Este Artículo También Está Disponible and Español.

The price of Bitcoin fell to $ 86,099 on 26 February, in which he sent almost $ 1.06 billion away from the market capitalization of crypto and ripples in the industry. According to Coinglass Tracking, around 230,000 positions are liquidated for the day.

Related lecture

As a sign of Bearish sentiment, the open interest from the digital actively has fallen to 5%, due to delevering among investors and holders. Data on chains also suggest that the influx of the exchange rose to 14.2%, which may suggest a panic sale at holders. Moreover, the financing percentages are now in a negative area, indicating that the sentiments of investors have shifted.

Huge losses for holders like BTC Test $ 86k

As the world’s best digital active, Bitcoin’s negative Price action caused many ripples in the industry. With the price test under $ 90k, thousands of positions were liquidated and strong recordings of Spot Bitcoin ETF funds were registered. According to several reports, the five -day outflow for ETF’s was $ 1.1 billion, with $ 516 million lost on 24 February.

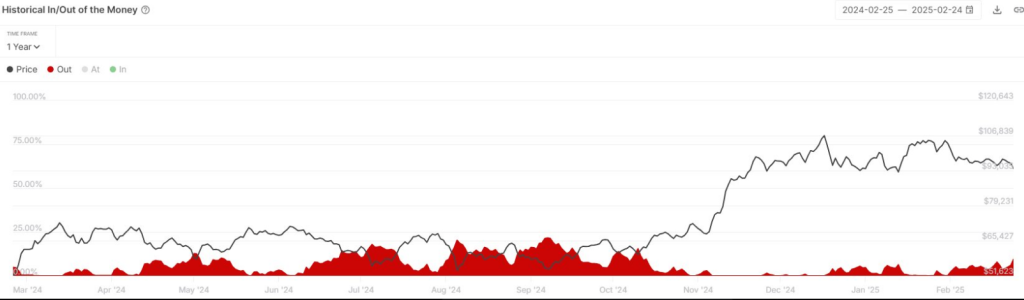

In a Twitter/X message, In De Block It noted that approximately 12% of all BTC addresses are in red. The post added that it is now the highest non -realized loss percentage for Bitcoin since October 2024.

With Bitcoin that falls shortly below $ 90k, about 12% of all Bitcoin addresses retain with loss.

🔴 This is the highest non -realized loss percentage since October 2024 pic.twitter.com/pnglz4g4wc

– Intotheblock (@intotheblock) February 25, 2025

Crypto-related shares

Apart from individual holders, members of crypto-related shares in the recent fall in Bitcoin. Michael Saylor’s Strategy Is one of the biggest victims, with its share price that has fallen by 11% in the last 24 hours. The shares of the company have fallen since the peak in November and has now fallen 55% compared to its peak.

Strategy has a portfolio worth more than $ 43 billion, including 499,096 Bitcoin. Now that the price of Bitcoin is falling, many crypto observers are speculating where strategy will sell part of its assets. However, some experts have shot this idea and say that it is doubtful that a company will fully commit itself to crypto.

Other crypto-related shares also fell, with Robinhood (hood) with 8% immersed, Coinbase (Coin) suffering a decrease of 6.4% and Marathon Digital (Mara) and Bitcoin Miners Bitdeer (BTDR) fell 9% and 29% respectively.

Traditional shares members too

Bitcoin’s underperformance was also felt in the wider market, with falls on traditional financial markets. The Nasdaq composite fell by 2.8% and the S&P 500 surrendered 2.1% of market capitalization. Observers also noticed the sudden power of the American dollar index, suggesting that many investors are looking for “safety paradone” for their investments.

Data on chains also indicate a recent increase in crypto-walvis activities. Bitcoin whales have sold more than $ 1.2 billion in digital assets.

Related lecture

According to analysts, the decline of Bitcoin is caused by macro -economic conditions. The market is still faltering from US President Donald Trump’s Tax announcementAnd geopolitical tensions between China and the United States encourage some investors to reconsider their long -term plans.

Featured image of Gemini Imagen, Graph of TradingView