining Expands As Crypto Industry Recovers From FTX Debacle

Iris Energy has three data centers in British Columbia, Canada and one in Texas, USA. The company is expanding its Texas mining center facility.

Other crypto mining companies, such as Block current And CleanSparkhave also announced significant expansions of mining power this year as Bitcoin price attempts to recover from its post-FTX lows.

Shares of the company rose 18% on the day from $3.55 to $4.20 on Nasdaq following the announcement. At the time of writing, the stock was trading at $4.13.

Source: Market overview