- SEC has approved Grayscale’s Bitcoin Mini Trust ETFs

- With greater institutional adoption, GBTC aims to leverage the changing global financial markets

Following the successful Ethereum Mini Trust model, the SEC has now approved Grayscale’s Bitcoin Mini Trust ETF. This is launched at a low fee of 0.15%. The Mini Trust will start trading from next Wednesday, according to reports Nate Geraci. On his X page he shared:

“Grayscale Bitcoin Mini Trust 19b-4 has been APPROVED… A spin-off of GBTC will take place next Wednesday (registration date is Tuesday). Will be the cheapest spot bitcoin ETF with a price of 15 basis points.”

SEC Gives Green Light to Grayscale Bitcoin Mini Trust

The SEC announced that the Form 19b-4 for Grayscale Bitcoin Mini Trust will act as the spinoff of GBTC. The shares of the mini Trust will be distributed to GBTC shareholders as they contribute a certain amount of BTC to the said Trust, according to initial filings.

The Commissionvia the official document, announced the move and stated:

“After careful review, the Commission concludes that the proposals are consistent with the Exchange Act and the rules and regulations thereunder applicable to a national securities exchange.”

The agency further explained:

“… are reasonably designed to promote fair disclosure of information that may be necessary to appropriately price the trusts’ shares, to prevent trading where a reasonable degree of transparency cannot be guaranteed, to disclose material non-public information in respect of the Trusts’ portfolios, and to ensure fair and orderly markets for the Trusts’ shares.”

However, Grayscale must wait for the effectiveness of BTC’s registration statement on Form S-1. This allows BTC to open up as a venue for Bitcoin ETP.

Lower costs for competitive advantage

Since the approval of eleven spot BTC ETFs earlier this year, increased institutional interest has increased competition. Therefore, the Mini Trust will have a lower fee of only 15 basis points (15bps). The lower fees are intended to compete with other lower-fee ETFs, such as Bitwise, which have a 0.2% fee.

Therefore, this move will play a crucial role in attracting investors while competing effectively with other ETFs as adoption of these digital assets becomes a norm among institutional investors.

What SEC Approval Means for Grayscale Bitcoin Trust

Source: Google Finance

Following SEC approval, GBTC shares rose 5.18% in 24 hours. According to Google Finance, GBTC shares have also been on an upward trend over the past thirty days.

Total assets under management have consistently increased from $16.98 billion to $17.54 billion over the past thirty days. This trend shows the prevailing positive market sentiment towards BTC and increased institutional interest.

According to prevailing market sentiment, BTC is now well positioned for growth due to the changing international monetary systems. The shifts mean a higher BTC velocity as governments, institutions, and individuals continually integrate and adopt BTC.

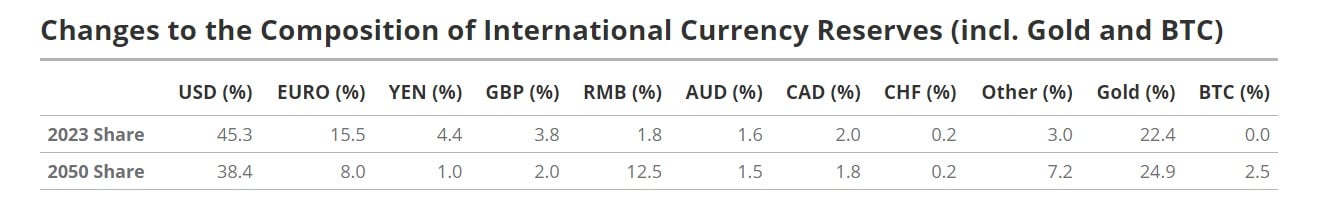

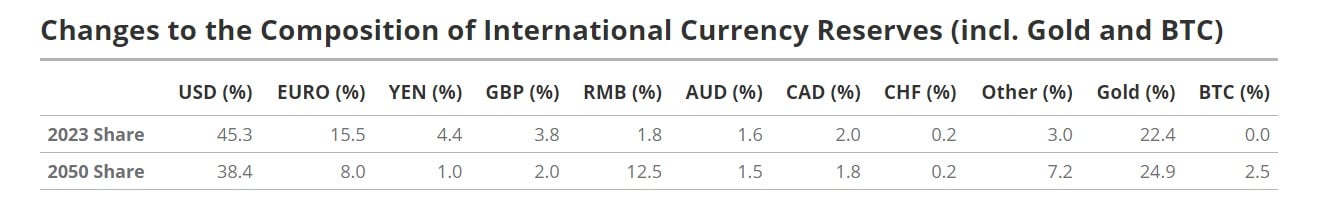

Source: VanEck Research

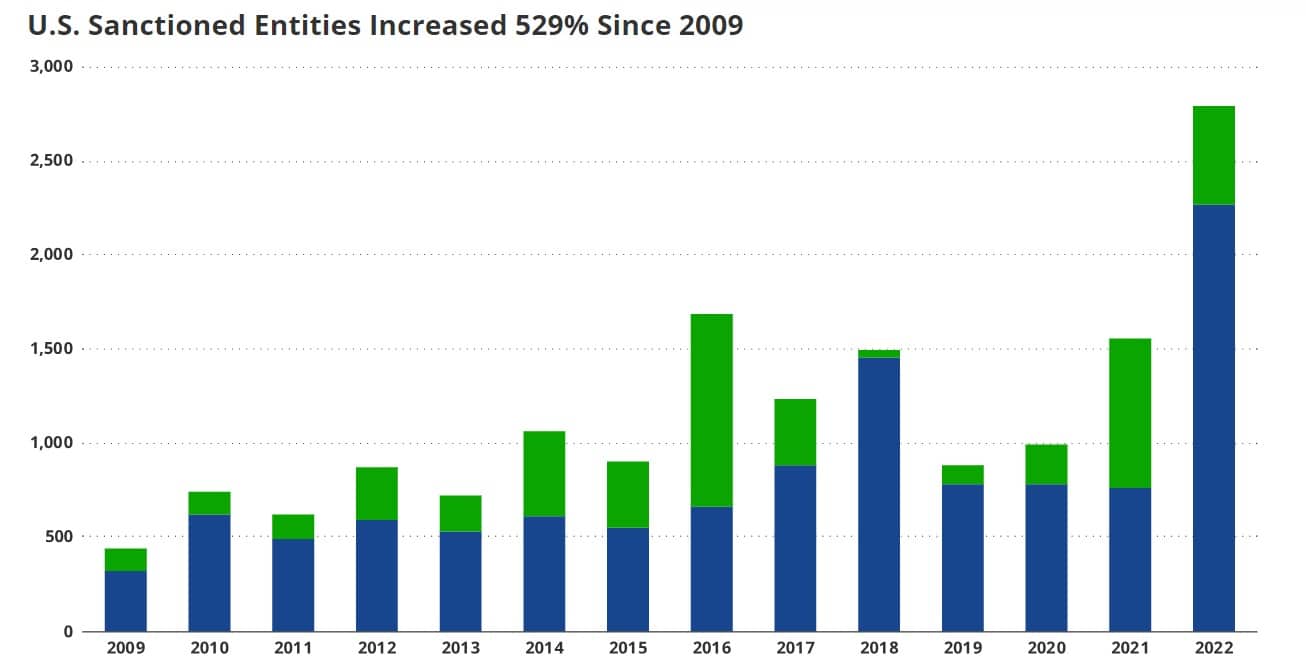

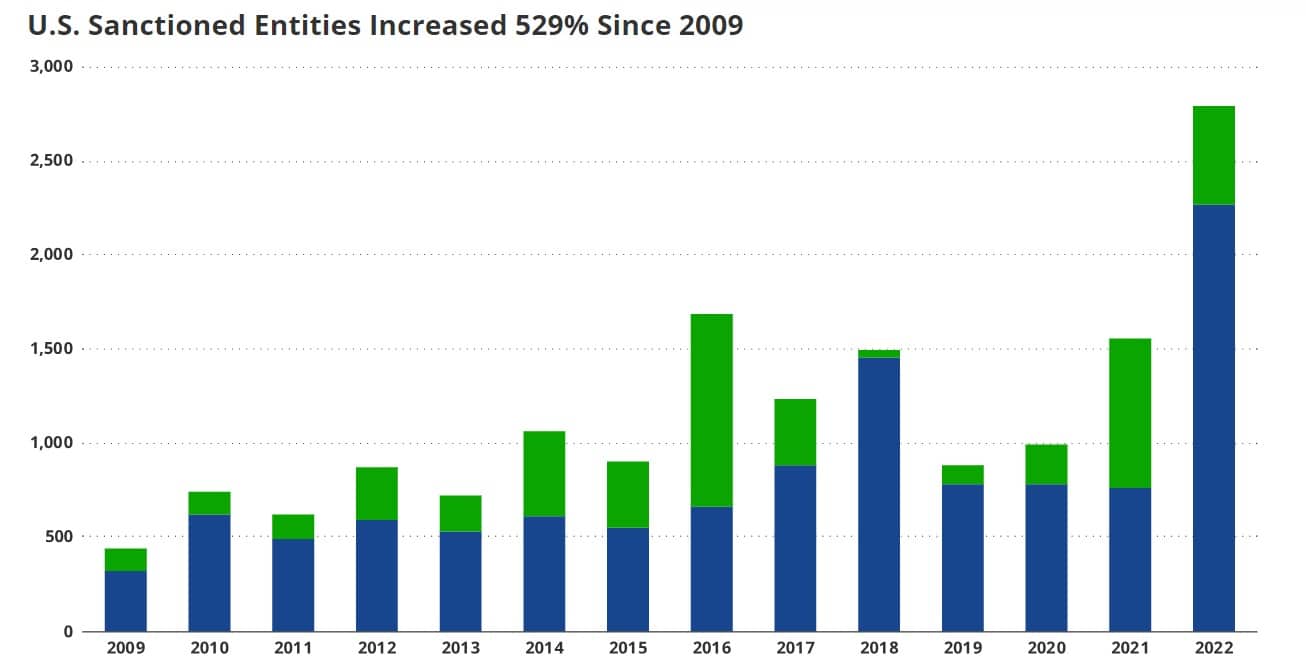

Due to high geopolitical tensions, crypto and BTC will be used more, especially to circumvent sanctions while regulating international trade. Such changes will benefit the price of BTC. The increase will have a positive impact on GBTC as its value depends on Bitcoin market volatility.

Source: CNAS

Implications for the crypto community

In particular, the approval of Grayscale BTC Mini Trust allows individual investors and institutions to invest at lower costs. With ETFs and ETPs on the rise, the need for an affordable rate allows customers to enter markets for affordability while helping Grayscale attract more revenue.

Essentially, it allows investors to enter the market and access BTC in a safe and regulated manner.